Tennis Rackets Market Size

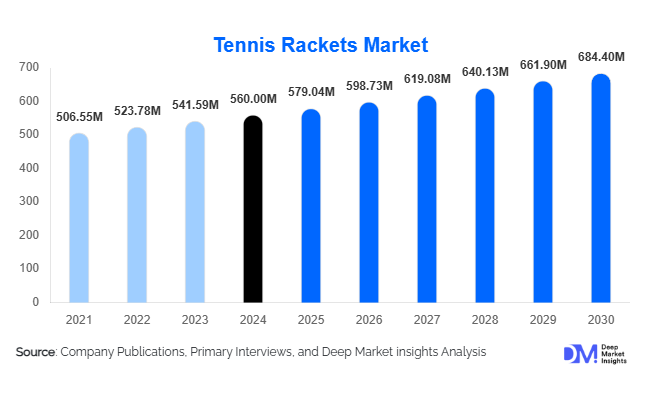

According to Deep Market Insights, the global tennis rackets market size was valued at USD 560 million in 2024 and is projected to grow from USD 579.04 million in 2025 to reach USD 684.40 million by 2030, expanding at a CAGR of 3.4% during the forecast period (2025–2030). Growth is supported by increasing recreational participation, advances in racket materials and design, and the steady expansion of tennis infrastructure across developing economies. The market’s evolution reflects both premiumization in advanced regions and new-player entry in emerging markets.

Key Market Insights

- Carbon-fiber/graphite composite rackets dominate, accounting for about 55-60% of market value in 2024 due to their lightweight performance and durability.

- Mid-plus head-size frames (98-102 sq in) lead globally, representing nearly 60% of racket sales.

- Recreational and amateur players drive about 50% of market value, highlighting the importance of the mass-participation base.

- Specialty sports stores remain the leading distribution channel with a 55% share, though e-commerce is rapidly expanding.

- North America and Europe collectively contribute 65% of the 2024 market revenue, while Asia-Pacific is the fastest-growing region (> 5% CAGR).

- Technological integration, including smart sensors and vibration-control systems, is reshaping performance benchmarking and product differentiation.

Latest Market Trends

Premiumization Through Advanced Materials

Manufacturers are focusing on high-performance composites, integrating graphene, titanium blends, and vibration-absorption technologies to improve control and comfort. These innovations elevate brand positioning and justify higher price points. Players are also demanding eco-friendly production using recycled carbon fiber and bio-resins, leading brands to invest in sustainable material R&D and green certifications.

Smart and Connected Rackets

The adoption of sensor-equipped rackets that capture swing data, ball-impact metrics, and shot analytics is gaining momentum. Professional and advanced amateurs are using these devices for performance tracking via mobile apps. The integration of AI-driven feedback is transforming training, enabling manufacturers to offer value-added digital ecosystems. Connected rackets are expected to represent 5-7% of total sales by 2030.

Tennis Rackets Market Drivers

Growing Recreational Participation

As global consumers prioritize active lifestyles, tennis is seeing renewed popularity as both a fitness and social activity. Participation surges in community clubs and school programs have strengthened replacement demand for rackets, particularly in urban areas of Asia and North America.

Technological Advancements in Design

Innovation in frame construction, such as aerodynamic profiles, shock-absorption handles, and lighter composite materials, has made rackets more ergonomic. Players at all skill levels are upgrading equipment, supporting steady market growth, and frequent model refresh cycles among key brands.

Influence of Professional Endorsements and Events

Global tournaments like the ATP and WTA tours drive aspirational demand. Endorsements by elite players create brand loyalty, influencing consumer purchasing behavior and boosting premium racket sales across all geographies.

Market Restraints

Competition from Alternative Racket Sports

Rapid expansion of sports such as padel and pickleball is diverting player interest and court development investment, especially in North America and Europe. This competition constrains incremental growth for traditional tennis equipment manufacturers.

High Product Costs in Mature Markets

Premium rackets are expensive, limiting upgrades among price-sensitive consumers. Extended replacement cycles and secondary markets for used rackets further moderate sales growth in developed economies.

