Tree Trimmers Market Size

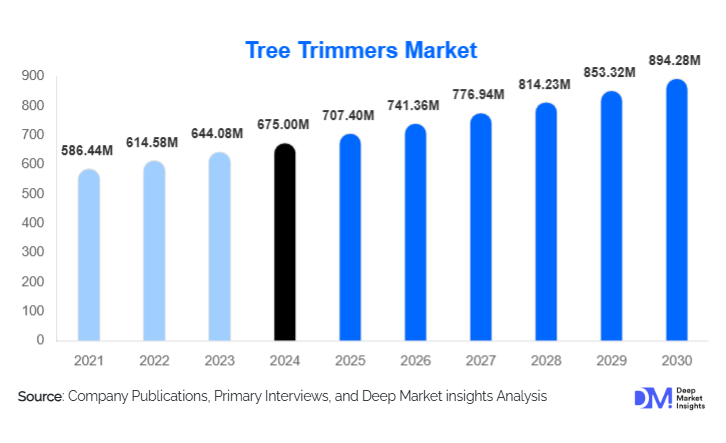

According to Deep Market Insights, the global tree trimmers market size was valued at USD 675 million in 2024 and is projected to grow from USD 707.40 million in 2025 to reach USD 894.28 million by 2030, expanding at a CAGR of 4.8% during the forecast period (2025–2030). Growth in the tree trimmers market is primarily driven by the accelerating adoption of battery-electric trimming equipment, increasing urban forestry investments, stricter emissions and noise regulations, and rising demand from commercial landscaping and utility vegetation management sectors.

Key Market Insights

- Battery-electric tree trimmers are rapidly becoming the preferred choice for both professionals and residential users due to emissions regulations and noise restrictions.

- Commercial landscaping companies dominate demand, driven by fleet upgrades, maintenance contracts, and sustainability-focused procurement.

- North America leads the global market, supported by high spending on residential and municipal landscaping and strong adoption of professional-grade tools.

- Asia-Pacific is the fastest-growing region, driven by urbanization, green infrastructure investments, and rising municipal spending in China and India.

- Technological integration, including IoT, telemetry, and predictive maintenance, is reshaping equipment usage, especially for large fleets.

- Utility vegetation management continues to be a critical demand driver, particularly in wildfire-prone regions where trimming is essential for grid safety.

What are the latest trends in the tree trimmers market?

Electrification and Eco-Friendly Equipment Surge

One of the strongest trends shaping the market is the rapid shift from gas-powered trimmers toward battery-electric models. Manufacturers are investing heavily in high-voltage lithium-ion platforms that deliver the torque of gas engines while eliminating emissions, reducing maintenance, and lowering operating noise. Municipal governments increasingly specify battery equipment for public procurement, driving market-wide transformation. Commercial landscapers are also adopting electrification to comply with sustainability guidelines, cut fuel costs, and improve employee safety. As a result, electric pole saws, chainsaws, and hedge trimmers are outpacing traditional power tools, fundamentally altering the product mix in the market.

IoT-Connected and Smart Trimming Equipment

The integration of digital capabilities is accelerating across the tree trimmers industry. Fleet operators now lean on telematics-enabled tools that provide real-time battery diagnostics, maintenance alerts, equipment tracking, and usage analytics. These technologies help reduce downtime, extend tool life, and enhance job-site safety. Smart pole saws and chainsaws are increasingly being fitted with vibration monitoring, operator safety sensors, and data-logging features. Manufacturers are building app ecosystems that allow contractors to manage entire fleets, streamline service scheduling, and monitor battery inventory. This technology-first shift is particularly impactful for utility companies and large commercial landscaping operators.

What are the key drivers in the tree trimmers market?

Growing Urban Green Infrastructure and Landscaping Activity

Global investment in urban forestry, residential landscaping, and public green zones is rising sharply. Cities worldwide are prioritizing tree maintenance to strengthen climate resilience, manage heat islands, and beautify public spaces. Commercial landscaping companies, which constitute one of the largest end-user groups, continue to expand fleets to meet demand from residential developments, corporate campuses, and municipal contracts. This sustained landscaping activity underpins consistent, long-term demand for professional-grade tree trimmers across regions.

Regulations on Emissions, Noise, and Worker Safety

Governments in North America, Europe, and increasingly Asia-Pacific are adopting strict emissions standards that restrict gas-powered tools and encourage electric alternatives. Noise-sensitive urban environments, especially residential neighborhoods and school zones, are accelerating the adoption of electric trimmers. Moreover, enforcement of worker safety requirements, including anti-kickback systems, vibration control, and ergonomic guidelines, is prompting commercial users to upgrade fleets more frequently. These regulatory tailwinds collectively stimulate demand for modern, compliant equipment.

Technological Advancements in Battery Systems and Tool Design

Advances in battery chemistry, thermal management, and fast-charging technology are pushing electric trimmers to professional-grade performance levels. Long-lasting, lightweight, swappable batteries reduce downtime and enable day-long operations for commercial landscapers. At the same time, improvements in chain braking systems, anti-vibration handles, telescopic pole designs, and blade precision enhance user safety, efficiency, and comfort. These innovations increase adoption across all user categories, especially among professionals who demand reliability and durability.

What are the restraints for the global market?

High Upfront Costs for Battery Equipment

Although electric trimmers offer long-term savings on fuel and maintenance, they require a higher upfront investment compared to traditional gas-powered models. Complete electric ecosystems, including batteries, rapid chargers, and backup units, can significantly raise initial capital requirements for landscapers and municipalities. Budget-constrained users in developing markets often find gas-powered tools more economical, slowing global electrification adoption rates.

