Visco Bath Market Size

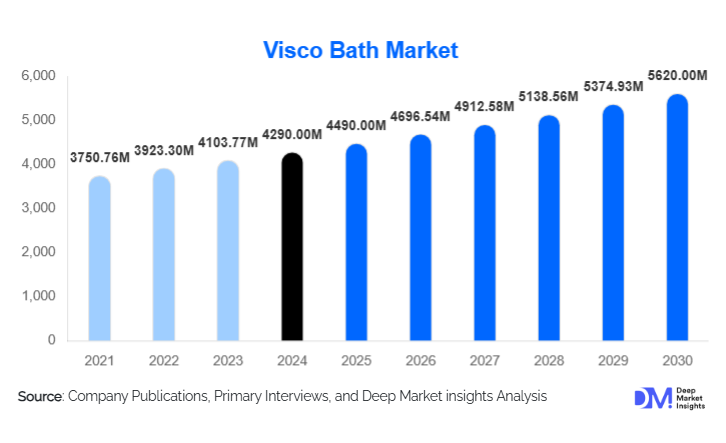

According to Deep Market Insights, the global visco bath market size was valued at USD 4,290 million in 2024 and is projected to grow from USD 4,490 million in 2025 to reach USD 5,620 million by 2030, expanding at a CAGR of 4.6% during the forecast period (2024–2030). The market growth is primarily driven by the increasing adoption of viscoelastic bath materials in industrial and laboratory applications, technological advancements in temperature control systems, and the growing emphasis on precision testing environments across the chemical and pharmaceutical sectors.

Key Market Insights

- Rising demand for high-precision thermal control systems is fueling the adoption of visco baths in research and industrial laboratories.

- Automation and digital monitoring technologies are enhancing operational efficiency and consistency in temperature-dependent testing processes.

- Pharmaceutical and biotechnology industries remain the largest end-users due to strict temperature control requirements during viscosity and stability testing.

- Asia-Pacific is the fastest-growing region, supported by expanding manufacturing capacities in China, India, and South Korea.

- Integration of IoT-enabled temperature monitoring and smart diagnostics is creating new opportunities for product innovation.

- Environmental and energy-efficient designs are gaining traction, particularly in Europe, driven by stringent sustainability standards.

Latest Market Trends

Smart and Automated Visco Baths

Manufacturers are increasingly introducing smart visco baths equipped with digital interfaces, automated calibration, and wireless connectivity. These systems allow real-time monitoring and control through mobile or cloud-based platforms, ensuring greater accuracy and repeatability in testing. The adoption of IoT and AI-driven diagnostics is improving maintenance predictability, reducing downtime, and optimizing energy consumption across research and industrial applications.

Eco-Efficient and Low-Energy Systems

With sustainability becoming a core priority, companies are investing in energy-efficient visco bath designs. The use of eco-friendly refrigerants, improved insulation materials, and optimized heat exchange systems is reducing overall power consumption. Green-certified manufacturing processes and recyclable components are also being adopted to comply with global environmental standards, particularly in European markets.

Visco Bath Market Drivers

Expanding Pharmaceutical and Life Sciences Sector

The growing pharmaceutical and biotechnology industries are driving visco bath demand due to the need for precise temperature control during drug formulation and testing. Increasing R&D investments, clinical trial activities, and quality compliance standards are encouraging laboratories to upgrade to advanced visco bath systems offering enhanced accuracy and stability.

Technological Advancements and Digital Integration

Ongoing innovations in automation, connectivity, and data analytics are reshaping the visco bath industry. Modern models now feature programmable digital interfaces, remote operation capabilities, and integrated sensors that enhance process visibility. This digital evolution supports predictive maintenance, performance optimization, and greater reliability across testing environments.

Market Restraints

High Equipment Costs and Maintenance Requirements

Advanced visco bath systems with smart controls and automation features entail high initial investments. Regular calibration, maintenance, and component replacement costs further add to operational expenses, posing challenges for small and medium-sized laboratories. These factors may limit adoption in cost-sensitive markets.

