Tick Repellent Market Size

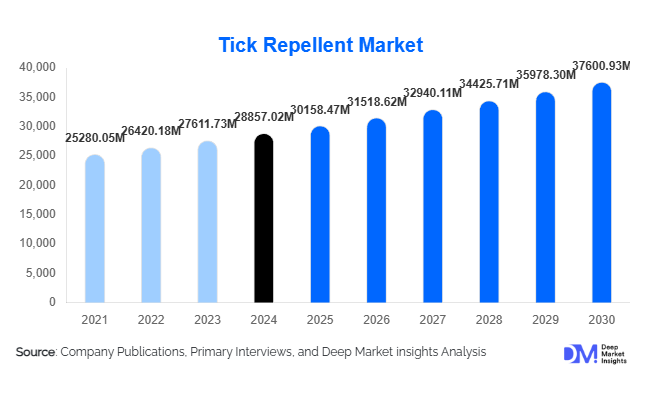

According to Deep Market Insights, the global tick repellent market size was valued at USD 28,857.02 million in 2024 and is projected to grow from USD 30,158.47 million in 2025 to reach USD 37,600.93 million by 2030, expanding at a CAGR of 4.51% during the forecast period (2025–2030). The growth of the tick-repellent market is primarily driven by increasing pet ownership and humanisation of pets, rising awareness of tick-borne diseases, and product innovations in delivery formats and natural/eco-friendly formulations.

Key Market Insights

- Pet ownership growth and preventive animal-health trends are fuelling demand, with more pet owners investing in tick-repellent solutions for dogs and cats as part of regular veterinary care.

- Spot-on topical treatments remain the dominant product format, due to their ease of use, strong adoption in veterinary channels, and familiarity among pet owners.

- North America dominates the market, accounting for roughly 35-45% of global revenue in 2024, supported by high pet-care spending and awareness of tick-borne conditions.

- Asia-Pacific is emerging as the fastest-growing region, driven by rising pet penetration, improved veterinary infrastructure, and increased awareness of outdoor/tick-risks in countries such as India and China.

- Distribution channel transformation is underway, with increasing online direct-to-consumer (D2C) sales, e-commerce subscriptions, and digital marketing reshaping how tick-repellent products reach end-users.

- Innovative formulations and natural/eco-friendly claims, such as botanical actives, chewables/oral treatments, collars/wearables, are reshaping product portfolios and enabling premium pricing.

What are the latest trends in the tick-repellent market?

Natural & Botanical Formulation Shift

There is a marked shift in consumer preference toward formulations that emphasise natural or botanical actives (e.g., essential oils, plant-based ingredients) and claim safer, more eco-friendly properties. Pet owners, especially millennials and Gen Z, are increasingly prioritising products that align with sustainability and minimal chemical exposure. This trend has led manufacturers to invest in R&D of novel delivery systems (e.g., collars, wearables) and marketing that highlights “clean” protection. The adoption of such formulations is helping brands differentiate themselves in a relatively commoditised segment and command premium pricing.

Wearables, Chewables, and Extended-Duration Formats

The market is evolving beyond traditional topical sprays to include advanced formats such as chewable/oral systemic treatments, prolonged-duration spot-ons, and collars or wearable devices for pets. These formats reduce application frequency, improve compliance (frequent re-application is a barrier), and support better protection outcomes. For example, chewables are gaining traction among pet owners seeking convenience, and collars are appealing due to their “set-and-forget” nature. This evolution is driving product upgrades and boosting average selling price in certain segments.

Online Retail & Subscription Models Rising

Digital commerce is increasingly important in the tick-repellent market. Pet-care products, including tick repellents, are being sold via online platforms, direct-to-consumer websites, and subscription models (monthly prophylactic packs). This channel shift allows brands to bypass traditional veterinary/brick-and-mortar exclusivity, reach geographically dispersed users, offer bundling (e.g., tick plus flea repellent), and gather consumer data for repeat marketing. The rise of online sales is particularly significant in emerging markets, supporting faster growth in regions such as Asia-Pacific and Latin America.

What are the key drivers in the tick-repellent market?

