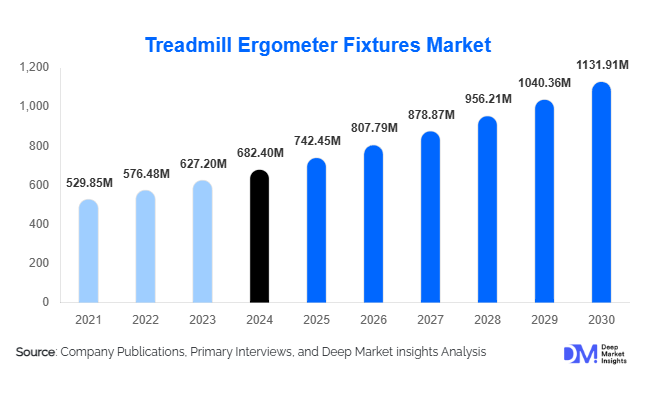

Treadmill Ergometer Fixtures Market Size

According to Deep Market Insights, the global treadmill ergometer fixtures market size was valued at USD 682.4 million in 2024 and is projected to grow from USD 742.45 million in 2025 to reach USD 1,131.91 million by 2030, expanding at a CAGR of 8.8% during the forecast period (2025–2030). The market growth is driven by increasing adoption of treadmill-based testing and rehabilitation systems in sports medicine, healthcare, and research, coupled with rising demand for precision exercise testing and ergometric calibration in performance diagnostics.

Key Market Insights

- Growing focus on performance monitoring and sports science is accelerating the adoption of treadmill ergometer fixtures across academic and research institutions.

- Healthcare applications dominate market demand, with treadmill ergometers being widely used for cardiopulmonary testing and rehabilitation.

- Integration of digital measurement systems such as force sensors, motion capture, and biomechanical data analytics is transforming the functionality of treadmill fixtures.

- North America leads the global market, supported by well-established sports medicine facilities and advanced diagnostic infrastructure.

- Asia-Pacific is the fastest-growing region, with expanding hospital networks and fitness technology investments in China, Japan, and India.

- Collaborations between universities, fitness equipment manufacturers, and healthcare technology firms are fueling product innovation and calibration precision.

Latest Market Trends

Integration of Smart Sensors and Data Analytics

Manufacturers are integrating IoT-enabled sensors and high-resolution motion analysis systems into treadmill ergometer fixtures to enhance testing accuracy. These technologies allow real-time tracking of parameters such as stride dynamics, ground reaction forces, and cardiovascular responses. The integration of AI-driven analytics enables precise performance diagnostics for athletes and patients, improving rehabilitation outcomes and enabling predictive maintenance of devices.

Expansion of Medical and Clinical Applications

Treadmill ergometer fixtures are increasingly being adopted for medical diagnostics, particularly in cardiology and physiotherapy departments. Hospitals and rehabilitation centers are investing in advanced treadmills equipped with adjustable fixtures and safety harness systems for patient support. The demand for customized clinical-grade ergometers is growing, particularly in aging populations requiring low-impact rehabilitation and controlled exercise testing.

Treadmill Ergometer Fixtures Market Drivers

Rising Demand for Performance and Health Monitoring

The global focus on preventive healthcare and sports performance optimization is a major driver of market growth. Elite athletes, physiotherapists, and researchers are increasingly relying on treadmill-based testing systems to assess biomechanical and cardiovascular performance under controlled conditions. The integration of wearable sensors and remote diagnostics further enhances the value proposition of treadmill fixtures across sports and medical environments.

Technological Advancements in Ergometer Design

Ongoing innovations in mechanical stability, motor precision, and calibration software are making treadmill ergometer fixtures more adaptable and accurate. The transition toward modular, digitally integrated fixtures with user-friendly interfaces enables greater flexibility in testing protocols. Manufacturers are also developing lightweight and portable ergometers suitable for field research and compact laboratory spaces.

Market Restraints

High Equipment and Maintenance Costs

Advanced treadmill ergometer fixtures involve significant capital expenditure due to their mechanical complexity and calibration requirements. The cost of maintenance and sensor recalibration can be prohibitive for smaller research institutions and clinics. Additionally, integrating advanced analytics software and data systems further increases total ownership costs, limiting adoption in cost-sensitive regions.

Limited Technical Expertise and Standardization

The market faces challenges due to a lack of standardized testing protocols and limited technical expertise for operating complex ergometric equipment. Inconsistent calibration practices can lead to variations in test results across facilities, impacting reliability. Training programs for technicians and standardized testing frameworks are critical for overcoming these challenges and improving global adoption rates.

