Vlogging Camera Market Size

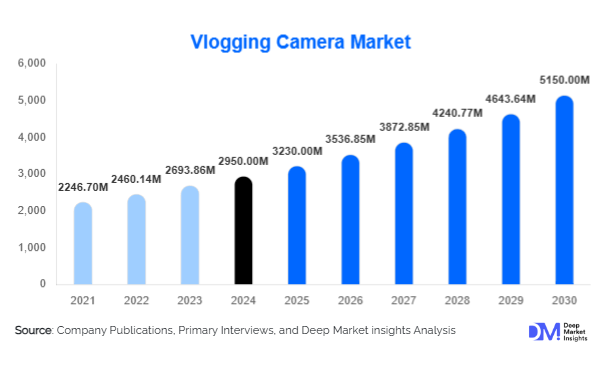

According to Deep Market Insights, the global vlogging camera market size was valued at USD 2,950 million in 2024 and is projected to grow from USD 3,230 million in 2025 to reach USD 5,150 million by 2030, expanding at a CAGR of 9.5% during the forecast period (2025–2030). Growth in this market is primarily driven by the explosion of digital content creation, rising demand for compact and high-quality cameras among vloggers, and continuous technological advancements such as 4K/8K recording, wireless connectivity, and AI-enabled editing support.

Key Market Insights

- Content creation and influencer marketing are fueling vlogging camera demand, with YouTube, TikTok, and Instagram creators driving significant hardware purchases.

- Mirrorless vlogging cameras dominate the product landscape, favored for portability, interchangeable lenses, and professional-quality output.

- Asia-Pacific is the fastest-growing region, led by India, China, and Southeast Asia, where a rising middle class is adopting vlogging as a career and lifestyle choice.

- North America remains the largest market, supported by the strong penetration of professional creators and tech-savvy consumers.

- Wi-Fi and Bluetooth integration are now standard, enabling instant sharing, live streaming, and editing across platforms.

- 360-degree and action vlogging cameras are gaining traction among travel and adventure vloggers seeking immersive experiences.

What are the prevailing trends currently influencing the global vlogging camera market?

Rise of Compact and Mirrorless Systems

Compact and mirrorless cameras are increasingly preferred by vloggers due to their lightweight build, advanced stabilization, and superior image quality. This trend reflects the shift from traditional bulky DSLRs to versatile, travel-friendly devices optimized for video. Interchangeable lenses, fast autofocus, and low-light performance make these systems the go-to choice for creators balancing mobility with professional content output.

AI and Connectivity Integration

Vlogging cameras are now being equipped with AI-driven features such as face tracking, scene recognition, and automated editing. Connectivity has also become a major differentiator, with Wi-Fi and Bluetooth enabling seamless transfer to social platforms, while USB-C streaming support enhances real-time broadcasting. These integrations reduce the post-production burden on creators and appeal strongly to tech-driven content workflows.

What are the primary growth drivers impacting the vlogging camera market?

Explosion of Influencer Marketing

Brands worldwide are allocating larger budgets to influencer-led campaigns, fueling demand for high-quality content equipment. Vlogging cameras tailored for YouTube, TikTok, and Instagram creators are becoming mainstream, driving upgrades from entry-level devices to advanced professional models.

Growth of Live Streaming and E-Learning

The surge in online education, webinars, and live streaming platforms has accelerated demand for cameras optimized for long-duration recording and streaming. Creators in fitness, music, and education increasingly rely on vlogging cameras for stable, high-resolution output, contributing to sustained demand across professional and casual segments.

Technological Advancements in Imaging

Recent innovations, such as in-body stabilization, 8K video, AI-based autofocus, and 360-degree recording, have made vlogging cameras indispensable for producing immersive, cinematic content. These advancements differentiate dedicated vlogging cameras from smartphones, sustaining their niche appeal.

What are the key challenges and restraints affecting the global vlogging camera market?

High Cost of Professional Cameras

Professional-grade vlogging cameras with advanced sensors and stabilization systems remain expensive, limiting accessibility for amateur creators. With smartphones offering strong video capabilities, the cost barrier continues to restrict adoption in price-sensitive markets.

Competition from Smartphones

High-end smartphones are increasingly equipped with advanced video capabilities, including 4K/8K resolution, stabilization, and AI editing tools. This has created substitution threats, particularly among casual vloggers who prefer multifunctional devices over standalone cameras.

Which strategic opportunities exist for stakeholders in the vlogging camera market?

