Twin Scissor Lift Table Market Size

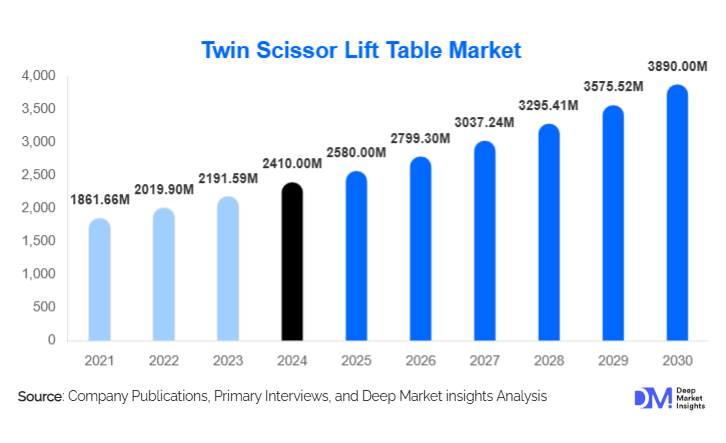

According to Deep Market Insights, the global twin scissor lift table market size was valued at USD 2,410 million in 2024 and is projected to grow from USD 2,580 million in 2025 to reach USD 3,890 million by 2030, expanding at a CAGR of 8.5% during the forecast period (2025–2030). The growth of the twin scissor lift table market is primarily driven by the rising demand for advanced material handling equipment, increasing automation in industrial operations, and growing adoption of ergonomic lifting solutions to improve workplace safety and productivity.

Key Market Insights

- The growing demand for efficient material handling systems in the manufacturing and logistics sectors is propelling market expansion.

- Hydraulic twin scissor lift tables dominate due to their high load-bearing capacity and adaptability in warehouse and assembly line applications.

- Electric and battery-operated models are gaining traction as industries shift toward energy-efficient and low-maintenance equipment.

- Asia-Pacific leads global demand, supported by large-scale industrialization in China, India, and Southeast Asia.

- North America and Europe are witnessing growth in replacement demand due to the modernization of existing lifting systems and regulatory emphasis on workplace safety.

- Integration of IoT and automation technologies is enabling predictive maintenance and real-time monitoring of lift table performance.

Latest Market Trends

Electrification and Smart Automation

Manufacturers are increasingly adopting electric twin scissor lift tables integrated with smart control systems. These models feature programmable lift heights, energy recovery systems, and remote monitoring capabilities through IoT sensors. Automation-enabled lift tables are enhancing operational precision in assembly lines, warehouses, and distribution centers, reducing downtime and improving safety. The integration of digital interfaces and predictive analytics supports proactive maintenance and lowers the total cost of ownership.

Customization and Modular Design Innovations

Market players are focusing on modular designs to enable customization based on industry-specific requirements. Twin scissor lift tables are being engineered with adjustable platforms, high-load twin-deck configurations, and enhanced stability mechanisms. These features are particularly valuable in sectors such as automotive, aerospace, and heavy machinery manufacturing, where operational flexibility and reliability are critical. The rise of modular production systems is encouraging the adoption of lift tables that can easily integrate into automated manufacturing lines.

Twin Scissor Lift Table Market Drivers

Rising Focus on Workplace Safety and Ergonomics

Increasing awareness of workplace injuries related to manual material handling has accelerated the adoption of twin scissor lift tables. These systems improve operator safety by reducing strain and providing stable lifting platforms for heavy loads. Regulatory bodies such as OSHA and the European Agency for Safety and Health at Work (EU-OSHA) are enforcing strict guidelines on ergonomic material handling, which in turn drives the need for automated lifting equipment across industries.

Industrial Automation and Efficiency Optimization

Automation trends across sectors such as e-commerce, logistics, and manufacturing are fueling demand for intelligent lifting systems. Twin scissor lift tables play a vital role in streamlining production lines, improving throughput, and enabling faster material flow. The need to reduce cycle times, minimize manual labor, and enhance operational efficiency is boosting adoption in both developed and emerging markets.

