Tattoo Removal Lasers Market Size

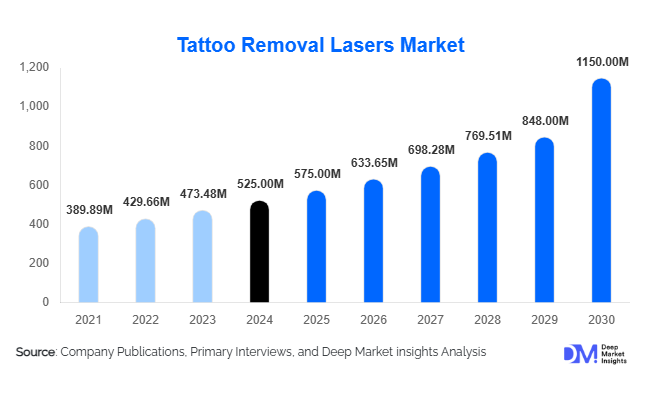

According to Deep Market Insights, the global tattoo removal lasers market was valued at USD 525 million in 2024 and is projected to grow from USD 575 million in 2025 to reach USD 1,150 million by 2030, expanding at a CAGR of 10.2% during the forecast period (2025–2030). The growth of the tattoo removal lasers market is primarily driven by rising aesthetic consciousness, increasing tattoo regret among consumers, and the adoption of advanced laser technologies such as picosecond and multi-wavelength systems that offer faster and safer removal solutions.

Key Market Insights

- Picosecond lasers are emerging as the fastest-growing technology segment, offering shorter treatment durations, fewer sessions, and better results for multi-colour tattoos and darker skin types.

- Aesthetic clinics and medical spas dominate end-use applications, accounting for the majority of device revenues due to elective procedures and higher adoption of advanced laser technologies.

- North America holds the largest market share (42% in 2024), driven by high tattoo prevalence, disposable income, and strong regulatory frameworks for device approval.

- Asia-Pacific is the fastest-growing region, fueled by increasing disposable income, growing aesthetic awareness, and the expansion of dermatology and cosmetic clinics in China, India, and Southeast Asia.

- Regulatory compliance and safety certifications are becoming key differentiators, as consumers and clinics increasingly prefer FDA- or CE-approved devices.

- Export-driven demand from North America and Europe is shaping growth in emerging regions, with high-end devices being imported into Asia-Pacific, Latin America, and the Middle East.

Latest Market Trends

Advanced Laser Technologies Driving Adoption

The tattoo removal lasers market is witnessing rapid adoption of advanced technologies such as picosecond lasers, combination/multi-wavelength devices, and AI-integrated systems. These innovations provide enhanced pigment clearance, minimize side effects, and reduce the number of sessions required. Clinics are increasingly upgrading from Q-switched and nanosecond lasers to picosecond systems, particularly for multi-colour professional tattoos. Integrated cooling and skin-sensing features further enhance patient safety and comfort, making treatments more appealing to a broader consumer base.

Portable and AI-Enhanced Devices

Emerging portable and handheld laser systems are gaining traction, particularly in mid-sized clinics and emerging markets. AI-powered features such as pigment mapping, real-time fluence adjustment, and skin-type recognition improve precision and patient outcomes. Telemedicine-enabled laser consultations and treatment planning apps are further enhancing accessibility and treatment customization, attracting tech-savvy younger demographics. This integration of AI and digital tools is reshaping the market landscape, allowing clinics to offer faster, safer, and more efficient procedures.

Tattoo Removal Lasers Market Drivers

Increasing Tattoo Regret and Social Trends

Rising awareness of tattoo regret, lifestyle changes, and workplace requirements is driving demand for tattoo removal. Millennials and Gen Z consumers, who have higher tattoo adoption rates, are increasingly seeking aesthetic correction or modification. The growing social emphasis on professional appearance and changing fashion trends is further fueling the adoption of tattoo removal lasers, particularly in urban centers and regions with higher disposable incomes.

Technological Advancements and Improved Safety

Advancements such as picosecond lasers, multi-wavelength systems, and integrated cooling have enhanced treatment efficiency and safety. These improvements reduce recovery time, minimize side effects, and allow treatment across different skin types. Clinics and medical spas are investing in cutting-edge devices to meet consumer expectations, improve patient satisfaction, and maintain competitive advantage.

Rising Disposable Incomes and Cosmetic Spending

Higher disposable incomes in emerging regions, coupled with increased spending on non-invasive aesthetic procedures, are driving the adoption of tattoo removal services. Expanding cosmetic clinics, medical spas, and dermatology practices, particularly in Asia-Pacific and Latin America, are facilitating market growth. Consumer willingness to invest in premium aesthetic services supports both device sales and recurring revenue streams from treatment packages.

Market Restraints

High Treatment Cost and Multiple Sessions

Tattoo removal typically requires multiple sessions, particularly for multi-colour or professional tattoos, increasing overall cost for consumers. The high upfront cost of advanced laser devices also affects clinics, limiting adoption in price-sensitive regions. These factors act as barriers to broader market penetration, particularly in emerging economies.

