USB Wall Charger Market Size

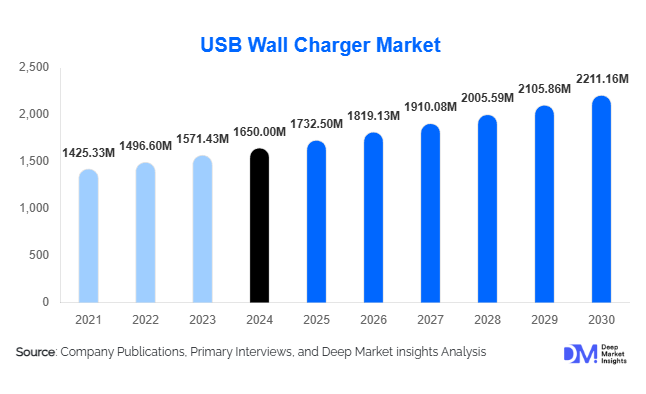

According to Deep Market Insights, the global USB Wall Charger Market was valued at approximately USD 1,650 million in 2024 and is projected to grow from USD 1,732.50 million in 2025 to reach USD 2,211.16 million by 2030, expanding at a CAGR of 5.0% during the forecast period (2025–2030). Market growth is primarily driven by the rapid adoption of USB-C and Power Delivery (PD) standards, the rise of multi-device households, and the technological shift toward compact, high-efficiency gallium nitride (GaN) chargers.

Key Market Insights

- USB-C and PD chargers dominate new sales, replacing legacy USB-A models as manufacturers and regulators push for universal charging standards.

- GaN-based fast chargers are reshaping the competitive landscape by offering higher power outputs in smaller, energy-efficient designs.

- Asia-Pacific leads global production and consumption, driven by China’s manufacturing base and India’s expanding smartphone market.

- North America and Europe are major import markets, focusing on premium, certified, and eco-efficient chargers.

- Online retail channels account for nearly 40% of global sales, accelerated by e-commerce adoption and competitive pricing.

- Sustainability mandates in the EU and energy-efficiency regulations are driving innovation in universal and recyclable charger designs.

What are the latest trends in the USB Wall Charger Market?

Transition Toward Universal USB-C Adoption

Driven by regulatory frameworks such as the European Union’s universal charger mandate, the global charger industry is witnessing a decisive shift toward USB-C connectors. Device makers are rapidly standardizing USB-C ports across smartphones, tablets, and laptops, compelling accessory manufacturers to align with the Power Delivery (PD) standard. This trend simplifies compatibility for users, reduces e-waste, and promotes inter-brand interoperability. The move toward USB-C also raises the average selling price of chargers due to increased wattage and embedded safety technologies, thus enhancing market value.

Rise of GaN and Fast-Charging Technologies

GaN (Gallium Nitride) technology is transforming charger design. GaN semiconductors enable higher energy efficiency, faster charging, and smaller form factors compared to silicon-based chargers. Premium charger brands are introducing compact, high-wattage (65–100 W+) multi-port GaN chargers suitable for laptops and tablets. This transition is fueling product differentiation and premiumization. Combined with adaptive fast-charging technologies and intelligent load distribution, GaN chargers are becoming the preferred choice among tech-savvy consumers and commercial users alike.

What are the key drivers in the USB Wall Charger Market?

Growing Multi-Device Ownership

The global proliferation of smartphones, tablets, laptops, and wearables has created sustained demand for efficient charging solutions. Multi-port wall chargers are increasingly replacing single-device units, especially in homes, offices, and travel setups. The convenience of simultaneous charging and the growing number of portable electronic devices per household are central to this trend.

Adoption of Fast-Charging and USB Power Delivery

USB Power Delivery (PD) standards have revolutionized charging speeds, enabling up to 100 W output through USB-C. The integration of fast-charging protocols like Qualcomm Quick Charge, PD 3.0, and PPS (Programmable Power Supply) is enhancing user experience and driving up average unit value. As OEMs exclude chargers from smartphone packaging, aftermarket demand for high-speed, certified wall chargers continues to expand.

Emerging E-Commerce and Digital Retail Channels

Digital commerce has transformed product availability and price transparency. Online retail now represents over 40% of global charger sales. Platforms such as Amazon, AliExpress, and Flipkart provide consumers with a wide variety of fast-charging and multi-port options, accelerating product penetration even in emerging economies. Online review systems and influencer marketing have also heightened brand competition and consumer awareness.

What are the restraints for the global market?

Price Erosion and Margin Pressure

Commoditization and fierce competition among global and regional players have led to significant price erosion in standard charger segments. While premium fast-charging products maintain healthier margins, budget categories face continual price compression. This limits profitability and discourages smaller manufacturers from investing in innovation.

Raw Material and Regulatory Challenges

Fluctuating costs of power semiconductors and GaN materials, coupled with stringent certification requirements (UL, CE, FCC), have increased production costs. Compliance with evolving regional energy-efficiency regulations adds further complexity, often delaying product launches and raising overall development expenses.