Emerging Demand from Asia-Pacific

The Asia-Pacific region, particularly India, China, and Southeast Asia, is seeing a surge in young creators adopting vlogging as a profession. With increasing internet penetration and growing social media monetization opportunities, demand for affordable yet high-quality vlogging cameras is poised to rise sharply.

Integration with AI and Cloud Ecosystems

Opportunities exist for manufacturers to integrate AI editing, auto-captioning, and cloud-based content storage directly into cameras. This could transform workflows for creators, reducing editing time and enhancing monetization opportunities through faster publishing.

Corporate and Educational Applications

Corporations and educational institutions are increasingly leveraging video for branding, training, and instruction. Vlogging cameras with professional-grade streaming support present a growing opportunity in these segments, beyond traditional consumer demand.

Product Type Insights

Mirrorless vlogging cameras accounted for 42% of the global market in 2024, leading the category due to their balance of portability and professional quality. Compact vlogging cameras follow closely, favored by amateur creators for affordability and ease of use. Action and 360-degree cameras are carving niche demand in travel, adventure, and immersive content creation, with double-digit growth projected through 2030. DSLRs, though declining, continue to serve a professional niche requiring interchangeable lenses and superior manual controls.

Application Insights

Professional content creators and influencers represent 48% of market share in 2024, establishing this as the dominant segment. The rise of casual/amateur vloggers contributes steadily, supported by the availability of affordable entry-level models. Travel and lifestyle content has become a significant driver, with action and compact cameras catering to this demand. Gaming and tech review creators also form a fast-growing application segment, particularly in North America and Asia.

Distribution Channel Insights

Online retail accounts for 61% of global sales in 2024, driven by e-commerce platforms, direct-to-consumer brand websites, and influencer-led marketing campaigns. Offline retail remains relevant in mature markets like North America and Europe, where consumers prefer testing devices physically before purchase. Subscription-based equipment rental models are emerging, allowing creators to upgrade frequently without large upfront costs.

End-Use Insights

Demand from influencer marketing and entertainment industries continues to dominate, followed by growing adoption in corporate communication and education sectors. The fitness, travel, and lifestyle industries are also driving vlogging camera adoption as content becomes central to engagement strategies. Export-driven demand for vlogging equipment is significant, with Asia-Pacific manufacturing hubs supplying a majority of global volumes while North America and Europe remain top importers.

| By Product Type | By Connectivity | By Sensor Type | By Distribution Channel | By Application |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America held 34% market share in 2024, making it the largest regional market. The U.S. leads demand due to its high concentration of professional vloggers, influencer marketing campaigns, and advanced retail ecosystems. Canada also contributes significantly with strong adoption of online video in education and lifestyle content creation.

Europe

Europe represents 27% of global demand in 2024, led by Germany, the U.K., and France. The region shows strong adoption of professional cameras for creative industries, while younger demographics drive amateur vlogging demand. Regulatory frameworks promoting digital entrepreneurship further encourage market growth.

Asia-Pacific

Asia-Pacific is the fastest-growing region with a projected CAGR above 12%. China and India are at the forefront, fueled by explosive social media usage and government support for digital entrepreneurship. Japan and South Korea remain strong demand centers for high-end cameras, while Southeast Asia drives growth in the entry- to mid-level category.

Latin America

Latin America is emerging steadily, with Brazil, Argentina, and Mexico driving demand for affordable vlogging equipment. The region benefits from rising creator economies and export-driven camera imports, although affordability remains a challenge.

Middle East & Africa

The Middle East shows strong potential, led by the UAE and Saudi Arabia, where influencer marketing is booming. Africa is at an early stage, but South Africa and Nigeria are seeing growing adoption of vlogging cameras among lifestyle and travel creators. Regional demand is expected to pick up as internet penetration and smartphone-video transitions foster more professional camera adoption.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Vlogging Camera Market

- Sony Corporation

- Canon Inc.

- Panasonic Corporation

- Nikon Corporation

- Fujifilm Holdings Corporation

- GoPro Inc.

- DJI Technology Co., Ltd.

- Olympus Corporation (OM Digital Solutions)

- Blackmagic Design

- Leica Camera AG

- Ricoh Imaging Company Ltd.

- Sharp Corporation

- Insta360

- AEE Technology

- Drift Innovation

Recent Developments

- In June 2025, Sony launched a new mirrorless vlogging camera featuring AI-enhanced autofocus and 8K support, targeting professional creators.

- In May 2025, Canon expanded its EOS R series with a lightweight vlogging-focused model, emphasizing portability and live streaming compatibility.

- In March 2025, GoPro introduced next-gen action cameras with modular lens systems, enabling creators to switch between wide, narrow, and 360-degree perspectives.