TFT LCD Market Size

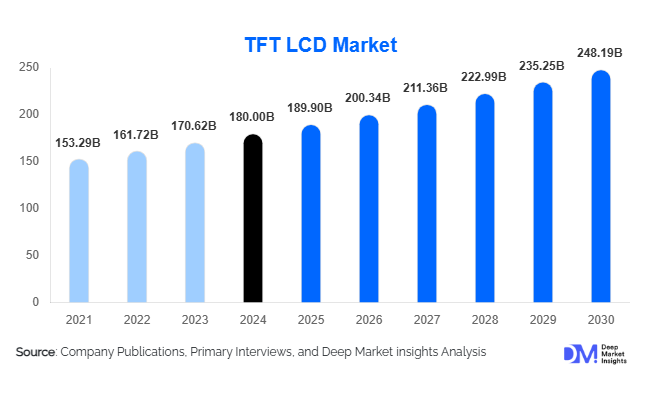

According to Deep Market Insights, the global TFT LCD market size was valued at USD 180 billion in 2024 and is projected to grow from USD 189.90 billion in 2025 to reach USD 248.19 billion by 2030, expanding at a CAGR of 5.5% during the forecast period (2025–2030). The market growth is primarily driven by rising demand for large-size TVs, automotive display integration, digital signage expansion, and the increasing adoption of IPS and high-performance TFT LCD panels across consumer electronics, industrial, and medical applications.

Key Market Insights

- IPS and high-resolution panels dominate the market, offering superior color accuracy, wide viewing angles, and premium display quality demanded by modern TVs, monitors, and tablets.

- Automotive and transportation displays are emerging as high-growth applications, driven by EV adoption, autonomous vehicle dashboards, infotainment systems, and rear-seat entertainment solutions.

- Asia-Pacific leads the market, with China, South Korea, and Taiwan holding over 60% of global revenue share, driven by strong manufacturing capacity and domestic consumption.

- North America maintains a significant market presence, with the U.S. and Canada demanding high-end TVs, gaming monitors, and automotive displays.

- Emerging regions, including India, Southeast Asia, and MEA, are rapidly expanding due to growing middle-class demand and local manufacturing initiatives.

- Technological integration, including mini-LED backlights, high refresh rates, flexible panels, and energy-efficient TFT technologies, is reshaping product offerings and market competitiveness.

What are the latest trends in the TFT LCD market?

Automotive Display Integration

TFT LCDs are increasingly being used in digital dashboards, infotainment systems, center stacks, heads-up displays (HUDs), and rear-seat entertainment units in modern vehicles. With EV adoption and autonomous driving technologies on the rise, automotive manufacturers demand high-brightness, wide-temperature-tolerant, durable displays. Partnerships with OEMs and Tier-1 suppliers have become critical for panel manufacturers to provide tailored solutions, offering opportunities for premium pricing. Flexible panels, curved dashboards, and multi-display configurations are emerging as key trends.

Ultra-Large and High-Resolution Panels

The market is witnessing growing demand for ultra-large TVs (≥75-inch), gaming monitors, and digital signage solutions. Mini-LED backlight technology, HDR support, and higher refresh rates are being incorporated to improve visual quality. Large panels, despite lower unit volumes compared to smartphones or small displays, contribute disproportionately to revenue due to higher pricing. Commercial applications like outdoor and indoor signage, retail displays, and corporate boards are fueling this trend.

Local Manufacturing and Emerging Market Demand

Governments in India, China, and Southeast Asia are encouraging local display panel manufacturing through incentives and “Make in” initiatives. This drives growth in local supply, reduces import dependency, and opens avenues for emerging markets to adopt TFT LCD technology in consumer electronics, healthcare, industrial automation, and retail sectors. Rising middle-class affluence in these regions is fueling the adoption of premium displays for TVs, smartphones, and automotive applications.

What are the key drivers in the TFT LCD market?

Rising Automotive and Industrial Display Adoption

The increasing integration of TFT LCD panels in automotive dashboards, infotainment systems, and industrial HMIs is a key driver. Electric and autonomous vehicles require advanced displays for safety, navigation, and connectivity. Industrial applications, including factory automation, medical devices, and digital signage, further drive demand for high-quality, reliable TFT LCD panels. This shift toward high-spec displays supports premium pricing and incremental market growth.

