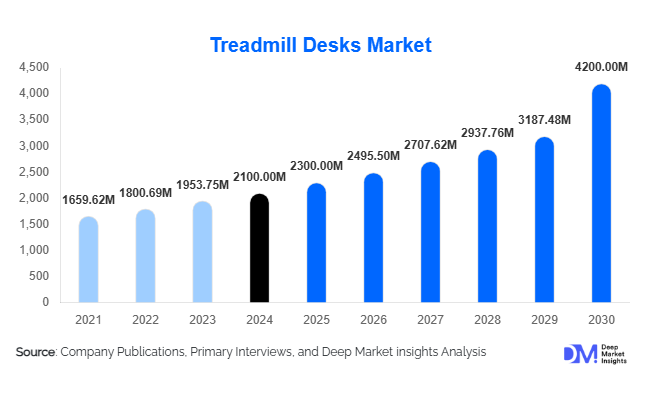

Treadmill Desks Market Size

According to Deep Market Insights, the global treadmill desks market was valued at approximately USD 2,100 million in 2024 and is projected to rise from around USD 2,278.50 million in 2025 to reach USD 3,426.08 million by 2030, expanding at a CAGR of about 8.5% over the forecast period (2025–2030). Treadmill desks combine work surfaces with walking platforms or mechanised under-desk treadmills to enable users to stay lightly active while working. The increase in hybrid and remote working, growing corporate wellness budgets, and broader health awareness are key drivers pushing adoption across regions and sectors.

Key Market Insights

- Standing-type treadmill desks maintain dominance with simpler design, lower cost, and lower mechanical complexity, making them a mainstay for many offices and homes.

- Walking / under-desk hybrid models are gaining traction as users seek more movement without full standing, aided by quieter motors and smarter controls.

- North America leads in absolute revenue share, driven by strong corporate wellness adoption, high purchasing power, and early awareness of ergonomic/health solutions.

- Asia-Pacific is the fastest-growing region, propelled by rising middle classes, expanding remote work, and increasing health consciousness.

- Online / D2C channels are disrupting sales models, enabling brands globally to reach consumers directly, reducing middlemen, and accelerating product adoption.

- Smart, connected treadmill desks with sensors, IoT integration, health tracking, and modular adaptability are emerging differentiators in the competitive landscape.

Latest Market Trends

Modular & Hybrid Desk Designs

One of the more notable trends in the treadmill desks market is the increasing adoption of modular and convertible designs. These designs allow users to switch between sitting, standing, or walking modes seamlessly, often with detachable treadmill bases or convertible platforms. This flexibility appeals especially to hybrid workers who may not want a full walking mode all the time. The modular approach also reduces cost barriers, letting users invest incrementally by first buying a standing desk and later adding the treadmill unit. As manufacturers focus on reducing bulk, improving foldability, and minimizing noise, modular solutions are becoming more commercially viable and attractive.

Smart & Connected Features Integration

Treadmill desks are evolving beyond purely mechanical products into smart furniture. New generation models come with sensors to monitor walking speed, distance, calories, posture changes, and integrate with health apps or corporate wellness platforms. AI-based reminders to shift between sitting and walking, predictive maintenance alerts, and firmware updates are being introduced. In offices, centralized dashboards allow facility managers to track usage, optimize settings, or schedule maintenance. This trend is reshaping user expectations; buyers increasingly demand not just static hardware but an ecosystem of data and health feedback.

Market Drivers

Rising Sedentary Lifestyle and Health Risk Awareness

Across regions, public health research is spotlighting the risks of prolonged sitting: cardiovascular disease, diabetes, obesity, musculoskeletal issues, and mortality risk. Corporations and institutions are responding by investing in interventions to reduce sedentary time. Treadmill desks address this demand by enabling low-intensity movement during routine work tasks, making them a compelling ergonomic and wellness solution. As awareness rises, more organizations are including active workstations in wellness programs and office design specifications.

Hybrid Work & Home Office Investments

The shift toward hybrid and remote work models has created demand for high-quality ergonomic and active furniture in homes and small offices. Many workers now seek solutions to improve health and productivity in their personal workspace. Treadmill desks, especially compact or foldable variants, are becoming a part of home office kits. This trend helps expand demand beyond corporate settings into the consumer / residential segment, accelerating market growth.

Technological Advances & Cost Efficiencies

Improvements in motor design, belt materials, noise dampening, safety mechanisms, and modular engineering are making treadmill desks more reliable, quieter, and competitive in cost. As production scales, component costs decline, enabling mid-tier and even more affordable models. Also, manufacturers investing in R&D reduce failure rates or maintenance overhead, which increases buyer confidence. The ability to ship modular units also reduces logistic costs and opens up new markets.

Market Restraints

High Upfront Cost & Total Cost of Ownership

One major barrier is the relatively high capital cost of treadmill desks vs. conventional or standing desks. Buyers often factor in not only purchase cost but maintenance (belt replacement, motors, service) and power consumption, which may deter price-sensitive customers or smaller enterprises. In emerging markets with tighter budgets, this can slow adoption.

Space, Noise & Usability Constraints

Treadmill desks require more physical space (length, clearance), careful floor support, and often produce noise or vibration that may interfere with work, particularly in shared office or residential environments. Some users find walking while typing or concentrating challenging. These ergonomic and practical limitations can dissuade organizations or individuals from adoption, especially in dense urban settings with limited space.