Regulatory and Safety Challenges

Strict regulatory requirements and the need for trained personnel can delay device adoption. Safety concerns, such as risks of scarring, pigmentation changes, and incomplete removal, also impact consumer confidence. Variability in regulations across countries further complicates market expansion and requires significant compliance investment by manufacturers and clinics.

Market Opportunities

Emerging Markets and Regional Expansion

Asia-Pacific, Latin America, and the Middle East present high-growth opportunities for tattoo removal lasers. Increasing urbanization, rising middle-class affluence, and growing aesthetic awareness are driving demand for advanced laser systems. Strategic entry through partnerships, localized manufacturing, or export of high-end devices can unlock incremental revenue streams in these regions.

Integration of AI and Hybrid Technologies

Combining laser technologies with AI, skin sensors, and cooling systems provides opportunities to differentiate products and improve outcomes. Hybrid devices that merge multiple wavelengths, adjustable pulses, and real-time treatment monitoring enhance efficiency and patient satisfaction, enabling premium pricing and brand recognition.

Regulatory Compliance as a Differentiator

Manufacturers that achieve FDA, CE, or regional certifications gain a competitive advantage, as clinics and patients increasingly prefer certified devices for safety and efficacy. Providing clinical evidence and certified outcomes can strengthen trust and expand market share.

Product Type Insights

Picosecond lasers lead the market in terms of growth due to superior pigment clearance, fewer sessions, and suitability for darker skin types. Q-switched lasers remain prevalent but are gradually losing share to advanced technologies. Multi-wavelength and hybrid systems are also emerging as high-potential segments, particularly in aesthetic and dermatology clinics seeking comprehensive treatment options.

Application Insights

Professional tattoos represent the largest application segment, accounting for 55% of revenue in 2024. Multi-colour and heavily inked tattoos require advanced removal technologies, driving the adoption of high-end lasers. Cosmetic tattoos and permanent make-up removal are also gaining traction, while amateur tattoos contribute to a smaller share of the overall market.

Distribution Channel Insights

Direct sales remain the leading channel, particularly for high-end laser devices in clinics and hospitals. Distributor and dealer networks support growth in emerging regions, while online sales and e-commerce platforms are gradually increasing the adoption of portable or mid-range devices. Service contracts, maintenance, and consumables provide additional revenue streams for manufacturers.

End-User Insights

Aesthetic clinics and medical spas dominate the market, contributing 75% of 2024 revenue. Hospitals and dermatology departments follow, while tattoo studios offering removal services represent a smaller, yet growing segment. Increasing awareness and adoption in emerging markets are likely to shift end-use distribution toward clinics and spas that cater to middle- and high-income consumers.

| By Product Type | By Application | By End-User | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America is the largest regional market, accounting for 42% of global revenue in 2024. The U.S. leads due to high tattoo prevalence, advanced healthcare infrastructure, and strong disposable income. Canada also contributes significantly, with growing interest in aesthetic clinics and med-spas. Demand is driven by both consumer awareness and regulatory-certified device adoption.

Europe

Europe holds 22% of the market in 2024, with Germany, the U.K., and France leading adoption. Regulatory compliance, safety certifications, and advanced dermatology clinics support market growth. Younger demographics are fueling demand for both professional tattoo removal and cosmetic tattoo modification.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by China, India, Japan, and Southeast Asia. Rising disposable income, urbanization, and aesthetic awareness are increasing the demand for advanced laser systems. Clinics are investing in picosecond and multi-wavelength devices to cater to both professional and cosmetic tattoo removal.

Latin America

Brazil, Mexico, and Argentina represent key markets, though overall adoption is limited by cost sensitivity. Demand is increasing among middle- and high-income consumers, particularly for aesthetic clinic services.

Middle East & Africa

Wealthy Gulf countries such as the UAE, Saudi Arabia, and Qatar are driving demand in the Middle East. South Africa leads regional demand in Africa, supported by urban clinics and cosmetic service providers. Medical tourism is also contributing to growth in both regions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Tattoo Removal Lasers Market

- Cynosure (Hologic, Inc.)

- Lumenis Ltd.

- Cutera, Inc.

- Fotona d.o.o.

- Alma Lasers Ltd.

- Lutronic Corporation

- Candela Corporation

- Asclepion Laser Technologies GmbH

- Quanta System S.p.A.

- EL.EN. S.p.A.

- Astanza Laser

- Lynton Lasers Ltd.

- Beijing Nubway S&T

- BISON Medical

- Sciton Inc.

Recent Developments

- In March 2025, Cynosure launched a next-generation picosecond laser with AI-assisted pigment mapping, reducing treatment sessions by up to 30%.

- In January 2025, Lumenis expanded its presence in Asia-Pacific by establishing a regional training and service center in India to support dermatology clinics and aesthetic centers.

- In November 2024, Cutera introduced a portable multi-wavelength laser system targeting mid-size clinics and emerging markets, enhancing device accessibility and reducing capital expenditure for clinics.