Ultra High Definition (UHD) TV Market Size

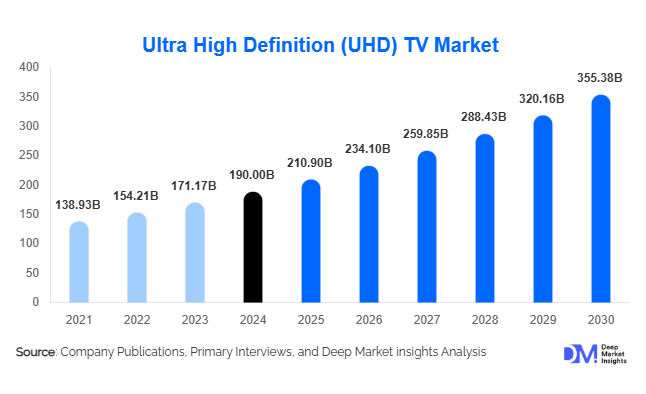

According to Deep Market Insights, the global Ultra High Definition (UHD) TV market size was valued at USD 190 billion in 2024 and is projected to grow from USD 210.90 billion in 2025 to reach USD 355.38 billion by 2030, expanding at a CAGR of 11.0% during the forecast period (2025–2030). The UHD TV market growth is primarily driven by the increasing consumer demand for immersive viewing experiences, proliferation of 4K and 8K content, technological innovations in display technologies such as OLED, QLED, and Mini-LED, and the steady rise in large-screen adoption across residential and commercial segments.

Key Market Insights

- 4K resolution TVs dominate the market, capturing nearly 80% share in 2024, owing to wide content availability and affordable pricing.

- Asia-Pacific leads globally with about 35% market share in 2024, driven by strong domestic production and rising household adoption in China and India.

- Large screen sizes (55–65 inches) account for the highest sales volume, representing around 45% of the total market value.

- Technologies such as OLED and Mini-LED are rapidly expanding the premium segment, offering improved contrast, energy efficiency, and design flexibility.

- Streaming and gaming ecosystems are key drivers of UHD TV demand, supported by platforms offering HDR and 4K/8K content.

- Declining ASPs and manufacturing efficiency are accelerating the shift toward large-screen UHD adoption even in developing regions.

Latest Market Trends

Rising Adoption of Large-Screen Smart TVs

Consumers are increasingly opting for larger screen sizes as average living-room spaces expand and prices decline. The 55–65-inch segment dominates global demand, accounting for approximately 45% of the 2024 UHD TV market. Manufacturers are focusing on bezel-less, wall-mounted, and ultra-slim form factors to complement modern interiors. Larger screens are also being integrated with high-refresh-rate panels and advanced gaming support, catering to home entertainment and e-sports enthusiasts. This shift toward bigger displays underscores the trend of TVs becoming central entertainment hubs within smart homes.

Expansion of 8K and Next-Gen Display Technologies

Although 4K remains the industry standard, the transition toward 8K is accelerating as brands like Samsung, LG, and Sony introduce new flagship models. Mini-LED and Micro-LED technologies are redefining display quality by enhancing brightness, color accuracy, and lifespan. Manufacturers are investing heavily in these next-generation panels, positioning them as luxury products with high margins. As production yields improve and content availability increases, 8K adoption is expected to grow steadily through 2030, especially in premium households and commercial applications such as digital signage.

Smart Connectivity and AI Integration

AI-enabled picture optimization, voice assistant integration (Alexa, Google Assistant), and IoT connectivity have become standard features in UHD TVs. Manufacturers are embedding advanced processors for real-time upscaling, ambient optimization, and gaming performance enhancement. These features are transforming UHD TVs from passive viewing devices into intelligent connected systems, capable of integrating with other smart home products. The rise of cloud gaming platforms and streaming services further supports this trend, as consumers seek seamless, interactive experiences across multiple devices.

UHD TV Market Drivers

Declining Production Costs and Affordable Pricing

Continuous innovation in panel manufacturing and economies of scale have sharply reduced production costs, allowing brands to offer large-screen UHD TVs at accessible price points. This affordability has opened new opportunities in emerging markets, where middle-class consumers are upgrading from Full HD to 4K televisions. The combination of competitive pricing and enhanced features continues to expand the global UHD TV customer base.

Proliferation of UHD Streaming and Gaming Content

The availability of 4K and 8K content on major streaming platforms such as Netflix, Disney+, and Amazon Prime Video is driving the demand for UHD televisions. The gaming industry is also contributing significantly, with next-generation consoles supporting native 4K resolutions and high frame rates. The integration of HDMI 2.1, HDR10+, and Dolby Vision standards enhances the visual experience, making UHD TVs essential for immersive home entertainment setups.

Technological Advancements and Premium Segment Growth

Continuous innovation in display technologies ranging from OLED and QLED to Mini-LED has fueled demand for premium UHD TVs. These advancements offer superior picture quality, better contrast, and thinner designs. As consumer awareness of picture quality and design aesthetics increases, premium models are gaining higher market share, particularly in urban households and commercial installations such as hotels and conference centers.

Market Restraints

Market Saturation in Developed Regions

In North America and Western Europe, the UHD TV market faces maturity, with high household penetration limiting replacement demand. The average replacement cycle for TVs in these regions has lengthened to 6–8 years, slowing overall market growth. To sustain revenue, brands are focusing on value-added services such as subscription-based smart TV ecosystems and hardware-software integration.