Tennis Rackets Market Opportunities

Expansion in Emerging Economies

Markets in India, China, and Southeast Asia are experiencing rapid growth in youth participation, tennis academies, and public-court construction. Affordable local manufacturing and strategic brand partnerships can unlock high-volume sales opportunities in these regions.

Technology Integration and Data Analytics

Connected rackets and digital coaching ecosystems present lucrative avenues for differentiation. Partnerships with wearable-tech firms can create new revenue streams through app subscriptions and data-driven performance insights.

Direct-to-Consumer (D2C) and E-commerce Expansion

Brands are strengthening online channels, enabling customization options for grip, weight, and color. D2C distribution enhances margins, global reach, and personalized customer engagement, especially for younger, tech-savvy buyers.

Product Type Insights

Carbon-fiber/graphite rackets dominate the market with a 60% value share in 2024. They provide a superior stiffness-to-weight ratio and control, making them preferred among professionals and serious amateurs. Aluminum and hybrid composite rackets cater to recreational users, offering lower costs and higher durability. Wooden rackets remain a niche for heritage collectors and training purposes.

Head Size Insights

Mid-plus rackets (98–102 sq in) capture roughly 60% market share due to their versatile balance of power and control. Oversized frames appeal to beginners seeking forgiveness, while midsize frames serve professionals requiring precision. The mid-plus category remains the global standard, sustaining consistent replacement demand.

Distribution Channel Insights

Specialty sports retailers hold around 55% share of total racket sales in 2024, driven by in-store demo services, expert fitting, and stringing facilities. However, online retail and brand-owned stores are the fastest-growing channels, rising at > 7% CAGR through 2030. Digital sales are supported by interactive product visualization, influencer marketing, and flexible return policies.

End-Use Insights

Recreational and club-level players dominate unit demand, while professional and tour-level players drive value growth. The junior/youth segment is expanding rapidly estimated > 5% CAGR due to government-supported sports programs and growing parental investment in training. Manufacturers supplying school and academy equipment are benefiting from export-driven demand from Asia and Latin America.

| By Product Type | By Material Type | By Distribution Channel | By End User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

Accounting for about 35% of global value in 2024, North America remains the largest region. The U.S. tennis boom post-pandemic continues, supported by strong retail networks and frequent equipment upgrades. Premium performance rackets dominate sales, driven by brand loyalty and tournament exposure.

Europe

Europe contributes roughly 30% of global revenue, anchored by mature markets such as the U.K., France, Germany, Spain, and Italy. Growth is moderate, with emphasis on sustainability and eco-friendly materials. European consumers increasingly prioritize racket recyclability and ethical manufacturing practices.

Asia-Pacific

With a 25% market share in 2024, Asia-Pacific is the fastest-growing region (5-6% CAGR). China and India are expanding rapidly through tennis academies and celebrity endorsements. Japan and Australia represent mature markets emphasizing quality and innovation.

Latin America

Holding an 8-10% share, Latin America’s market is led by Brazil and Argentina, where tennis enjoys cultural significance. Rising middle-class incomes and local tournaments are stimulating moderate growth.

Middle East & Africa

Representing a 5-7% share, this region benefits from growing sports infrastructure in Gulf countries. Africa’s demand centers on South Africa and Kenya, where tennis federations are promoting junior participation.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Tennis Rackets Market

- Wilson Sporting Goods Co.

- Babolat VS S.A.

- Head NV

- Yonex Co., Ltd.

- Prince Global Sports LLC

- Dunlop Sports Group

- Technifibre

- Volkl Tennis

- ProKennex International Co.

- Pacific Brands Tennis Division

- Gamma Sports

- Slazenger

- Solinco

- Diadora Sport

- PowerAngle Inc.

Recent Developments

- March 2025: Wilson launched a new AI-integrated “Shift Pro” racket featuring embedded swing analytics sensors.

- February 2025: Babolat introduced eco-friendly graphite frames using 50% recycled carbon fiber in its Pure Strike Eco series.

- January 2025: Head NV announced an expansion of its manufacturing capacity in China to meet rising Asia-Pacific demand.