Tool Belts Market Size

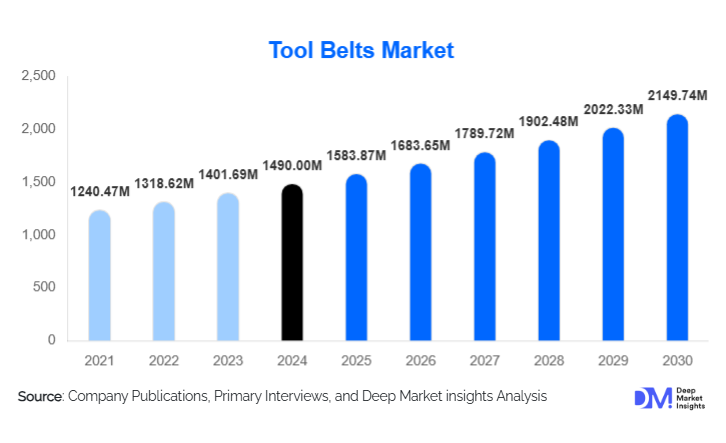

According to Deep Market Insights, the global tool belts market size was valued at USD 1,490 million in 2024 and is projected to grow from USD 1,583.87 million in 2025 to reach USD 2,149.74 million by 2030, expanding at a CAGR of 6.3% during the forecast period (2025–2030). The tool belts market growth is primarily driven by the expanding construction and home improvement sectors, increasing DIY culture, and growing demand for ergonomic, durable, and multipurpose tool-carrying solutions among professionals and hobbyists.

Key Market Insights

- Rising adoption of ergonomic and lightweight designs is enhancing worker comfort and reducing fatigue during long hours of tool use.

- Leather and canvas tool belts remain dominant materials, favored for durability and strength, while synthetic and hybrid variants gain traction for improved flexibility.

- North America leads the global market, driven by robust construction activity and a well-established DIY culture.

- Asia-Pacific is the fastest-growing region, supported by rapid industrialization and expanding residential construction in China and India.

- Technological innovations, such as modular and magnetic tool-holding systems, are reshaping product design and usability.

- E-commerce platforms are increasingly critical distribution channels, offering wide product accessibility and consumer reviews that influence purchase behavior.

What are the latest trends in the tool belts market?

Integration of Ergonomic and Smart Design Features

Manufacturers are focusing on designing tool belts with advanced ergonomics to reduce strain and improve worker efficiency. Padded waist supports, adjustable straps, and balanced weight distribution are becoming standard. Additionally, smart tool belts with RFID tags and modular attachments are emerging, allowing professionals to track tools digitally and customize layouts for specific tasks. These innovations align with growing workplace safety standards and the demand for efficiency-enhancing accessories in professional settings.

Rising Demand for Sustainable and Eco-Friendly Materials

The market is witnessing a shift toward sustainable materials, including recycled fabrics, plant-based leather alternatives, and biodegradable components. Leading manufacturers are adopting eco-friendly production methods to minimize carbon footprints and appeal to environmentally conscious consumers. This trend is particularly visible among European brands emphasizing circular economy principles and long product lifespans. The use of water-based dyes, ethical leather sourcing, and minimal packaging are also gaining prominence in premium product lines.

What are the key drivers in the tool belts market?

Growth in Construction and Infrastructure Development

Rapid infrastructure development across emerging economies and the ongoing boom in residential and commercial construction projects are fueling demand for tool belts. Professionals in carpentry, electrical work, and plumbing increasingly rely on ergonomic belts for mobility and efficiency. Governments’ focus on large-scale infrastructure programs in Asia-Pacific and the Middle East further accelerates product demand in industrial and civil engineering applications.

Expansion of the DIY and Home Improvement Sector

The rise of home renovation and DIY activities, especially in North America and Europe, is a major contributor to tool belt sales. Consumers increasingly invest in personal tool sets and accessories, with tool belts serving as essential components for organization and convenience. Online tutorials, home improvement media, and influencer marketing are amplifying this trend, encouraging product adoption among hobbyists and part-time craftsmen.

What are the restraints for the global market?

Price Sensitivity and Availability of Low-Cost Alternatives

High-quality leather and specialized ergonomic tool belts often carry premium price tags, which can deter price-sensitive customers. The widespread availability of low-cost, imported alternatives, especially from local and unorganized players, creates pricing pressure on established brands. These lower-cost products may lack durability, impacting overall market profitability and brand loyalty among professional users.

