Traditional Armchairs Market Size

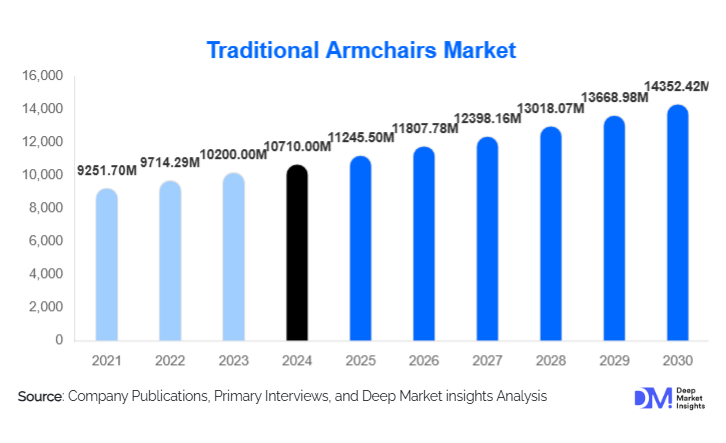

According to Deep Market Insights, the global traditional armchairs market size was valued at USD 10,710 million in 2024 and is projected to grow from USD 11,245.50 million in 2025 to reach USD 14,352.42 million by 2030 (or by 2033, depending on the forecasting horizon), expanding at a CAGR of 5.0% during the forecast period (2025–2030). The growth is underpinned by renewed interest in heritage and classic décor, rising demand in premium residential and hospitality sectors, and increasing adoption of customization and sustainable design in furniture markets.

Key Market Insights

- Wooden frames coupled with leather or premium upholstery dominate the product mix, as they deliver both aesthetic prestige and durable performance in traditional armchair styles.

- Residential remains the largest end-use segment, though commercial and hospitality demand is growing faster due to renovation and luxury interiors projects.

- Asia-Pacific is emerging as one of the fastest-growing regional markets, driven by rising disposable incomes, urbanization, and design consciousness in China, India, and Southeast Asia.

- North America and Europe still claim major shares in value terms, due to mature consumer markets and high per-unit prices of premium traditional furniture.

- Customization, direct-to-consumer sales, and omnichannel distribution are reshaping industry competition, cutting middlemen and enhancing customer engagement.

- Sustainability credentials (e.g., certified wood, low-VOC finishes) are gaining traction as differentiators in premium furniture segments.

Latest Market Trends

Resurgence of Heritage & Transitional Design

In recent years, interior design trends have shifted back toward classical, vintage, and transitional styles. Many consumers now prefer furniture pieces that convey character and timeless elegance rather than ultra-minimalist forms. Thus, traditional armchair swingback, tufted, rolled arms, and carved wood have found renewed interest in modern settings when blended with neutral palettes or simpler silhouettes. Some manufacturers are launching “heritage revival” lines, where classic motifs are reinterpreted with lighter finishes or modular design to suit contemporary homes.

Rise of Customization & Digital Visualization

Furniture brands are increasingly offering customization optionschoice of upholstery, finishes, and dimensions, to cater to discerning consumers who want designs that match their interiors. To support this, digital tools such as AR/VR room visualization, 3D previews, and online configurators are being integrated into sales platforms. This helps reduce uncertainty in buying large furniture and reduces return rates, especially in high-end segments.

Traditional Armchairs Market Drivers

Increasing Discretionary Spending & Design Aesthetics

As disposable incomes rise globallyespecially in Asia and Latin Americaconsumers are investing more in home décor and premium furniture. A growing middle and upper middle class is willing to pay for style, craftsmanship, and durable, meaningful pieces rather than mass-produced, cheap furniture. The emphasis on curated interior design and “living spaces that tell a story” boosts demand for traditional armchairs that combine comfort and aesthetics.

Growth in Hospitality, Luxury Real Estate & Renovation Projects

Luxury hotels, boutique resorts, heritage property restorations, and high-end commercial interiors are incorporating traditional furniture to evoke elegance and timeless appeal. These sectors often procure in bulk and with design specifications. The steady investment in real estate renovations and hospitality expansions in emerging marketsespecially in Asia, the Middle East, and Latin Americaacts as a strong tailwind for premium traditional armchairs.

Focus on Sustainability & Eco-Friendly Certifications

Consumers and regulators alike are demanding more sustainable and environmentally friendly furniture options. In response, manufacturers are adopting certified wood (e.g., FSC, PEFC), using reclaimed materials, low-VOC finishes, and ethical leather sources. This “green branding” not only appeals to eco-conscious buyers but also serves as a barrier to entry for less compliant manufacturers.

Market Restraints

Volatility in Raw Materials and Labor Costs

The cost and availability of premium hardwoods, exotic woods, natural leather, and quality upholstery fabrics are subject to global supply chain disruptions, trade policies, and environmental restrictions. Labor cost pressures, especially for skilled craftsmanship, further squeeze margins. Many mid-tier manufacturers struggle to preserve profitability without passing costs to the end consumer.

Competition from Contemporary & Modular Furniture Alternatives

Minimalist, modular, ready-to-assemble (RTA) furniture appeals strongly to younger buyers, small-space dwellers, and cost-sensitive segments. These alternatives are easier to ship and assemble, often cheaper, and sometimes perceived as more modern. This creates headwinds for ornate, heavy, traditional armchairs, especially in urban apartments with limited space.