What are the key opportunities in the USB Wall Charger Industry?

Expansion in Emerging Markets

Asia-Pacific, Latin America, and Africa represent high-growth regions as smartphone adoption deepens and power infrastructure improves. Increasing electrification and affordable data connectivity are fueling charger demand, particularly for value-priced USB-C and multi-port units. Local assembly supported by government manufacturing incentives (e.g., “Make in India”) offers attractive entry points for both global and regional firms.

Smart and Sustainable Charger Development

Manufacturers are exploring “green” and smart-charging innovations that minimize idle power consumption and extend product lifespan. Integration of micro-controllers, IoT features, and adaptive load-balancing can reduce energy waste and enhance safety. Eco-friendly packaging and recyclable components align with sustainability goals and upcoming e-waste directives in the EU and North America, representing a premium segment opportunity.

B2B and Institutional Installations

Commercial adoption is rising in offices, airports, hotels, and transportation hubs. Businesses are upgrading wall outlets to include USB-C PD ports, and OEMs are offering integrated power modules for furniture and workspaces. The institutional segment offers long-term contracts and recurring revenue streams for charger manufacturers and distributors.

Product Type Insights

By port count, single-port chargers remain the largest product category, accounting for about 30% of the 2024 global market (USD 495 million) due to affordability and compatibility with most smartphones. However, dual- and multi-port chargers are growing rapidly as consumers seek versatility. In terms of technology, USB-C PD chargers lead with a 35% value share, while GaN chargers represent the fastest-growing premium sub-segment. Mid-power (30–65 W) models are the market’s sweet spot, supporting both phones and laptops at competitive prices.

Distribution Channel Insights

Online retail platforms dominate global distribution, capturing roughly 40% of total sales in 2024. E-commerce channels enable rapid global reach, dynamic pricing, and wider model variety. Offline retail and OEM bundling continue to hold relevance in mature markets, while institutional sales are gaining traction through hospitality and commercial contracts. Hybrid distribution strategies combining online promotion with offline service centers are emerging as best practices.

End-Use Insights

The individual consumer segment represents approximately 60% of the total market value (USD 990 million in 2024), driven by personal electronics usage. However, the commercial and hospitality sectors are expanding rapidly, upgrading outlets to include fast-charging USB-C ports. The rise of IoT devices, electric mobility accessories, and smart-home products further broadens industrial applications. Export-driven demand from Asia’s electronics manufacturing base continues to reinforce supply chain dominance in this sector.

| By Port Type | By Charging Technology | By Power Output | By Distribution Channel | By End-Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for about 30% of global USB wall charger revenue (USD 495 million). The U.S. leads demand due to high device penetration, premium product adoption, and a strong online retail ecosystem. Consumers prefer certified fast-charging models, while offices and airports are upgrading to multi-port GaN charging stations.

Europe

Europe contributes around 20% (USD 330 million) and is distinguished by strict regulatory standards and sustainability mandates. The EU’s universal charger policy is accelerating USB-C adoption, benefitting compliant manufacturers. Germany, the U.K., and France dominate demand, while Scandinavian markets lead in eco-certified products.

Asia-Pacific

Asia-Pacific leads globally with a 35% market share (USD 578 million) and is the fastest-growing region. China remains the world’s largest charger manufacturer and exporter, while India and Southeast Asia represent booming consumption markets. Local production initiatives, rising disposable incomes, and rapid smartphone penetration continue to drive APAC leadership.

Latin America

Latin America holds 8–10% of the market (USD 130–165 million), led by Brazil and Mexico. Growth is supported by the expanding e-commerce sector and increasing adoption of fast-charging smartphones. Regional players are entering with cost-competitive models tailored for local power standards.

Middle East & Africa

MEA contributes about 5–7% (USD 80–115 million) of global revenue but is experiencing above-average growth. Demand is driven by rising smartphone usage and infrastructure development. The UAE and Saudi Arabia lead in premium charger adoption, while African markets see strong demand for affordable, durable models.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the USB Wall Charger Market

- Anker Innovations

- Belkin International

- Baseus Technology

- Aukey

- Philips N.V.

- RAVPower

- Mophie (ZAGG Inc.)

- Otter Products

- Scosche Industries

- iClever Technology Co.

- Atomi Systems

- Just Wireless

- Rayovac Corporation

- Amazon Basics

- 3Thirty Electrical

Recent Developments

- In May 2025, Anker Innovations introduced a new range of 100 W GaNPrime multi-port chargers, combining USB-C PD 3.1 and adaptive fast-charging technology to enhance efficiency.

- In April 2025, Belkin announced its sustainability-focused “EcoSmart” charger line, featuring recyclable materials and low idle power consumption.

- In February 2025, Baseus launched compact wall chargers with integrated smart load management for safe multi-device operation across global markets.