Warming Cabinets Market Size

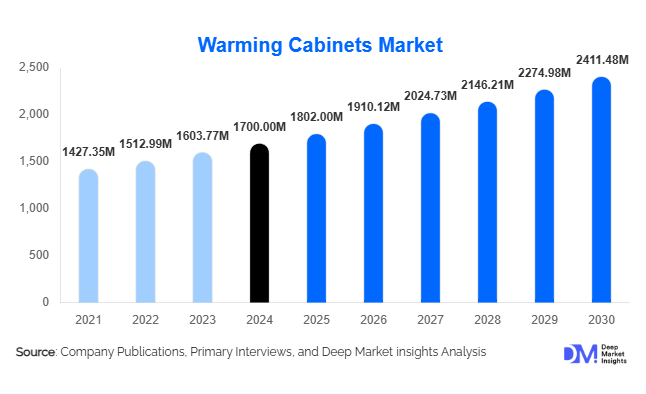

According to Deep Market Insights, the global warming cabinets market size was valued at USD 1,700 million in 2024 and is projected to grow from USD 1,802.00 million in 2025 to reach USD 2,411.48 million by 2030, expanding at a CAGR of 6.0% during the forecast period (2025–2030). The warming cabinets market growth is primarily driven by increasing demand in healthcare facilities, stringent food safety regulations in commercial kitchens, and rising adoption of energy-efficient and smart technology-enabled warming solutions globally.

Key Market Insights

- Healthcare facilities remain the dominant end-use segment, with hospitals and surgical centers requiring warming cabinets for blankets, fluids, and sterile items, accounting for nearly 50% of global demand in 2024.

- Large-capacity, stationary warming cabinets lead globally, capturing about 40% of the market due to bulk handling requirements in hospitals and commercial kitchens.

- North America holds the largest regional market share at approximately 40% in 2024, supported by advanced healthcare infrastructure and stringent regulations.

- Asia-Pacific is the fastest-growing region, led by China and India, fueled by healthcare expansion, urban foodservice growth, and rising disposable income.

- Electric heating technology dominates due to reliability, ease of installation, and widespread adoption, accounting for 55% of the global market.

- Technological integration, including IoT-enabled cabinets, remote monitoring, and predictive maintenance, is reshaping product offerings and driving premium pricing.

Latest Market Trends

Smart and Energy-Efficient Cabinets

Manufacturers are increasingly introducing warming cabinets with smart monitoring, IoT connectivity, and energy-efficient insulation. Hospitals, laboratories, and large-scale foodservice operators prefer units with digital temperature controls, predictive maintenance features, and modular designs. These features reduce operational costs and improve patient safety or food quality compliance. Smart cabinets are also increasingly integrated with facility management systems, enabling centralized monitoring of multiple units and real-time alerts for temperature deviations. Such innovations position the market toward high-value products and premium installations.

Adoption in Foodservice and Hospitality

With the growth of cloud kitchens, QSR chains, and catering services, the demand for compact, reliable warming cabinets is increasing. Operators are moving away from traditional warming methods to cabinets with precise temperature control, easy cleaning, and rapid heating cycles. The trend is further strengthened by stricter local and international food-safety regulations, which mandate accurate temperature maintenance to prevent spoilage and contamination.

Warming Cabinets Market Drivers

Healthcare Infrastructure Expansion

The rising incidence of surgeries, chronic diseases, and ambulatory care centers has increased the demand for warming cabinets to store blankets, fluids, and sterile items. Hospitals are upgrading facilities and adding specialty wards, driving both new installations and replacements. Large-capacity, stationary cabinets are preferred due to their efficiency and ability to handle bulk requirements.

Stricter Food-Safety and Temperature Regulations

Commercial kitchens and foodservice establishments face tighter regulations to maintain holding temperatures for prepared food. Warming cabinets provide reliable, regulated temperature control, reducing food waste and enhancing safety compliance. Restaurants, hotels, and catering services increasingly invest in advanced cabinets, particularly in developed regions with rigorous inspection standards.

Demand for Smart and Energy-Efficient Solutions

Energy efficiency and technology integration are key factors driving adoption. IoT-enabled warming cabinets offer remote monitoring, predictive maintenance, and automated temperature control. Energy-efficient units reduce electricity consumption and appeal to buyers focused on long-term operational savings, boosting adoption in hospitals, laboratories, and large foodservice facilities.

Market Restraints

High Upfront Costs

Advanced warming cabinets with smart technology and premium insulation are significantly more expensive than basic models. Small hospitals, clinics, and budget foodservice providers may delay adoption due to high initial costs, limiting penetration in price-sensitive markets.

