Tattoo After-Care Products Market Size

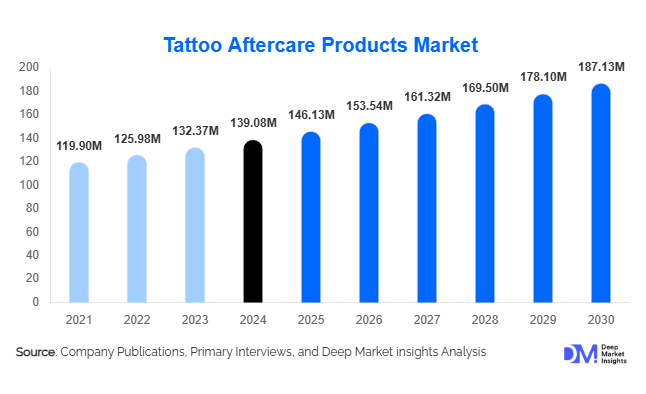

According to Deep Market Insights, the global tattoo after-care products market size was valued at USD 139.08 million in 2024 and is projected to grow from USD 146.13 million in 2025 to reach USD 187.13 million by 2030, expanding at a CAGR of 5.07% during the forecast period (2025–2030). Market growth is primarily driven by the rising global popularity of tattoos, growing consumer awareness of skin health post-tattoo, and the emergence of premium, dermatologist-approved, and vegan after-care formulations.

Key Market Insights

- Moisturizers and lotions dominate the product category, accounting for over 50% of global revenue due to their daily-use convenience and broad adoption across new and healed tattoos.

- North America leads the global market with approximately 40% share in 2024, supported by a mature tattoo culture and advanced e-commerce channels.

- Asia-Pacific is the fastest-growing region, projected to register a double-digit CAGR driven by rising tattoo adoption in India, South Korea, and Southeast Asia.

- Vegan, cruelty-free, and natural formulations are becoming key purchasing factors, with brands integrating organic oils, shea butter, and aloe vera-based products.

- E-commerce and direct-to-consumer (D2C) models are reshaping distribution, offering personalized after-care kits, subscriptions, and studio-bundled starter packs.

- Professional partnerships with tattoo studios are emerging as a key sales channel for premium brands targeting at-point-of-service demand.

What are the latest trends in the tattoo after-care products market?

Premiumization and Natural Formulations

Clean-label, plant-based, and hypoallergenic formulations are gaining traction as consumers seek safer healing products for tattooed skin. Brands are investing in vegan certifications, sustainable packaging, and transparency in ingredient sourcing. Premium products that combine hydration with protective actives such as SPF, antioxidant oils, and anti-fading compounds are emerging as differentiators. This premiumization trend is expected to expand profit margins and attract health-conscious consumers who associate tattoos with self-care and lifestyle identity.

Studio Partnerships and Professional Integration

Tattoo studios and parlors are becoming pivotal distribution partners for after-care brands. Co-branded starter kits and professional-grade balms provided immediately after a tattoo procedure ensure early product adoption and long-term customer loyalty. Professional endorsement enhances credibility, while retail tie-ups with tattoo chains and training programs for artists are helping brands establish themselves as trusted post-care experts.

Emerging Applications and New Consumer Segments

Beyond traditional body tattoos, the rise of permanent makeup (PMU), microblading, and scalp micropigmentation (SMP) is expanding the market scope. These applications require gentle formulations for facial and scalp skin, prompting the development of specialized after-care products. This diversification into beauty and cosmetic micropigmentation after-care represents a major growth frontier for existing players and new entrants alike.

What are the key drivers in the tattoo after-care products market?

Rising Global Tattoo Adoption

Tattoos have shifted from subculture expression to mainstream fashion and identity statements. Increasing tattoo prevalence among Millennials and Gen Z, combined with the normalization of body art in professional settings, has expanded the consumer base. As more individuals get tattooed, demand for proper skin-healing solutions continues to accelerate.

Growing Awareness of Post-Tattoo Skin Health

Dermatologists and tattoo professionals are educating clients about infection risks, color fading, and proper after-care routines. This has driven the replacement of generic ointments with dedicated, dermatologically tested after-care products. The result is greater market differentiation and brand loyalty within the skincare ecosystem.

E-Commerce Expansion and Digital Branding

Online platforms and social media marketing have transformed how after-care products reach consumers. D2C websites, influencer partnerships, and subscription-based care kits allow brands to reach tattoo enthusiasts globally. Real-time reviews, tutorials, and product demos enhance transparency and consumer trust, fostering rapid adoption of premium products.

What are the restraints for the global market?

Limited Awareness in Emerging Markets

Despite rising tattoo trends, consumer knowledge of specialized after-care remains low in developing economies. Many users substitute general skincare or petroleum-based ointments, slowing market penetration for professional products. Regulatory inconsistencies and limited product availability in retail further challenge adoption.

Fragmented Market and Counterfeit Risks

The global tattoo after-care landscape remains fragmented, with numerous small brands offering variable quality. Counterfeit or unverified formulations can lead to allergic reactions or poor healing, damaging overall consumer trust. Establishing global standards and certification systems remains a key challenge for long-term credibility.

What are the key opportunities in the tattoo after-care products industry?

