Vacuum Sealer Market Size

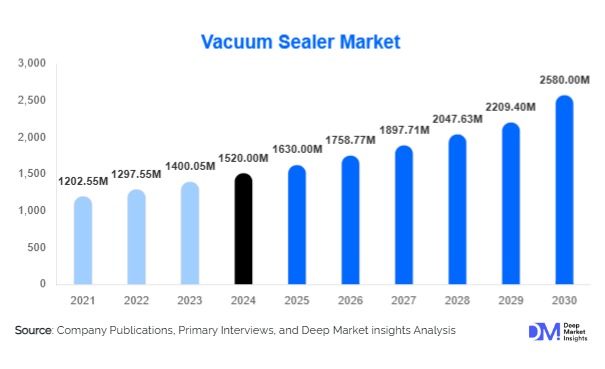

According to Deep Market Insights, the global vacuum sealer market size was valued at USD 1,520 million in 2024 and is projected to grow from USD 1,630 million in 2025 to reach USD 2,580 million by 2030, expanding at a CAGR of 7.9% during the forecast period (2025–2030). The market growth is primarily driven by the rising demand for convenient food preservation methods, expanding packaged food consumption, and the adoption of vacuum sealing in industrial applications such as pharmaceuticals and electronics packaging.

Key Market Insights

- Rising household adoption of vacuum sealers for food preservation is a key factor driving market expansion globally.

- Commercial vacuum sealers dominate revenue share, driven by the hospitality, packaged food, and retail sectors.

- Asia-Pacific is the fastest-growing region, supported by rising disposable incomes, urbanization, and growing packaged food consumption in China and India.

- North America and Europe hold over 55% of the global market, with strong penetration in food processing industries and household adoption.

- Integration of smart technologies, including IoT-enabled vacuum sealers and energy-efficient models, is reshaping the market landscape.

- E-commerce is a rapidly growing distribution channel, offering access to a wide range of brands, competitive pricing, and global reach.

What are the prevailing trends currently influencing the global vacuum sealer market?

Smart and IoT-Enabled Vacuum Sealers

Manufacturers are integrating smart technologies into vacuum sealers, enabling consumers to monitor sealing progress, track storage times, and connect with mobile apps for automated alerts. IoT-enabled sealers are particularly gaining traction in urban households where consumers prioritize convenience, food waste reduction, and kitchen automation. Features such as adjustable pressure settings, touchless operation, and automatic bag detection are becoming standard across premium models.

Eco-Friendly and Sustainable Packaging Integration

The rising emphasis on sustainability is driving demand for vacuum sealers compatible with recyclable, compostable, and reusable packaging materials. Companies are investing in bio-based vacuum bags and low-energy sealers to align with environmental regulations and consumer expectations. This trend is particularly strong in Europe, where strict packaging waste directives encourage manufacturers to innovate around eco-friendly sealing solutions.

What are the primary growth drivers impacting the vacuum sealer market?

Increasing Demand for Packaged and Processed Foods

The surge in global consumption of packaged foods, ready-to-eat meals, and frozen products is one of the strongest growth drivers for the vacuum sealer market. Food producers rely on vacuum sealing technology to extend shelf life, maintain nutritional value, and prevent spoilage. Rising urban populations and busy lifestyles are reinforcing this demand.

Growing Household Adoption for Food Preservation

Consumers are increasingly adopting vacuum sealers for home kitchens to reduce food waste, buy in bulk, and store seasonal produce for longer durations. The affordability of entry-level household vacuum sealers, coupled with rising awareness of food waste issues, has fueled adoption across both developed and emerging economies.

Industrial Applications Beyond Food

Beyond food, vacuum sealers are seeing rising applications in sectors such as pharmaceuticals, medical devices, and electronics, where air-free packaging is critical for product integrity. Pharmaceutical companies use vacuum sealing to ensure sterile packaging, while electronics manufacturers use it to prevent oxidation and moisture damage.

What are the key challenges and restraints affecting the global vacuum sealer market?

High Initial Costs of Advanced Models

Industrial-grade and smart vacuum sealers often come with high upfront costs, which can be a barrier for small businesses and price-sensitive consumers. This limits penetration in emerging economies where affordability remains a key concern.

