Travel Accommodation Market Size

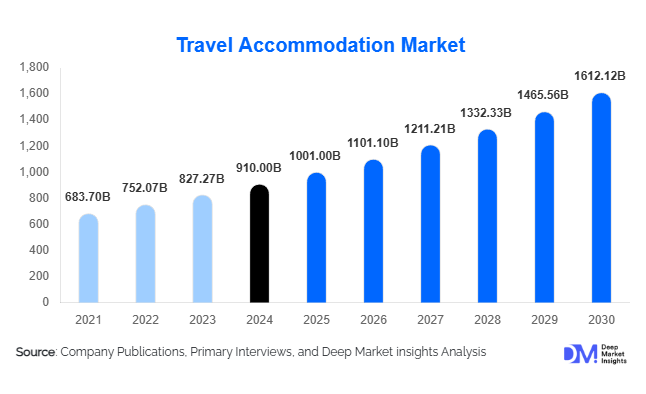

According to Deep Market Insights, the global travel accommodation market size was valued at USD 910.00 billion in 2024 and is projected to grow from USD 1,001.00 billion in 2025 to reach USD 1,612.12 billion by 2030, expanding at a CAGR of 10.0% during the forecast period (2025–2030). The market growth is primarily driven by the expansion of global tourism, the rise of digital booking platforms, and increasing consumer preference for personalized, sustainable, and experience-led lodging options.

Key Market Insights

- Digital transformation is redefining the accommodation landscape, with AI-powered booking systems and mobile apps improving customer engagement and personalization.

- Short-term rental platforms are gaining traction globally, offering travelers flexible, affordable, and localized lodging alternatives to traditional hotels.

- Luxury and boutique hotels continue to dominate premium segments, driven by demand for high-end experiences and exclusive services.

- Sustainability is becoming a central pillar of accommodation strategy, with eco-certified hotels and carbon-neutral operations attracting environmentally conscious travelers.

- Asia-Pacific leads market growth, supported by rapid tourism development, urban expansion, and rising middle-class travel expenditure.

- Technology-driven innovations such as contactless check-ins, smart rooms, and AI-based concierge services are enhancing guest satisfaction and operational efficiency.

Latest Market Trends

Growth of Alternative Accommodation Models

Alternative accommodation options such as vacation rentals, serviced apartments, and homestays are reshaping the market. Platforms like Airbnb, Vrbo, and Booking.com are expanding their portfolios to include unique, experience-driven stays. The growing demand for “home-away-from-home” experiences among millennial and Gen Z travelers is accelerating this shift. Operators are investing in property management technologies, flexible leasing models, and verified listings to ensure quality and safety standards while catering to travelers seeking affordability and authenticity.

Rise of Smart and Sustainable Hotels

Hotels worldwide are integrating advanced technologies and sustainability practices to improve efficiency and guest experience. Smart room automation, digital concierge systems, and energy-efficient designs are becoming industry standards. Hotels are adopting renewable energy sources, water recycling, and zero-waste initiatives to align with global sustainability goals. Green certifications and ESG compliance are increasingly influencing traveler decisions, prompting brands to invest in eco-friendly infrastructure and transparent reporting of carbon footprints.

Travel Accommodation Market Drivers

Rising Global Tourism and Urbanization

The steady rise in international tourist arrivals and rapid urban development in emerging economies are fueling demand for diverse accommodation types. Expanding air connectivity, visa relaxations, and tourism promotion initiatives by governments are driving hotel construction and property conversions worldwide. Additionally, global events, business travel, and leisure tourism are sustaining high occupancy rates across segments, from budget hostels to five-star resorts.

Increasing Consumer Preference for Personalized Experiences

Modern travelers prioritize customized lodging experiences that reflect local culture and comfort. This has driven demand for boutique hotels, theme-based stays, and curated packages that blend accommodation with cultural, culinary, or wellness experiences. Operators are leveraging data analytics and AI to offer personalized recommendations, flexible booking options, and loyalty programs that strengthen customer retention and enhance satisfaction.

Market Restraints

High Operational and Maintenance Costs

The hospitality industry faces significant operational expenses, including staff wages, energy consumption, and property maintenance. Inflationary pressures, supply chain disruptions, and increasing construction costs pose financial challenges for both large hotel chains and small property owners. Additionally, rising costs of compliance with sustainability standards and safety regulations may affect profitability, especially in price-sensitive markets.

Regulatory and Zoning Challenges for Short-Term Rentals

The rapid proliferation of vacation rentals and peer-to-peer accommodation has triggered regulatory scrutiny in several regions. Local governments are imposing restrictions on property usage, occupancy limits, and taxation to balance tourism growth with residential needs. These evolving legal frameworks create uncertainty for hosts and platforms, potentially limiting short-term rental expansion in key metropolitan areas.

Travel Accommodation Market Opportunities

Expansion in Emerging Markets

Rapid economic growth in Asia, the Middle East, and Latin America presents major expansion opportunities for accommodation providers. Rising disposable incomes, improving infrastructure, and government-led tourism initiatives are attracting both global hotel chains and local entrepreneurs. Mid-scale and affordable hotel segments are witnessing especially strong growth as they cater to a burgeoning middle-class traveler base seeking quality yet budget-friendly stays.