Segmental Insights

From the segmentation described previously, here is a focus on one leading sub-segment in each dimension, with estimated share in 2024 and rationale:

By Type: Standing Treadmill Desks (50%) - In 2024, the standing variant commands an estimated 50% of the global treadmill desks revenue. Its dominance stems from simpler mechanics, lower cost, easier integration, and broader user comfort in alternating between sitting and standing. It appeals to a wide audience unwilling to fully commit to walking while working.

By Application – IT & Telecom (32%) - The IT & Telecom vertical is estimated to take 32% of 2024 revenues. This sector is highly desk-oriented, has high ergonomic budgets, is early in adopting wellness technologies, and is quick to trial new productivity tools. Many product launches are initially piloted in tech firms.

By Region – North America (38%) - North America likely represented 38% of the 2024 market in value terms. Its dominance arises from a high willingness to invest in wellness, robust corporate adoption, established ergonomic furniture channels, and consumer awareness. Europe follows, and Asia-Pacific is growing rapidly.

By Distribution Channel – Online / Direct (40%) - While channel data is less explicit, online / D2C is becoming one of the fastest-growing routes and may account for 40% of sales in 2024 in many markets. It allows manufacturers to reach global customers directly, reduce intermediaries, and offer customized configurations. As logistics improve, this channel share may expand further.

End-Use / Application Demand

The greatest demand comes from corporate and commercial offices, particularly in sectors like IT, finance, consulting, and tech firms, which are actively investing in employee wellness and ergonomic upgrades. These organizations are among the earliest adopters, leveraging treadmill desks in pilot zones, open offices, or wellness initiatives. The institutional segment (education, healthcare) is growing as schools, universities, and hospitals begin providing active workstations for staff and faculty. The residential/home office segment is growing, though from a lower base, as hybrid work stabilizes and more workers look to replicate ergonomic setups at home. Emerging industries such as fintech, remote services, content creation, and even call centers see potential, given their long hours of desk work. On the export side, many treadmill desk manufacturers in Asia (China, Taiwan, Vietnam) cater to demand in North America, Europe, and Australia, leveraging cross-border e-commerce and logistics. The growth in those end-use sectors (e.g., growth in the IT industry, increase in the number of knowledge workers, expansion in hybrid working) supports a healthy tailwind for treadmill desk demand globally.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America remains the largest revenue region, with a 38% share of the global 2024 treadmill desks market. The U.S. leads, thanks to high corporate wellness spending, large enterprises piloting active workstations, and high consumer awareness. Canada is smaller but growing. Many U.S. ergonomic furniture firms and treadmill desk brands are headquartered here, reinforcing local supply and distribution. Future growth is driven by retrofits of existing offices and increasing home office upgrades.

Europe

Europe holds the second-largest share (approx. 25–30%) of the 2024 market. Key markets include the U.K., Germany, France, and the Nordics, where strong labor laws, health & safety regulations, and corporate wellness culture support adoption. Eastern European countries represent lower penetration but faster growth potential. As awareness and budgets rise, Europe's share may stabilize or slightly drop due to aggressive APAC growth, but it remains significant.

Asia-Pacific

Asia-Pacific contributed roughly 18-22% of the 2024 market value. China, Japan, South Korea, India, and Australia are key. In China and Japan, high urban density, rising health focus, and strong e-commerce infrastructure support growth. India is an emerging hotspot: as white-collar jobs expand and hybrid work norms settle, treadmill desks become more accessible. Southeast Asia also offers pockets of growth. APAC is the fastest-growing region by CAGR over 2025–2030.

Latin America (LATAM)

Latin America’s share is modest (5–8%) as of 2024. Brazil and Mexico are the largest markets, with a rising middle class, increased office investments, and awareness. However, import duties, cost sensitivity, limited local manufacturing, and logistics challenges limit faster growth. Still, LATAM offers a high CAGR opportunity from a low base.

Middle East & Africa (MEA)

MEA accounts for 4–6% of the global market in 2024. GCC countries (UAE, Saudi Arabia) and South Africa lead adoption. Wealthy corporate offices, government building projects, and wellness focus in Gulf nations support growth. Infrastructure, cost, and awareness are constraints in many African countries, but intra-Africa demand and rising wellness trends may drive growth into the next decade.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Treadmill Desks Market

- Rebel Desk

- TrekDesk (TrekDesk Treadmill Desk)

- WalkTop

- LifeSpan

- iMovR

- NordicTrack

- Varidesk (or equivalent office furniture innovators)

- FlexiSpot (in desk / ergonomic furniture hybrid space)

- ErgoFin (or regional ergonomic furniture brands)

- StandDesk (with walking hybrid models)

- Xiaomi (or consumer electronics firms entering smart treadmill desks)

- TechDesk (innovative smart furniture entrant)

- UrbanFit (hybrid fitness furniture brand)

- DeskSense (IoT / sensor-enabled workstation supplier)

- ActiveWork (new generation ergonomic workstation specialist)

Recent Developments & Strategic Moves

- 2025: Several major ergonomic furniture brands launched modular treadmill desk kits enabling retrofit upgrades, reflecting demand for hybrid flexibility.

- 2024–2025: Some players introduced smart, IoT-enabled models that integrate with wellness platforms and remote dashboards, strengthening competitive differentiation.

- 2025: Manufacturing expansion and new plant investments in Southeast Asia (Vietnam, India) to reduce costs and serve regional markets more competitively.