Traffic Safety Products Market Size

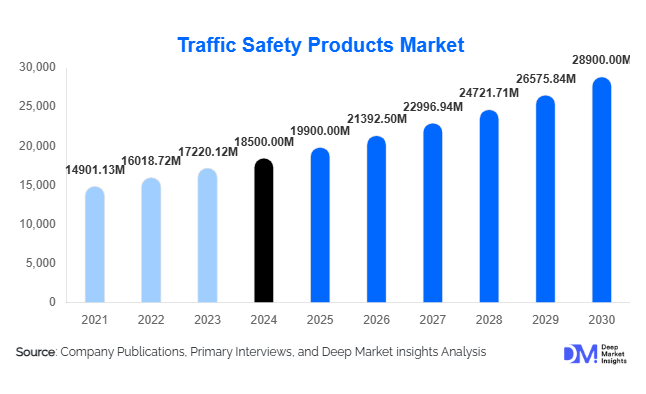

According to Deep Market Insights, the global traffic safety products market size was valued at USD 18,500 million in 2024 and is projected to grow from USD 19,900 million in 2025 to reach USD 28,900 million by 2030, expanding at a CAGR of 7.5% during the forecast period (2025–2030). The growth of the traffic safety products market is primarily driven by rapid urbanization, increasing vehicular traffic, growing investments in road infrastructure, and the adoption of smart traffic management systems globally.

Key Market Insights

- Traffic safety products are increasingly integrating technology, including AI-based traffic signals, IoT-enabled monitoring, and intelligent road safety systems to improve urban mobility and reduce accidents.

- Government initiatives and regulations are driving adoption, with stricter traffic safety compliance mandates in North America, Europe, and Asia-Pacific ensuring steady demand for high-quality safety products.

- Urban infrastructure expansion in APAC and LATAM is creating strong demand for road markings, barriers, and signage, contributing significantly to market growth.

- North America dominates the global market, driven by high public and private spending on advanced traffic safety solutions.

- Europe is a key growth region, led by smart city projects and sustainable road safety programs.

- Technological adoption, such as reflective, weather-resistant materials and integrated traffic management systems, is reshaping industry standards and enhancing product efficiency.

Latest Market Trends

Smart Traffic Management and Connected Solutions

Traffic safety product manufacturers are increasingly offering integrated solutions that include connected traffic signals, vehicle detection sensors, and intelligent monitoring systems. These smart traffic solutions allow real-time data collection and adaptive control, improving road safety and congestion management. Adoption of ITS (Intelligent Transportation Systems) in urban areas is driving growth, particularly in APAC and Europe, where governments aim to modernize road infrastructure while reducing accident rates. Digital dashboards, AI-enabled predictive analytics, and IoT-enabled signage are becoming mainstream offerings, attracting municipalities seeking long-term cost savings and efficiency improvements.

Eco-Friendly and Durable Materials

Manufacturers are focusing on environmentally friendly, long-lasting materials such as recycled plastics, durable thermoplastics, and reflective coatings for signage and road markings. These materials reduce maintenance costs and enhance visibility under various weather conditions. Rising environmental awareness and regulatory pressure are encouraging companies to adopt sustainable production methods, ensuring compliance while increasing product lifespan. This trend is especially prevalent in North America and Europe, where eco-compliant materials are increasingly mandated for government-funded infrastructure projects.

Traffic Safety Products Market Drivers

Rapid Urbanization and Infrastructure Expansion

Increasing urban populations and vehicle ownership rates worldwide are fueling demand for improved traffic safety measures. Governments and private developers are investing in modern road networks, highways, and urban mobility systems, which necessitate the deployment of advanced traffic safety products, including signage, barriers, and speed management devices. Projects such as smart highways and urban redevelopment programs are contributing to robust market growth across both developed and emerging regions.