Rising Pet Ownership & Humanisation of Pets

One of the strongest growth drivers in the tick-repellent market is the increasing number of companion animals globally, particularly dogs and cats, combined with the humanisation of pets (i.e., pets treated like family members). As pet owners become more willing to invest in preventive health, including tick repellents, the demand for such solutions rises. Veterinary care is becoming more routine, and manufacturers are introducing tick-repellent products aligned with general pet-health regimes. This trend also opens up cross-selling opportunities with other preventive treatments.

Increasing Awareness of Tick-Borne Diseases & Outdoor Exposure

Greater awareness of the health risks posed by ticks, including diseases such as Lyme disease, babesiosis, and ehrlichiosis in pets and humans, has heightened demand for effective preventive solutions. Moreover, increased outdoor recreation (pet walks, hiking, rural/ peri-urban living) exposes both pets and humans to tick habitats more frequently, further enhancing the perceived need for repellents. This awareness, combined with regulatory encouragement of animal wellness, supports growth in the tick-repellent market.

Innovation in Product Formats & Premiumisation

Product innovation, including chewables/oral treatments, collars and wearables, natural/eco-friendly formulations, and premiumisation, is driving growth in the tick-repellent market. These advancements improve user convenience, extend protection duration, and allow brands to charge higher margins. The emergence of online channels amplifies this trend as consumers look for easier and more effective solutions. Companies investing in R&D and marketing of differentiated tick-repellent formats are finding growth opportunities in both mature and emerging markets.

Restraints

Regulatory Complexity & Safety Concerns

Tick-repellent products for pets and humans are subject to regulatory oversight, safety testing, and efficacy proof, especially when dealing with chemicals, systemics, or olfactory-active agents. These regulatory burdens can delay product launches, increase compliance costs, and limit speed to market. In some geographies, the regulatory landscape is fragmented, which adds complexity for global manufacturers.

Raw Material Costs & Supply-Chain Volatility

The availability and cost of active ingredients (especially botanical ones), packaging materials, and components for advanced delivery formats are subject to fluctuation. Supply-chain disruptions (e.g., import tariffs, ingredient shortages) increase manufacturing costs and may squeeze margins or slow product roll-out. In addition, in emerging regions where local manufacturing is limited, dependence on imports can increase vulnerability to currency/transport volatility.

What are the key opportunities in the tick-repellent market?

Emerging Markets Expansion & Pet-Care Infrastructure Growth

Emerging economies, particularly in Asia-Pacific (India, China, Southeast Asia) and Latin America, offer substantial opportunities for tick-repellent market growth. In these geographies, pet-ownership is rising, veterinary infrastructure is improving, and awareness of tick-borne risks is increasing. Companies that establish early presence, localise formulations and distribution, and tailor marketing to local consumer behaviour can capture market share before penetration saturates. Additionally, targeting “other animals” (horses, livestock, exotic pets) beyond dogs/cats further expands the addressable market.

Premiumisation & Natural/Botanical Product Adoption

As consumers increasingly seek safer and higher-quality pet-care products, there is a significant opportunity for tick-repellent solutions that emphasise natural/botanical actives, eco-friendly/fabric-safe application, extended protection duration, and convenient formats (collars, chewables, wearables). Brands that invest in differentiation and communicate strong safety/efficacy credentials can command premium pricing, build loyalty, and drive margin expansion.

Digital-First Channels & Subscription Models

The growing penetration of e-commerce and D2C channels in pet-care allows tick-repellent brands to reach consumers directly, build subscription-based prophylactic treatment programmes, bundle with other pet-health offerings, and gather user data to tailor campaigns. This channel shift reduces dependence on traditional vet or retail channels, accelerates distribution in less-penetrated geographies and offers improved customer lifetime value via repeat purchases. Entrants or incumbents that embrace digital platforms, mobile-app engagement, and consumer-subscription offerings stand to gain a growth advantage.

