Therapeutic Clay Market Size

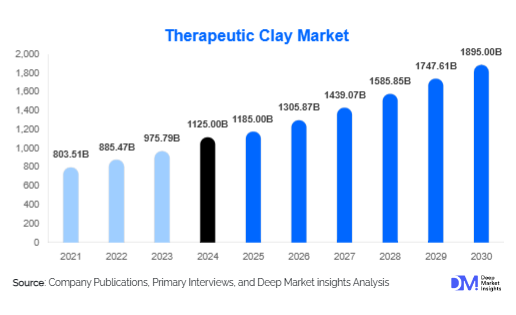

According to Deep Market Insights, the global therapeutic clay market size was valued at USD 1,125 million in 2024 and is projected to grow from USD 1,185 million in 2025 to reach USD 1,895 million by 2030, expanding at a CAGR of 10.2% during the forecast period (2025–2030). The market growth is primarily driven by rising consumer awareness of natural and organic skincare products, increasing demand for wellness and spa treatments, and growing applications of therapeutic clays in cosmetic, pharmaceutical, and industrial sectors.

Key Market Insights

- Clay-based treatments are gaining mainstream acceptance, with the rising popularity of natural remedies and holistic health approaches across North America, Europe, and the Asia-Pacific.

- Cosmetic and skincare applications dominate market adoption, particularly for facial masks, detoxifying products, and anti-aging formulations.

- North America holds the largest share in the therapeutic clay market, driven by high consumer spending on wellness and spa services, especially in the U.S. and Canada.

- Asia-Pacific is the fastest-growing region, fueled by increasing disposable income, beauty consciousness, and the expansion of wellness tourism in China, India, and Japan.

- Technological innovation in clay processing, including micronization and blending with bioactive compounds, is enhancing product efficacy and consumer appeal.

What are the latest trends in the therapeutic clay market?

Integration of Therapeutic Clays in Cosmetics and Personal Care

Therapeutic clays are increasingly being incorporated into cosmetic products such as face masks, body wraps, cleansers, and anti-aging creams. Their natural detoxifying and mineral-rich properties appeal to consumers seeking chemical-free and sustainable skincare. Blends of kaolin, bentonite, and French green clay are being marketed for specific skin benefits, including oil absorption, exfoliation, and rejuvenation. Premium brands are introducing clay-based products combined with botanicals, vitamins, and probiotics to differentiate offerings in a crowded skincare market.

Expansion into Spa and Wellness Therapies

Spas and wellness centers are driving demand for therapeutic clays through body treatments, mud baths, and facial therapies. Health-conscious consumers increasingly prefer holistic and natural therapies, boosting revenue opportunities for spa operators and clay suppliers. Innovations include temperature-controlled clay wraps, mineral-rich mud baths, and combination therapies that integrate aromatherapy, hydrotherapy, and clay-based applications for enhanced relaxation and skin benefits.

What are the key drivers in the therapeutic clay market?

Rising Consumer Preference for Natural Remedies

There is a strong shift toward natural, chemical-free wellness products. Therapeutic clays are perceived as safe, organic alternatives for skincare, detoxification, and minor health treatments. Increasing consumer awareness about harmful chemicals in conventional cosmetics is accelerating adoption globally. Retail and online channels are emphasizing organic certifications, clean-label marketing, and sustainable sourcing to capture eco-conscious buyers.

Growth of the Wellness and Spa Industry

The expansion of wellness tourism and spa services is fueling therapeutic clay demand. Rising disposable incomes, urbanization, and increasing focus on mental and physical health are creating opportunities for spas, salons, and wellness resorts to offer clay-based therapies. This trend is strongest in North America, Europe, and APAC, where luxury and mid-tier wellness segments are integrating advanced clay treatments into standard service offerings.

Expanding Applications in Industrial and Pharmaceutical Sectors

Beyond cosmetics and wellness, therapeutic clays are being used in pharmaceutical formulations, including topical ointments, detoxifying pastes, and oral health products. Industrial applications such as eco-friendly adsorbents, natural pigments, and water purification are also contributing to market expansion, particularly in emerging economies where demand for multifunctional clays is growing.

What are the restraints for the global market?

Raw Material Availability and Quality Variability

The therapeutic clay market faces challenges in sourcing high-quality clays with consistent mineral composition. Variability in raw material properties affects product efficacy and standardization. Limited high-grade deposits in specific regions, along with environmental restrictions on mining, can constrain supply and increase costs for manufacturers.

Regulatory Compliance and Certification Challenges

Strict regulations governing cosmetic, pharmaceutical, and therapeutic products pose barriers to market entry. Obtaining certifications for natural or organic products, ensuring compliance with safety standards, and navigating labeling requirements can delay product launches. Emerging markets with less stringent regulations may face quality concerns, impacting consumer trust and market credibility.

What are the key opportunities in the therapeutic clay market?

