Toupee Market Size

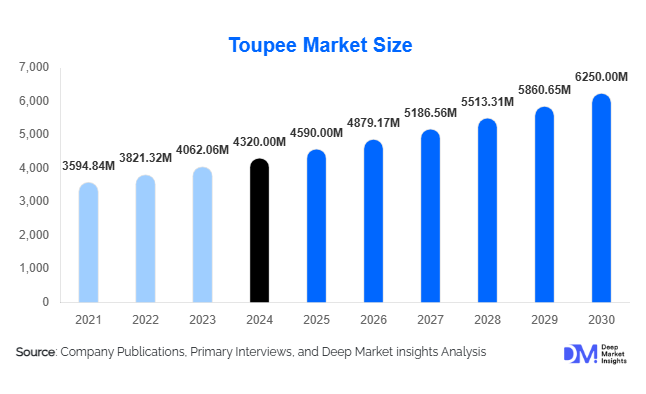

According to Deep Market Insights, the global toupee market size was valued at USD 4,320 million in 2024 and is projected to grow from USD 4,590 million in 2025 to reach USD 6,250 million by 2030, expanding at a CAGR of 6.3% during the forecast period (2025–2030). The growth of the toupee market is primarily driven by increasing incidences of hair loss, rising consumer awareness of hair replacement solutions, technological innovations in toupee design, and the expansion of online and direct-to-consumer distribution channels globally.

Key Market Insights

- Human hair toupees dominate the market due to their natural look, longevity, and customization options, accounting for approximately 55% of the 2024 market.

- Synthetic toupees are gaining traction in emerging markets like Asia-Pacific and Latin America due to affordability and easy maintenance, representing roughly 30% of the market.

- E-commerce is a rapidly growing distribution channel, capturing around 25% of sales in 2024, driven by virtual try-on tools and direct-to-consumer convenience.

- Male consumers represent the largest end-use segment, comprising nearly 65% of the market, although female adoption is growing at a faster CAGR of 7%.

- North America and Europe collectively hold 65% of the market share, with the U.S. and Germany as the largest contributors in their respective regions.

- Asia-Pacific is the fastest-growing region, driven by rising disposable income, urbanization, and increased awareness of grooming solutions.

Latest Market Trends

Technological Advancements in Toupees

Innovations such as 3D scalp mapping, AI-assisted fitting, lightweight lace bases, and breathable cap designs are improving comfort, realism, and user satisfaction. These technologies are enabling highly personalized hair replacement solutions, boosting repeat purchases and premium product adoption. Additionally, advanced synthetic fibers are mimicking natural hair appearance, allowing cost-effective alternatives to human hair toupees.

Rising Awareness and Social Influence

Influence from social media, celebrity endorsements, and online tutorials is increasing consumer awareness about hair replacement options. Younger demographics and urban populations are increasingly accepting toupees for fashion, lifestyle, and professional purposes. The normalization of toupee use in media and entertainment has further reduced stigma, expanding market penetration.

Toupee Market Drivers

Increasing Incidence of Hair Loss

The rising prevalence of androgenetic alopecia, chemotherapy-induced hair loss, and stress-related hair thinning is driving demand globally. Male pattern baldness is a dominant factor, but female hair loss is emerging as a critical growth segment, encouraging innovative product development and personalized solutions.

Technological Innovation and Customization

Advanced human hair and synthetic toupees with customizable fit, color matching, and comfort-focused designs are driving adoption. Features such as invisible knots, breathable bases, and natural texture replication improve user experience, allowing companies to charge premium prices and enhance brand loyalty.

Influence of Media and Celebrity Endorsements

Celebrity-driven fashion trends and online influencer campaigns are shaping consumer preferences. Educational content about styling, maintenance, and application of toupees is increasing engagement and broadening acceptance among diverse age groups.

Market Restraints

High Costs of Premium Products

Human hair toupees, while highly realistic, are expensive and can deter price-sensitive consumers in emerging markets. This limits widespread adoption despite growing awareness and demand.

Maintenance and Durability Challenges

Synthetic toupees may degrade faster, and human hair toupees require regular maintenance. Limited after-sales support in some regions further restricts consumer adoption, creating a potential barrier for market expansion.

Toupee Market Opportunities

Technological Integration and Personalization

Companies can leverage AI, 3D scanning, and virtual try-on technology to deliver highly customized solutions. This innovation enhances consumer confidence, encourages premium purchases, and allows new entrants to differentiate themselves from existing players.

Expansion into Emerging Markets

Regions like India, China, and Brazil are witnessing rising urban populations, disposable incomes, and growing social acceptance of grooming products. Market participants can capture untapped demand through e-commerce, localized marketing, and affordable synthetic variants.

Export-Oriented Growth

Established producers in China, India, and the U.S. can target high-demand markets in North America and Europe. By aligning production with international quality standards and leveraging global trade networks, companies can expand their global footprint and maximize profitability.