Fluctuations in Raw Material Prices

Volatility in the prices of leather, textiles, and synthetic polymers affects production costs and profit margins. Supply chain disruptions and increasing transportation expenses have further compounded these challenges post-pandemic. Manufacturers are adopting flexible sourcing strategies and regional material procurement to mitigate risks associated with price fluctuations.

What are the key opportunities in the tool belts industry?

Customization and Modular Product Development

There is a growing opportunity for manufacturers to offer customizable tool belts that cater to specific professional needs. Modular tool pouches, detachable compartments, and adjustable loops allow users to personalize their gear based on trade type and task requirements. These features appeal to both professionals seeking efficiency and consumers valuing flexibility in DIY applications.

Digitalization and Smart Integration

Integration of smart sensors, RFID tracking, and IoT-enabled devices within tool belts is emerging as a future opportunity. Such innovations enable real-time tool tracking and inventory management, reducing losses and improving worksite productivity. Smart tool belt systems are expected to find strong adoption in industrial environments and large-scale construction projects, emphasizing digital transformation and operational efficiency.

Material Type Insights

Leather tool belts continue to dominate the global market due to their durability, aesthetics, and strength, particularly favored by professional tradesmen. Canvas and nylon tool belts are gaining market share for being lightweight and weather-resistant, making them suitable for outdoor and high-mobility tasks. Hybrid tool belts combining leather reinforcements with synthetic materials are emerging as a preferred choice for users seeking durability without added weight.

End-User Insights

The construction sector remains the largest end-user, followed by electrical and mechanical services, where tool organization is essential for operational efficiency. The DIY and home improvement segment is witnessing the fastest growth, supported by expanding consumer engagement in renovation projects and accessible online retail platforms. Industrial and maintenance professionals represent a stable market segment, valuing high-performance and safety-oriented tool belts.

Distribution Channel Insights

Offline retail channels, including hardware stores and specialty outlets, continue to account for a major share of sales due to hands-on product evaluation. However, online platforms are rapidly gaining momentum, offering wide product selections, reviews, and discounts. Direct-to-consumer (D2C) strategies adopted by leading brands are enabling better consumer engagement, product customization, and brand loyalty through personalized shopping experiences.

| By Material Type | By End User | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America dominates the global tool belts market, driven by a strong DIY culture, robust home improvement spending, and the presence of established tool manufacturers in the U.S. and Canada. High professional adoption rates and the prevalence of safety regulations further reinforce market leadership. The growing trend of home-based workshops and e-commerce-based tool accessory sales also supports regional growth.

Europe

Europe represents a mature market characterized by strong demand for eco-friendly materials and premium craftsmanship. Countries such as Germany, the U.K., and France are focusing on sustainability and ergonomic product innovations. The rise of small-scale woodworking and artisan trades in Western Europe also supports niche demand for customized, high-quality tool belts.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, driven by urbanization, booming construction sectors, and expanding manufacturing bases in China, India, and Southeast Asia. Local production facilities and cost-effective labor are strengthening the regional supply chain. Increasing adoption of Western-style DIY culture and improved retail access are fueling consumer-level growth in the region.

Latin America

Growth in Latin America is moderate but accelerating, supported by residential construction projects and government infrastructure investments in Brazil and Mexico. Expanding awareness of tool organization efficiency and the entry of international brands are contributing to demand expansion, particularly among professional users.

Middle East & Africa

Infrastructure development and large-scale construction projects across the UAE, Saudi Arabia, and South Africa are boosting tool belt demand in the region. The growing number of skilled laborers and industrial technicians in these countries presents long-term growth opportunities for both local and international tool belt manufacturers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Tool Belts Market

- DeWalt

- Milwaukee Tool

- Occidental Leather

- CLC Custom LeatherCraft

- Makita Corporation

- Bucket Boss

- Stanley Black & Decker

Recent Developments

- In June 2025, DeWalt introduced its new line of ergonomic tool belts featuring modular pouch attachments and lightweight materials designed for high mobility.

- In March 2025, Milwaukee Tool launched a smart tool storage ecosystem integrating RFID-enabled tool tracking to enhance worksite organization.

- In January 2025, Occidental Leather announced a new eco-leather series made from sustainably sourced hides and low-impact tanning processes, catering to environmentally conscious professionals.