Vaccine Cooler Market Size

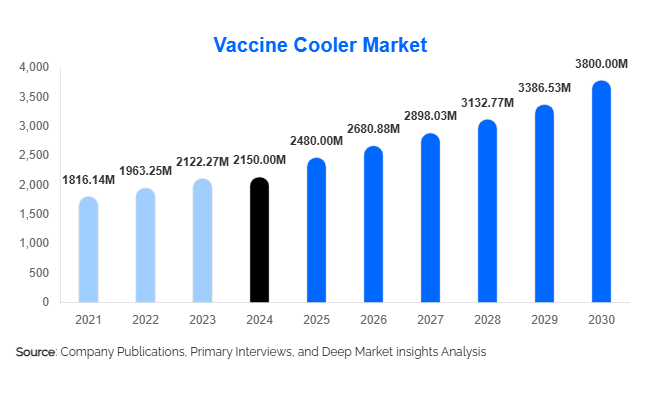

According to Deep Market Insights, the global vaccine cooler market size was valued at USD 2,150 million in 2024 and is projected to grow from USD 2,480 million in 2025 to reach USD 3,800 million by 2030, expanding at a CAGR of 8.1% during the forecast period (2025–2030). The market growth is primarily driven by the increasing demand for temperature-sensitive vaccine storage, expansion of global immunization programs, and technological advancements in cold chain solutions such as IoT-enabled and solar-powered vaccine coolers.

Key Market Insights

- Passive vaccine coolers continue to dominate in cost-sensitive regions, offering simple, reliable solutions for rural immunization programs.

- Active and solar-powered vaccine refrigerators are gaining traction in developed markets due to their energy efficiency, digital monitoring, and adaptability in regions with unstable power supply.

- North America holds a significant market share, driven by strong healthcare infrastructure and widespread adoption of advanced vaccine cold storage systems.

- Asia-Pacific is the fastest-growing market, supported by expanding immunization coverage in India, China, and Southeast Asia, alongside increasing government funding for vaccine cold chains.

- Technological integration, including remote temperature monitoring, IoT-enabled sensors, and smart alerts, is enhancing reliability and adoption in both hospitals and field operations.

- Export-driven demand from established manufacturing hubs in China, Germany, and the U.S. is increasing access to developing regions worldwide.

Latest Market Trends

Rising Adoption of IoT and Smart Vaccine Coolers

Healthcare providers are increasingly adopting smart vaccine coolers with IoT capabilities that monitor temperature fluctuations in real-time. Alerts are sent to mobile devices or centralized dashboards to prevent spoilage, ensuring vaccine efficacy. Integration with cloud-based management systems allows centralized tracking of storage conditions across multiple locations, which is particularly valuable for government immunization programs and large hospital chains.

Growth of Solar-Powered and Energy-Efficient Solutions

Solar-powered vaccine coolers and refrigerators are becoming mainstream, particularly in remote or off-grid regions. These devices reduce dependency on unstable electricity grids, cut operational costs, and are aligned with sustainability initiatives. Manufacturers are also developing energy-efficient active coolers that maintain precise temperature ranges, ensuring vaccines such as mRNA COVID-19 and other temperature-sensitive immunizations are stored safely. This trend has been accelerated by global funding programs aimed at strengthening healthcare infrastructure in developing countries.

Vaccine Cooler Market Drivers

Expansion of Global Immunization Programs

Government and international health organizations are actively increasing immunization coverage across all age groups, especially in emerging economies. Large-scale vaccination drives for polio, measles, influenza, and COVID-19 boosters are driving demand for reliable vaccine cold storage solutions. Long-term government contracts and public-private partnerships are providing stable growth opportunities for manufacturers.

Technological Advancements in Cold Chain Management

Innovations such as IoT-enabled vaccine coolers, remote temperature monitoring, phase change material integration, and solar-powered active refrigerators have improved vaccine storage reliability. Healthcare providers are adopting these technologies to reduce vaccine wastage, improve patient safety, and comply with stringent regulations. Companies investing in smart cooler technologies are seeing higher adoption rates and gaining market share.

Rising Demand in Emerging Markets

Regions such as Asia-Pacific, Africa, and Latin America are witnessing rapid growth due to expanding healthcare infrastructure, government funding, and rising awareness of vaccine storage importance. Developing nations are increasingly procuring both passive and active vaccine coolers to support national immunization programs and rural healthcare delivery, driving overall market expansion.

