Water Filtration System Market Size

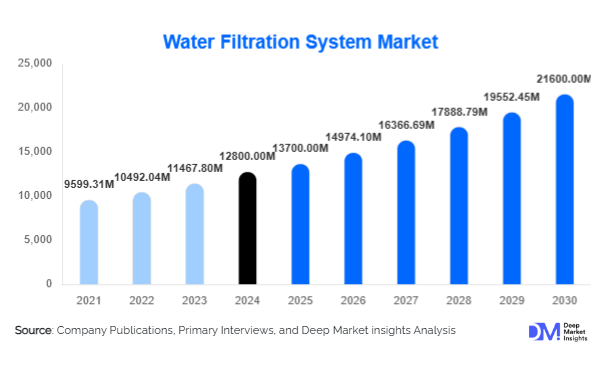

According to Deep Market Insights, the global water filtration system market size was valued at USD 12,800 million in 2024 and is projected to grow from USD 13,700 million in 2025 to reach USD 21,600 million by 2030, expanding at a CAGR of 9.3% during the forecast period (2025–2030). The market growth is primarily driven by increasing urbanization, rising water pollution concerns, stringent government regulations on potable water standards, and growing awareness regarding safe drinking water across residential, industrial, and municipal applications.

Key Market Insights

- Growing demand for point-of-use and point-of-entry filtration systems is reshaping the residential water treatment segment, driven by consumer preference for safe and chemically balanced water at homes and offices.

- Industrial and municipal water filtration systems are witnessing significant growth, particularly in regions facing water scarcity or industrial wastewater challenges, where large-scale filtration and recycling are critical.

- Asia-Pacific dominates market demand for water filtration systems, with China, India, and Japan leading due to rapid urbanization, industrial expansion, and heightened awareness of waterborne diseases.

- North America remains the fastest-growing region for advanced filtration technologies, including reverse osmosis, ultrafiltration, and UV-based purification systems.

- Technological adoption is transforming the market, with smart filtration systems, IoT-enabled monitoring, and real-time water quality analytics enhancing operational efficiency and consumer engagement.

- Sustainability trends, including water recycling and zero-liquid discharge solutions, are becoming key drivers in industrial and municipal segments, further boosting market growth.

What are the prevailing trends currently influencing the global water filtration system market?

Integration of Smart Technologies

Water filtration systems are increasingly integrating IoT-enabled sensors, real-time water quality monitoring, and smart alerts. Consumers and industries benefit from predictive maintenance, efficiency optimization, and automated replacement notifications for filters. Smart filtration systems also support energy-efficient operations and remote monitoring, which is particularly useful for commercial and municipal water treatment facilities.

Growth of Eco-Friendly and Sustainable Solutions

Environmental concerns are driving demand for eco-friendly filtration systems, such as low-energy reverse osmosis units, reusable filters, and systems designed to reduce water wastage. Industrial and municipal sectors are increasingly adopting water recycling and zero-liquid discharge solutions to meet sustainability goals and regulatory requirements. Consumers are also leaning toward biodegradable or recyclable filtration media for home use, reflecting rising eco-conscious preferences.

Adoption of Advanced Filtration Technologies

Membrane technologies, including nanofiltration, ultrafiltration, and reverse osmosis, are witnessing rapid adoption due to their high efficiency in removing contaminants. UV and ozone-based disinfection systems are gaining traction in residential, industrial, and municipal segments to ensure microbial-free water. Hybrid filtration solutions combining multiple purification technologies are emerging as a preferred choice for both safety and operational efficiency.

What are the primary growth drivers impacting the water filtration system market?

Rising Health Awareness and Demand for Safe Drinking Water

Increasing cases of waterborne diseases and contamination incidents have heightened consumer awareness about clean water. Households and businesses are increasingly investing in filtration systems that remove pathogens, heavy metals, and chemical pollutants. Government campaigns promoting safe water usage are also driving residential adoption globally.

Industrial Expansion and Water Scarcity

Industrial growth, particularly in chemicals, pharmaceuticals, and food & beverage sectors, is increasing demand for high-capacity filtration systems. Industries require high-quality water for processes and cooling, alongside sustainable wastewater treatment. Water scarcity in emerging economies accelerates the adoption of water recycling and advanced filtration solutions to maintain operational continuity and comply with environmental regulations.

Regulatory Compliance and Government Initiatives

Governments worldwide are implementing stringent water quality standards for both residential and industrial sectors. Initiatives such as clean water programs, subsidies for home purification systems, and industrial wastewater regulations are acting as growth catalysts. Compliance requirements encourage private and public sector investment in advanced filtration solutions.

What are the key challenges and restraints affecting the global water filtration system industry?

High Initial Costs of Advanced Systems

Advanced water filtration technologies, such as reverse osmosis and UV systems, require significant upfront investment, limiting adoption in cost-sensitive regions. Small industries and low-income households often prefer low-cost alternatives, which can restrict overall market expansion.

Maintenance Complexity and Operational Challenges

Industrial and municipal filtration systems require regular maintenance, skilled operators, and periodic filter replacements. Operational inefficiencies and a lack of trained personnel can increase downtime and operational costs, posing a challenge for sustained adoption, particularly in developing countries.

