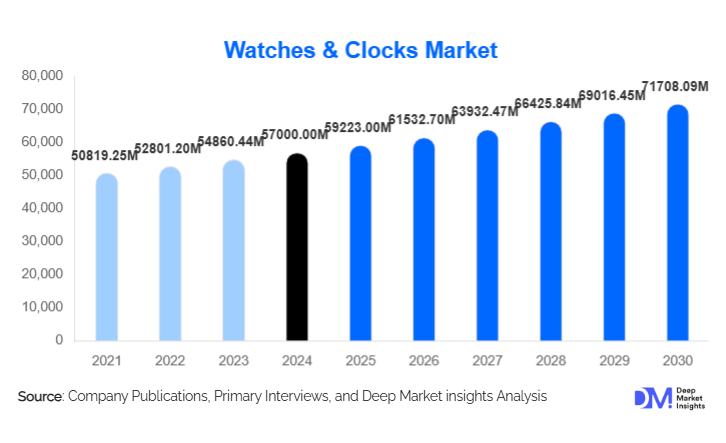

Watches and Clocks Market Size

According to Deep Market Insights, the global watches and clocks market size was valued at USD 57,000.00 million in 2024 and is projected to grow from USD 59,223.00 million in 2025 to reach USD 71,708.09 million by 2030, expanding at a CAGR of 3.9% during the forecast period (2025–2030). The market growth is primarily driven by rising demand for smart and hybrid watches, increasing disposable income in emerging regions, and growing consumer interest in watches as fashion statements, collectibles, and lifestyle accessories.

Key Market Insights

- Hybrid watches and smartwatches are reshaping the market, blending traditional craftsmanship with digital functionality to appeal to tech-savvy consumers.

- Premium and luxury watch segments are expanding, fueled by rising affluence in Asia-Pacific and the Middle East, as consumers increasingly value heritage, exclusivity, and design.

- Asia-Pacific dominates the global market, driven by China and India, which together account for nearly half of the total market revenue.

- North America and Europe remain significant markets, characterized by steady demand for luxury mechanical watches and strong brand loyalty.

- E-commerce and digital retail platforms are rapidly growing, enabling brands to reach younger demographics and first-time buyers directly.

- Sustainability and eco-conscious manufacturing, including recycled materials and refurbishment programs, are becoming increasingly important for brand differentiation.

What are the latest trends in the watches and clocks market?

Rise of Smart and Hybrid Watches

Timepieces are evolving beyond traditional quartz and mechanical functions. Smart and hybrid watches integrate fitness tracking, notifications, GPS, and other connected features, appealing to tech-oriented consumers. This trend allows traditional brands to innovate while maintaining craftsmanship and heritage value. Many luxury brands are launching hybrid collections that combine mechanical dials with discreet digital modules, enabling them to capture both traditional watch enthusiasts and new-age tech buyers.

Fashion and Personalization Trends

Watches are increasingly purchased as fashion statements or status symbols rather than purely functional devices. Consumers seek customizable dials, straps, engravings, and limited-edition models. Collaborations between fashion brands and watchmakers have grown, creating timepieces that cater to diverse aesthetics. Younger demographics particularly value personalized offerings, driving mid-range and premium segments.

What are the key drivers in the watches and clocks market?

Rising Disposable Income and Affluence

Increasing global wealth, especially in Asia-Pacific and the Middle East, has driven demand for premium and luxury watches. Consumers are willing to pay higher prices for exclusivity, craftsmanship, and recognized brands. The rise of high-net-worth individuals fuels the market for limited-edition and high-end mechanical watches, while expanding middle-class populations in emerging economies stimulate mid-range sales.

Growing E-commerce and Digital Retail Channels

The proliferation of online shopping platforms and direct-to-consumer brand websites has reduced distribution barriers, allowing brands to reach global audiences efficiently. Digital marketing, virtual try-ons, and AR-based watch visualizers are enhancing the consumer experience, particularly for younger buyers. Online platforms also enable transparent pricing, easier comparisons, and access to niche or luxury models previously limited to regional boutiques.

Adoption of Health and Smart Features

Integration of smart functionalities, such as heart rate monitoring, sleep tracking, notifications, and GPS, has expanded the use cases for watches beyond timekeeping. Consumers in wellness, fitness, and professional segments are increasingly adopting smartwatches and hybrid models, driving overall market growth and creating opportunities for traditional brands to innovate.