Government Regulations and Safety Standards

Strict traffic regulations, including mandatory installation of safety signage, pedestrian barriers, and speed control devices, are driving adoption globally. Initiatives such as Vision Zero in Europe and road safety campaigns in India and China aim to reduce traffic fatalities, creating a reliable demand stream for manufacturers of high-quality traffic safety products. Compliance requirements are particularly driving the adoption of standardized, certified products, increasing market penetration.

Technological Advancements

Innovations in reflective coatings, smart signage, speed detection cameras, and crash-absorbing barriers are enhancing the efficacy of traffic safety solutions. These technologies improve road visibility, automate traffic management, and reduce accident rates. Companies investing in R&D to integrate AI, IoT, and durable materials are gaining a competitive edge, particularly in developed markets such as North America and Europe.

Market Restraints

High Installation and Maintenance Costs

Advanced traffic safety products, including smart traffic signals and intelligent monitoring systems, involve significant installation and operational costs. Smaller municipalities and private road developers may face budgetary constraints, limiting the adoption of technologically advanced solutions in certain regions.

Regulatory Compliance Complexity

Variations in traffic safety regulations across countries, combined with frequent updates to standards, create compliance challenges for manufacturers. Navigating multiple regulatory frameworks can increase costs, delay project implementation, and act as a potential growth constraint for new entrants.

Traffic Safety Products Market Opportunities

Intelligent Traffic Systems

The integration of smart traffic management systems presents opportunities to provide comprehensive solutions combining signage, signals, sensors, and connected software. Cities upgrading urban infrastructure are increasingly prioritizing adaptive traffic control, vehicle detection, and real-time monitoring, creating high-margin opportunities for technologically advanced product providers.

Infrastructure Growth in Emerging Economies

Rapid road network expansion in India, China, Brazil, and parts of the Middle East is driving demand for road markings, safety barriers, and pedestrian protection systems. Private and government investments in highway and industrial zone development present an opportunity for both domestic manufacturers and exporters to capture substantial market share.

Regulatory-Driven Demand

Governments worldwide are enforcing stringent traffic safety regulations, including mandatory reflective signage, speed management devices, and pedestrian safety barriers. Compliance-driven demand ensures a steady growth pipeline for manufacturers who can provide certified, durable, and technologically compliant solutions. Long-term contracts with public authorities offer stable revenue streams for established players.

Product Type Insights

Traffic signs continue to dominate the global traffic safety products market, accounting for approximately 25% of the 2024 market share. Regulatory and warning signs are widely adopted across highways, urban roads, and industrial zones due to mandatory government standards and public safety regulations. The growing use of reflective and weather-resistant materials is enhancing visibility and durability, encouraging higher adoption rates. Following closely, road marking products, especially thermoplastics and epoxy coatings, are preferred for long-lasting lane demarcation and pedestrian safety applications.

Segment Driver: The increasing deployment of Intelligent Traffic Systems is driving demand for technologically advanced signage and signals, particularly as cities implement smart city initiatives. Similarly, Barriers and Barricades are seeing strong adoption due to extensive highway expansion and urban infrastructure development projects worldwide.

Application Insights

Highways and expressways are the leading application segment, contributing nearly 40% of the total market in 2024. Growth is fueled by rising traffic volumes, large-scale government investments in smart highway systems, and initiatives targeting accident reduction. Urban roads and pedestrian zones are increasingly adopting advanced safety solutions such as intelligent traffic signals, pedestrian barriers, and automated speed monitoring systems, reflecting a growing focus on urban mobility and road safety.

Segment Driver: Construction zones represent a growing application segment, benefiting from rising global infrastructure spending and the expansion of industrial and urban development projects.

Distribution Channel Insights

Direct sales to government agencies dominate the market due to large-scale procurement for public infrastructure projects. Specialized industrial suppliers and B2B distributors cater to private construction, logistics, and industrial sectors. Online B2B platforms are emerging as secondary channels, providing streamlined procurement for mid-size private projects. Increasing digital adoption enables manufacturers to offer product customization, ensure compliance with regulatory standards, and improve after-sales support.

