Water Polo Equipment Market Size

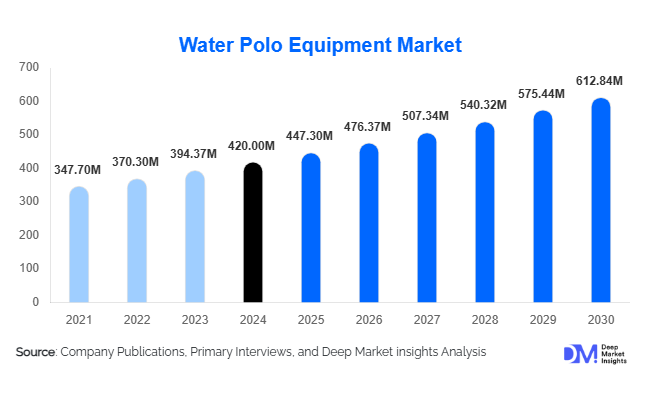

According to Deep Market Insights, the global water polo equipment market size was valued at USD 420 million in 2024 and is projected to grow from USD 447.30 million in 2025 to reach USD 612.84 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The market growth is primarily driven by increasing global participation in water polo, rising investments in aquatic sports infrastructure, and the integration of advanced materials and technologies into equipment for professional and recreational use.

Key Market Insights

- Professional water polo leagues and tournaments are driving consistent demand for high-quality, certified balls, caps, and goalposts across North America, Europe, and APAC.

- Technological innovation is reshaping equipment offerings, including smart sensors in caps and balls, advanced anti-chlorine swimwear, and high-durability materials for enhanced performance.

- Online retail is emerging as a preferred distribution channel, facilitating access to certified equipment for clubs, schools, and recreational centers globally.

- Emerging markets in APAC and Latin America are the fastest-growing regions, driven by government initiatives promoting aquatic sports and rising awareness among youth.

- Educational institutions and recreational centers are increasing the adoption of water polo programs, supporting steady long-term market expansion.

- Export-driven demand is rising, particularly from regions lacking local manufacturing, creating opportunities for global equipment suppliers.

What are the latest trends in the water polo equipment market?

Smart and Performance-Enhancing Equipment

Manufacturers are integrating technology into traditional equipment, such as wearable sensors in caps to track player performance metrics and balls with improved grip and visibility. Swimwear and protective gear are now designed with advanced materials to enhance comfort, durability, and water resistance. These innovations are especially attractive to professional teams, training academies, and competitive leagues, driving adoption of higher-value equipment.

Sustainable and Eco-Friendly Materials

There is a growing preference for eco-friendly and sustainable materials, including recycled polyester swimwear, biodegradable mouthguards, and non-toxic rubber balls. Companies are responding to environmental awareness among institutions and recreational users, creating a niche for sustainable product lines. This trend also aligns with government regulations and sports associations’ emphasis on safety and environmental compliance.

What are the key drivers in the water polo equipment market?

Rising Global Participation in Water Polo

Increasing participation in professional leagues, school and university programs, and recreational clubs is a major growth driver. Countries in North America, Europe, and APAC are investing heavily in competitive water polo infrastructure, prompting higher demand for certified equipment. Regular replacement of balls, caps, and other essential gear further boosts market revenue.

Government Investments in Aquatic Sports

Governments are funding modern aquatic centers, competitive pools, and training programs. Initiatives promoting water polo as part of youth and community fitness programs are expanding end-user adoption, particularly in emerging regions such as China, India, and Brazil. Public-private collaborations are also supporting sustainable growth for equipment manufacturers.

Advancements in Materials and Design

Innovations in high-grip rubber balls, quick-dry polyester swimwear, and anti-chlorine fabrics are improving performance and safety. These advances appeal to both professional athletes and recreational users, driving preference for premium products and supporting higher market value.

What are the restraints for the global market?

High Cost of Professional Equipment

Premium water polo equipment, including certified balls and advanced caps, can be cost-prohibitive for small clubs and recreational users, limiting broader adoption in developing countries.

Limited Awareness in Non-Traditional Regions

Despite increasing global popularity, water polo remains a niche sport in regions like Africa and parts of Latin America, which restricts overall market expansion.

What are the key opportunities in the water polo equipment industry?

Emerging Market Expansion

APAC and Latin America present significant opportunities due to growing interest in water polo and investments in aquatic sports infrastructure. Countries such as China, India, and Brazil are establishing regional tournaments and youth programs, creating demand for certified and standardized equipment.

Technological Integration and Innovation

Smart equipment, including wearable performance sensors and advanced material innovations, offers a competitive advantage. Eco-friendly product lines cater to environmentally conscious buyers, while high-durability gear improves safety and performance, attracting professional teams and clubs worldwide.

Government and Institutional Initiatives

Sports federations and government programs promoting water polo increase demand across schools, universities, and community pools. Standardized safety certifications and infrastructure investments further expand market opportunities for equipment suppliers.

Product Type Insights

Balls dominate the market with a 35% share in 2024, driven by the mandatory use of certified balls in professional competitions. Rubber-based equipment, including balls and caps, accounts for 40% of material-based sales, highlighting the importance of high-grip, durable materials. Swimwear and protective gear are seeing steady growth as players demand improved performance, comfort, and safety.

Application Insights

Professional clubs and associations represent the largest end-use segment, contributing 50% of total revenue in 2024. Educational institutions are increasingly adopting water polo programs, while recreational facilities, including fitness centers and water parks, are growing steadily. Export-driven demand is strong in regions without local manufacturing capabilities.

Distribution Channel Insights

Online retail dominates with 45% of total sales, enabling global access to certified equipment. Offline sports stores and club outlets maintain relevance for bulk institutional purchases. E-commerce adoption continues to expand, particularly in emerging markets with limited local distribution networks.

| By Product Type | By Material | By Distribution Channel | By End-Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America leads with a 30% market share in 2024, driven by professional leagues, collegiate water polo programs, and high sports infrastructure investment in the USA and Canada. Strong government support and the availability of certified equipment maintain steady growth.

Europe

Europe holds a 28% share, with Hungary, Italy, Spain, and Serbia being major demand centers due to historical popularity and strong youth programs. Investment in training academies sustains long-term demand.

Asia-Pacific

APAC is the fastest-growing region at a CAGR of 7.5–8%, led by China, Japan, and Australia. Rising middle-class awareness, government sports initiatives, and new aquatic infrastructure are driving strong adoption.

Latin America

Brazil and Argentina are emerging markets, with professional and recreational adoption gradually rising at a CAGR of 6%. Outbound demand for certified equipment from the USA and Europe is also contributing to growth.

Middle East & Africa

UAE, South Africa, and other Middle Eastern countries are expanding water polo adoption with newly built aquatic centers. The region grows steadily at 5% CAGR, with niche demand for high-quality equipment.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Water Polo Equipment Market

- Mikasa Sports

- Speedo International

- Turbo Sports

- Kap7 International

- FINIS Inc.

- Tyr Sport

- Water Polo World

- DMC Sports

- Aqua Sphere

- Jaked

- Molten Corporation

- Nike (Water Polo Division)

- Arena

- H2O Sports

- Swimline

Recent Developments

- In March 2025, Mikasa Sports launched a new high-grip rubber ball line for professional leagues, enhancing durability and performance in international competitions.

- In February 2025, Kap7 International introduced smart caps with integrated sensors for real-time performance tracking, targeting elite water polo clubs.

- In January 2025, Speedo International rolled out an eco-friendly swimwear collection designed for water polo athletes, made from recycled polyester and chlorine-resistant fabrics.