Thermal Wellness Market Size

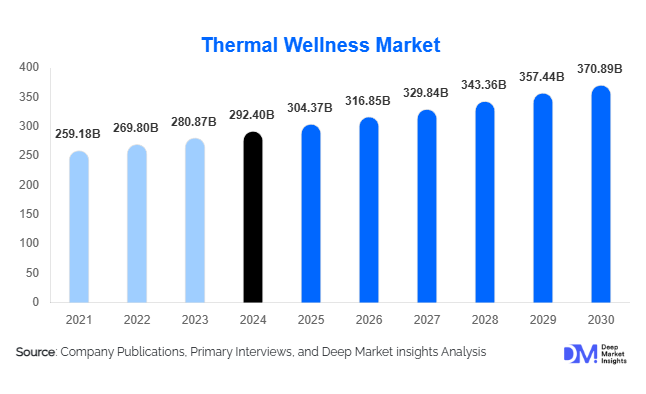

According to Deep Market Insights, the global thermal wellness market size was valued at USD 292.4 billion in 2024 and is projected to grow from USD 304.37 billion in 2025 to reach USD 370.89 billion by 2030, expanding at a CAGR of 4.1% during the forecast period (2025–2030). Market expansion is driven by growing consumer preference for holistic health, rising wellness tourism, and large-scale infrastructure investments in thermal spas, hydrotherapy centers, and wellness resorts worldwide.

Key Market Insights

- Thermal wellness is transitioning from luxury to mainstream preventive health, driven by consumer focus on relaxation, stress management, and therapeutic rejuvenation.

- Europe leads the global thermal wellness market with over 40% share, supported by a strong heritage of spa culture and extensive infrastructure in Germany, France, and Italy.

- Asia-Pacific is the fastest-growing region, supported by increasing disposable incomes, government-backed wellness tourism, and rapid resort development in China, Japan, and India.

- Massage therapy and hydrotherapy dominate service segments, jointly accounting for more than 60% of global revenues due to wide consumer adoption and cross-industry integration.

- Technological adoption is reshaping wellness experiences, including smart hydrotherapy systems, wearable-based wellness tracking, and AI-driven personalization.

- Wellness tourism integration is expanding revenue streams for hotels and resorts through destination spa models that combine recreation with medical-wellness offerings.

Latest Market Trends

Integration of Thermal Wellness with Wellness Tourism

Hotels and resorts worldwide are increasingly incorporating thermal water therapies into tourism experiences, aligning with the global rise of wellness travel. Destination spas featuring natural hot springs, mineral water pools, and hydrotherapy circuits have become a major draw for health-conscious tourists. In Europe, the renovation of historic thermal towns and spa resorts has revitalized the sector, while Asia-Pacific is witnessing new resort clusters in Japan, China, and India. This cross-sector integration is not only diversifying the hospitality industry but also positioning thermal wellness as a key component of sustainable tourism development.

Digital Transformation and Smart Spa Technologies

Digitalization is reshaping thermal wellness experiences through online booking systems, AI-powered treatment personalization, and real-time health monitoring. Smart hydrotherapy pools, automated temperature control systems, and mineral infusion technology enhance therapeutic outcomes and operational efficiency. Mobile apps now enable customers to track wellness progress, book sessions, and receive post-treatment guidance. This technology-led shift appeals to millennials and Gen Z consumers seeking measurable, personalized wellness outcomes, thereby elevating the sophistication and accessibility of the market globally.

Thermal Wellness Market Drivers

Growing Health and Wellness Awareness

Consumers across demographics are prioritizing preventive healthcare and mental well-being. Thermal wellness services—ranging from hydrotherapy to mineral baths—offer holistic benefits for stress management, musculoskeletal relief, and skin health. The post-pandemic surge in wellness adoption has particularly accelerated demand for natural, water-based therapies perceived as both safe and restorative.

Rising Wellness Tourism and Resort Integration

Global tourism recovery is fueling a surge in wellness-oriented travel. Resorts are increasingly integrating thermal facilities into their service portfolios to attract high-value visitors seeking rejuvenation and medical-wellness experiences. Governments in Europe and Asia are supporting wellness infrastructure and promoting thermal heritage sites as international destinations, stimulating tourism-linked revenues and local employment.

Infrastructure Investments and Modernization

Thermal wellness facilities are expanding through public-private partnerships and private CapEx in spas, hydrotherapy installations, and resort wellness zones. Modern designs integrating sustainability (energy-efficient pools, water recycling systems) are enhancing capacity and long-term profitability. Many operators are diversifying offerings with digital wellness programs and therapeutic retreats to increase customer retention and utilization rates.

Market Restraints

High Capital and Operational Costs

Establishing and maintaining thermal facilities requires significant upfront investment in infrastructure, geothermal systems, and water treatment technologies. Operational costs, including energy consumption and staff training, remain high, limiting profitability in price-sensitive regions. These financial barriers can deter small or new entrants from scaling effectively.

Regulatory and Environmental Constraints

Strict environmental and geothermal resource regulations, combined with seasonal tourism patterns, can restrict development. Licensing for thermal water extraction, sustainability mandates, and compliance with hygiene standards increase operational complexity. Furthermore, accessibility challenges in remote spa regions can limit year-round visitor inflow.