End-Use Insights

Government and municipal projects remain the primary end-use segment, accounting for roughly 60% of total market demand in 2024. This is largely due to the mandatory implementation of traffic safety standards and ongoing infrastructure upgrades. Private construction, logistics, and industrial applications are growing at a faster rate, driven by expanding road networks, industrial park developments, and heightened safety compliance requirements. Export-driven demand is substantial, with manufacturers in North America and Europe supplying high-quality, durable products to developing markets in APAC and LATAM.

Segment Driver: Government and municipalities lead the market because of policy mandates and urban modernization programs that necessitate comprehensive traffic safety solutions.

| By Product Type | By Application | By End-Use Industry | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America dominates the traffic safety products market with a 30% share in 2024. Growth is underpinned by strong regulatory frameworks, such as the Federal Highway Administration (FHWA) and Occupational Safety and Health Administration (OSHA), along with high public awareness of road safety. The U.S. leads demand for intelligent traffic signals, reflective signage, and advanced road markings, supported by extensive urban and highway networks. Canada contributes steadily, driven by urban redevelopment and highway modernization initiatives.

Regional Drivers: Stringent safety regulations, widespread adoption of smart traffic systems, and high government infrastructure spending are the key factors driving North American growth.

Europe

Europe holds approximately 28% of the market, with Germany, the U.K., and France leading demand for technologically advanced traffic safety products. Growth is fueled by the EU Vision Zero initiative, mandatory adoption of advanced safety standards, and investment in eco-friendly and intelligent traffic solutions. Smart city programs and integration of AI-based traffic management systems are further accelerating adoption across urban zones.

Regional Drivers: The Vision Zero initiative, strict safety compliance mandates, and increasing smart city projects are the main drivers for European market expansion.

Asia-Pacific

APAC is the fastest-growing region, with India, China, and Japan showing rapid market expansion. High urbanization rates, rising vehicle ownership, and massive government investments in highway and urban mega road projects are driving demand for traffic safety products, including intelligent signage, barriers, and road marking systems. The region’s market growth is further supported by industrialization and the modernization of urban traffic infrastructure.

Regional Drivers: Rapid urbanization, rising vehicle ownership, and government-led infrastructure projects are the key catalysts boosting market demand in APAC.

Latin America

Brazil, Mexico, and Argentina are the largest contributors in LATAM. Growth is being fueled by ongoing urban infrastructure development, highway modernization projects, and international funding to improve road safety standards. Road marking products, pedestrian safety devices, and traffic signage are increasingly adopted across urban and highway networks.

Regional Drivers: Increasing infrastructure spending, international funding for road safety, and modernization of urban transport systems are driving market growth.

Middle East & Africa

The Middle East, led by the UAE and Saudi Arabia, is witnessing growing demand for highway safety and urban traffic management systems. Africa’s market is concentrated in South Africa, Kenya, and Nigeria, supported by urban expansion and aid programs focused on road safety improvements. Mega urban development projects such as Saudi Vision 2030 and UAE smart city initiatives are driving infrastructure investments.

Regional Drivers: Mega urban development initiatives, rising traffic volumes in expanding urban hubs, and investment in smart city infrastructure are fueling market growth across the Middle East & Africa.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Traffic Safety Products Market

- 3M Company

- Hella GmbH & Co. KGaA

- Transpo Industries Inc.

- Wanco Inc.

- Traffic Technology Services Ltd.

- Seton

- Valmont Industries

- Harris Company

- VPG Traffic Systems

- Wirtgen Group

- Hexagon AB

- Roadsafe Traffic Systems

- Dynniq

- Contech Engineered Solutions

- TEC Traffic & Parking Control Co.

Recent Developments

- In March 2025, 3M Company launched a new line of reflective, eco-friendly road signs for U.S. highways, reducing maintenance costs and improving visibility.

- In January 2025, Hella GmbH & Co. KGaA introduced AI-enabled traffic signal systems in Europe to optimize congestion management.

- In February 2025, Transpo Industries Inc. expanded its crash barrier production facility in Canada to meet growing North American highway safety demand.