Fragmented Regulatory Requirements

Different end-use industries and regions have varied technical standards and certification requirements. Compliance complexity can slow market adoption, especially in emerging economies where local regulatory frameworks are still developing.

Warming Cabinets Market Opportunities

Healthcare Expansion in Emerging Economies

Emerging markets such as India, China, and Southeast Asia are investing heavily in healthcare infrastructure. New hospitals, surgical centers, and ambulatory care facilities are driving demand for warming cabinets, particularly large-capacity and smart-enabled units. This presents a strong growth opportunity for global players to establish an early presence and capture market share.

Growth in Foodservice and Hospitality

The rise of cloud kitchens, QSR chains, and catering operations worldwide is fueling demand for compact and modular warming cabinets. New entrants can target mid-size and small-capacity units optimized for space and energy efficiency, catering to fast-growing urban markets.

Technological Advancements and Smart Integration

Manufacturers can capitalize on trends such as IoT-enabled monitoring, predictive maintenance, and energy-efficient designs. Offering smart, connected products enhances product differentiation and enables premium pricing, creating opportunities in developed markets and high-end facilities in emerging regions.

Product Type Insights

Stationary/floor-standing warming cabinets dominate the market due to their suitability for hospitals, large kitchens, and laboratories. These units offer high-volume capacity and greater operational efficiency. Mobile and portable cabinets are gaining traction in smaller facilities, QSRs, and catering operations due to their flexibility and lower cost.

Application Insights

Healthcare remains the largest application segment, accounting for 50% of global demand. Foodservice and hospitality are the fastest-growing segments, driven by regulatory compliance and convenience needs. Laboratory and biotech applications are niche but growing, fueled by increasing R&D activities and pharmaceutical manufacturing.

Distribution Channel Insights

Direct sales dominate the market, especially in healthcare and large foodservice facilities, accounting for 60% of revenue. Distributors and dealers serve smaller buyers and regional markets, while online platforms and e-commerce are emerging channels for small-capacity units. After-market service contracts also influence purchasing decisions.

End-Use Insights

Hospitals, surgical centers, and clinics are the largest buyers, with replacement cycles and new installations driving steady demand. QSRs, cloud kitchens, and hotels represent high-growth markets due to urbanization and the expansion of foodservice chains. Laboratories and biotech companies are growing niche consumers with specialized requirements.

| By Product Type | By Heating Technology | By Capacity / Size | By End-Use / Industry Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for 40% of the global market. High adoption is driven by stringent healthcare standards, advanced foodservice infrastructure, and strong regulatory compliance requirements. The U.S. dominates within the region, focusing on large-capacity, smart warming cabinets for hospitals and commercial kitchens.

Europe

Europe holds 25% of the market, led by Germany, the UK, and France. Healthcare and foodservice sectors are mature, with demand for energy-efficient and digitally controlled cabinets. Retrofitting older facilities and replacing aging equipment drives steady growth.

Asia-Pacific

APAC is the fastest-growing region, with China and India leading adoption due to rapid hospital expansion, urban foodservice growth, and increasing disposable income. Growth in South Korea and Australia is supported by technological adoption and modernized facilities.

Latin America

Latin America accounts for 8% of the market, with Brazil and Mexico driving demand in healthcare and hospitality. Economic volatility limits rapid adoption, but urban centers show strong potential.

Middle East & Africa

MEA contributes 7% of global demand. Gulf countries (UAE, Saudi Arabia) are important buyers, investing in healthcare infrastructure and high-end hospitality. Africa remains the source region for some manufacturing, and intra-regional demand is growing.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Warming Cabinets Market

- STERIS Corporation

- Thermo Fisher Scientific Inc.

- Enthermics Medical Systems

- Becton Dickinson and Company (BD)

- Skytron LLC

- Mac Medical, Inc.

- Medline Industries, Inc.

- Barkey GmbH & Co. KG

- Continental Metal Products, Inc.

- Pedigo Products, Inc.

- Natus Medical Incorporated

- Future Health Concepts, Inc.

- Kanmed AB

- Getinge AB

- DRE Medical

Recent Developments

- In March 2025, STERIS Corporation launched a new line of IoT-enabled warming cabinets for hospitals in North America and Europe, focusing on energy efficiency and remote monitoring capabilities.

- In February 2025, Thermo Fisher Scientific introduced modular, mobile warming cabinets for laboratories and biotech facilities in APAC, expanding its footprint in emerging markets.

- In January 2025, Skytron LLC upgraded its floor-standing warming cabinet portfolio with advanced digital controls and predictive maintenance features for large hospitals in the U.S.