Water Bottle Market Size

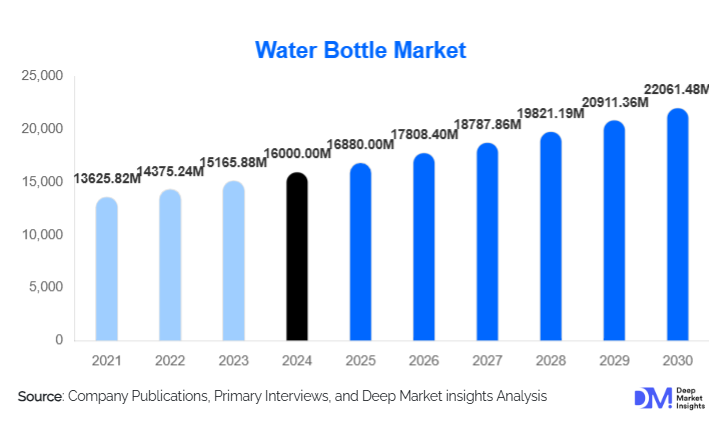

According to Deep Market Insights, the global water bottle market size was valued at USD 16,000 million in 2024 and is projected to grow from USD 16,880 million in 2025 to reach USD 22,061.48 million by 2030, expanding at a CAGR of 5.5% during the forecast period (2025–2030). The market’s steady expansion is primarily driven by the rising demand for sustainable and reusable hydration solutions, heightened consumer awareness regarding health and fitness, and continuous innovation in materials and smart technologies.

Key Market Insights

- Reusable and eco-friendly bottles dominate market value, reflecting a global shift toward sustainability and reduced single-use plastic dependency.

- Asia-Pacific leads in production and fastest growth, while North America and Europe remain strong premium markets driven by lifestyle and health trends.

- Technological integration, such as smart bottles with hydration tracking and temperature control, is reshaping premium segments.

- Corporate and institutional demand is rising due to wellness initiatives and environmental mandates promoting reusable bottles.

- Material innovation using stainless steel, glass, and biodegradable composites is enabling both product differentiation and margin expansion.

Latest Market Trends

Sustainability and Eco-Conscious Consumption

Growing environmental awareness is driving the transition from disposable plastic bottles toward reusable and recyclable materials. Consumers are increasingly favoring stainless steel, glass, and biopolymer-based bottles that align with eco-conscious lifestyles. Governments worldwide are enforcing bans or levies on single-use plastics, encouraging manufacturers to invest in sustainable alternatives. Many brands are now positioning themselves as environmentally responsible, offering lifetime warranties, recycling programs, and carbon-neutral manufacturing practices. This shift not only attracts environmentally aware consumers but also opens opportunities for premium pricing and brand loyalty.

Smart and Connected Water Bottles

Technology is transforming hydration habits through connected, sensor-enabled bottles. Smart bottles with Bluetooth connectivity, LED hydration reminders, and app-based tracking are gaining traction among health-focused and tech-savvy consumers. These bottles sync with fitness devices, record daily intake, and alert users to maintain optimal hydration levels. The integration of IoT and AI into hydration products is enhancing user engagement, offering personalization, and creating new growth opportunities in the premium and corporate wellness segments.

Water Bottle Market Drivers

Health and Fitness Awareness

Global emphasis on wellness and preventive healthcare has made hydration an integral part of daily life. Rising gym memberships, outdoor recreation, and corporate wellness programs are boosting reusable bottle sales. Consumers increasingly view water bottles as lifestyle accessories, blending functionality with design.

Environmental Regulations and Sustainability Push

Regulations restricting single-use plastics are reshaping demand patterns. Countries in Europe, North America, and parts of Asia have introduced policies encouraging reusable alternatives, propelling the adoption of metal, glass, and bioplastic bottles. Brands aligning with sustainability goals are witnessing higher consumer preference and long-term retention.

Material Innovation and Premiumization

Advances in materials science, such as double-wall vacuum insulation, lightweight aluminum alloys, and biodegradable composites, are driving product differentiation. Premium reusable bottles featuring superior insulation and design aesthetics cater to consumers seeking durability and style, expanding the market’s value share.

Market Restraints

High Manufacturing Costs and Price Sensitivity

While sustainable and smart bottles command higher margins, elevated production costs limit penetration in price-sensitive markets. Many consumers in emerging economies continue to prefer low-cost plastic bottles, restraining premium adoption rates.