Consumer Electronics Upgrade and Large-Screen Adoption

Consumers are demanding larger, higher-resolution TVs, gaming monitors, and laptops with high refresh rates and HDR support. Upgrades from 1080p to 4K and 8K, alongside enhanced color accuracy and viewing angles, are encouraging manufacturers to produce higher-value TFT LCD panels. The trend is particularly strong in North America, Europe, and the Asia-Pacific, where premium and mid-range products dominate sales.

Cost Efficiency and Technological Advancements

Advances in Gen-10/10.5 fabs, mini-LED backlight technology, IGZO/oxide TFT materials, and efficient driver ICs have made TFT LCD panels more energy-efficient, thinner, and cost-competitive. Economies of scale from large manufacturing facilities, particularly in China, Taiwan, and South Korea, allow high-volume production at lower unit costs, enhancing market competitiveness against emerging display technologies like OLED.

What are the restraints for the global market?

Competition from OLED and Emerging Technologies

OLED, Micro-LED, and other emerging display technologies offer superior contrast ratios, deeper blacks, and sometimes lower power consumption. Premium smartphones, TVs, and niche applications are increasingly adopting these technologies, reducing demand for TFT LCD panels in certain segments. This creates price pressure and margin challenges for traditional TFT LCD manufacturers.

Price Erosion and Oversupply

Intense competition, especially from large-scale Chinese manufacturers, has led to significant price erosion in standard panels. Overcapacity in some regions, coupled with fluctuating demand in mature markets, may result in reduced utilization rates and squeezed profit margins. Panel makers must optimize production efficiency, innovate in premium segments, or diversify applications to maintain profitability.

What are the key opportunities in the TFT LCD market?

Premium Automotive Display Solutions

EV adoption and connected vehicle systems present an opportunity to integrate TFT LCD panels into dashboards, infotainment systems, and rear-seat entertainment. High-performance panels with advanced durability, brightness, and curved or flexible form factors can attract premium pricing. Collaboration with OEMs for customized automotive solutions is an emerging opportunity for manufacturers.

Large-Format Displays and Digital Signage

Ultra-large panels and signage solutions are increasingly in demand across retail, commercial, and smart city applications. The shift toward high-resolution, high-brightness, and mini-LED-enhanced displays is creating a niche for specialized, high-margin products. Emerging markets in Asia-Pacific, the Middle East, and Latin America represent key growth zones.

Emerging Markets and Local Production

Regions such as India, Southeast Asia, and MEA are investing in local panel manufacturing through government incentives. Rising disposable incomes, urbanization, and technology adoption are driving demand for consumer electronics, automotive displays, and medical-grade panels. Local production can reduce imports, improve supply chain efficiency, and unlock new growth potential.

Product Type Insights

IPS TFT LCD panels continue to dominate the market due to their superior color accuracy, wide viewing angles, and high adoption in TVs, monitors, laptops, and tablets. TN panels remain relevant for low-cost, high-speed applications such as entry-level monitors and budget laptops. Advanced VA, AFFS, and ASV panels are preferred in niche applications, including industrial, automotive, and medical displays, where durability and clarity under varying conditions are essential. Large and ultra-large panels contribute the highest revenue despite lower unit shipments due to premium pricing, driven by growing demand in home entertainment and digital signage. Mini-LED and HDR-enabled panels are gaining traction in high-end consumer and commercial markets, supporting enhanced brightness, contrast, and energy efficiency.

Application Insights

Televisions and home entertainment dominate the application segment, capturing the largest revenue share, fueled by increasing consumer preference for large-screen, high-resolution displays. Smartphones, laptops, and monitors remain significant contributors. Automotive displays are the fastest-growing application, driven by the integration of infotainment systems, driver assistance technologies, and advanced dashboard displays in electric and autonomous vehicles. Industrial and medical applications are expanding rapidly, particularly for HMIs, digital signage, and patient monitoring systems. Emerging applications, including smart appliances, wearable devices, and educational tools, are creating diversified demand, opening new revenue avenues for panel manufacturers.

Distribution Channel Insights

B2B channels dominate TFT LCD distribution, with OEMs purchasing directly from panel manufacturers. Key channels include consumer electronics assembly lines, automotive Tier-1 suppliers, industrial OEMs, and medical device integrators. Increasingly, distribution leverages online procurement platforms, long-term contracts, and strategic partnerships to improve supply chain efficiency. In emerging markets, regional distributors are playing a larger role, particularly for small and mid-range displays. Digital platforms now enable real-time tracking, quality verification, and direct engagement between suppliers and corporate clients, improving transparency and operational efficiency.

