USB Devices Market Size

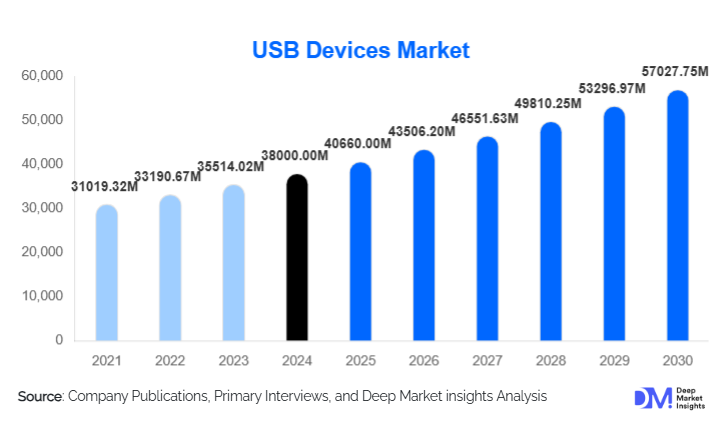

According to Deep Market Insights, the global USB devices market size was valued at USD 38,000 million in 2024 and is projected to grow to USD 40,660.00 million in 2025 and reach USD 57,027.75 million by 2030, expanding at a CAGR of around 7.0% during the forecast period (2025–2030). Growth in the USB devices market is driven by the rapid adoption of USB-C and USB4 standards, rising demand for high-speed data transfer and power delivery, regulatory mandates for universal charging ports, and expanding usage in consumer electronics, automotive, and industrial applications.

Key Market Insights

- USB-C and USB4 are becoming the dominant connectivity standards, driven by global regulatory pressure toward universal charging solutions and higher-bandwidth data applications.

- Consumer electronics remain the largest end-use industry, accounting for nearly half of total USB device demand in 2024 due to smartphone, laptop, and gaming peripheral sales.

- Industrial and automotive USB adoption is accelerating, driven by automation, infotainment systems, and EV-related charging demands.

- Asia-Pacific leads the global market with more than half of global production and consumption due to strong electronics manufacturing ecosystems.

- North America and Europe are major adopters of high-speed USB devices, particularly USB 3.x, USB4 hubs, adapters, SSDs, and enterprise-strength peripherals.

- Technological innovationincluding rugged USB drives, encrypted enterprise USBs, and high-watt USB-C PD chargers reshaping consumer and industrial usage patterns.

What are the latest trends in the USB devices market?

Shift Toward USB-C and USB4 Standardization

The global USB devices market is undergoing a rapid transition toward USB-C and USB4 due to their superior bandwidth, reversible design, and high-power delivery capabilities. Regulatory bodiesparticularly in the European Union and Indiaare mandating USB-C as the universal charging interface for mobile phones, laptops, and consumer electronics. This has accelerated the decline of legacy Type-A connectors in mobile applications and boosted demand for USB-C flash drives, adapters, hubs, docking stations, and high-performance SSDs. USB4 adoption is rapidly rising in premium devices, offering up to 40 Gbps transfer speeds and robust power delivery, fueling demand for next-generation storage and connectivity solutions.

Rising Demand for High-Capacity External Storage & Rugged Industrial USB Devices

As data volumes grow exponentially, the market is seeing increased adoption of high-capacity flash drives and portable SSDs, especially those supporting USB 3.x and USB4. Industrial sectorsincluding manufacturing, logistics, and defenseare driving demand for rugged USB devices that can withstand vibration, extreme temperatures, and continuous use. Encrypted USB drives are also gaining traction in enterprise IT environments as cybersecurity concerns grow. With factories digitizing and edge devices proliferating, industrial-grade USB storage and connectors are emerging as an important trend.

What are the key drivers in the USB devices market?