Raw Material Volatility and Recycling Complexity

Fluctuations in the prices of metals and polymers impact manufacturing economics. Additionally, complex recycling processes for mixed materials such as multi-layer plastics pose challenges for achieving full circularity, potentially slowing sustainability-driven growth.

Water Bottle Market Opportunities

Expansion in Emerging Markets

Rapid urbanization and income growth across Asia-Pacific, Africa, and Latin America are fostering demand for affordable yet sustainable hydration solutions. Local manufacturing investments and regional brand development can unlock massive untapped potential in these regions.

Corporate and Institutional Adoption

Workplaces, schools, and hospitality sectors are increasingly distributing branded reusable bottles as part of eco-friendly and wellness initiatives. This presents bulk-order opportunities for manufacturers and supports consistent recurring demand.

Smart Technology Integration

IoT-enabled hydration tracking and integration with fitness ecosystems are still in early adoption stages but present a lucrative long-term opportunity. Manufacturers focusing on innovation, connectivity, and data-driven personalization will benefit from premium consumer segments and B2B partnerships with health-tech companies.

Product Type Insights

Reusable bottles lead the global market, accounting for roughly 60% of the 2024 value share. Their popularity is driven by growing environmental awareness and consumer preference for durability and premium aesthetics. Single-use bottles remain significant in volume but are declining due to regulatory and ethical concerns. Smart bottles, though niche today, represent the fastest-growing product category, supported by connected device adoption and health-tracking trends.

Material Insights

Plastic bottles still hold about 35% of the global market due to affordability and mass availability, but their share is eroding. Metal bottles, primarily stainless steel and aluminum, are expanding rapidly owing to their reusability and insulation capabilities. Glass bottles cater to premium consumers, valued for purity and design, while biodegradable materials are gaining regulatory favor and early adopter interest.

Distribution Channel Insights

Offline retail, including supermarkets, hypermarkets, and specialty stores, accounts for nearly 40% of 2024 sales, supported by visual merchandising and impulse buying behavior. However, online channels are growing fastest, driven by e-commerce penetration and D2C brand strategies. Subscription-based water bottle programs and corporate bulk purchases through digital platforms are emerging as new sales formats.

End-Use Insights

The household and personal hydration segment remains dominant with approximately 50% of global value, driven by daily reuse. Sports and outdoor applications are expanding fastest as active lifestyles proliferate. The corporate and promotional use segment also shows rapid growth due to sustainability campaigns and employee wellness initiatives.

| By Product Type | By Material Type | By Capacity | By Distribution Channel | By End-Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 28% of the global market, driven by high disposable incomes, a strong health consciousness, and the presence of premium brands. The U.S. remains a hub for innovation, with brands such as Hydro Flask and CamelBak leading sales through design and smart features.

Europe

Europe accounts for about 22% of the global market value and leads in eco-friendly adoption. The EU’s stringent single-use plastic bans and consumer emphasis on sustainability drive strong demand for reusable and glass bottles. Germany, the U.K., and France remain top consumers.

Asia-Pacific

Asia-Pacific leads global volume and is the fastest-growing region, with a 35% market share in 2024. China and India dominate production and consumption. Growth is driven by rising urban populations, disposable incomes, and the shift from single-use to affordable reusable bottles.

Latin America

Holding roughly 8% of global market value, Latin America shows growth in Brazil and Mexico as eco-awareness increases. The market remains price-sensitive but is transitioning toward reusable plastic and metal options.

Middle East & Africa

MEA contributes about 7% of global value. Gulf countries are adopting premium reusable bottles through corporate sustainability programs and retail demand, while African nations show growing local manufacturing potential and export-oriented production.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Water Bottle Market

- Tupperware Brands Inc.

- Hydro Flask

- CamelBak Products LLC

- Klean Kanteen Inc.

- Thermos LLC

- Newell Brands

- Brita GmbH

- SIGG Switzerland AG

- O2COOL LLC

- PathWater

- Zhejiang Haers Vacuum Containers Co. Ltd.

- Vapur Inc.

- Hydaway

- Contigo

- Bulletin Brands LLC

Recent Developments

- June 2025: Hydro Flask launched its first smart insulated series integrating hydration tracking and LED alerts for optimal daily intake.

- April 2025: CamelBak announced expansion of its eco-manufacturing plant in Nevada, powered by 100% renewable energy.

- February 2025: SIGG introduced a fully recyclable aluminum bottle line with compostable caps, targeting European eco-conscious consumers.