Product Type Insights

Human hair toupees continue to lead the market, accounting for approximately 55% of global sales in 2024. Their superior realism, natural appearance, and customization options make them highly preferred among professionals and older adults seeking discreet, long-lasting solutions. Synthetic toupees, on the other hand, are gaining traction in emerging regions due to their affordability, low maintenance, and ease of styling. Blended hair toupees provide a middle ground for consumers who desire a natural look at a relatively lower cost. The human hair segment growth is primarily driven by increased adoption in professional and fashion settings, whereas synthetic toupees benefit from online retail proliferation and younger, cost-conscious demographics.

Application Insights

The male segment dominates the market at 65%, largely due to the prevalence of androgenetic alopecia and growing awareness of male grooming trends. The aging male population and rising desire for aesthetic maintenance further fuel demand. Female consumers, while representing a smaller share, are growing rapidly at a 7% CAGR as more women participate in professional and public domains, where appearance plays a pivotal role. Fashion, media influence, and healthcare applications—particularly chemotherapy-induced hair loss—contribute significantly to overall adoption. Customized solutions for actors, models, and social media influencers are expanding niche applications, adding a premium, lifestyle-driven dimension to market demand.

Distribution Channel Insights

E-commerce platforms account for roughly 25% of sales globally, driven by convenience, privacy, wider product selection, and access to international brands. Traditional retail channels continue to hold importance in mature markets, offering hands-on fitting and styling assistance. Specialty salons and medical clinics contribute to healthcare-focused demand, particularly for medically prescribed toupees. Online channels are the fastest-growing segment, supported by virtual try-on technologies and personalized fitting solutions, which make them particularly appealing to younger, tech-savvy consumers in APAC and North America.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America represents approximately 35% of the global market, with the U.S. as the dominant contributor. High awareness of cosmetic solutions, a strong presence of specialized hair clinics, and widespread adoption of premium human hair toupees drive the region's growth. Additionally, e-commerce penetration, influencer-led marketing, and social media exposure encourage younger consumers to experiment with both synthetic and human hair toupees. Rising male grooming trends and increasing disposable income further reinforce the demand for high-quality, realistic hair replacement products.

Europe

Europe holds around 30% market share, led by Germany, the UK, and France. The region benefits from a strong fashion-conscious population and a growing preference for innovative synthetic and human hair toupees. High awareness of aesthetic grooming, coupled with healthcare applications for alopecia and chemotherapy patients, drives sustained adoption. Premium product offerings and advanced retail infrastructure, including specialty salons and online customization services, reinforce market penetration. Synthetic toupees are increasingly popular among younger consumers seeking affordable yet stylish alternatives, complementing the growth of the human hair segment.

Asia-Pacific

Asia-Pacific is the fastest-growing region, exhibiting a CAGR of 8%. Key drivers include a growing middle-class population, rapid urbanization, and rising disposable incomes in countries such as China, India, and Japan. Increasing penetration of online retail platforms allows consumers easy access to global brands, promoting both synthetic and blended toupee adoption. Young, fashion-conscious populations in urban centers are fueling demand for cost-effective, easy-to-maintain solutions. Human hair toupees are also gaining ground in professional and media-focused applications, adding to the region’s overall growth momentum.

Middle East & Africa

The Middle East & Africa together account for approximately 10% of the market. The region’s growth is driven by cultural emphasis on personal appearance and grooming, particularly in premium urban markets like the UAE, Saudi Arabia, and South Africa. High-income consumers increasingly prefer realistic human hair toupees, while fashion-driven younger demographics adopt synthetic and blended options. Intra-regional tourism and cross-border trade further contribute to market expansion. Premiumization trends, combined with social media influence, are boosting demand for luxury hair replacement solutions in both metropolitan and affluent suburban areas.

Latin America

Latin America holds about 5% of the global market, with Brazil as the primary contributor. Rapid adoption of beauty and grooming products, particularly among younger demographics, is fueling synthetic and blended toupee sales. Increasing awareness of cosmetic and fashion trends, coupled with the expansion of e-commerce channels, supports wider market reach. Premium human hair toupees are also gaining limited traction among professionals and affluent consumers in urban centers, indicating potential for long-term growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Toupee Market

- Aderans Co., Ltd.

- HairUWear

- Lordhair

- Jon Renau

- Gisela Mayer

- Rene of Paris

- Great Lengths

- Ellen Wille

- Raquel Welch

- Hairdreams

- Vivica Fox Hair Collection

- Malouf

- Shapiro MD

- Hairlocs

- HairWorld Co.

Recent Developments

- In March 2025, Jon Renau launched a new AI-assisted custom toupee fitting service, enhancing personalization for global consumers.

- In February 2025, Lordhair expanded its e-commerce platform, offering virtual try-on features and global shipping options.

- In January 2025, Aderans Co., Ltd. introduced lightweight, breathable human hair toupees targeting male consumers in North America and Europe.