Vitrified Tiles Market Size

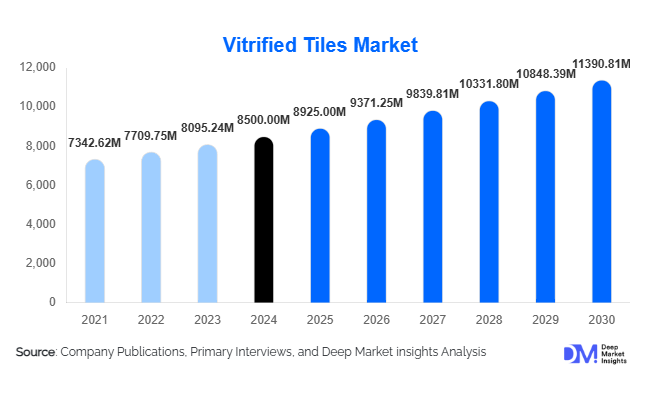

According to Deep Market Insights, the global vitrified tiles market size was valued at USD 8,500 million in 2024 and is projected to grow from USD 8,925 million in 2025 to reach USD 11,390.81 million by 2030, expanding at a CAGR of approximately 5.0% during the forecast period (2025–2030). The market’s growth is driven by rapid urbanization, rising demand for premium flooring materials, technological innovation in tile design, and expanding infrastructure development across emerging economies.

Key Market Insights

- Asia-Pacific leads the global vitrified tiles market, accounting for nearly 40% of total revenue in 2024, supported by booming construction activities in India and China.

- Residential construction remains the largest end-use sector, contributing about 60% of market demand, driven by home renovation and new housing projects.

- Glazed vitrified tiles (GVT) dominate the product landscape, capturing around 50% market share due to their superior aesthetics and cost-effectiveness.

- Digital printing and large-format tile innovations are enabling manufacturers to offer premium, customizable design solutions to global customers.

- Growing export opportunities from manufacturing hubs such as India and China are reshaping global supply chains for vitrified tiles.

- Rising sustainability focus, including the use of recycled raw materials and energy-efficient production, continues to influence product development and purchasing decisions.

Latest Market Trends

Premiumization and Large-Format Tiles

Premiumization is transforming the vitrified tiles market as consumers increasingly favor sophisticated designs, marble-like finishes, and larger tile formats (800×800 mm and above). Large-format vitrified slabs are gaining traction in high-end residential and commercial interiors due to their seamless appearance and reduced grout lines. Manufacturers are investing in digital printing, nano-coating, and surface texturing technologies to enhance visual appeal and functionality, positioning premium vitrified tiles as alternatives to natural stone and engineered marble.

Eco-Friendly Manufacturing and Green Certifications

Sustainability has become a defining trend across global tile production. Tile manufacturers are adopting cleaner kilns, renewable energy sources, and recycled input materials to reduce environmental impact. Certifications such as LEED and ISO 14001 are becoming key differentiators, especially for export-oriented producers. The adoption of low-VOC glazes and water-efficient production techniques underscores the industry’s transition toward greener operations aligned with global sustainability goals.

Vitrified Tiles Market Drivers

Rapid Urbanization and Housing Demand

Rapid urban expansion in emerging markets is fueling large-scale residential construction. The demand for aesthetically appealing, durable, and low-maintenance flooring materials has accelerated the adoption of vitrified tiles, which outperform traditional ceramics in terms of wear resistance and longevity.

Commercial Infrastructure Development

Growing investments in commercial real estate, hospitality, and institutional infrastructure, particularly airports, offices, and retail centers, are propelling market growth. Developers prefer vitrified tiles for their superior mechanical strength, design versatility, and long-term cost efficiency compared to alternatives like marble or vinyl flooring.

Technological Advancements in Tile Manufacturing

Technological innovation, including digital inkjet printing, automated glazing, and nano-coating techniques, has revolutionized tile production. These advances have expanded aesthetic possibilities and enabled the production of anti-slip, stain-resistant, and large-format tiles catering to both residential and commercial users.

Market Restraints

Volatile Raw Material and Energy Costs

Energy-intensive production processes make vitrified tile manufacturing vulnerable to fluctuations in fuel and electricity costs. Price volatility in clay, feldspar, and silica also pressures margins, particularly for small and mid-sized producers competing on cost.