Market Opportunities

Expansion into Rehabilitation and Elderly Care

The growing global aging population is creating new opportunities for treadmill ergometer fixtures in physiotherapy and rehabilitation. Hospitals and care centers are increasingly deploying adaptive treadmill systems with safety supports, adjustable speeds, and feedback modules for gait analysis. These applications are expected to drive sustained demand in clinical and home-based rehabilitation markets.

Integration with Virtual Reality and Telemedicine Platforms

Combining treadmill ergometer fixtures with VR-based training modules and telemedicine platforms is an emerging trend. These integrations enable remote performance assessments, virtual physiotherapy sessions, and immersive rehabilitation experiences. As telehealth adoption increases globally, the demand for connected ergometric fixtures compatible with digital health ecosystems is expected to rise.

Product Type Insights

Medical-grade treadmill ergometer fixtures dominate the market, driven by applications in hospitals, clinics, and sports medicine facilities. These systems feature advanced stabilization mechanisms and high-precision calibration. Research-grade fixtures are gaining traction among universities and sports science institutions for biomechanical and physiological studies. Commercial and industrial treadmill fixtures, used in fitness testing and occupational health, represent a growing secondary segment.

Application Insights

Clinical diagnostics account for the largest market share, primarily in cardiopulmonary testing and physical rehabilitation. Sports and performance analysis is another major segment, where treadmill fixtures support gait, endurance, and force assessment. Research and development applications are expanding as universities and laboratories invest in precise ergometric testing for biomechanics, kinesiology, and robotics studies.

Distribution Channel Insights

Direct sales through manufacturers and distributors remain the dominant channel, particularly for hospitals and research facilities requiring installation and calibration services. Online sales channels are expanding rapidly, enabling smaller institutions and fitness centers to access standardized testing systems. Specialized medical equipment resellers and tender-based procurement processes also play a key role in market distribution.

End-User Insights

Hospitals and rehabilitation centers represent the leading end-user category, leveraging treadmill ergometer fixtures for diagnostic and therapeutic applications. Sports institutes and universities form a fast-growing segment, driven by demand for athletic performance testing. Corporate wellness and occupational health programs are emerging users, employing treadmill testing to assess employee fitness and ergonomics.

| By Product Type | By Application | By Distribution Channel | By End-User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America dominates the global treadmill ergometer fixtures market, driven by advanced healthcare infrastructure, high sports participation, and established research networks. The U.S. leads in adoption, with universities and hospitals integrating digital ergometer systems for both performance and medical applications.

Europe

Europe represents a significant market share due to robust investment in sports medicine and clinical rehabilitation. Countries such as Germany, the U.K., and France are key hubs for ergometric testing research, supported by strong academic collaborations and public health programs promoting exercise-based therapies.

Asia-Pacific

Asia-Pacific is the fastest-growing region, supported by expanding healthcare access, growing awareness of physical fitness, and rising investments in sports science infrastructure. China and Japan lead the regional market, while India is emerging as a high-potential market for affordable medical-grade ergometers.

Latin America

The market in Latin America is gradually expanding, led by Brazil and Mexico, where hospitals and sports institutes are investing in advanced treadmill testing systems. Local distributors and partnerships with global manufacturers are improving product accessibility and affordability.

Middle East & Africa

Growth in the Middle East & Africa is supported by increasing investments in healthcare modernization and sports performance facilities. The UAE and Saudi Arabia are investing in high-end rehabilitation centers equipped with advanced ergometers, while South Africa leads adoption within Sub-Saharan Africa.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Treadmill Ergometer Fixtures Market

- Woodway Inc.

- h/p/cosmos sports & medical GmbH

- Lode B.V.

- TechnoGym S.p.A.

- Life Fitness

- SCHILLER AG

- Trackmaster Treadmills

- GE Healthcare (Cardio Systems)

- Noraxon USA Inc.

Recent Developments

- In June 2025, Lode B.V. launched a next-generation medical treadmill ergometer with integrated ECG analysis and AI-based gait tracking capabilities for cardiology departments.

- In April 2025, h/p/cosmos introduced its “motion lab” system featuring modular treadmill fixtures compatible with biomechanical motion-capture systems for research institutions.

- In January 2025, Woodway announced a partnership with the U.S. Olympic Training Center to deploy custom ergometer fixtures for athlete conditioning and performance benchmarking.