Traditional Armchairs Market Opportunities

Growth in Emerging Markets & Regional Penetration

Many regionssuch as India, Southeast Asia, Latin America, and Africaare still underpenetrated in premium traditional furniture. Rapid urbanization, rising incomes, and a growing interest in interior design in second/third-tier cities offer room for expansion. A strategic presence (local manufacturing, regional distribution, partnerships) can unlock new demand pools.

Customization & Bespoke Heritage Collections

Offering tailor-made armchairs where customers choose upholstery, finish, arm style, cushions, and proportion is a powerful differentiator. Heritage lines or limited-edition collections with artisanal craftsmanship generate brand prestige and higher margins. Furniture firms that can combine efficient production with customization will capture loyal, high-value customers.

Integration with Hospitality & Government Projects

Supplying large-scale orders to boutique hotels, resorts, heritage restoration projects, museums, and government guest houses can yield steady volume and branding benefits. Winning contracts in public infrastructure or cultural heritage refurbishments (where traditional style is preferred) offers high-value, long-term opportunities for established players.

Product Type Insights

Within the traditional armchairs universe, wood-frame + premium upholstery (leather, rich fabrics) commands the largest share, particularly in the premium bracket. These models offer durability, a luxury feel, and design versatility. Mid-range offerings using wood + fabric are also substantial, targeting the broader decorative furniture segment. Simpler or mixed-material designs (wood + metal accents, engineered wood) are used for cost control and appeal in transitional lines. As digital customization proliferates, sales of bespoke models (custom finishes, size variants) are growing disproportionately compared to standard SKUs.

Application Insights

Residential remains the core application, accounting for the majority of volume and value, especially in living rooms, studies, reading nooks, and lounges. Commercial / Hospitality is growing fastest: luxury hotels, boutique lodgings, corporate lobbies, and restaurants increasingly opt for designer traditional armchairs to evoke prestige. Institutional / Heritage use (museums, restoration projects, government guest houses) is a niche but high-value segment that emphasizes authentic style and craftsmanship. As tourism and cultural renovation projects expand, this institutional demand is expected to climb.

Distribution Channel Insights

Traditionally, offline channels (specialty furniture showrooms, artisan galleries, premium retail stores) dominate the high-end traditional armchair sales, because customers prefer to physically touch, evaluate craftsmanship, and see finishes in person. However, online sales are growing fast, and brands offering AR/VR previews, customization configurators, and white-glove delivery (with installation) are gaining traction. Hybrid omnichannel models, one showroom plus digital ordering becoming the norm. Direct-to-consumer (D2C) brands are also emerging in premium segments, cutting retailer margins and forging stronger customer relationships.

| By Product Type | By Application | By Distribution Channel | By Material Type | By Price Range |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific is among the fastest-growing and highest-potential markets. In 2024, APAC may already command 35–40% of global revenue. China leads (urban affluence, design adoption), followed by India (rapid housing growth) and Southeast Asia (Vietnam, Indonesia, Thailand). If APAC holds a 38% share, that is USD 4.1 billion in 2024. Growth is expected at 5.5%–6.0% CAGR, outpacing mature regions. Local manufacturing hubs are also developing (Vietnam, Malaysia, India) to cater to regional and export demand.

Europe

Europe holds a strong share (25–30%) of the market by value. Countries like Italy, Germany, Spain, the UK, and France are not only consumption markets but also global manufacturing and export hubs. In 2024, Europe’s share (28%) corresponds to USD 3.0 billion. Growth is more modest (3–4% annually), but the region remains critical in style leadership, craftsmanship, premium brands, and exports into other geographies.

North America

North America (primarily the U.S. and Canada) commands a 20–25% share (USD 2.5–2.8 billion in 2024). The U.S. consumer’s appetite for heritage décor, renovation activity, and steady disposable incomes sustains demand. Growth is moderate (4–5%) given market maturity, but premium and custom segments still see solid innovation.

Latin America

Latin America accounts for 5–7% (USD 0.6 billion) of global revenue. Brazil and Mexico dominate consumption. Growth is more volatile due to economic fluctuations and import barriers, but rising urbanization and expanding design awareness in upper-class segments provide upside.

Middle East & Africa (MEA)

MEA contributes 5–8% (USD 0.5–0.8 billion) of traditional armchair value. Gulf Cooperation Council (GCC) nations (UAE, Saudi Arabia, Qatar) undertake many luxury interior and hospitality projects, often importing premium furniture. Africa’s domestic demand is nascent but growing in upscale residential and boutique hospitality sectors. Growth rates in GCC may reach 6%+ given wealth and refurbishment cycles.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Traditional Armchairs Market

- Alberta

- B&B Italia

- Artifort

- Sancal

- Dante

- Interprofil

- Jess Design

- Koinor

- Alf Uno

- Mikabarr

- IKEA

- Ashley Furniture Industries

- La-Z-Boy

- Natuzzi

- Restoration Hardware

Recent Developments

- In 2025, several established European manufacturers announced expansion of their bespoke heritage lines into Asia, targeting premium buyers in China and India.

- In early 2025, a major U.S. furniture brand launched an AR/VR configurator allowing customers to visualize traditional armchairs in their rooms before purchasing, reducing returns and boosting consumer confidence.

- In late 2024, a premium brand introduced a sustainability-certified traditional armchair line using FSC timber and eco-leather, promoting it aggressively in the EU and North America as a “green luxury” option.