Market Restraints

High Cost of Advanced Vaccine Coolers

While passive coolers are affordable, high-end active and solar-powered vaccine refrigerators come with significant upfront costs, which may limit adoption in price-sensitive regions. Budget constraints in developing countries can slow market penetration, particularly for advanced IoT-enabled devices.

Challenges in Cold Chain Infrastructure

Inconsistent electricity supply, limited distribution networks, and a lack of trained personnel in rural and remote areas can restrict the effective deployment of vaccine coolers. Maintaining cold chain integrity over long distances remains a logistical challenge, impacting market growth potential in certain geographies.

Vaccine Cooler Market Opportunities

Government-Funded Immunization Programs

Governments and NGOs are increasingly funding immunization campaigns, particularly in developing countries. This creates long-term procurement opportunities for manufacturers and distributors, enabling partnerships for large-scale supply and maintenance of vaccine coolers in public health initiatives.

Integration of Smart and Digital Technologies

IoT-enabled, cloud-integrated vaccine coolers that offer real-time monitoring and remote alerts present a major growth avenue. Manufacturers investing in digital solutions can enhance customer trust, improve operational efficiency, and differentiate products in a competitive market. Smart vaccine coolers are particularly valuable for large hospital chains, vaccination centers, and mobile outreach programs.

Expanding Demand in Emerging Markets

Emerging economies in the Asia-Pacific and Africa are investing heavily in healthcare infrastructure and immunization programs. With rising vaccination rates and unmet cold chain requirements, the demand for both passive and active vaccine coolers is surging. Companies can capitalize on this by offering region-specific solutions and expanding export operations to underserved markets.

Product Type Insights

Passive vaccine coolers currently dominate, accounting for roughly 55% of the 2024 market share, due to their cost-effectiveness, simplicity, and suitability for rural immunization campaigns. Active electric and solar-powered vaccine refrigerators are gaining traction, particularly in North America and Europe, driven by the need for precise temperature control, energy efficiency, and digital monitoring.

End-Use Insights

Hospitals and clinics represent the largest end-use segment, contributing approximately 40% of the 2024 market share. Vaccination centers and government immunization programs are rapidly growing, especially in emerging regions. Pharmaceutical companies and research laboratories are increasingly adopting vaccine coolers for R&D and distribution purposes. Export-driven demand from these end-use segments further amplifies market growth, particularly from manufacturers in China, Germany, and the U.S.

| By Product Type | By Storage Capacity | By End-Use | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for roughly 30% of the global vaccine cooler market in 2024. High adoption rates in hospitals and vaccination centers, robust cold chain infrastructure, and technological innovation support market dominance. The U.S. and Canada lead demand, particularly for advanced active and IoT-enabled vaccine coolers.

Europe

Europe represents approximately 25% of the 2024 market, driven by widespread government immunization programs, strong healthcare systems, and the adoption of energy-efficient vaccine refrigerators. Germany, France, and the U.K. are major markets within this region.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by India, China, and Southeast Asia. Expansion of vaccination coverage, government funding, and rising healthcare investments drive growth. Emerging economies in APAC are expected to see double-digit CAGR during 2025–2030.

Middle East & Africa

MEA is witnessing moderate growth with countries like the UAE, Saudi Arabia, and South Africa investing in modern cold chain infrastructure. Africa benefits from international immunization programs requiring reliable vaccine storage, increasing demand for both passive and solar-powered coolers.

Latin America

Brazil, Argentina, and Mexico are the key markets. While the overall market size is smaller, rising healthcare expenditure and immunization programs present growth opportunities, particularly for cost-effective passive vaccine coolers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Players in the Vaccine Cooler Market

- PHC Corporation

- Arctic Cooler Technologies

- Helmer Scientific

- Danby Appliances

- Thermo Fisher Scientific

- Haier Biomedical

- Haier Electronics Group

- Haier Biomedical Cold Chain Division

- Fisher Scientific

- BD (Becton Dickinson)

- Soheil Refrigeration

- Binder GmbH

- Revco Scientific

- VWR International

- BioMedical Systems

Recent Developments

- In March 2025, PHC Corporation launched a new solar-powered vaccine cooler optimized for rural immunization campaigns in Africa and Asia.

- In February 2025, Helmer Scientific expanded its IoT-enabled vaccine refrigerator line, providing centralized monitoring for large hospital chains in North America and Europe.

- In January 2025, Danby Appliances introduced compact, energy-efficient passive vaccine coolers for government immunization programs in Southeast Asia and Latin America.