End-Use Industry Insights

Consumer electronics remain the largest end-use industry, particularly for TVs, laptops, monitors, and smartphones. Automotive is the fastest-growing segment, driven by infotainment and EV dashboard adoption, coupled with increasing integration of driver assistance systems. Industrial applications, including digital signage, HMIs, and machinery interfaces, are expanding due to automation and Industry 4.0 initiatives. Healthcare is also witnessing growth, with high-resolution displays being adopted for diagnostics, imaging, telemedicine, and patient monitoring. Export-driven demand continues to strengthen, with Asia-Pacific serving as the primary supplier to North America, Europe, and emerging regions.

Age Group Insights

Consumers aged 25–45 years are the primary adopters of high-value TFT LCD products in premium electronics and gaming monitors. Younger demographics (18–24 years) drive demand for smartphones, tablets, and budget displays. Older consumers (46–65 years) tend to prefer large-screen TVs and premium monitors, while the 65+ age group contributes to niche demand in medical, assistive technology, and specialized high-end displays.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounts for 20–25% of global TFT LCD revenue. Growth is supported by high consumer spending on premium electronics, including large TVs, gaming monitors, and automotive infotainment systems. Technological leadership in display innovation, R&D centers, and strong brand presence of key manufacturers drive adoption. The automotive sector is a key contributor, with increasing integration of TFT LCD dashboards, infotainment systems, and advanced driver assistance displays. Overall, the combination of high disposable incomes, technological sophistication, and a mature consumer base underpins steady market growth.

Europe

Europe contributes 15–20% of global revenue, with Germany, the UK, and France leading demand. Growth is driven by regulatory support for energy-efficient and sustainable display technologies, including EU directives on low-power and environmentally friendly panels. Automotive innovation, particularly the adoption of digital dashboards and infotainment systems, further boosts demand. Industrial automation, premium TV consumption, and healthcare display applications also contribute. The focus on sustainability and high-quality standards encourages the adoption of advanced IPS and VA panels, reinforcing the region's moderate but steady growth trajectory.

Asia-Pacific

Asia-Pacific dominates the TFT LCD market with a 55–65% share, led by China, South Korea, and Taiwan. The region is the global manufacturing hub for TFT LCD panels, benefiting from economies of scale, local R&D, and advanced production facilities. High consumer electronics demand, including smartphones, televisions, and gaming devices, drives domestic consumption. Emerging markets such as India and Southeast Asia are seeing rapid adoption due to increasing disposable incomes and urbanization. Large-scale exports from the region to North America, Europe, and MEA further strengthen its market leadership. Government initiatives like “Make in India” and industrial investment incentives accelerate local manufacturing and technology adoption.

Latin America

Latin America contributes 5–8% of global revenue, with Brazil, Mexico, and Argentina as key markets. Growth is fueled by increasing market penetration of consumer electronics and digital signage solutions. Economic growth and rising middle-class populations are expanding affordability, leading to higher demand for TVs, monitors, and smartphones. The gradual adoption of automotive infotainment and industrial displays, combined with targeted local distribution, supports moderate growth in the region.

Middle East & Africa

MEA accounts for approximately 5% of the global market, with the UAE, Saudi Arabia, South Africa, and Nigeria as major demand centers. Regional growth is driven by infrastructure development, including smart city projects, modern retail environments, and government-led digitalization initiatives. The tourism industry also contributes, creating demand for interactive kiosks, information displays, and digital signage in airports, hotels, and tourist attractions. Luxury consumer electronics adoption further supports market expansion, with premium IPS and VA panels being preferred for high-end applications.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the TFT LCD Market

- BOE Technology Group

- LG Display

- AU Optronics

- Innolux Corporation

- TCL CSOT

- Sharp Corporation

- Japan Display Inc.

- Samsung Display (LCD segment)

- Tianma Microelectronics

- Chimei Innolux

- Visionox

- HannStar Display

- Compal Electronics

- Hydis Technology

- AUO Crystal

Recent Developments

- In March 2025, BOE Technology announced the expansion of its Gen-11 large panel manufacturing line to enhance ultra-large TV and signage production capacity.

- In April 2025, LG Display launched a series of automotive-grade TFT LCD panels optimized for EV dashboards and high-brightness outdoor use.

- In May 2025, TCL CSOT announced a partnership with a Southeast Asian electronics manufacturer to establish local large-screen display production, benefiting from regional government incentives.