Limited Awareness and Technical Expertise

In emerging economies, a lack of skilled professionals capable of operating and maintaining high-precision temperature control systems limits market penetration. Additionally, inconsistent technical training and low awareness regarding calibration standards can restrict optimal utilization of advanced visco baths in laboratory environments.

Visco Bath Market Opportunities

Integration of IoT and Predictive Maintenance

The growing trend toward Industry 4.0 is creating opportunities for IoT-enabled visco baths with real-time performance analytics and predictive maintenance capabilities. These systems can detect anomalies, optimize energy use, and ensure continuous operational performance, making them ideal for high-throughput testing environments.

Expansion in Emerging Economies

Rapid industrialization in Asia-Pacific, Latin America, and the Middle East offers significant growth opportunities for visco bath manufacturers. The expansion of research facilities, pharmaceutical production, and university laboratories is increasing product adoption in these regions. Local partnerships and distribution networks are key to tapping into these high-potential markets.

Product Type Insights

Based on product type, circulating visco baths dominate the market due to their precise temperature regulation and broad application across chemical, pharmaceutical, and materials testing. Non-circulating visco baths cater to basic laboratory applications requiring limited temperature uniformity. The adoption of automated and programmable visco baths is increasing rapidly as laboratories prioritize precision and process efficiency.

Application Insights

Pharmaceutical and biotechnology applications account for the largest market share, driven by viscosity, stability, and dissolution testing requirements. The chemical and petrochemical sector is another major segment, where visco baths are used for quality control and materials analysis. Food and beverage testing is an emerging application area, supported by growing regulatory emphasis on quality assurance and process validation.

Distribution Channel Insights

Direct sales and OEM partnerships dominate the market, allowing manufacturers to maintain control over pricing and technical support. Online platforms and digital distributors are witnessing strong growth as customers seek transparent pricing, technical specifications, and easy product comparison. Specialized laboratory equipment suppliers continue to play a critical role in servicing niche and institutional clients.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America leads the global visco bath market, driven by strong R&D infrastructure, established pharmaceutical production, and early adoption of smart laboratory systems. The U.S. accounts for the largest share, supported by stringent quality standards and continuous technological innovation.

Europe

Europe remains a key market, with countries such as Germany, France, and the U.K. focusing on sustainable and energy-efficient visco bath solutions. The region’s robust regulatory framework and commitment to eco-friendly technologies are shaping product design and performance standards.

Asia-Pacific

Asia-Pacific is projected to be the fastest-growing region during the forecast period, supported by expanding pharmaceutical manufacturing in China and India, and increasing R&D investments in Japan and South Korea. Government initiatives promoting industrial automation and scientific research further bolster demand.

Latin America

Latin America’s visco bath market is growing steadily, driven by industrial modernization and the establishment of new quality testing facilities in Brazil and Mexico. Increasing partnerships between global suppliers and local distributors are improving market accessibility.

Middle East & Africa

The Middle East and Africa region is witnessing gradual growth, with the UAE, Saudi Arabia, and South Africa emerging as key markets. Rising pharmaceutical production and laboratory infrastructure investments are supporting market expansion in this region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Visco Bath Market

- IKA-Werke GmbH & Co. KG

- Julabo GmbH

- Huber Kältemaschinenbau AG

- Thermo Fisher Scientific Inc.

- PolyScience

- LAUDA DR. R. WOBSER GMBH & CO. KG

- Grant Instruments Ltd.

- IKA Lab Systems

- Techne (Cole-Parmer)

- LabTech Srl

Recent Developments

- In May 2025, Julabo introduced a new line of digital visco baths with AI-powered thermal optimization for precision laboratory applications.

- In April 2025, Thermo Fisher Scientific launched its EcoSmart series, integrating sustainable refrigerants and advanced energy management features.

- In February 2025, LAUDA announced a partnership with European research institutions to develop ultra-stable visco baths for high-precision analytical testing.