Environmental Concerns Around Plastic Packaging

Most vacuum sealing still relies on plastic bags, which face growing scrutiny due to environmental regulations. The slow adoption of sustainable alternatives can hinder long-term growth if manufacturers fail to innovate around eco-friendly materials.

Which strategic opportunities exist for stakeholders in the vacuum sealer market?

Integration with Smart Kitchens and IoT Ecosystems

The rapid adoption of smart home appliances creates opportunities for vacuum sealers to integrate into connected kitchen ecosystems. Linking vacuum sealers with refrigerators, mobile apps, and inventory management systems could drive next-generation adoption among tech-savvy consumers.

Expansion into Emerging Markets

Rising disposable incomes, growing middle-class populations, and increasing packaged food consumption in Asia-Pacific, Latin America, and the Middle East present strong growth opportunities. Household vacuum sealers are expected to witness particularly high adoption rates in India, China, and Brazil.

Eco-Friendly Packaging Innovation

Manufacturers who lead in developing biodegradable vacuum bags and energy-efficient sealers stand to gain a competitive edge. With stricter regulations and consumer demand for sustainable packaging, eco-innovation is expected to create new revenue streams and brand differentiation opportunities.

Product Type Insights

Chamber vacuum sealers dominate the market, accounting for nearly 45% of revenue in 2024, due to their strong adoption in commercial food processing and packaging. External vacuum sealers are the fastest-growing category, favored by households and small businesses for their affordability and ease of use. Handheld vacuum sealers are gaining traction in urban households for light usage and portability, often marketed as budget-friendly solutions for food storage.

Application Insights

Food packaging accounts for more than 70% of the market in 2024, led by frozen foods, meat, seafood, and dairy packaging. Non-food applications, including pharmaceuticals and electronics, are expanding rapidly, driven by the need for sterile, moisture-resistant, and contamination-free packaging.

Distribution Channel Insights

Offline retail continues to dominate, with supermarkets, specialty appliance stores, and industrial distributors being key sales channels. However, online platforms are growing at over 12% CAGR, supported by e-commerce penetration, wider product availability, and increasing preference for direct-to-consumer models. E-commerce channels also support international cross-border sales, particularly for premium brands.

End-Use Insights

Commercial end-users, including food processors, restaurants, and hospitality businesses, dominate the market with over 55% share in 2024. Household end-use is the fastest-growing segment, expected to expand at a CAGR above 9% through 2030, supported by consumer awareness campaigns around food waste reduction. Emerging industries such as healthcare packaging are adding new growth avenues.

| By Product Type | By Application | By Distribution Channel | By End Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for nearly 30% of the global market in 2024, led by the U.S., which has strong adoption across both households and industrial sectors. Consumer awareness of food waste reduction and advanced retail packaging drives demand.

Europe

Europe contributes around 25% of the global share, with Germany, France, and Italy leading adoption. Strict EU packaging regulations and strong consumer demand for sustainable solutions are shaping the market.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expected to grow at a 9.5% CAGR, led by China, India, and Japan. Rising disposable incomes, rapid urbanization, and growing food exports drive the adoption of vacuum sealers in both households and industrial sectors.

Latin America

Latin America, led by Brazil and Mexico, is emerging as a significant growth market. Rising middle-class income and packaged food demand support household adoption, while industrial usage is expanding in food exports.

Middle East & Africa

The Middle East & Africa are a smaller but steadily growing market, with demand concentrated in the Gulf states for luxury household appliances and in Africa’s food processing sectors for export-driven demand.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Vacuum Sealer Market

- Henkelman

- Multivac

- VacMaster

- Fresherpack

- PolyScience

- FoodSaver

- V. Trepko

- Ultravac

- Hamilton Beach

- GERYON

- LAVA

- ARY VacMaster

- SealerSales

- Proseal

- Promarks

Recent Developments

- In June 2025, Multivac introduced a new energy-efficient industrial vacuum sealer with recyclable packaging compatibility to meet EU sustainability directives.

- In April 2025, FoodSaver launched a new line of household vacuum sealers with IoT connectivity, targeting North American consumers.

- In March 2025, Henkelman announced expansion into Asia-Pacific with a new distribution hub in Singapore to cater to rising demand in Southeast Asia.