Thermos Bottle Market Size

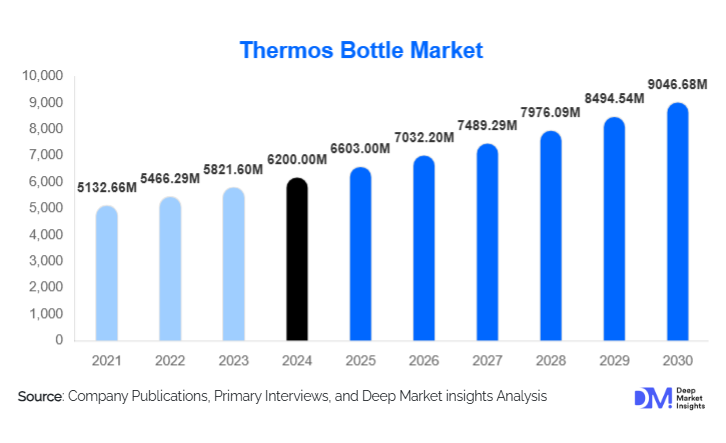

According to Deep Market Insights, the global thermos bottle market size was valued at USD 6,200 million in 2024 and is projected to grow from USD 6,603.00 million in 2025 to reach USD 9,046.68 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The thermos bottle market growth is primarily driven by rising health-conscious behavior, increasing travel and outdoor activity participation, and growing consumer preference for sustainable and reusable beverage containers.

Key Market Insights

- Consumer preference is shifting toward eco-friendly and sustainable thermos bottles, replacing single-use plastics and disposable beverage containers.

- Premium vacuum-insulated bottles are dominating the market, with high adoption in offices, households, and corporate gifting programs.

- North America holds a major market share, with strong demand for high-quality, durable, and hygienic thermos bottles among urban consumers.

- Asia-Pacific is the fastest-growing region, driven by rising urbanization, disposable income, and a growing travel culture in countries such as India and China.

- Technological innovations such as smart temperature indicators, leak-proof designs, and digital integrations are reshaping consumer expectations and driving premium product adoption.

What are the latest trends in the thermos bottle market?

Shift Toward Sustainable and Eco-Friendly Products

Manufacturers are increasingly offering thermos bottles made from sustainable materials such as BPA-free stainless steel, bamboo-coated exteriors, and recyclable composites. Eco-conscious consumers are willing to pay a premium for products that align with environmental values, which is creating opportunities for product differentiation. Brand strategies now emphasize sustainability as a core selling point, with campaigns highlighting reduced plastic usage and longevity of thermos bottles.

Integration of Smart Technologies

Emerging smart features, such as digital temperature indicators, Bluetooth-enabled tracking, and self-cleaning mechanisms, are transforming consumer expectations. These innovations appeal to tech-savvy urban consumers and premium buyers. Companies are investing in R&D to combine functionality with style, creating thermos bottles that offer both performance and enhanced user experience.

What are the key drivers in the thermos bottle market?

Health and Wellness Awareness

Rising health consciousness is driving demand for home-prepared beverages in insulated containers rather than commercial alternatives. Thermos bottles allow consumers to carry healthy drinks while maintaining hygiene, temperature, and freshness, fueling growth in both urban and travel-oriented markets.

Growth in Travel and Outdoor Activities

The expansion of recreational travel, trekking, camping, and outdoor sports has significantly increased the need for portable beverage containers. Thermos bottles, particularly vacuum-insulated types, are preferred due to their ability to maintain drink temperatures over extended periods, making them ideal for on-the-go lifestyles.

Corporate and Promotional Demand

Thermos bottles are widely adopted in corporate gifting programs, promotions, and branded merchandise. Bulk orders from businesses and institutions contribute to sustained demand, especially in North America and Europe, where office culture supports premium lifestyle products.

Restraints

High Cost of Premium Products

Premium vacuum-insulated bottles are priced higher than alternative beverage containers, limiting adoption in cost-sensitive regions. Consumers in developing countries often prefer basic or plastic bottles due to affordability concerns.