Increasing Adoption of High-Speed Data Transfer Technologies

A major growth driver in the USB devices market is the widespread move toward high-speed standards such as USB 3.x and USB4. Consumers increasingly require faster data transfer for 4K/8K media, gaming, enterprise workloads, and large-file exchanges. Manufacturers are accelerating development of high-bandwidth flash drives, Type-C docking stations, and external SSDs optimized for rapid read/write speeds. As device performance expectations rise, these high-speed standards are becoming essential across laptops, tablets, desktops, and smartphones.

Growing Demand for Universal Connectivity Across Devices

The expanding ecosystem of personal electronics, smartphones, and tablets to wearables, gaming consoles, and smart home devices is driving sustained demand for USB peripherals. USB remains the world’s most universal interface, supporting both power and data transfer. With consumers using multiple connected devices, demand for hubs, adapters, power-delivery chargers, and portable storage continues to climb. This driver remains central to USB device growth across both mature and emerging markets.

Regulatory Push for USB-C Standardization

Government mandates for USB-C charging, particularly in Europeare forcing hardware manufacturers to redesign devices with standardized connectors. This is generating a surge of demand for USB-C-enabled accessories, adapters, power bricks, and cables. The market is benefiting from accelerated replacement cycles as older devices get phased out and consumers upgrade to compliant models. This regulatory driver is one of the most influential forces shaping the future growth of the USB devices market.

What are the restraints for the global market?

Growing Shift Toward Cloud Storage

Despite strong overall market growth, some segmentsparticularly traditional USB flash drivesare facing stagnation due to widespread adoption of cloud storage solutions. Consumers and businesses are increasingly relying on online storage, reducing dependence on physical external drives for everyday use. This shift poses a challenge for manufacturers of low-capacity and mid-range flash drives, prompting them to pivot toward high-capacity, encrypted, or ruggedized solutions.

Volatility in Raw Material and Semiconductor Supply Chains

The USB devices industry remains vulnerable to fluctuations in NAND memory prices, controller-chip availability, and supply chain disruptions. Semiconductor shortages can limit production capacity and increase manufacturing costs, especially for smaller players. Uncertainty in raw material pricing also affects profit margins and slows down innovation cycles. These supply-related restraints are among the most critical challenges impacting market growth.

What are the key opportunities in the USB devices industry?

Automotive USB Integration and EV-Centric Power Delivery

The automotive sector represents one of the most promising growth areas for USB devices. Modern vehicles increasingly rely on USB-C ports for infotainment, passenger connectivity, diagnostics, and high-watt in-car charging. The rise of electric vehicles (EVs) is pushing demand for even higher-power delivery USB-C connectors capable of supporting rapid charging. Manufacturers can capitalize by developing automotive-grade connectors, robust hubs, and high-current cables tailored for EV ecosystems.

Expansion of Industrial-Grade and Secure USB Devices

Industries requiring rugged, tamper-proof, or encrypted USB devicessuch as manufacturing, defense, oil & gas, aerospace, and healthcarepresent strong growth opportunities. As digital transformation accelerates, enterprises are upgrading to durable, high-performance USB solutions designed for demanding environments. This niche market supports higher margins and strong recurring demand. Manufacturers investing in security features, ruggedization, and long-lifecycle designs stand to gain significantly.

Product Type Insights

USB flash drives represent the largest product category, capturing approximately 40–41% of the global market in 2024. Their affordability, portability, and widespread usage make them a staple in both consumer and enterprise environments. External storage devicesincluding portable SSDsare gaining share as demand rises for high-speed, high-capacity solutions. USB hubs and docking stations are also expanding rapidly due to remote work adoption and the dominance of USB-C in modern laptops. Specialized industrial USB devices are emerging as a niche but fast-growing category driven by ruggedization and security requirements.

Application Insights

Consumer electronics dominate the application landscape with nearly 49% market share in 2024, driven by strong adoption of laptops, smartphones, gaming devices, and home electronics. Automotive applications are experiencing strong growth due to USB-C integration in infotainment systems and EV charging ecosystems. Industrial and automation usage is rising rapidly, fueled by factory digitization, IoT adoption, and secure data-transfer needs. Healthcare and medical devices represent another growing application segment, utilizing USB interfaces for diagnostics, device updates, and data capture.