Market Restraints

High Initial Costs and Maintenance Requirements

The installation and maintenance costs associated with twin scissor lift tables can be high, particularly for heavy-duty or custom-engineered systems. Small and medium-sized enterprises often face budget constraints that limit investment in advanced lifting solutions. Moreover, regular inspection, hydraulic fluid replacement, and component wear management can add to operational costs, restraining widespread adoption among cost-sensitive end users.

Operational Limitations and Load Constraints

Despite technological advances, twin scissor lift tables face limitations in terms of maximum height and load stability at extreme lifting positions. Applications requiring high vertical reach or constant mobility often prefer alternatives such as vertical lifts or telescopic platforms. These performance constraints can affect deployment in specialized industries, particularly aerospace and large-scale construction.

Twin Scissor Lift Table Market Opportunities

Adoption in E-commerce and Logistics Warehouses

The rapid expansion of global e-commerce and third-party logistics operations presents significant opportunities for twin scissor lift tables. These platforms enhance picking, packing, and sorting efficiency by enabling height-adjustable workstations and seamless integration with conveyor systems. Automated lift tables are increasingly deployed in fulfillment centers to improve throughput and ergonomic handling of large product volumes.

Green and Energy-Efficient Lifting Solutions

As sustainability becomes a key purchasing criterion, manufacturers are developing eco-friendly lift tables with energy-efficient motors, low hydraulic fluid consumption, and recyclable materials. The trend toward electric and battery-powered lift tables aligns with global efforts to reduce carbon emissions and operational noise, making them suitable for indoor applications such as cleanrooms, electronics manufacturing, and pharmaceuticals.

Product Type Insights

Hydraulic twin scissor lift tables hold the largest market share, driven by robust lifting capacity and cost-effectiveness. Electric lift tables are projected to witness the fastest growth due to zero-emission operation, low maintenance, and enhanced precision control. Pneumatic and mechanical variants cater to niche industrial uses where safety and environmental considerations are paramount.

Application Insights

Manufacturing dominates the application segment, leveraging lift tables for assembly, welding, and component transfer tasks. Logistics and warehousing applications are growing rapidly, propelled by automation in fulfillment operations. Additional applications include automotive repair workshops, aerospace component handling, and packaging industries, where ergonomic efficiency is critical.

| By Product Type | By Application | By End-Use Industry |

|---|---|---|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global twin scissor lift table market, accounting for the largest revenue share in 2024. The region’s dominance is driven by rapid industrialization, infrastructure expansion, and growth in manufacturing output in China, India, and Southeast Asia. Government initiatives promoting industrial safety and workplace modernization are further enhancing regional demand.

North America

North America’s market growth is supported by high adoption of automation technologies and stringent safety standards in the U.S. and Canada. The replacement of aging hydraulic systems with advanced electric models is a key trend. Rising investment in warehouse automation and the expansion of e-commerce infrastructure are fueling market growth.

Europe

Europe remains a mature but stable market, with strong demand for energy-efficient and ergonomic lift tables across automotive and aerospace sectors. The presence of key manufacturers and continuous product innovation focused on sustainability and safety compliance are key growth enablers.

Middle East & Africa

Steady growth is observed in industrial sectors such as oil & gas, construction, and logistics. Infrastructure projects in GCC nations and industrial diversification in Africa are boosting adoption. Local manufacturing expansion and import substitution strategies are expected to enhance market presence over the next decade.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Twin Scissor Lift Table Market

- Interthor

- EdmoLift AB

- Autoquip Corporation

- Marco Group AB

- Liftsafe Group

- Bishamon Industries Corporation

- Helio Hydrosystem

Recent Developments

- In July 2025, EdmoLift AB introduced a new series of electric twin scissor lift tables with energy recovery systems and smart load monitoring features for industrial automation.

- In May 2025, Autoquip Corporation launched its next-generation hydraulic scissor tables with enhanced safety interlocks and real-time diagnostics for assembly line applications.

- In March 2025, Bishamon Industries expanded its North American distribution network, offering customizable twin scissor lift solutions for automotive and aerospace clients.