Infrastructure and Runtime Limitations for Remote Operations

Utility vegetation management crews, arborists, and forestry contractors often operate in remote or off-grid regions where reliable charging infrastructure is limited. Even with high-capacity batteries, runtime constraints and long charging intervals can hinder productivity. This challenge prevents full replacement of gas-powered tools in mission-critical, high-output, or extended-shift applications, restricting the total addressable market for electric trimmers.

What are the key opportunities in the tree trimmers industry?

Smart Fleet Management and Telematics Integration

Companies have a major opportunity to integrate cloud-connected telematics into trimming equipment fleets. Tools that offer predictive maintenance, battery health tracking, asset location, and usage optimization can generate new recurring revenue streams. Municipalities and large landscaping firms increasingly prefer digitally managed fleets, making IoT-enabled devices and subscription-based services a rapidly expanding market opportunity.

High-Growth Potential in Emerging Markets

Urban expansion in Asia-Pacific, Latin America, and the Middle East is creating unprecedented demand for tree maintenance tools. Countries like India, China, and Brazil are investing in smart-city green infrastructure, public landscaping, and roadside vegetation management. Market entrants offering affordable electric tools, portable chargers, and localized service networks can capture high-growth share in these fast-developing regions. Additionally, governments promoting sustainable landscaping present fertile territory for the expansion of electric and hybrid tool ecosystems.

Product Type Insights

Among product categories, pole trimmers dominate global revenue due to their superior safety profile, extended reach, and suitability for both residential and commercial use. They account for approximately 30% of the 2024 market, leading adoption across municipal forestry, utility companies, and professional landscapers. Chain saws and stump grinders remain essential for heavy-duty applications, while robotic and autonomous trimmers, although nascent, are gaining attention for high-precision, labor-saving tasks. Wood chippers represent a specialized but high-value segment, particularly for arborists and forestry contractors.

Application Insights

Commercial landscaping services represent the largest application segment, contributing around 35% of the global market in 2024. These users depend on high-performance, durable equipment for daily operations, fleet-level purchases, and long-term maintenance contracts. Municipal and public works departments form the second-largest segment, fueled by urban forestry budgets and compliance requirements. Utility operators continue to be mission-critical buyers for trimming near power lines and grid infrastructure. Residential demand is growing steadily as homeowners migrate to battery-powered tools for convenience and noise reduction.

Distribution Channel Insights

Direct-to-fleet sales are rising quickly, representing about 25% of market value in 2024, driven by bulk procurement from landscapers and municipal agencies. Specialty arborist dealers maintain a strong influence in the professional segment due to their service expertise and tool specialization. Online sales channels are expanding rapidly among residential consumers, supported by product comparisons, customer reviews, and doorstep delivery. Big-box hardware retailers continue to play a major role in mainstream product distribution.

End-Use Insights

Commercial users, including landscapers, utility contractors, and arborists, represent the most significant end-use category. The rise of electric fleet transitions, combined with increasing maintenance requirements for parks, campuses, and residential communities, drives robust demand. Municipal forestry departments are seeing multi-year budget increases for public-space maintenance, further supporting equipment procurement. In the residential segment, growing DIY culture and suburban landscaping trends are accelerating sales of cordless tools. The forestry and logging sector continues to rely on high-power equipment, with moderate growth linked to reforestation and timber management programs.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America is the largest market globally, accounting for 35–40% of 2024 demand. The United States drives the majority share, supported by mature commercial landscaping sectors, strong homeownership rates, and extensive utility vegetation management activities. Canada contributes steadily, particularly in municipal forestry and property-maintenance applications. The region also leads in electric tool adoption due to strong environmental regulations and high purchasing power.

Europe

Europe represents a highly regulated, sustainability-driven market with widespread adoption of electric trimmers. Countries like Germany, the U.K., France, and the Nordics have stringent noise and emissions rules that accelerate electrification. The region accounts for roughly 25–30% of global demand in 2024. Fleet management tools and IoT-enabled devices are in particularly high demand among municipal and landscaping contractors.

Asia-Pacific

Asia-Pacific is the fastest-growing region, supported by urban expansion, infrastructure development, and increasing landscaping investments in China, India, Japan, and Southeast Asia. Rapidly expanding middle-class populations and government-led green initiatives are encouraging the adoption of modern trimming tools. While cost sensitivity remains a factor, demand for electric and hybrid tools is rising quickly, particularly in urban centers.

Latin America

Demand in Latin America is steadily increasing, particularly in Brazil, Mexico, and Argentina, where urban beautification programs and commercial landscaping are expanding. Buyers in this region tend to favor robust, cost-effective tools, though electric models are slowly gaining traction. The region remains underpenetrated but offers strong long-term potential as public green-space investments grow.

Middle East & Africa

The MEA region shows emerging demand for tree-trimming equipment, driven by urban development in the Gulf states and increasing forestry activities in African nations. Countries like the UAE and Saudi Arabia are investing heavily in city landscaping and green corridors, boosting demand for high-end electric tools. Africa’s demand is driven mainly by municipal maintenance and tourism-oriented landscaping in countries like Kenya, South Africa, and Nigeria.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Tree Trimmers Market

- Stihl

- Husqvarna

- Makita

- DeWalt (Stanley Black & Decker)

- Greenworks

- EGO Power+

- Honda

- Emak

- Echo

- Toro

- WORX

- Zomax

- STIGA

- MTD

- Fiskars

Recent Developments

- In March 2025, Husqvarna launched a new generation of battery-powered pole saws equipped with cloud-based telemetry for commercial fleets.

- In January 2025, STIHL announced investments in expanding its battery production facility to meet rising demand for electric landscaping tools.

- In June 2025, Makita introduced a smart battery management mobile app enabling real-time monitoring and predictive diagnostics for contractors and fleet operators.