Competition from Alternative Flooring Materials

Vitrified tiles face increasing competition from luxury vinyl tile (LVT), engineered wood, and laminate flooring solutions. These alternatives attract consumers seeking easy installation and softer surface textures, potentially constraining vitrified tile penetration in certain residential markets.

Vitrified Tiles Market Opportunities

Technological Integration and Design Innovation

Emerging opportunities lie in advanced digital design and surface technologies. Customizable 3D prints, digitally textured finishes, and AI-based pattern design are expected to redefine consumer preferences. Integration of smart tile technology, such as temperature-regulating or self-cleaning surfaces, may open new growth frontiers.

Infrastructure and Smart City Investments

Government-led housing and smart city programs in India, China, and the Middle East are fueling massive infrastructure development. These projects demand high-volume, durable, and visually appealing tile solutions, creating expansion prospects for both local manufacturers and international suppliers.

Export Market Expansion

Manufacturers in Asia are capitalizing on growing global demand by expanding export portfolios to the Middle East, Africa, and Latin America. India, in particular, is emerging as a leading exporter of vitrified tiles, leveraging cost advantages, abundant raw materials, and compliance with global quality standards.

Product Type Insights

Glazed vitrified tiles (GVT) dominate the product category, holding approximately 50% of global market revenue in 2024. Their superior design flexibility, surface sheen, and affordability make them the preferred choice across residential and commercial projects. Double-charged vitrified tiles cater to heavy-traffic areas such as airports and malls, while full-body vitrified tiles are gaining popularity in industrial and outdoor applications for their exceptional durability.

Application Insights

Flooring applications account for nearly 70% of global vitrified tile demand, driven by growing adoption in both residential and commercial spaces. Interior wall cladding is the second-largest application, supported by aesthetic and hygiene benefits in kitchens, bathrooms, and retail environments. Exterior paving and façade applications are rising steadily as architects adopt textured, anti-slip vitrified tiles for outdoor and high-traffic spaces.

End-Use Insights

The residential sector leads the vitrified tiles market with about 60% share in 2024, primarily supported by urban housing projects and remodeling activities. Commercial sectors, offices, hospitality, and retail represent the second-largest segment, driven by the growing trend toward premium interiors and long-lasting materials. Industrial and institutional uses, including hospitals and schools, are emerging as new areas of growth as project developers prioritize easy-to-clean and wear-resistant surfaces.

Distribution Channel Insights

Offline retail, including showrooms and dealer networks, continues to dominate distribution with approximately 65% of global revenue. Physical touchpoints remain essential for product visualization and selection. However, e-commerce and B2B online platforms are growing rapidly, particularly for smaller-scale renovation projects and direct contractor sourcing.

| By Product Type | By End Use | By Finish Type | By Size | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific remains the largest and fastest-growing regional market, accounting for 35–40% of global value in 2024. China and India are the dominant contributors, driven by strong housing demand, low production costs, and expanding export activities. India, supported by “Make in India” initiatives, is the fastest-growing national market with over 5% CAGR forecast through 2030.

Europe

Europe commands roughly 20–25% of market value, emphasizing high-end design, eco-friendly tiles, and architectural innovation. Italy and Spain remain major production centers, with demand rising in Eastern Europe due to residential renovation and infrastructure modernization.

North America

North America holds around a 15% share of the global vitrified tiles market in 2024. Growth is steady, supported by remodeling activity in the U.S. and Canada. The market favors premium, digitally designed tiles as consumers upgrade from traditional ceramics to vitrified materials.

Middle East & Africa

The MEA region accounts for roughly 8–10% of global market value. GCC nations are key demand centers, led by infrastructure projects and luxury real estate. Africa’s tile consumption is expanding due to urbanization and Chinese/Indian import penetration.

Latin America

Latin America contributes approximately a 5–8% share. Brazil and Mexico are key markets, driven by construction recovery and increased exports from regional tile producers. Rising middle-class spending on home improvement is boosting demand for durable, cost-effective vitrified tiles.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Vitrified Tiles Market

- Kajaria Ceramics Ltd

- Mohawk Industries, Inc.

- RAK Ceramics

- Grupo Lamosa

- SCG Ceramics

- Asian Granito India Ltd

- Pamesa Cerámica

- Crossville, Inc.

- Florim Ceramiche S.p.A.

- Ceramiche Ricchetti

- Casalgrande Padana

- Royal Ceramic PLC

- Ceramic Industries Ltd

- NITCO Tiles

- Johnson Tiles