Vanilla Perfume Market Size

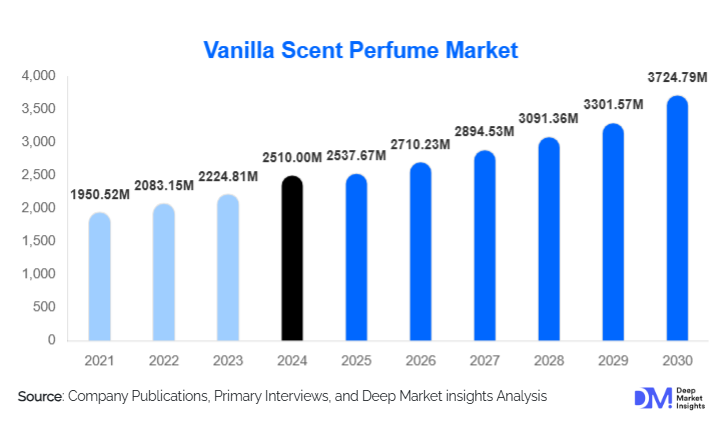

According to Deep Market Insights, the global vanilla scent perfume market size was valued at USD 2,510.00 million in 2024 and is projected to grow from USD 2,680.68 million in 2025 to reach USD 3,724.79 million by 2030, expanding at a CAGR of 6.8% during the forecast period (2025–2030). The vanilla perfume market growth is primarily driven by the rising consumer preference for natural and sustainable fragrance ingredients, increasing premiumization in personal care, and growing demand for long-lasting gourmand scents across global markets.

Key Market Insights

- Natural vanilla-based fragrances are witnessing robust demand as consumers shift toward plant-derived and ethically sourced ingredients.

- Luxury and niche perfume brands are expanding their vanilla product portfolios to cater to evolving olfactory preferences favoring warm, sensual, and comforting notes.

- Europe dominates the global vanilla perfume market, led by strong perfume manufacturing bases in France and Italy.

- Asia-Pacific represents the fastest-growing regional market, driven by urbanization, rising disposable income, and westernized grooming trends.

- Technological innovation in extraction and encapsulation techniques is enhancing vanilla fragrance stability, longevity, and authenticity.

- Clean beauty and cruelty-free certifications are becoming key differentiators influencing brand trust and consumer loyalty.

Latest Market Trends

Shift Toward Natural and Sustainable Ingredients

Consumers are increasingly rejecting synthetic vanillin in favor of natural Madagascar vanilla and sustainably harvested vanilla planifolia extracts. Fragrance houses are investing in traceable supply chains and partnering with vanilla cooperatives to ensure ethical sourcing. This trend is reshaping product portfolios, with leading brands highlighting origin transparency and environmental responsibility as core marketing messages. Certifications such as Fair Trade and Rainforest Alliance are gaining prominence across premium product lines.

Rise of Niche and Artisanal Vanilla Perfumes

Independent and artisanal perfume brands are redefining vanilla as a versatile note beyond its traditional sweet associations. These brands are crafting complex blends that pair vanilla with spices, resins, and woods, appealing to consumers seeking individuality and sophistication. Limited-edition releases, personalized fragrance experiences, and small-batch production are fueling this trend, positioning vanilla as a timeless yet innovative anchor in modern perfumery.

Vanilla Perfume Market Drivers

Growing Consumer Preference for Gourmand and Comfort Scents

The rising popularity of gourmand fragrances, characterized by edible, warm, and comforting notes, is driving vanilla’s prominence in perfume formulations. Vanilla’s universal appeal, emotional warmth, and association with nostalgia make it a staple ingredient in both mass and luxury fragrances. Brands are leveraging this sentiment-driven appeal to launch signature vanilla-based perfumes targeting diverse demographics.

Premiumization and Expansion of Luxury Fragrance Portfolios

Leading fragrance houses are capitalizing on the premium fragrance boom by introducing high-end vanilla-centric collections. The growing global appetite for designer and niche perfumes has accelerated demand for complex vanilla formulations blended with amber, oud, and musk. Luxury consumers increasingly view perfume as an extension of personal identity, prompting brands to emphasize craftsmanship, authenticity, and exclusivity.

