Toddler Wear Market Size

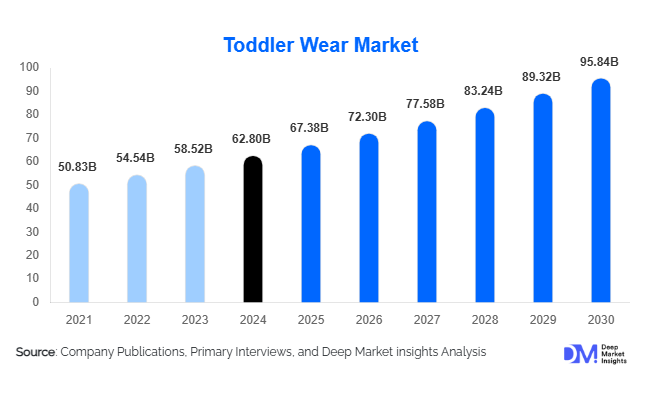

According to Deep Market Insights, the global toddler wear market size was valued at USD 62.8 billion in 2024 and is projected to increase from USD 67.38 billion in 2025 to reach USD 95.84 billion by 2030, expanding at a CAGR of 7.3% during the forecast period (2025–2030). The toddler wear market growth is driven by rising global birth rates in emerging economies, the premiumization of children’s apparel, increasing e-commerce penetration, and a shift toward sustainable, organic fabrics and digitally personalized clothing.

Key Market Insights

- Rapid premiumization in toddler apparel as millennial and Gen Z parents who increasingly prefer branded, organic, and ethically produced clothing.

- E-commerce commands over 38% of global toddler wear sales, driven by mobile-first shopping and influencer-led marketing.

- North America leads the global toddler wear market with high spending per child and strong demand for premium and designer toddler apparel.

- Asia-Pacific is the fastest-growing region, supported by rising disposable income, urbanization, and the expansion of organized retail.

- Technological integration, AI sizing tools, AR trial rooms, and customized print-on-demand toddler wear are transforming the global competitive landscape.

What are the latest trends in the toddler wear market?

Sustainability & Certified Fabrics Taking Center Stage

Parents and caregivers are increasingly prioritizing toddler apparel made from organic, low-chemical, and recycled fabrics. This shift is driven by concerns around skin sensitivity, long-term health effects of textile chemicals, and broader environmental awareness. Brands are responding with GOTS- and OEKO-TEX-certified lines, recycled polyester blends, and traceable supply-chain communications. Retailers that clearly label fabric provenance and certification are seeing higher conversion and repeat purchase rates, while brands that invest in circular models (resale, rental, take-back) are reducing inventory waste and building loyalty among eco-conscious shoppers.

Digital-First Shopping, Personalization & AR/AI Tools

The toddler wear segment is rapidly migrating online, where personalization and convenience drive sales. AI sizing tools, virtual try-ons (AR), and improved size guides are helping reduce returns and boost customer confidence. Subscription boxes and curated capsule wardrobes for toddlers are gaining traction, meeting parents’ needs for convenience and discovery. Social commerce (shoppable video and influencer collaborations) is accelerating trend adoption and shortening the product discovery-to-purchase cycle for toddler apparel.

What are the key drivers in the toddler wear market?

Premiumization & Higher Per-Child Spend

Household willingness to spend more per child on safer, better-designed, and longer-lasting clothing is a core driver. Millennial and Gen Z parents often treat toddler clothing as both functional and a form of self-expression, favoring premium basics, character/licensed apparel, and designer capsule collections. This willingness to pay supports growth in mid-to-premium price tiers and fuels demand for value-added features such as stain resistance, temperature regulation, and organic materials.

E-commerce Penetration & Omni-Channel Fulfilment

Rapid growth in online marketplaces, improved last-mile logistics, and flexible return policies have made purchasing toddler wear online far more attractive. Digital native brands and established retailers investing in omnichannel fulfilment (click & collect, curbside pickup, fast returns) are capturing a growing share of purchases that were historically made in brick-and-mortar stores.

What are the restraints for the global market?

Raw Material & Supply-Chain Volatility

Price swings in cotton, disruptions in polyester feedstocks, and rising freight costs increase manufacturing unpredictability and compress margins, particularly for small and mid-sized producers. Sourcing certified organic fibers also raises input costs and often requires longer lead times, creating supply-side pressure when demand spikes seasonally.

