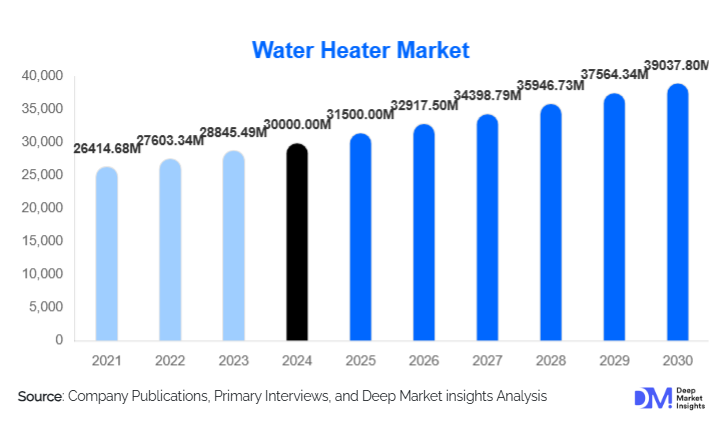

Water Heater Market Size

According to Deep Market Insight global water heater market size was valued at USD 30,000 million in 2024 and is projected to grow from USD 31,350.00 million in 2025 to reach USD 39,067.80 million by 2030, expanding at a CAGR of 4.5% during the forecast period (2025–2030). The market growth is driven by rising demand for residential and commercial construction, increasing adoption of energy-efficient and smart water heating systems, and strong urbanization trends in emerging economies such as China, India, and Southeast Asia.

Key Market Insights

- Electric water heaters dominate the market, accounting for over 50% of global revenue in 2024, driven by easy installation, electrification of housing, and widespread availability.

- Storage (tank-type) heaters hold the majority share due to their affordability, reliability, and established infrastructure in both residential and commercial sectors.

- Asia-Pacific leads the global market, capturing approximately 37.5% share in 2024, followed by Europe and North America.

- Technological innovations such as smart, IoT-enabled, and hybrid heat pump heaters are reshaping the industry and improving energy efficiency.

- Government energy-efficiency mandates and green building codes are accelerating the replacement of conventional systems with solar, hybrid, and high-efficiency units.

- Residential applications remain the largest demand driver, accounting for around 55–60% of total installations worldwide.

What are the latest trends in the water heater market?

Shift Toward Smart and Connected Water Heaters

Manufacturers are increasingly integrating IoT connectivity and smart controls into water heaters, allowing remote monitoring, predictive maintenance, and energy optimization. Connected water heaters enable users to adjust settings through mobile apps, track consumption, and integrate with home energy-management systems. This digital transformation is attracting tech-savvy homeowners and aligns with broader smart home trends across North America, Europe, and Asia-Pacific.

Adoption of Renewable and Hybrid Heating Solutions

The market is witnessing rapid adoption of renewable-powered water heating systems, including solar thermal and hybrid heat-pump models. These systems offer higher energy efficiency and lower operating costs, supported by government incentives and stricter emission regulations. Hybrid systems, which combine electricity with ambient heat sources, are gaining popularity in both residential and commercial applications, especially in Europe and Japan, where environmental standards are stringent.

What are the key drivers in the water heater market?

Rising Demand from Residential and Commercial Construction

Rapid urbanization, population growth, and rising living standards are boosting construction activities across emerging economies. The expansion of residential housing, hotels, hospitals, and office complexes directly fuels water heater installations. Infrastructure upgrades and increased plumbing penetration in developing regions are further amplifying market demand.

Growing Focus on Energy Efficiency and Sustainability

Governments and consumers are increasingly prioritizing energy-efficient appliances to reduce carbon footprints and energy costs. Policies such as energy-efficiency labeling, minimum performance standards, and renewable-energy subsidies are pushing the adoption of heat pumps and solar water heaters. This trend aligns with global decarbonization goals and presents substantial growth opportunities for high-efficiency technologies.

What are the restraints for the global market?

High Initial Cost and Installation Complexity

Despite long-term savings, advanced water heaters such as heat pumps and solar hybrids require a higher upfront investment and more complex installation compared to traditional electric or gas units. These barriers hinder adoption in price-sensitive markets and rural areas with limited technical expertise.

Raw Material and Energy Price Volatility

Fluctuations in steel, copper, and insulation material prices directly impact manufacturing costs. Similarly, volatile electricity and gas prices affect operating costs for end-users. These cost uncertainties challenge manufacturers to maintain profitability while offering competitive pricing, especially in emerging markets.