Which strategic opportunities exist for stakeholders in the water filtration system market?

Expansion in Emerging Economies

Rising urbanization, industrialization, and increasing awareness of waterborne diseases in countries like India, China, Brazil, and Southeast Asia present substantial growth opportunities. Governments are investing heavily in clean water infrastructure, creating demand for residential, commercial, and municipal filtration systems. New entrants can tap into these markets through localized solutions and affordable, scalable filtration systems.

Integration of Smart and IoT-Enabled Filtration

Smart filtration systems with IoT integration, real-time water quality monitoring, and predictive maintenance offer a promising avenue for differentiation. Residential consumers, hospitals, commercial facilities, and industries are increasingly seeking automated systems that optimize performance, reduce energy consumption, and track water quality trends. This trend can drive premium pricing and recurring revenue models through subscription-based filter replacements.

Water Recycling and Industrial Wastewater Treatment

With increasing water scarcity, industries are investing in water recycling and zero-liquid discharge systems. Advanced filtration solutions for industrial effluent treatment are becoming critical for regulatory compliance and sustainability targets. New technology adoption in this space, including membrane bioreactors and hybrid treatment solutions, presents lucrative opportunities for market participants.

Product Type Insights

Reverse osmosis systems dominate the market, accounting for 35% of the global market in 2024, due to their efficiency in removing dissolved salts, heavy metals, and pathogens. Activated carbon filters, widely used in households and small commercial setups, hold 25% of the market share, valued for their affordability and ease of use. Ultraviolet and ultrafiltration systems are gaining traction in industrial and municipal segments, driven by demand for microbial-free water and large-scale purification capabilities. Point-of-use filtration systems are particularly growing in North America and the Asia-Pacific due to residential adoption trends.

Application Insights

Residential applications hold 40% of the market share, driven by increasing consumer awareness and the affordability of home filtration systems. Industrial applications account for 35%, led by the chemical, pharmaceutical, and food & beverage industries, requiring high-quality water. Municipal water treatment projects comprise 20%, fueled by urban water supply challenges and government initiatives for clean water provision. Emerging applications include healthcare facilities, educational institutions, and hospitality, reflecting the diversification of end-use demand.

Distribution Channel Insights

Online platforms and e-commerce channels are increasingly capturing market share due to convenience, real-time product comparisons, and digital payment options. Direct sales through manufacturers, particularly for industrial and municipal systems, remain strong due to customization requirements. Retail distribution continues to dominate the residential segment, particularly in emerging economies. Service-based contracts and subscription models for filter replacement are becoming common in mature markets.

End-Use Insights

Residential end-use dominates globally, driven by awareness about safe drinking water and urbanization trends. Industrial applications, particularly in pharmaceuticals, chemicals, and food & beverage sectors, are growing rapidly due to stringent water quality requirements. Healthcare facilities and educational institutions are emerging as new applications, requiring high-purity water for operational and sanitary purposes. Export-driven demand is notable from North America and Europe to developing regions where localized production is limited.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounts for 28% of the market in 2024, led by the U.S. and Canada. Strong regulations on water quality, high consumer awareness, and advanced infrastructure support growth. Smart and IoT-enabled filtration systems are particularly popular in this region.

Europe

Europe holds 25% of the global market, with Germany, France, and the U.K. leading demand. Emphasis on sustainability, regulatory compliance, and water recycling technologies drives adoption. Residential and industrial segments are growing steadily, with renewable-energy-powered filtration gaining traction.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by China, India, Japan, and Southeast Asian countries. Rapid urbanization, industrial expansion, and increasing awareness about waterborne diseases are key growth factors. The market here is projected to expand at a CAGR of 11% through 2030.

Latin America

Brazil, Mexico, and Argentina are driving growth in Latin America, primarily for residential and industrial water treatment applications. Government-led clean water initiatives are expanding the adoption of filtration systems.

Middle East & Africa

Water scarcity in the Middle East and parts of Africa is driving demand for large-scale industrial and municipal filtration systems. Countries like Saudi Arabia, UAE, South Africa, and Egypt are investing in sustainable water management solutions, including desalination and filtration technologies.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Companies in the Water Filtration System Market

- Pentair

- GE Water & Process Technologies

- Veolia Water Technologies

- Grundfos

- Dow Water & Process Solutions

- 3M Purification

- Toray Industries

- Kurita Water Industries

- A. O. Smith

- Culligan International

- Lanxess

- LG Chem

- Bluewater

- Hyflux Ltd.

- EcoWater Systems

Recent Developments

- In March 2025, Pentair launched a smart IoT-enabled residential filtration system integrating real-time water quality monitoring and automated filter replacement alerts.

- In January 2025, Veolia expanded its industrial wastewater filtration services in India, introducing hybrid membrane-biological treatment solutions for chemical and pharmaceutical plants.

- In February 2025, GE Water & Process Technologies unveiled energy-efficient reverse osmosis systems for municipal water treatment projects in Southeast Asia.