Market Restraints

Price Volatility and Limited Availability of Natural Vanilla

The supply of natural vanilla remains highly concentrated, primarily in Madagascar, which accounts for over 70% of global production. Climate instability, cyclones, and agricultural challenges frequently cause price surges, creating cost pressures for fragrance manufacturers. This volatility leads some brands to use synthetic substitutes, potentially limiting appeal among clean beauty consumers who favor natural authenticity.

Regulatory and Sustainability Challenges

Stringent regulations governing ingredient sourcing, labeling, and allergen disclosures present operational challenges. Meeting compliance standards for IFRA (International Fragrance Association) and REACH guidelines adds complexity to product development. Moreover, ensuring sustainability throughout the vanilla supply chain, from cultivation to extraction, requires ongoing investment, which can impact smaller and emerging perfume brands.

Vanilla Perfume Market Opportunities

Expansion of Unisex and Gender-Neutral Fragrance Lines

The global shift toward inclusive and gender-neutral beauty products presents significant opportunities for vanilla perfume brands. Vanilla’s balanced scent profile, warm yet universally appealing, makes it ideal for unisex formulations. Brands launching gender-fluid collections are increasingly incorporating vanilla as a core note, enhancing market reach across age and gender segments.

Technological Innovation in Fragrance Delivery

Advancements in fragrance encapsulation, slow-release formulations, and alcohol-free carriers are creating new avenues for vanilla-based products. These technologies improve scent longevity and performance across perfumes, body mists, and skincare hybrids. Emerging digital fragrance tools, including AI-assisted scent design, are also enabling personalized vanilla blends that cater to individual olfactory preferences.

Product Type Insights

Parfum and Extrait de Parfum represent the most premium segment of the vanilla perfume market, benefiting from the global premiumization trend and consumer demand for long-lasting, high-concentration formulations. These formats are typically associated with niche perfumeries and limited-edition launches that highlight artisanal craftsmanship and the authenticity of natural vanilla ingredients.

Eau de Parfum (EDP) remains the volume leader and the most commercially significant segment, striking a balance between concentration, longevity, and affordability. EDPs serve as the preferred choice for both luxury and mass-premium consumers, supporting large-scale launches across designer brands. Vanilla-based EDPs often act as anchor products in cross-category campaigns and are particularly favored for their ability to blend sensual warmth with modern freshness.

Eau de Toilette (EDT) and body mists cater to younger demographics seeking approachable, everyday vanilla scents at accessible price points. These lighter formulations are commonly used in seasonal collections and layering lines, promoting the trend of fragrance customization and self-expression. Perfume oils and solid perfumes are emerging as sustainable, travel-friendly formats that appeal to eco-conscious consumers, offering long wear and portability without the use of alcohol.

Distribution Channel Insights

Brick-and-mortar retail continues to play a vital role in the vanilla perfume market, offering tactile, sensory, and experiential engagement through department stores, boutique counters, and luxury outlets. In-store sampling, gifting, and exclusive retail experiences drive conversions in this channel, although footfall is gradually shifting toward digital discovery.

E-commerce has emerged as the fastest-growing distribution channel, propelled by influencer-driven marketing, TikTok virality, and the convenience of direct-to-consumer (D2C) brand ecosystems. Gourmand trends, digital storytelling, and algorithm-driven product recommendations amplify visibility for vanilla fragrances online. Subscription-based discovery boxes and miniature formats further enhance trial and repeat purchase opportunities.

Travel retail and duty-free channels remain crucial for high-end vanilla perfume sales, particularly in airports across Europe, the Middle East, and Asia. Exclusive SKUs, gifting sets, and limited-edition packaging tailored for travelers reinforce the category’s association with indulgence and luxury.

| By Formulation Type | By Price Tier | By Ingredient Source | By Distribution Channel | By Application / Use Case |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Europe

Europe commands the largest share of the vanilla perfume market, anchored by established fragrance capitals such as France, Italy, and the U.K. The region’s deep-rooted perfume heritage continues to shape global trends, with leading houses innovating around vanilla’s versatility. European consumers are showing heightened demand for sophisticated, multifaceted vanilla compositions, favoring less sweet, more woody or ambery blends that align with evolving olfactory preferences.