Competition from Alternative Containers

Reusable plastic bottles, disposable coffee cups, and single-use containers continue to offer lower-cost alternatives, posing a challenge for thermos bottle penetration, particularly in emerging markets where price sensitivity is high.

What are the key opportunities in the thermos bottle industry?

Expansion in Emerging Markets

Rising urbanization, disposable income, and travel culture in APAC and LATAM create significant opportunities for thermos bottle manufacturers. Countries like India, China, and Brazil represent high-growth potential, with increasing demand for portable and reusable beverage solutions among commuters and travelers.

Product Innovation and Premiumization

Introducing smart features, ergonomic designs, customizable exteriors, and aesthetic enhancements enables brands to differentiate products. Luxury and lifestyle-focused thermos bottles are attracting premium consumers willing to pay for quality, functionality, and style.

Corporate and Promotional Integration

The increasing use of thermos bottles for corporate gifting, events, and promotional campaigns presents opportunities to drive bulk demand. Partnerships with organizations for customized branding, colors, and logos strengthen market visibility and drive sales volume.

Product Type Insights

Vacuum-insulated bottles dominate the thermos bottle market, accounting for approximately 55% of global sales in 2024. Their superior temperature retention, leak-proof design, and premium appeal make them the preferred choice among urban consumers, corporate buyers, and outdoor enthusiasts. The rising health consciousness trend, along with increasing outdoor and travel activities, drives the adoption of vacuum-insulated bottles globally. Double-wall bottles follow in market share, offering moderate insulation at a competitive price and appealing to budget-conscious consumers who still require functional temperature retention. Single-wall bottles cater primarily to cost-sensitive consumers seeking lightweight, portable, and basic functionality, such as children or casual users. Market trends indicate a gradual shift toward premium vacuum-insulated products, particularly in North America and Europe, where higher disposable incomes and lifestyle-driven purchases favor advanced thermal retention, design aesthetics, and durability. Technological innovations, such as smart temperature indicators and ergonomic designs, are also encouraging the adoption of premium product types, creating new differentiation opportunities for market leaders.

Material Insights

Stainless steel thermos bottles lead the material segment, contributing about 60% of the 2024 market share. Their dominance is driven by durability, corrosion resistance, hygiene, and eco-friendliness. As consumers increasingly prioritize long-lasting products and sustainable alternatives to single-use plastics, stainless steel bottles have emerged as the preferred choice across personal, corporate, and travel applications. Plastic bottles serve niche segments, mainly for affordability, lightweight portability, and children’s use, while glass bottles cater to premium household applications where aesthetics and non-reactive materials are valued. Overall, the market is seeing a trend toward durable, sustainable materials, with stainless steel remaining the top driver due to the rising premiumization and eco-conscious consumption patterns in mature markets.

Distribution Channel Insights

Online retail is the fastest-growing distribution channel, accounting for approximately 35% of global sales. The convenience of e-commerce, wide product selection, competitive pricing, and home delivery appeal to both urban and semi-urban consumers, driving rapid adoption. Supermarkets and hypermarkets follow, contributing about 30% of sales, providing accessibility and visibility to mass-market consumers. Specialty stores and brand outlets, representing roughly 25% of sales, attract premium buyers seeking high-quality, design-driven thermos bottles. Corporate bulk orders and promotional sales contribute around 10% of overall sales, driven by growing demand from organizations for employee gifts, events, and branding initiatives. Overall, the increasing penetration of online retail and strategic expansion of premium-focused channels are reshaping the market’s distribution landscape.