Integration with Advanced Skincare Technologies

Companies can capitalize on combining therapeutic clays with bioactive compounds, probiotics, or nanotechnology to enhance product efficacy. Such innovations can address specific skin concerns like acne, aging, or pigmentation, creating premium product lines that cater to growing consumer demand for functional skincare solutions.

Expansion into Emerging Markets

Rising beauty consciousness and wellness trends in emerging economies, particularly in Asia-Pacific, Latin America, and the Middle East, present significant growth opportunities. Expanding distribution networks, leveraging e-commerce, and introducing localized clay-based products can capture new consumer bases while establishing early brand recognition in high-growth markets.

Public-Private Partnerships in Wellness Tourism

Government initiatives promoting wellness, tourism, and health-focused infrastructure offer opportunities for clay suppliers. Public-private collaborations in spa, resort, and therapeutic centers can facilitate bulk supply contracts, co-branding, and integrated wellness experiences, further expanding market reach and consumer engagement.

Product Type Insights

Bentonite clay dominates the market, accounting for approximately 35% of the global therapeutic clay market in 2024, due to its high adsorption capacity and versatility in cosmetics and pharmaceutical applications. Kaolin clay follows, widely used in facial masks and body treatments. Specialty clays, such as French green clay and Rhassoul, are gaining popularity in premium wellness segments for their mineral richness and detoxifying properties.

Application Insights

Facial masks and skin treatment products constitute the largest application segment, representing 40% of the market in 2024. Spa therapies, including mud baths and body wraps, follow closely. Industrial applications like water purification, natural pigments, and pharmaceuticals are emerging segments contributing to overall market growth. There is also rising adoption in veterinary and animal care treatments, reflecting diversified application opportunities.

Distribution Channel Insights

Retail pharmacies and specialty beauty stores hold a major share of therapeutic clay sales, particularly for end-user cosmetic products. Online platforms, including D2C and e-commerce marketplaces, are rapidly gaining traction due to ease of access and increasing awareness through digital marketing. Wellness centers, spas, and hotels act as niche channels, offering direct B2B demand for bulk therapeutic clay products, particularly bentonite and kaolin clays for spa treatments.

End-Use Insights

The cosmetic and personal care industry drives the highest demand for therapeutic clays, accounting for 50% of market revenue in 2024. The spa and wellness segment follows, with strong growth potential due to rising wellness tourism. Pharmaceutical and industrial end-users, while smaller in revenue share, are expected to grow at a double-digit CAGR, driven by innovations in therapeutic and environmental applications. Export-driven demand is significant, with Europe and North America importing high-quality clays from Asia-Pacific and Africa.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounted for approximately 32% of the global therapeutic clay market in 2024. The U.S. leads demand due to strong wellness awareness, high disposable incomes, and extensive spa infrastructure. Canada contributes to growing organic skincare adoption. Both countries are seeing rising import volumes of high-purity clays from Europe and APAC.

Europe

Europe held around 28% market share in 2024, driven by France, Germany, and the U.K. France dominates spa and cosmetic applications, particularly for high-end skincare, while Germany leads in pharmaceutical formulations. Emerging wellness tourism hubs in Eastern Europe are also contributing to growth. Europe is expected to maintain steady demand with an emphasis on certified organic and sustainable clays.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with significant uptake in China, India, and Japan. Rising beauty consciousness, increasing spa and wellness infrastructure, and urbanization are primary growth factors. China is leading adoption in both cosmetics and spa applications, while India is witnessing rapid growth in wellness resorts integrating clay therapies.

Latin America

Brazil, Mexico, and Argentina are key markets, primarily for cosmetics and wellness treatments. While the overall market size is smaller, growth rates are strong due to increasing consumer interest in natural products and wellness tourism.

Middle East & Africa

In the Middle East, the UAE and Saudi Arabia drive demand for premium cosmetic and spa applications, supported by luxury wellness resorts. Africa, as a raw material source, supplies high-quality bentonite and kaolin clays to global markets, especially Europe, North America, and the Asia-Pacific.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Therapeutic Clay Market

- Bentonite Clay Inc.

- Kaolin Ltd.

- Imerys

- ClayWorks Global

- Mother Earth Minerals

- Thorp & Sons

- ClayTech Solutions

- GreenEarth Clays

- Clay Science Co.

- Mineral Therapeutics

- Earth Elements

- Global Clay Industries

- Nature’s Clay

- BioClay Solutions

- Terra Minerals

Recent Developments

- In June 2025, Imerys expanded its French green clay production in Europe, targeting high-demand cosmetic applications in skincare and spa products.

- In March 2025, Bentonite Clay Inc. launched micronized therapeutic clay powders for pharmaceutical and cosmetic formulations, enhancing absorption and efficacy.

- In January 2025, Kaolin Ltd. partnered with luxury spa chains in the Asia-Pacific region to supply customized clay blends for wellness treatments.