Product Type Insights

Among product types, spot-on topical treatments remain the market leader globally, accounting for roughly 60 % of market share in 2024. This dominance reflects broad adoption among pet owners and strong veterinary-channel support. Chewables or oral systemic treatments are growing swiftly, offering convenience and longer duration protection, and attracting pet owners seeking simplified regimes. Collars/wearables and natural/botanical formulations represent niche but expanding segments, benefiting from premiumisation. The move toward longer-duration, convenience-oriented formats is a key trend reshaping product mix in the tick-repellent market.

Application Insights

The dogs segment dominates the application landscape, with approximately 60-65% share of global tick-repellent usage in 2024, as dogs engage in more outdoor activity and require more frequent preventive treatments. The cats segment holds around 25% share, while “other animals” (horses, exotic pets, small mammals) account for the remainder and are the fastest-growing among application segments. Emerging adoption of tick repellents for non-traditional pets and small livestock broadens the end-use base and offers incremental growth opportunities.

Distribution Channel Insights

Veterinary clinics and professional channels remain the largest distribution route for tick‐repellent products, reflecting trusted veterinary recommendations and prescription/purchase habits. Modern trade (supermarkets/hypermarkets) and convenience stores also play a role. However, online retail and subscription models are the fastest-growing channels, enabling brands to reach consumers directly, offer home delivery of prophylactic packs, and engage with pet owners digitally. This shift is especially significant in emerging markets where digital penetration is high and traditional retail infrastructure may be weaker.

| By Product Type | By Active Ingredient | By Application | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America remains the largest regional market for tick repellents, accounting for approximately 35-45% of global revenue in 2024 (USD 320-400 million). The U.S. is the primary national market, supported by high pet-care spending, widespread awareness of tick-borne diseases (e.g., Lyme disease), and well-developed veterinary and retail infrastructures. Growth in this region is moderate, with saturation and established competition limiting acceleration. However, premium product formats and digital channels continue to provide incremental expansion.

Europe

Europe held around a 25-30% share of the global tick-repellent market in 2024 (USD 225-270 million). Countries such as Germany, the UK, and France are prominent. Demand is driven by preventive pet-care trends, but regulatory complexity and mature markets contribute to moderate growth rates. Online channel growth and natural formulation adoption are key growth vectors in Europe.

Asia-Pacific

Asia-Pacific is emerging as the fastest-growing region in the tick-repellent market, holding 23% share in 2024 (USD 205 million) and exhibiting CAGRs as high as 7–9% in some markets (for example, India 9.3%). Growth is supported by rising pet-ownership, increased veterinary infrastructure, growing awareness of tick-borne risks in both pets and humans, and expanding online distribution. Countries such as China (USD 92.65 million in 2024) and India are among the high-momentum markets.

Latin America

Latin America contributed roughly 5% of global market share in 2024 (USD 45 million). Brazil is a key national market (USD 19 million in 2024). While the base is smaller and growth moderate (4–6% CAGR), the region offers opportunities with rising pet-care spending, expanding e-commerce, and growing awareness of tick-borne diseases.

Middle East & Africa (MEA)

The MEA region represented a relatively small share (2% of global revenue, USD 18 million in 2024). Growth is constrained by lower pet-penetration and less developed veterinary/retail infrastructure; however, niche growth exists in Gulf Cooperation Council (GCC) countries and South Africa, where affluent pet-owners, luxury channel, and online reach are improving.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Tick Repellent Market

- Bayer AG

- Merck & Co., Inc.

- Zoetis Inc.

- Boehringer Ingelheim International GmbH

- Ceva Santé Animale S.A.

- Perrigo Company plc

- Central Garden & Pet Company

- Virbac Corporation

- The Hartz Mountain Corporation

- Beaphar B.V.

- EBOS Group Limited

- PetEdge

- Petlife International Ltd.

- Sergeant’s Pet Care Products Inc.

- Mars, Incorporated

Recent Developments

- In 2024–2025, several major players launched chewable/oral tick-repellent products for dogs, emphasizing monthly systemic protection and improved compliance.

- In 2025, brands expanded direct-to-consumer subscription services globally, bundling tick-repellent with flea-treatment and wellness check-ups.

- In late 2024, natural/botanical tick-repellent variants were introduced targeting eco-conscious pet-owners, with marketing emphasising essential-oil actives and chemical-free claims.