Thermal Wellness Market Opportunities

Wellness Tourism and Destination Development

There is a major opportunity for resorts, spas, and governments to position thermal wellness as a cornerstone of health tourism. Developing integrated destinations with thermal circuits, hydrotherapy facilities, and complementary medical services can attract international visitors seeking preventive health experiences. Countries such as Japan, Hungary, and Italy already showcase successful thermal-tourism ecosystems that new entrants can replicate in emerging markets.

Emerging Market Expansion

Asia-Pacific, the Middle East, and Latin America offer strong growth potential due to expanding middle-class populations and rising health awareness. Governments in India, China, and Saudi Arabia are promoting wellness infrastructure through investment incentives, creating favorable entry conditions for international spa brands and local entrepreneurs. Localization of services—blending thermal therapy with indigenous traditions like Ayurveda—enhances cultural appeal and consumer loyalty.

Technological Personalization in Wellness

Adopting technology to personalize thermal wellness services presents a transformative opportunity. Data-driven treatment programs, wellness tracking, and AI-guided hydrotherapy can improve therapeutic precision and customer experience. Integration with wearable devices and virtual wellness coaching will further differentiate high-end spas and attract tech-savvy clientele. This digital edge can help operators optimize pricing, improve operational efficiency, and expand recurring revenue models.

Product Type Insights

Massage therapy dominates the global service mix, accounting for about 40% of market revenues in 2024 ( USD 26 billion). It remains the most accessible and widely recognized thermal wellness service. Hydrotherapy follows closely with around 25% market share, gaining popularity through resort spas and wellness clubs integrating thermal pools and aquatic therapies. Facial and skin treatments using thermal minerals represent another growing niche, supported by consumer demand for natural beauty and detox solutions.

Facility Type Insights

Thermal spas lead globally, capturing around 35% of the 2024 market ( USD 22.8 billion). Their success stems from dedicated infrastructure and consumer trust in authentic hydro-mineral experiences. Wellness resorts and hotels are expanding rapidly, blending luxury accommodation with spa offerings to capture tourism-driven demand. Medical wellness centers, leveraging hydrotherapy for rehabilitation and recovery, represent an emerging high-value segment, especially in Europe and Asia.

End-Use Insights

The primary end-use industries driving demand include hospitality and tourism, urban wellness clubs, and medical rehabilitation centers. Wellness resorts and destination spas account for the largest revenue share, while urban day spas are the fastest-growing subsegment due to increasing demand from young professionals in metropolitan areas. Medical wellness applications such as hydrotherapy for physiotherapy and chronic pain management are gaining traction, particularly in developed healthcare systems. Export-driven demand for spa equipment, furnishings, and thermal systems is also increasing, benefitting manufacturing hubs in Europe and Asia.

| By Service Type | By Application | By End User | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America represents a mature market led by the United States and Canada, driven by strong adoption of wellness tourism and corporate wellness programs. The region accounts for roughly 20% of global revenues. High disposable incomes and an established luxury spa culture continue to sustain growth. The market is characterized by premium resort spas and urban wellness centers offering thermal-inspired treatments.

Europe

Europe remains the global leader, holding approximately 41% of the 2024 thermal wellness market ( USD 26.7 billion). Germany, France, Italy, and Hungary dominate due to centuries-old spa traditions and extensive thermal infrastructure. Continuous modernization of historical spa towns and government support for wellness tourism reinforce Europe’s leading position. The region’s growth is steady, supported by sustainability-focused upgrades and digital enhancements to heritage facilities.

Asia-Pacific

Asia-Pacific is the fastest-growing region, projected to register a CAGR exceeding 5% through 2030. Key markets include China, Japan, India, and South Korea. The region’s expansion is underpinned by growing wellness tourism, cultural alignment with hot-spring traditions, and supportive public policies. Rapid urbanization and an expanding middle class are further propelling the adoption of thermal wellness services across urban resorts and hospitality chains.

Latin America

Latin America, led by Brazil and Mexico, is emerging as a promising market with increasing wellness infrastructure investment and urban spa development. Rising domestic tourism, coupled with cross-border travel to wellness destinations in Europe and Asia, supports regional growth. The segment is smaller in absolute size but shows steady upward momentum.

Middle East & Africa

The Middle East and Africa currently hold a modest share but display growing potential. The UAE and Saudi Arabia are investing in luxury spa resorts aligned with national wellness tourism visions, while South Africa’s established spa industry continues to evolve with premium hydrotherapy offerings. These developments are positioning the region as a future hotspot for high-end thermal wellness experiences.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Thermal Wellness Market

- Accor S.A.

- Hilton Worldwide Holdings Inc.

- Marriott International Inc.

- InterContinental Hotels Group PLC

- Aman Group S.à r.l.

- Six Senses Hotels Resorts Spas

- Kempinski Hotels S.A.

- Lanserhof Group

- Banyan Tree Holdings Limited

- The Peninsula Hotels

- Mandarin Oriental Hotel Group

- Shangri-La International Hotel Management Ltd.

- Jumeirah Group

- Chiva-Som International Health Resort

- Como Hotels and Resorts

Recent Developments

- In May 2025, Accor S.A. announced the expansion of its luxury spa portfolio in Europe, integrating thermal-wellness suites across its MGallery and Sofitel properties.

- In April 2025, Aman Group launched a new thermal-wellness retreat in Japan, combining traditional onsen culture with digital health analytics for personalized therapy.

- In February 2025, Six Senses introduced an eco-thermal resort in Thailand featuring geothermal pools powered by renewable energy sources.