What are the key opportunities in the water heater industry?

Expansion in Emerging Markets

Asia-Pacific, the Middle East, and Africa present significant growth potential due to rapid urban development, improved power access, and rising middle-class income. Manufacturers investing in localized production, affordable product lines, and strong distribution networks can capture substantial market share in these fast-growing regions.

Integration of Smart Technologies and IoT

Integration of connected and AI-enabled technologies offers an opportunity to differentiate products and create new service revenue streams. Features such as remote diagnostics, usage analytics, and automatic temperature optimization appeal to energy-conscious consumers and property managers, enhancing customer loyalty and recurring revenue models.

Product Type Insights

Electric water heaters dominate the market with a 51% share in 2024, driven by the availability of electricity infrastructure and ease of use. Gas water heaters hold a significant portion of demand in regions with strong gas distribution networks, such as North America and Europe. Solar and hybrid heat-pump water heaters represent the fastest-growing segments, supported by government incentives and rising environmental awareness. Geothermal and other renewable systems remain niche but are gaining visibility in eco-conscious markets.

Technology Insights

Storage (tank-type) water heaters lead the global market with over 54% share, owing to their affordability and convenience in mass housing applications. However, tankless or on-demand water heaters are rapidly expanding, particularly in urban apartments, where space optimization and instant heating are key priorities. Hybrid systems, combining tank storage and heat pump functionality, are projected to record double-digit growth due to their superior efficiency.

End-Use Insights

The residential sector accounts for over half of total installations, driven by rising homeownership, household upgrades, and increasing awareness of smart and efficient water-heating systems. The commercial segment, including hotels, hospitals, and offices, is the second-largest, requiring large-capacity units and centralized systems. The industrial segment contributes a smaller share but plays a critical role in sectors such as food processing, chemicals, and healthcare, where a consistent hot-water supply is essential.

| By Product Type | By Capacity | By Fuel Type | By End Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America represents a mature market with steady replacement-driven demand. Efficiency regulations, rebates, and rising consumer awareness have spurred the adoption of hybrid and smart water heaters. The United States remains the largest market, with major players such as A.O. Smith, Rheem, and Bradford White dominating the landscape.

Europe

Europe is a key region driven by stringent environmental regulations and a strong shift toward renewable and heat-pump technologies. Markets such as Germany, the U.K., and France are investing heavily in energy-efficient retrofits and solar-assisted systems, supported by EU directives and carbon-neutral targets.

Asia-Pacific

Asia-Pacific leads the global market with around 37.5% share in 2024 and remains the fastest-growing region. China, India, and Japan are major contributors, driven by rapid urbanization, government housing initiatives, and growing adoption of smart home appliances. Local manufacturing expansion by global brands such as Haier, Havells, and Midea is strengthening regional supply chains.

Latin America

Latin America is emerging as a promising region, with countries such as Brazil and Mexico witnessing rising demand for residential water heaters amid expanding middle-class populations. However, price sensitivity and infrastructure challenges remain barriers to advanced product adoption.

Middle East & Africa

The Middle East & Africa region shows increasing demand for both residential and large-capacity commercial water heaters, particularly in the UAE, Saudi Arabia, and South Africa. Solar and hybrid systems are gaining traction due to high solar irradiance and government-led sustainability programs.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Product Type Insights

Electric water heaters dominate the market with a 51% share in 2024, driven by the availability of electricity infrastructure and ease of use. Gas water heaters hold a significant portion of demand in regions with strong gas distribution networks, such as North America and Europe. Solar and hybrid heat-pump water heaters represent the fastest-growing segments, supported by government incentives and rising environmental awareness. Geothermal and other renewable systems remain niche but are gaining visibility in eco-conscious markets.

Technology Insights

Storage (tank-type) water heaters lead the global market with over 54% share, owing to their affordability and convenience in mass housing applications. However, tankless or on-demand water heaters are rapidly expanding, particularly in urban apartments, where space optimization and instant heating are key priorities. Hybrid systems, combining tank storage and heat pump functionality, are projected to record double-digit growth due to their superior efficiency.

End-Use Insights

The residential sector accounts for over half of total installations, driven by rising homeownership, household upgrades, and increasing awareness of smart and efficient water-heating systems. The commercial segment, including hotels, hospitals, and offices, is the second-largest, requiring large-capacity units and centralized systems. The industrial segment contributes a smaller share but plays a critical role in sectors such as food processing, chemicals, and healthcare, where a consistent hot-water supply is essential.