Wall Covering Market Size

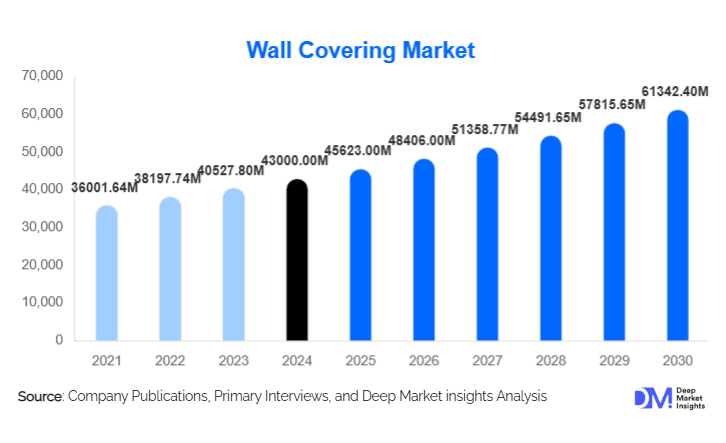

According to Deep Market Insights, the global wall covering market size was valued at USD 43,000.00 million in 2024 and is projected to grow from USD 45,623.00 million in 2025 to reach USD 61,342.40 million by 2030, expanding at a CAGR of 6.1% during the forecast period (2025–2030). This growth is fueled by accelerating construction activity, heightened demand for customization, and rising adoption of sustainable, high-performance wall finish solutions.

Key Market Insights

- Wallpaper remains a core product segment, driven by digital-printing innovations and growing renovation demand.

- Synthetic (vinyl) substrates dominate the material mix, owing to their durability, ease of maintenance, and cost-efficiency.

- Commercial interiors (offices, hospitality, institutional) are key end-users, particularly for acoustic panels and designer wall finishes.

- Asia-Pacific is the fastest-growing region, driven by rapid urbanization and rising middle-class housing demand.

- North America holds a significant share due to strong renovation cycles and green building penetration.

- Sustainability and digital design are reshaping the market, enabling low-VOC materials and custom wall art.

What are the Latest Trends in the Wall Covering Market?

Sustainability & Eco-Materials

Manufacturers are increasingly developing sustainable wall covering solutions, such as bio-based substrates, recycled PET, and low-VOC vinyl, to align with stricter environmental standards and green building certifications (e.g., LEED). This shift not only meets regulatory demands but also appeals to eco-conscious consumers and builders. In parallel, circular-economy initiatives such as take-back and recycling programs for old wall coverings are gaining momentum, helping reduce waste and lower lifecycle carbon footprints.

Customization and Digital Printing

Digital printing is transforming wall coverings by enabling highly customized designs, limited runs, and near real-time production. Customers from homeowners to commercial specifiers can now design bespoke wallpapers or murals tailored to the space. This democratization of design also reduces inventory risk for manufacturers and enables just-in-time or on-demand production.

Functional Wall Panels for Commercial Interiors

Beyond decoration, wall coverings are increasingly functional. Acoustic, fire-rated, and modular wall panels are being adopted in offices, hospitality venues, and institutional buildings. These panels offer not only visual appeal but also performance benefits such as sound control and easy reconfiguration, making them a vital part of modern interior architecture.

What Are the Key Drivers in the Wall Covering Market?

Urbanization & Construction Growth

Rapid urbanization in emerging economies is fueling a construction boom, both in residential and commercial sectors. This surge in building activity is translating directly into increased demand for wall finishing materials. As cities expand and middle-class populations rise, interior design and upgrading become more important, driving demand for wall coverings.

Demand for Aesthetic Personalization

Consumers and specifiers increasingly prioritize aesthetics, texture, and personalization. Peel-and-stick wallpapers, digitally printed murals, and innovative panels let people customize their environments. This trend is particularly strong in renovation markets, where homeowners want to refresh interiors without extensive structural changes.

