Waffle Maker Market Size

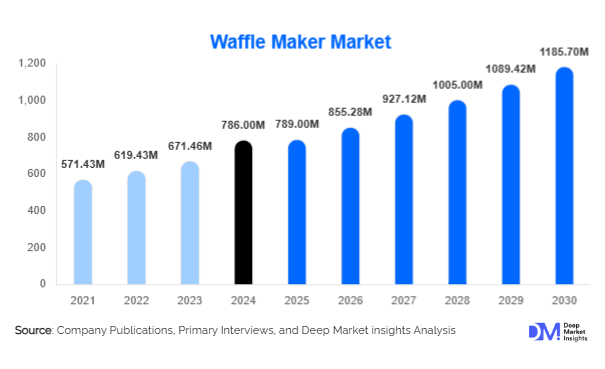

The global waffle maker market size was valued at USD 748.6 million in 2024 and is projected to grow from USD 789.5 million in 2025 to reach USD 1,185.7 million by 2030, expanding at a CAGR of 8.4% during the forecast period (2025-2030). Growth in this industry is driven by rising consumer preference for convenient breakfast appliances, the expansion of commercial foodservice outlets, and increasing demand for smart kitchen appliances that integrate digital controls and IoT features.

Key Market Insights

- Rising home cooking trends and at-home breakfast culture are significantly fueling demand for residential waffle makers worldwide.

- Commercial-grade waffle makers are expanding in quick-service restaurants (QSRs), cafés, and hotels, creating a strong base for B2B growth.

- North America leads the global waffle maker market due to high per-capita appliance penetration and an established café culture.

- Asia-Pacific is the fastest-growing region, driven by urbanization, growing disposable income, and the rising popularity of Western breakfast habits.

- Online sales channels dominate growth, particularly through e-commerce platforms such as Amazon, Flipkart, JD.com, and Alibaba.

- Smart and IoT-enabled waffle makers, featuring digital timers, app integration, and energy efficiency, are reshaping consumer adoption patterns.

What are the latest trends in the waffle maker market?

Smart Kitchen Integration

Consumers are increasingly shifting toward connected and smart appliances. Waffle makers with digital displays, programmable cooking modes, and smartphone-enabled controls are gaining traction. Integration with home assistants like Alexa or Google Home is also emerging, appealing to urban households seeking convenience. Smart waffle makers are being bundled with AI-based recipe suggestions, temperature sensors, and automatic shut-off systems to improve safety and user experience.

Growing Popularity of Compact and Portable Models

Mini and compact waffle makers are trending among millennials and Gen Z customers living in apartments or dormitories. Their affordability, space efficiency, and ability to make single-serve portions cater well to solo consumers and small families. The rise of social media-driven food culture, where compact waffle makers are showcased in cooking videos and DIY recipes, has further boosted this product segment.

Expansion of Commercial Foodservice Applications

The café and quick-service restaurant sector is increasingly adopting industrial and rotating waffle makers to cater to growing demand for waffles, desserts, and all-day breakfast menus. Commercial-grade appliances offer higher throughput, durability, and energy efficiency. This trend is particularly strong in regions like North America, Europe, and urban Asia-Pacific markets, where café chains and fast-food outlets are rapidly expanding.

What are the key drivers in the waffle maker market?

Rising Adoption of Convenient Breakfast Solutions

With busier lifestyles, consumers are seeking convenient and quick-to-prepare breakfast options. Waffles have become a preferred alternative to traditional breakfast meals, especially in Western countries. The ability of waffle makers to deliver fresh, customizable food at home is driving demand in residential segments, contributing to market growth globally.

Growing Penetration of E-Commerce Platforms

E-commerce has transformed how consumers purchase appliances. Platforms like Amazon, Walmart, and Alibaba allow customers to compare models, check reviews, and access discounts, boosting online sales. The direct-to-consumer (D2C) strategy adopted by appliance manufacturers further strengthens margins and enhances brand reach, particularly in developing economies.

Expansion of the Foodservice and QSR Industry

The global growth of cafés, bakeries, and quick-service restaurants has led to a surge in commercial waffle makers. Menu diversification strategies, including the addition of waffles and waffle-based desserts, are helping food chains attract younger demographics and increase per-customer spending. This B2B growth driver is expected to remain dominant during the forecast period.

What are the restraints for the global waffle maker market?

High Market Saturation in Developed Regions

Markets in North America and Western Europe already have a high penetration of kitchen appliances, including waffle makers. The replacement cycle is longer for durable appliances, which can restrain growth rates in these regions compared to emerging economies.