Integration of Wellness and Experiential Lodging

The fusion of hospitality with wellness, adventure, and cultural immersion is opening new revenue streams. Hotels and resorts are incorporating wellness centers, yoga retreats, and spa-focused offerings to cater to health-conscious travelers. Likewise, experience-driven lodging such as eco-lodges, farm stays, and heritage accommodations are growing in popularity, reflecting a global shift toward mindful and purposeful travel experiences.

Product Type Insights

Hotels and Resorts dominate the market, catering to both leisure and business travelers with standardized amenities and service quality. Vacation Rentals and Homestays are gaining momentum, offering flexibility and localized experiences at competitive rates. Hostels and Budget Accommodations appeal to young and solo travelers, emphasizing affordability and community-driven experiences. Serviced Apartments are increasingly preferred for extended stays, particularly among corporate travelers seeking home-like comfort with hotel-style services.

Application Insights

Leisure Travel represents the largest application segment, driven by the global rise in holidaymakers seeking relaxing and experiential stays. Business Travel remains crucial, supported by corporate events, conferences, and the return of in-person meetings post-pandemic. Group Travel and Long-Stay Segments are expanding with customized accommodation packages that offer discounted rates and flexible amenities tailored to diverse traveler needs.

Distribution Channel Insights

Online Booking Platforms (OTAs) such as Booking.com, Expedia, and Airbnb dominate the global accommodation booking landscape by offering convenience, transparency, and competitive pricing. Direct Bookings via hotel websites are growing as brands invest in loyalty programs and digital engagement tools. Travel Agencies and Corporate Partnerships continue to serve niche and high-value segments, while Meta-search Engines like Google Travel and TripAdvisor enhance visibility and price comparison capabilities.

Traveler Type Insights

Solo Travelers and Millennials drive demand for budget and flexible accommodation options, often preferring digital-first booking experiences. Couples and Honeymooners prioritize luxury stays with exclusive amenities and privacy. Families favor mid-range hotels and serviced apartments offering space, safety, and child-friendly facilities. Corporate Travelers remain a stable segment, preferring centrally located hotels with business amenities and loyalty incentives.

Age Group Insights

Travelers aged 25–44 years dominate global accommodation demand, as this group represents a balance of financial capability and travel enthusiasm. The 18–24 age group drives growth in hostels, short-term rentals, and shared spaces due to budget-conscious travel behavior. The 45–64 age group is increasingly opting for premium and wellness-focused stays, while the 65+ segment contributes to steady demand for safe, accessible, and comfortable accommodations tailored to senior travelers.

| By Product Type | By Application | By Distribution Channel | By Traveler Type | By Age Group |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America represents a mature and high-value market, led by the United States, which remains a global hub for business and leisure travel. Growth is driven by digital innovation, luxury hotel expansion, and the popularity of short-term rentals in urban and coastal destinations. Sustainable lodging and wellness-focused resorts are also gaining traction among environmentally conscious travelers.

Europe

Europe continues to hold a significant market share, supported by strong intra-regional tourism and well-established hospitality infrastructure. Countries like the U.K., France, Italy, and Spain are witnessing rising demand for boutique hotels and experiential stays. EU-wide sustainability regulations are pushing hoteliers to adopt greener practices, while the growth of budget airlines supports steady inbound tourism.

Asia-Pacific

Asia-Pacific is the fastest-growing region in the travel accommodation market, driven by economic expansion, a rising middle-class population, and rapid digitalization. China, India, Japan, Thailand, and Indonesia are key contributors, with major investments in resort development, business hotels, and eco-friendly properties. The region’s diverse cultural attractions and expanding air networks continue to boost tourism-led accommodation demand.

Latin America

Latin America is emerging as a promising market, with Mexico, Brazil, and Argentina leading growth. The region benefits from a rich cultural heritage, adventure tourism, and growing domestic travel demand. Investment in boutique hotels, eco-lodges, and beach resorts is increasing, supported by improving infrastructure and favorable government tourism policies.

Middle East & Africa

The Middle East and Africa are rapidly expanding hospitality frontiers, driven by government-led tourism diversification initiatives. The UAE and Saudi Arabia are investing heavily in luxury hotels and futuristic city projects, while African nations such as Kenya, South Africa, and Morocco are strengthening eco-tourism and boutique lodging sectors. Religious, cultural, and adventure tourism continue to fuel accommodation demand across the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Travel Accommodation Market

- Marriott International

- Hilton Worldwide Holdings Inc.

- Accor S.A.

- Hyatt Hotels Corporation

- Airbnb, Inc.

- Booking Holdings Inc.

- Expedia Group

Recent Developments

- In September 2025, Marriott International announced plans to open 200 new hotels in Asia-Pacific by 2028, emphasizing eco-friendly designs and digital guest experiences.

- In August 2025, Airbnb introduced an AI-driven personalization engine to enhance stay recommendations and improve host-guest matching accuracy.

- In June 2025, Hilton launched its “GreenStay” program, integrating sustainability certifications and carbon tracking for all global properties.