High Cost and Limited 8K Content Availability

Although 8K technology represents the next frontier in resolution, its adoption is limited by the scarcity of native content and higher retail prices. Production and broadcasting in 8K remain costly, and most streaming platforms are still optimizing 4K as the standard. This delay in ecosystem development restricts mass adoption of 8K televisions, confining them to niche premium buyers.

UHD TV Market Opportunities

Emerging Market Expansion

Rapid urbanization, growing disposable incomes, and improving broadband infrastructure in emerging economies such as India, Indonesia, Vietnam, and Nigeria are driving first-time adoption of UHD TVs. Affordable 4K models and financing options are making premium viewing accessible to a wider consumer base, creating strong potential for both global and local manufacturers.

Feature Differentiation through Smart Ecosystems

As resolution and size become commoditized, differentiation now hinges on smart ecosystems. Manufacturers can leverage AI upscaling, voice recognition, and home automation to create unique selling propositions. Partnerships with streaming and gaming platforms also provide opportunities to enhance consumer stickiness and recurring revenue streams.

Commercial and Hospitality Applications

The growing use of UHD TVs in commercial environments, including hotels, retail outlets, offices, and digital signage, presents untapped opportunities. The blurring line between professional and consumer display applications is prompting manufacturers to diversify their product portfolios. UHD TVs are increasingly replacing traditional signage solutions, thanks to their cost-effectiveness and superior visual impact.

Product Type Insights

4K UHD TVs dominate the global market with around 80% share in 2024, primarily due to mass-market affordability and abundant content availability. 8K UHD TVs are expected to register the fastest growth through 2030 as manufacturing costs decline. In terms of screen size, 55–65-inch models account for nearly 45% of total shipments, followed by 66–75-inch models that are gaining traction among premium buyers.

Application Insights

The residential segment commands approximately 85% of the UHD TV market, driven by home entertainment and gaming applications. The commercial segment, though smaller, is expanding rapidly due to demand from hospitality, retail, and corporate sectors. UHD TVs are increasingly deployed for dynamic advertising and conferencing solutions, enhancing engagement through superior picture quality and digital integration.

Distribution Channel Insights

Online sales channels, including e-commerce platforms and brand-direct websites, dominate UHD TV distribution due to convenience, price transparency, and global reach. Brick-and-mortar electronics retailers continue to play a vital role in experiential marketing, offering consumers product demonstrations and post-sale support. Hybrid omnichannel models are becoming increasingly common, integrating digital marketing, virtual showrooms, and in-store pick-up options.

| By Product Type | By Screen Size | By Application | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounted for approximately 30% of the global UHD TV market value in 2024. High disposable incomes, strong broadband connectivity, and widespread 4K content availability support market growth. The U.S. remains the largest market, while Canada exhibits rising demand for smart home-integrated televisions. Replacement purchases are primarily driven by larger sizes and advanced gaming features.

Europe

Europe holds roughly 25% market share, with major countries such as Germany, the U.K., and France leading adoption. Consumers in this region favor energy-efficient and design-oriented models. The growth of OTT streaming services and the shift toward carbon-neutral manufacturing practices align well with Europe’s sustainability-driven market trends.

Asia-Pacific

Asia-Pacific leads globally with around a 35% share in 2024. China remains the largest producer and consumer of UHD TVs, while India and Southeast Asia represent the fastest-growing markets. Expanding middle-class populations and local assembly incentives such as “Make in India” are boosting production and affordability. Japan and South Korea continue to be hubs of technological innovation, spearheading OLED and 8K advancements.

Middle East & Africa

MEA accounts for approximately 8% of the global market. Growth is concentrated in the Gulf Cooperation Council (GCC) countries, the UAE, Saudi Arabia, and Qatar, where premium and ultra-large-screen models are in high demand. Africa is witnessing rising adoption in urban centers, driven by expanding electrification and increasing access to digital broadcasting.

Latin America

Latin America holds around 7% of the market, led by Brazil and Mexico. The region’s growth is supported by improving logistics, rising broadband penetration, and increasing availability of affordable 4K TVs. Manufacturers are focusing on localized content partnerships and mid-tier pricing to capture emerging consumer segments.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the UHD TV Market

- Samsung Electronics

- LG Electronics

- Sony Corporation

- TCL Technology

- Hisense International

- Panasonic Corporation

- Sharp Corporation

- Xiaomi Corporation

- Vizio Inc.

- Philips (TP Vision)

- Skyworth Group

- Konka Group

- Changhong Electric

- Toshiba Corporation

- Haier Group

Recent Developments

- In March 2025, Samsung announced the expansion of its Micro-LED TV lineup with smaller screen variants targeting premium consumers.

- In February 2025, LG introduced its latest OLED evo series featuring AI-assisted brightness optimization and energy-saving technology.

- In January 2025, Sony unveiled its new Bravia XR lineup, integrating cognitive processors for real-time picture enhancement and gaming optimization.

- In December 2024, TCL opened a new panel manufacturing facility in Vietnam to boost regional supply and reduce export costs.

- In November 2024, Hisense launched an 85-inch Mini-LED TV targeting mid-premium consumers in emerging markets.