Price Sensitivity & Second-Hand Competition

While premium segments expand, a large portion of global demand remains highly price sensitive. The growing second-hand and resale market for children’s clothes (where rapid out-growth makes pre-loved clothing attractive) puts pricing pressure on new clothing volumes, especially in cost-conscious regions. Informal local manufacturers in emerging markets also sustain a lower-price alternative that mainstream brands must contend with.

What are the key opportunities in the toddler wear industry?

Subscription & Circular Business Models

Given how quickly toddlers outgrow clothing, rental and subscription models present a compelling value proposition: parents access high-quality or premium clothing at a fraction of replacement cost, and brands gain recurring revenue and customer data. Operators who can execute logistics and garment hygiene at scale stand to capture both sustainability-minded shoppers and cost-conscious families seeking better value.

Technical & Functional Apparel for Toddlers

There is growing demand for toddler wear with functional benefits, UV-protective swimwear, temperature-regulating fabrics, anti-stain coatings, and adaptive clothing for children with sensory needs. These specialized categories command premium pricing and open routes into healthcare/education partnerships and institutional procurement (early childhood centers, pediatric clinics).

Product Type Insights

Everyday apparel (tops, t-shirts, leggings/shorts) accounts for the majority of volume because of the high replacement frequency in toddler wardrobes. Sleepwear and outerwear represent important seasonal contributors; sleepwear demands stringent safety & flammability compliance, while footwear and accessories are smaller but growing segments as parents purchase coordinated outfits. Premium and organic product lines are expanding faster than mass-market basics, reflecting parents’ willingness to invest in durability and safety.

Application Insights

Toddler wear is primarily purchased for daily home/school use, but demand for occasion wear (festive, party, and formal mini-suits/dresses) is rising in markets with growing disposable income. Functional applications (UV-protective and thermal clothing) are becoming mainstream in regions with high sun exposure or seasonal extremes. Additionally, adaptive clothing for toddlers with special needs is a small but fast-growing niche attracting product innovation and specialized distribution partners.

Distribution Channel Insights

Online marketplaces, brand D2C sites, and social commerce channels have become dominant distribution routes, enabling a wide assortment, dynamic pricing, and data-driven personalization. Specialty children’s stores and department stores remain important for touch-and-feel purchases (safety, fit). Subscription boxes, rental platforms, and resale marketplaces are emerging channels that alter lifetime value and acquisition strategies for brands.

Buyer Type Insights

Primary buyers are parents and caregivers, especially urban millennials and Gen Z parents who prioritize style, safety, and convenience. Institutional buyers (daycare centers, preschools) and gifting purchasers (relatives buying occasion wear) also represent stable demand pockets. Retailers and e-commerce platforms increasingly segment offerings by buyer persona, value shoppers, eco-conscious buyers, and premium seekers, to tailor assortment and pricing.

Age Group Insights

Toddler wear caters primarily to ages 12–36 months (with some lines extending to 48 months). Within fashion marketing, parents of 12–24-month-olds buy more basic, high-frequency items; 24–36-month buyers trend toward more style and occasion purchases. Rapid size turnover in the 12–36 month window increases purchase frequency compared with older children’s apparel.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America is a major market driven by high spending per child, emphasis on safety/certification, and widespread adoption of premium and organic toddler wear. The U.S. leads in per-capita spend, strong brand presence, and mature e-commerce penetration.

Europe

Western Europe (the U.K., Germany, France, Scandinavia) places strong emphasis on sustainability and certifications. Parents there commonly seek organic and eco-labelled toddler clothing and are receptive to higher price points for verified environmental and safety credentials.

Asia-Pacific

Asia-Pacific (China, India, Southeast Asia) is the fastest-growing region. Large population bases, rising disposable incomes, urbanization, and rapid e-commerce adoption are driving both volume and value growth. China shows premiumization trends; India and Southeast Asia are expanding organized retail and digital D2C penetration.

Latin America

Growth in Brazil and Mexico is supported by expanding e-commerce and urban retail, but price sensitivity remains higher than in North America and Europe. Opportunity exists in mid-tier branded apparel and coordinated online experiences.

Middle East & Africa

The GCC countries show demand for premium and designer toddler wear, while parts of Africa are emerging markets for volume growth as organized retail and e-commerce expand. Infrastructure and import-cost challenges persist in some markets.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|