Distribution Channel Insights

Online sales channels, including e-commerce platforms and direct-to-consumer manufacturer websitesdominate USB device distribution due to their convenience and broad product visibility. Retail electronics stores remain important for accessory purchases, while enterprise and industrial buyers rely on specialized distributors for high-performance and ruggedized devices. OEM bundling continues to be a significant distribution model, especially for cables, chargers, and adapters included with new devices. Subscription-based accessory programs and replacement cycles offered by some OEMs are beginning to emerge as new distribution innovations.

End-Use Insights

Consumer usage represents the largest end-use category, driven by personal computing, gaming, and smartphone adoption. The fastest-growing end-use segment is automotive, followed by industrial applications. Healthcare and enterprise IT continue to expand their reliance on USB devices for secure storage, diagnostics, and operational connectivity. Emerging end-use opportunities include robotics, smart cities infrastructure, and defense applications requiring encrypted or ruggedized storage devices. Export-driven demand from China, Vietnam, Mexico, and Taiwanmajor electronics manufacturing hubs, continues to support global supply and consumption.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America is a major market for USB devices, driven by high adoption of advanced consumer electronics, early implementation of USB-C and USB4, and significant enterprise IT spending. The United States accounts for the majority of regional demand, with consumers purchasing large quantities of high-performance flash drives, SSDs, hubs, and adapters. Strong gaming and remote work trends further strengthen the market, while robust industrial automation creates additional demand for rugged USB solutions.

Europe

Europe is one of the fastest-growing markets due to strict regulatory enforcement of USB-C as the standard charging port for all portable electronics. This regulatory shift is accelerating replacement cycles and creating strong consumer and enterprise demand for USB-C peripherals, adapters, and high-speed storage solutions. Germany, the U.K., and France lead regional consumption. Strong automotive manufacturing in Germany further reinforces USB device adoption for in-vehicle connectivity.

Asia-Pacific

Asia-Pacific remains the global leader, accounting for over 50% of the USB devices market in 2024. The region’s dominance is supported by massive electronics production in China, Taiwan, South Korea, Vietnam, and Japan. Growing smartphone adoption, rapid digitalization, and strong OEM manufacturing activity drive continuous demand for USB cables, chargers, adapters, and storage devices. India shows robust growth due to rising middle-class spending and government initiatives favoring digital infrastructure.

Latin America

Latin America is experiencing steady growth, particularly in Brazil and Mexico, where smartphone penetration and gaming adoption are rising. The region is also becoming a secondary manufacturing and assembly hub for consumer electronics, increasing domestic demand for USB components, cables, and storage devices. While still smaller than other regions, LATAM’s growth trajectory remains positive.

Middle East & Africa

MEA is among the fastest-growing regions due to rapid digital infrastructure expansion, rising incomes, and increased reliance on mobile devices. Countries such as the UAE, Saudi Arabia, Nigeria, and South Africa are experiencing significant growth in consumer electronics, enterprise IT, and automotive sectors, all of which drive USB device demand. Government-backed digital transformation efforts are further accelerating adoption.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the USB Devices Market

- Western Digital (SanDisk)

- Kingston Technology

- Corsair

- Samsung Electronics

- Micron Technology

- Transcend Information

- Kioxia

- HP Inc.

- Intel Corporation

- Verbatim

- Adata Technology

- Netac

- Teclast

- Imation

- Seagate Technology

Recent Developments

- In January 2025, several leading manufacturers launched USB4 next-generation flash drives and portable SSDs supporting up to 40 Gbps bandwidth and enhanced power delivery for high-performance computing.

- In March 2025, multiple companies expanded their USB-C automotive product lines, offering high-watt charging connectors and rugged in-vehicle USB hubs for EV manufacturers.

- In June 2025, industrial USB suppliers introduced new ruggedized, encrypted USB drives targeted at aerospace, defense, and manufacturing customers.