Price Sensitivity and Low Awareness in Developing Regions

In parts of Latin America, Africa, and Southeast Asia, waffle makers are still seen as non-essential appliances. Price sensitivity, coupled with low awareness of waffle consumption habits, creates barriers to entry. Manufacturers must invest in consumer education and affordable product ranges to penetrate these markets.

What are the key opportunities in the waffle maker industry?

IoT and Smart Appliance Ecosystem

The integration of IoT into waffle makers presents a strong growth opportunity. Brands introducing app-enabled devices with recipe databases, energy efficiency metrics, and AI-based personalization can capture urban tech-savvy consumers. This opportunity also aligns with the broader smart home appliance trend.

Expansion in Asia-Pacific and Emerging Markets

Rising disposable incomes and Western influence on food habits in countries like China, India, Indonesia, and Vietnam present growth opportunities. The café culture in these regions is rapidly expanding, creating commercial demand, while urban households are adopting premium kitchen appliances.

Sustainability and Energy-Efficient Designs

Consumer demand for eco-friendly appliances is rising. Energy-efficient waffle makers with recyclable materials and minimal carbon footprint manufacturing present a key opportunity. Companies investing in sustainable product design can gain a competitive edge and align with government energy regulations.

Product Type Insights

Belgian waffle makers dominate the product category, accounting for nearly 32% of the 2024 market. Their popularity stems from the growing demand for thicker, gourmet-style waffles both at home and in restaurants. Compact waffle makers follow closely, supported by demand in residential settings. Commercial waffle makers, although lower in unit sales, contribute significantly to revenue due to higher price points and institutional adoption.

Operation Mode Insights

Fully automatic waffle makers lead the segment with a 38% share in 2024, driven by convenience and adoption in commercial kitchens. Manual waffle makers still hold strong demand in developing economies due to affordability, but smart, app-integrated models are gaining traction rapidly in North America and Europe.

Distribution Channel Insights

Online channels account for 55% of global sales in 2024, with e-commerce marketplaces dominating the landscape. Offline retail continues to thrive in emerging markets where physical product inspection and price comparison remain important, but the growth rate of online channels is higher due to convenience and discounts.

End-Use Insights

Residential use dominates the waffle maker market with a 60% share in 2024, reflecting consumer appetite for home cooking solutions. However, commercial end-use is the fastest-growing segment, driven by QSR chains, cafés, and institutional catering services. As waffles become more mainstream globally, their use in diversified menus will continue to fuel demand.

| By Product Type | By Operation Mode | By Material | By End-User | By Price Range |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the global waffle maker market, contributing 38% of the total revenue in 2024. The U.S. accounts for the majority share due to established breakfast culture, high appliance penetration, and a strong commercial foodservice sector. Canada follows with steady growth in both residential and café adoption.

Europe

Europe holds around 26% market share in 2024, with Germany, the U.K., and France leading demand. The region’s preference for premium and durable stainless steel waffle makers supports growth. Cafés and hotels are adopting Belgian waffle makers as part of all-day breakfast and dessert menus.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at a CAGR of over 10%. China and India are key drivers due to urbanization, rising disposable incomes, and Western breakfast influence. Japan and South Korea represent mature, steady markets with high adoption of compact and smart waffle makers.

Latin America

LATAM is an emerging market, with Brazil and Mexico leading adoption. Growth is supported by increasing café penetration and youth-driven demand for international food trends. However, price sensitivity and limited awareness remain challenges.

Middle East & Africa

The MEA region is gradually adopting waffle makers, especially in the Gulf countries, where café culture is expanding rapidly. South Africa is showing traction in both household and commercial segments. However, overall market share remains under 5% globally.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Players in the Global Waffle Maker Market

- Breville Group

- Cuisinart (Conair Corporation)

- Krups (Groupe SEB)

- Hamilton Beach Brands

- BLACK+DECKER (Stanley Black & Decker)

- KitchenAid (Whirlpool Corporation)

- Oster (Newell Brands)

- Dash (StoreBound LLC)

- Chefman

- All-Clad

- Waring Commercial

- Holstein Housewares

- Vitantonio

- Yongkang Shuangtao Electrical Appliance Co., Ltd.

- Star Manufacturing International

Recent Developments

- In March 2025, Breville launched a new IoT-enabled waffle maker with app-controlled cooking presets and energy monitoring features.

- In February 2025, Hamilton Beach announced the expansion of its product line in Asia-Pacific through partnerships with regional e-commerce platforms.

- In January 2025, Cuisinart introduced a line of eco-friendly waffle makers made from recyclable stainless steel and energy-saving components.