Regulatory frameworks such as IFRA and REACH have further influenced market behavior, prompting reformulation toward compliant, nature-identical alternatives that maintain olfactory integrity while ensuring safety. Growth in Europe is additionally driven by luxury craftsmanship, sustainability initiatives, and artisanal perfumery that showcase traceable vanilla sourcing and eco-conscious production.

North America

North America represents a mature yet highly dynamic vanilla perfume market characterized by strong e-commerce penetration, influencer-led marketing, and TikTok-driven discovery. The region’s consumers exhibit a strong appetite for gourmand and nostalgia-infused vanilla fragrances, with high receptivity to celebrity collaborations and limited-edition releases. The United States leads market growth, supported by high per capita beauty spending and a vibrant niche fragrance culture.

Millennial and Gen Z consumers are key demand drivers, drawn to minimalist, clean, and cruelty-free formulations. Brands are increasingly leveraging social commerce and subscription platforms to foster community engagement and repeat purchase behavior. The overall regional trajectory is reinforced by digital-native brand launches, experiential retail pop-ups, and cross-category fragrance integration across personal care lines.

Asia-Pacific

Asia-Pacific is the fastest-growing region in the vanilla perfume market, bolstered by rapid urbanization, rising disposable incomes, and a growing middle class seeking Western-style luxury experiences. Consumers in China, India, and Japan are driving demand for premium, aspirational perfumes that combine international sophistication with localized cultural preferences. The region’s emerging trend toward vanilla blended with florals or oriental spices reflects both cultural fusion and personalization in fragrance design.

Asia-Pacific’s growth is further accelerated by robust retail digitization, celebrity-endorsed campaigns, and the rising influence of K-beauty and J-beauty aesthetics on fragrance consumption. Local brands are experimenting with vanilla-forward compositions that highlight natural sourcing and sustainability narratives to appeal to younger, environmentally conscious buyers.

Latin America

Latin America is an emerging yet promising region for the vanilla perfume market, characterized by a growing perfume culture and consumer preference for richer, sweeter vanilla scents. Countries such as Brazil, Mexico, and Argentina are witnessing increased interest in both international and local brands. Regional consumers demonstrate strong in-store loyalty, favoring tactile retail experiences and established perfume houses.

Growth in Latin America is driven by expanding retail networks, urban middle-class development, and the growing influence of beauty influencers and social media communities. Vanilla’s warmth and familiarity align well with regional taste profiles, positioning it as a dominant note across both mass and premium segments. Moreover, brands leveraging experiential retail and celebrity partnerships are gaining significant traction in this market.

Middle East & Africa

The Middle East and Africa region presents strong growth opportunities, underpinned by a deep cultural affinity for intense, long-lasting vanilla-oriental perfumes. Consumers favor luxurious, layered fragrances featuring vanilla intertwined with oud, amber, and musk accords. The region’s perfume consumption is heavily influenced by gifting traditions and travel retail activity, particularly in markets such as the UAE, Saudi Arabia, and Qatar.

Rising tourism, luxury retail expansion, and the proliferation of international niche fragrance houses have elevated regional demand. Africa, led by Madagascar, remains integral to the global vanilla supply chain, driving local initiatives around sustainable cultivation and fair-trade practices. Regional growth is propelled by premiumization, cultural attachment to strong scent profiles, and government-backed tourism retail investments that amplify fragrance accessibility.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Vanilla Perfume Market

- LVMH (Christian Dior, Guerlain)

- Estée Lauder Companies (Tom Ford, Jo Malone London)

- L’Oréal Group (Yves Saint Laurent, Lancôme)

- Coty Inc. (Calvin Klein, Gucci)

- Byredo

- Le Labo

- Kilian Paris

- Maison Margiela

Recent Developments

- In September 2025, Dior launched Vanilla Infusion, a new addition to its Maison Christian Dior collection featuring sustainably sourced Madagascar vanilla.

- In July 2025, Le Labo announced an expansion of its classic Vanille 44 into a permanent collection following rising global demand.

- In March 2025, Givaudan partnered with Malagasy cooperatives to develop a regenerative vanilla sourcing program aimed at improving farmer livelihoods and ensuring ingredient traceability.