Green Building & Regulatory Pressure

Sustainability is an ever-stronger factor. Building codes, green certification programs, and buyer preferences are pushing manufacturers toward eco-friendlier materials. The adoption of bio-substrates, recycled content, and low-emitting products is enhancing the appeal of wall coverings in regions with stringent environmental standards.

What Are the Restraints for the Global Wall Covering Market?

Raw Material Volatility

Many wall covering products rely on petrochemical-based materials such as PVC. Price fluctuations in resins, supply chain disruptions, and geopolitical risks can severely affect costs and margins. For manufacturers, managing this volatility remains a major challenge, particularly in competing commodity segments.

Intense Market Competition

The wall covering market is becoming increasingly competitive, with commoditization in lower-end categories like basic vinyl wallpaper. Without clear differentiation between sustainability, design, or performance, companies may face margin compression and margin squeeze. Innovation becomes essential to avoid competing purely on price.

What Are the Key Opportunities in the Wall Covering Industry?

Bio-Based & Circular Material Innovation

There is a substantial opportunity in developing and scaling bio-based wall coverings (e.g., grasscloth, recycled PET, bio-PVC) and circular models (take-back, recycling). As green building standards tighten and sustainability becomes a selling point, manufacturers that invest in low-carbon, recyclable materials can capture premium market segments and reduce reliance on volatile petrochemicals.

On-Demand Customized Design

The growing appetite for personalized interiors opens the door for just-in-time digital printing services, online design platforms, and bespoke wall coverings. By combining e-commerce, augmented reality (AR) visualization, and digital print, companies can offer unique, design-rich products with lower inventory risk and faster fulfillment.

Performance & Functional Wall Systems

Acoustic, fire-rated, and modular wall panels present a high-value growth vector, especially in commercial, institutional, and hospitality settings. Manufacturers can expand into these segments by integrating performance attributes (sound absorption, demountability, safety) with aesthetic design, thus creating multifunctional wall systems that serve as both art and building components.

Product Type Insights

Wallpaper continues to dominate the global wall covering market, particularly in residential and design-focused applications. Its popularity stems from material versatility, ranging from vinyl, non-woven to textile substrate, and ease of installation, which allows for both DIY and professional projects. Digital printing innovations have further strengthened wallpaper adoption by enabling highly customizable designs, catering to the rising demand for aesthetic personalization. Wall panels, including acoustic, decorative, and modular systems, are increasingly gaining traction in commercial and institutional interiors, driven by their functional benefits such as sound absorption, fire resistance, and modular flexibility. Tiles and metal wall coverings, while niche, serve specialized applications, including wet areas, industrial facilities, and premium architectural projects, highlighting the importance of durability and performance alongside visual appeal. Overall, the growth of functional wall panels is currently the leading driver within product types, supported by commercial real estate expansion, office redesigns, and increasing adoption of multifunctional interior systems.

Application Insights

In residential applications, wall coverings are widely adopted for both new construction and renovation projects, especially among homeowners seeking to enhance interior aesthetics and express individuality through design-rich solutions. Commercial applications spanning offices, hotels, restaurants, and institutional facilities favor wall coverings not only for decorative purposes but also for performance attributes, including acoustic optimization, fire safety, and modular adaptability. Industrial applications, although smaller in scale, leverage high-performance wall coverings in manufacturing plants, hospitals, laboratories, and public infrastructure, where durability, hygiene, and compliance with safety standards are essential. The convergence of decorative appeal and functional performance is creating hybrid use cases, such as coworking spaces, wellness centers, and educational facilities, where interior design needs to complement operational requirements. Notably, the performance-oriented wall panel segment is leading within applications, driven by growing demand in commercial and institutional sectors where multi-functionality and compliance with building standards are critical.