What are the restraints for the global market?

Competition from Smartphones

The prevalence of smartphones for timekeeping reduces the functional need for basic watches, especially in the entry-level segment. Younger consumers often rely on multifunctional devices, impacting quartz watch demand in particular.

High Manufacturing Costs and Supply Chain Challenges

Mechanical and premium watches require skilled labor, precision components, and costly raw materials such as metals and sapphire crystals. Rising costs, coupled with potential supply chain disruptions and tariffs, can impact margins, particularly for smaller brands and emerging manufacturers.

What are the key opportunities in the watches and clocks market?

Hybrid Innovation and Smart Technology Integration

Combining mechanical craftsmanship with smart technology provides a major growth opportunity. Brands that successfully introduce hybrid watches, luxury smartwatches, or connected devices can appeal to both traditional collectors and tech-savvy consumers, expanding the overall market base.

Expansion into Emerging Markets

Rising disposable incomes in countries such as China, India, and Southeast Asia offer strong growth potential. Premium and mid-range watches are increasingly affordable to aspirational buyers. Localization, regional marketing, and targeted distribution strategies can accelerate market penetration.

Sustainable and Circular Manufacturing

Consumer awareness of environmental responsibility is creating demand for eco-friendly materials, repair, and refurbishment programs. Watches made with recycled metals, sustainable straps, and certified ethical sourcing can strengthen brand positioning while opening new revenue streams in the secondary and pre-owned markets.

Product Type Insights

Quartz wristwatches remain the largest segment globally, accounting for approximately 45–50% of the market in 2024. Their dominance is attributed to affordability, high accuracy, low maintenance, and widespread adoption across both emerging and mature markets. Mechanical watches continue to dominate the luxury segment, appealing to collectors and high-net-worth consumers who value craftsmanship, heritage, and investment potential. Smart and hybrid watches are the fastest-growing category, particularly in Asia-Pacific and North America, driven by rising health-conscious consumers, technological adoption, and integration of fitness tracking, notifications, and other connected features. Wall clocks and desk clocks maintain steady demand, mainly for decorative and functional purposes in residential and corporate environments. Overall, the growth of luxury and premium mechanical watches is reinforced by their increasing perception as collectibles and investment assets, while the rapid adoption of hybrid and smartwatches highlights the market’s pivot toward multifunctionality, merging traditional aesthetics with modern convenience.

Application Insights

Fashion and personal adornment remain the primary applications for watches, capturing 40–45% of total demand. Consumers increasingly view watches as status symbols and fashion accessories, driving demand for personalized, limited-edition, and designer collections. Health and lifestyle applications are fueling the rapid adoption of smartwatches, particularly among Millennials and Gen Z, where fitness tracking, sleep monitoring, and connectivity features add functional value beyond traditional timekeeping. The investment and collectible segment continues to grow, especially for mechanical and luxury watches, supported by high resale value and brand prestige. Clocks are primarily used for functional home and office purposes, but novelty and specialty designs are gaining traction in gifting and décor applications. The increasing multifunctional nature of timepieces, combining style, wellness, connectivity, and self-expression, is further expanding their market potential across diverse consumer segments.

Distribution Channel Insights

Offline retail remains dominant, accounting for 55–60% of global sales in 2024. The tactile experience of trying on watches, examining craftsmanship, and interacting with knowledgeable sales staff continues to attract consumers, particularly in luxury and mid-range segments. However, online and digital channels are rapidly gaining market share, driven by e-commerce adoption, virtual try-on tools, digital marketing campaigns, and global shipping capabilities. Brand websites, marketplace platforms, and subscription-based models enable direct engagement and create a seamless purchasing experience. Social media influencer campaigns, AR-based try-ons, and interactive digital content are increasingly shaping buying decisions, especially among younger consumers seeking convenience, personalization, and trend-aligned designs.