Growth in Natural and Vegan-Certified Lines

Rising consumer preference for natural, cruelty-free, and sustainable skincare presents major opportunities for differentiation. Brands adopting organic ingredients such as coconut oil, chamomile extract, and shea butter are capturing environmentally conscious consumers. Product certifications, vegan, FDA-approved, and dermatologically tested, enhance brand reputation and export potential.

Strategic Studio Partnerships

Collaboration with tattoo studios through co-branding and exclusive product lines enables companies to access customers immediately post-procedure, ensuring early brand exposure. Studios acting as retail points bridge the gap between procedure and home-care, driving recurring demand for refills and complementary products such as cleansers and SPF creams.

Expansion into Emerging Regions and Cosmetic Tattoo Segments

Rapid tattoo adoption in Asia-Pacific, Latin America, and the Middle East, alongside the rising popularity of permanent makeup, offers vast untapped potential. Brands entering these regions with locally manufactured, affordable formulations stand to benefit from first-mover advantage and increasing social acceptance of tattoo culture.

Product Type Insights

Moisturizers, lotions, and oils lead the market with an estimated 50% share in 2024. These products are preferred due to their versatility, non-greasy texture, and daily applicability beyond initial healing. Balms and salves represent the second-largest category, catering to the immediate post-tattoo recovery phase. Protective films, cleansers, and tattoo-specific sunscreens remain niche but are recording the fastest growth rates as innovation introduces breathable film technologies and SPF-infused maintenance solutions.

Application Insights

Personal or individual use dominates demand, fueled by e-commerce accessibility and home-based after-care routines. However, the professional tattoo studio channel remains crucial as many brands distribute through artist partnerships and in-studio retail. New applications in PMU and SMP clinics are emerging as complementary verticals, opening avenues for sensitive-skin-oriented after-care formulations and cross-marketing with cosmetic dermatology products.

Distribution Channel Insights

Online sales account for the largest and fastest-growing channel, supported by social media marketing, influencer engagement, and global shipping options. Direct-to-consumer brands leverage personalized marketing and subscription models for repeat purchases. Offline retail—including tattoo studios, pharmacies, and specialty beauty outlets—continues to play a strong role in brand visibility and trust-building, especially for first-time buyers seeking professional recommendations.

Material & Formulation Insights

Natural and organic formulations are expected to outpace synthetic counterparts during the forecast period. Consumers are increasingly wary of parabens, alcohol, and petroleum bases, preferring plant-derived, hypoallergenic alternatives. Hybrid formulations combining organic ingredients with active dermatological agents (vitamin E, panthenol) are gaining share as they offer enhanced healing and moisture retention without irritation.

| By Product Type | By Ingredient Type | By Skin Type | By Distribution Channel | By End Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds approximately a 40% share of the global market in 2024 (USD 100 million). The U.S. drives this dominance through a well-established tattoo culture, rising studio counts, and a mature skincare infrastructure. Brands benefit from advanced logistics, widespread e-commerce adoption, and collaborations with celebrity tattoo artists that strengthen digital visibility.

Europe

Europe contributes about 30% of global revenue (USD 75 million) with strong demand from Germany, the U.K., France, and Italy. The region emphasizes product safety, ingredient transparency, and eco-friendly packaging under strict EU cosmetics regulations. Growing tattoo tourism across Spain and Portugal also boosts regional demand.

Asia-Pacific

APAC is the fastest-growing region, expected to achieve a CAGR above 13% through 2030. Rising youth culture, social media influence, and the expansion of professional tattoo studios in China, Japan, India, and South Korea are accelerating adoption. Affordable price points and localized e-commerce platforms are making premium products accessible to broader demographics.

Latin America

Latin America holds a 7–10% market share (USD 20–25 million) led by Brazil and Mexico. A vibrant body-art culture, rising disposable incomes, and increasing exposure to global beauty trends are key drivers. Brands are focusing on partnerships with local influencers and tattoo conventions to increase visibility.

Middle East & Africa

MEA accounts for under 5% of the global market (USD 10–15 million) but shows promising potential in the UAE, Saudi Arabia, and South Africa. Affluent consumers and strong retail ecosystems support premium after-care imports, while rising tattoo acceptance among younger urban populations hints at long-term growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Tattoo After-Care Products Market

- Bayer AG

- Beiersdorf Inc.

- Dr. Bronner’s Magic Soaps

- Tattoo Goo LLC

- Hustle Butter Deluxe

- INK-EEZE

- Dermalize

- H2Ocean Inc.

- Redemption Aftercare

- Skinfix Inc.

- La Roche-Posay

- Viking Revolution LLC

- Aussie Inked

- Ora’s Amazing Herbal

- TATSoul

Recent Developments

- In June 2025, Hustle Butter Deluxe introduced a biodegradable packaging line to align with sustainability initiatives and reduce plastic waste in after-care products.

- In May 2025, INK-EEZE partnered with international tattoo conventions in Europe and Japan to promote its professional-grade after-care kits directly to artists and consumers.

- In March 2025, Tattoo Goo LLC expanded its product portfolio with SPF-infused after-care lotion to prevent tattoo fading from UV exposure.

- In February 2025, H2Ocean Inc. launched a vegan, cruelty-free healing balm with natural sea-mineral actives, targeting eco-conscious consumers in North America and Europe.