End-Use Insights

Household and personal use remains the largest end-use segment, accounting for around 65% of demand in 2024. Urban consumers increasingly rely on thermos bottles for carrying beverages to work, school, or during outdoor activities. Corporate gifting, travel, hospitality, sports, and outdoor activities are emerging as fast-growing end-use segments. For instance, corporate gifting is expanding rapidly in North America and Europe due to lifestyle adoption and brand-driven promotions. Travel and hospitality sectors in APAC are driving premium bottle adoption as consumers increasingly demand hygienic, portable beverage solutions. Healthcare and hospitals are gradually integrating thermos bottles for staff and patient beverages, creating additional growth opportunities. Export-driven demand is particularly strong in regions with high tourist traffic, international travel culture, and urban lifestyle adoption, further reinforcing end-use diversification and growth potential.

| By Product Type | By Material | By Distribution Channel | By End-Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds the largest market share (28% in 2024), driven by high disposable incomes, lifestyle adoption, and corporate gifting culture. The U.S. leads demand due to urban commuter behavior, health-conscious consumers, and a strong preference for premium and smart thermos bottles with advanced temperature retention and leak-proof designs. The growth of outdoor recreational activities, including hiking, camping, and sports, further drives the adoption of vacuum-insulated bottles. Online retail and specialty stores contribute significantly, with e-commerce platforms facilitating premium product penetration across urban centers.

Europe

Europe accounts for 26% of the market, with Germany, France, and the U.K. leading adoption. The region’s growth is fueled by sustainability trends, eco-conscious consumers, and high disposable incomes, favoring premium lifestyle purchases. BPA-free stainless steel thermos bottles with superior insulation are widely preferred for both personal and corporate use. Additional drivers include a strong corporate gifting culture, increasing outdoor leisure activities, and growing awareness of health and wellness trends. Urbanization, environmental regulations, and government campaigns promoting reusable products further reinforce market growth in Europe.

Asia-Pacific

APAC is the fastest-growing region, with a CAGR exceeding 7%. India, China, and Japan are key growth markets due to rising urbanization, disposable income, digital penetration, and evolving lifestyle trends. Online retail platforms and e-commerce expansion are accelerating thermos bottle adoption, particularly in urban and semi-urban areas. The rising travel culture, outdoor sports participation, and increasing corporate gifting programs are additional drivers. Growing health awareness and eco-friendly consumption behavior are boosting demand for premium vacuum-insulated stainless steel bottles in both personal and commercial segments.

Middle East & Africa

The region accounts for 8% of the global market. GCC countries, including the UAE, Saudi Arabia, and Qatar, drive premium product adoption due to high disposable income and lifestyle-oriented consumption. Corporate gifting, urban commuters, and increasing tourism are significant demand drivers. Intra-African sales are growing modestly, supported by urbanization, expanding retail infrastructure, and rising participation in travel and outdoor recreational activities. Premium vacuum-insulated bottles with ergonomic designs and durable materials are increasingly preferred.

Latin America

LATAM represents 6% of the global market, led by Brazil and Mexico. Growth is moderate but supported by rising urbanization, increasing disposable income, and growing travel and outdoor activity participation among affluent consumers. Demand is primarily for mid-range and premium thermos bottles, particularly stainless steel and vacuum-insulated types. E-commerce platforms and retail expansion in major urban centers are enabling better accessibility and driving adoption, while corporate gifting programs and promotional campaigns further support regional growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Thermos Bottle Market

- Thermos LLC

- Stanley Black & Decker

- Zojirushi Corporation

- Tiger Corporation

- CamelBak

- S’well

- Contigo

- Alfi GmbH

- Lock&Lock

- Hydro Flask

- Klean Kanteen

- Sigg Switzerland

- Borraccia

- Sunhouse

- La Gourmet

Recent Developments

- In May 2025, Thermos LLC launched a new line of smart vacuum-insulated bottles with temperature display and Bluetooth tracking, targeting premium urban consumers.

- In March 2025, Stanley Black & Decker expanded its European manufacturing facility to increase production capacity for high-demand stainless steel thermos bottles.

- In February 2025, Zojirushi Corporation introduced eco-friendly glass-lined bottles with BPA-free coatings, focusing on sustainability and premium household applications.