End-User Insights

Male consumers account for 60–70% of market sales, largely dominated by mechanical and sports watches. Millennials and Gen Z are driving the demand for smart and hybrid watches, attracted by health, lifestyle, and connectivity features. Older demographics, particularly aged 40–65, dominate the premium and collectible segments due to a preference for craftsmanship, heritage brands, and investment-grade watches. Corporate gifting and institutional demand for clocks provide a stable and predictable revenue stream. The pre-owned and refurbishment market is growing steadily, offering affordability and sustainability benefits while extending the life cycle of premium watches. Luxury buyers continue to pursue exclusivity, limited editions, and bespoke customization, sustaining demand in the high-value segment.

| By Product Type | By Application | By Distribution Channel | By End User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America represents 20–25% of the global watches & clocks market, led by the U.S. and Canada. Growth is driven by high disposable income, strong brand loyalty, and a mature retail ecosystem combining luxury boutiques and e-commerce channels. The luxury mechanical watch segment dominates, while smartwatches and hybrid watches are increasingly popular due to health, fitness, and connectivity features. The presence of affluent consumers who value craftsmanship, combined with digital adoption for purchasing mid-range watches, contributes to steady market expansion. In addition, corporate gifting, collectibles, and lifestyle-focused watches support diversified demand across the region.

Europe

Europe accounts for 25–30% of global market revenue, led by Switzerland, Germany, and the U.K. The region remains synonymous with luxury and mechanical watches, supported by heritage brands and strong export-oriented production. Market growth is driven by high consumer preference for quality, precision, and exclusivity. Smartwatch adoption is gradually rising in Western Europe, especially in urban centers, complementing traditional mechanical demand. Additionally, the region benefits from established distribution networks, e-commerce platforms, and strong tourism-driven watch sales in cities like Geneva, Zurich, and London. The convergence of luxury appreciation, digital integration, and fashion trends continues to sustain Europe’s robust market performance.

Asia-Pacific

Asia-Pacific is the largest and fastest-growing regional market, representing 45–50% of global revenue. China and India are key growth engines, driven by rising middle-class affluence, urbanization, and increasing exposure to international brands. Demand spans mid-range watches for everyday fashion, luxury mechanical watches for status, and smart/hybrid watches for health-conscious consumers. Japan, South Korea, and Southeast Asia contribute through both traditional and smart watch adoption. E-commerce and digital retail channels are highly influential, with online marketing, virtual try-ons, and influencer engagement accelerating adoption. Regional growth is further supported by expanding retail networks, increased tourism, and rising consumer preference for technology-integrated timepieces, making APAC a highly dynamic market.

Latin America

Latin America contributes 4–6% of global market revenue, with Brazil, Mexico, and Argentina leading demand. Growth is driven by increasing urbanization, rising disposable incomes, and growing awareness of international brands through travel and social media. Mid-range watches and fashion-oriented collections dominate, while premium and luxury segments are emerging among affluent consumers. Expansion of retail networks, e-commerce adoption, and lifestyle trends are fueling regional demand. In particular, younger consumers’ interest in smart and hybrid watches, coupled with increased corporate gifting and décor applications, presents growth opportunities for manufacturers and distributors in the region.

Middle East & Africa

The Middle East & Africa region contributes 2–4% of global market revenue. The GCC countries, including the UAE, Saudi Arabia, and Qatar, drive luxury watch demand due to high-income populations, brand consciousness, and cultural emphasis on luxury and gifting. Africa represents an emerging market with rising demand for affordable and mid-range watches, supported by increasing urbanization and growing disposable incomes. Regional growth is fueled by the combination of luxury consumption in the Gulf, expansion of retail networks, increased tourism, and adoption of fashion and smart watches. Niche opportunities exist in pre-owned, collectible, and hybrid watches, which cater to both status-seeking and tech-oriented consumers, positioning the region for incremental growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Watches and Clocks Market

- Rolex

- Richemont

- Swatch Group

- LVMH

- Citizen Group

- Seiko Holdings

- Fossil Group

- Casio

- Timex Group

- Titan Company Limited

- Apple

- Samsung

- Orient

- Movado

- Bulova

Recent Developments

- In May 2025, Swatch Group expanded its mid-range smartwatch lineup, integrating health monitoring and improved battery efficiency for global markets.

- In April 2025, Rolex launched a limited-edition hybrid watch combining traditional mechanical dials with discreet digital features, targeting tech-savvy luxury consumers.

- In February 2025, Titan Company announced new sustainable watch collections in India, utilizing recycled metals and ethically sourced materials, reinforcing its eco-conscious positioning.