Distribution Channel Insights

Specialty decor retailers and design boutiques continue to play a crucial role in premium wallpapers and designer wall panels, offering curated catalogs and personalized guidance to end-users. Home improvement chains and building-material distributors serve both professional contractors and DIY customers, particularly for volume-oriented products like vinyl and non-woven wallpapers. E-commerce platforms are experiencing rapid growth, providing customization options, AR visualization, and direct-to-consumer sales, which reduce lead times and inventory costs. Specification-driven channels, including architects, interior designers, and contractors, are increasingly influential for projects involving high-performance acoustic, fire-rated, or modular wall systems. Across all channels, digital tools, project visualization technologies, and design consulting are becoming key enablers of sales growth, bridging the gap between aesthetic aspirations and functional requirements.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America remains one of the largest wall covering markets globally, driven by robust residential renovation activity, stringent sustainability regulations, and high demand for performance-oriented wall systems in commercial and institutional buildings. The U.S. leads in the adoption of acoustic wall panels, modular designs, and green building–certified materials. Renovation culture, aging housing stock, and stringent VOC-related building codes are key drivers of market growth, alongside the increasing use of digital design tools and interior personalization trends. Canada contributes through both residential upgrades and commercial projects, emphasizing eco-friendly materials, further strengthening regional demand.

Asia-Pacific

Asia-Pacific is the fastest-growing region, fueled by rapid urbanization, strong residential construction, and rising disposable incomes in countries such as China and India. Expanding local manufacturing capabilities, rising middle-class aspirations for premium interiors, and the growing hospitality sector are major growth drivers. Demand for modular and acoustic wall panels is particularly strong in high-rise commercial and residential developments, while digital-print wallpapers are gaining traction among design-conscious urban homeowners. Government infrastructure investments and the emergence of smart buildings are also supporting the adoption of functional and aesthetic wall coverings across the region.

Europe

Europe's wall covering market is characterized by a strong emphasis on sustainability, energy efficiency, and design heritage. Countries like Germany, the UK, and France lead in renovation projects, commercial interior upgrades, and green-certified building adoption. Key growth drivers include stringent environmental regulations, widespread green building certifications (LEED, BREEAM), and high consumer preference for low-VOC and recyclable materials. Architects and designers play a pivotal role, promoting customized wallpaper and wall panel solutions. Additionally, renovation of historical and urban properties fuels demand for both aesthetic and functional wall covering solutions.

Latin America

Latin America is experiencing steady growth in wall coverings, driven by urban residential renovations, expansion of commercial interiors, and a growing focus on design aesthetics in middle- and upper-class housing. Brazil and Mexico represent the largest markets, supported by increasing investments in hotels, retail spaces, and office modernization. Drivers include rising disposable incomes, urbanization trends, and growing awareness of modern interior design solutions. While economic volatility can affect high-end segments, the demand for modular panels and digitally printed wallpapers is steadily increasing as consumers seek both style and functionality.

Middle East & Africa

The Middle East & Africa region is emerging rapidly, with growth driven by luxury real estate projects, hospitality investments, and large-scale infrastructure development. Key markets include the UAE, Saudi Arabia, South Africa, and Nigeria. Decorative wall panels, acoustic solutions, and premium wallpapers are in high demand for upscale hotels, commercial spaces, and institutional buildings. Drivers include high per-capita income, increased construction of office and retail spaces, and government-backed initiatives promoting urban modernization. Additionally, the adoption of sustainable materials and modern design trends in new residential developments is contributing to market expansion across the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Wall Covering Market

- Saint-Gobain

- A.S. Création Tapeten AG

- Asian Paints

- Armstrong World Industries

- 3M

- Graham & Brown

- York Wallcoverings

- F. Schumacher & Co.

- Ahlstrom-Munksjö

- Grandeco Wallfashion Group

- Osborne & Little

- Sanderson Design Group

- Benjamin Moore

- Brewster Home Fashions

- Daltile (TILE / Ceramic wall covering)

Recent Developments

- In 2025, several major players expanded their digital-print wallpaper capacity to serve growing demand for bespoke and on-demand wall coverings.

- In 2024–2025, leading manufacturers launched new eco-friendly lines using recycled PET, bio-based substrates, and low-VOC coatings to align with green building standards.

- Strategic partnerships and acquisitions have accelerated: some wall covering manufacturers have acquired or partnered with acoustic panel firms, boosting their presence in performance wall system markets.