Tattoo Accessories Market Size

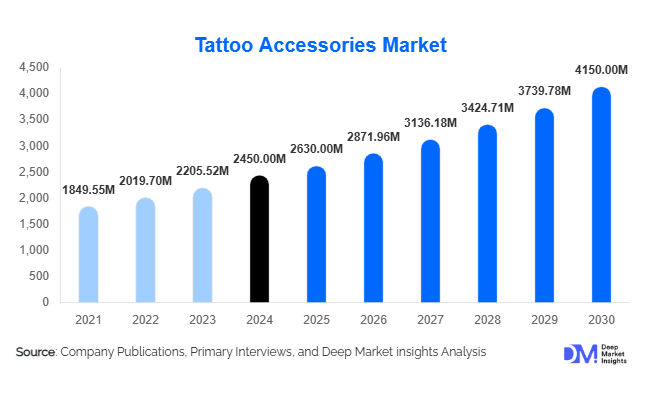

According to Deep Market Insights, the global tattoo accessories market size was valued at USD 2,450 million in 2024 and is projected to grow from USD 2,630 million in 2025 to reach USD 4,150 million by 2030, expanding at a CAGR of 9.2% during the forecast period (2025–2030). The tattoo accessories market growth is primarily driven by the increasing popularity of body art, rising adoption of professional tattoo studios, and expanding applications in cosmetic and medical tattooing, alongside growing consumer interest in personalized tattoo experiences.

Key Market Insights

- Tattoo culture is expanding globally, with millennials and Gen Z driving demand for personalized and cosmetic tattoos.

- Technological advancements in tattoo machines and inks are improving precision, safety, and overall customer experience, fueling market growth.

- North America dominates the tattoo accessories market, with the U.S. and Canada leading demand due to established tattoo culture and regulatory compliance standards.

- Asia-Pacific is the fastest-growing region, driven by rising disposable incomes, emerging tattoo studios, and growing awareness of professional tattoo services.

- E-commerce platforms and online retailing are significantly enhancing accessibility to tattoo accessories, enabling both professional studios and DIY consumers to procure high-quality products globally.

- Government initiatives and hygiene regulations in various regions are shaping product standards and boosting the adoption of certified tattoo accessories.

Latest Market Trends

Rise of Cosmetic and Medical Tattooing

Cosmetic tattooing, including permanent makeup for eyebrows, lips, and scalp micropigmentation, is gaining traction alongside medical tattoo applications such as scar camouflage and vitiligo treatments. These segments are expanding beyond traditional body art, creating demand for specialized inks, precision machines, and hygienic aftercare products. The trend is particularly strong in urban regions of North America, Europe, and the Asia-Pacific, where consumers prioritize aesthetics and professional standards.

Technological Integration in Tattoo Equipment

Advances in rotary and digital tattoo machines, wireless tattoo pens, and smart sterilization equipment are transforming the market. High-performance needles, cartridges, and color-stable inks enhance efficiency and safety. Additionally, innovations in vegan and hypoallergenic inks are meeting consumer demand for ethical and skin-friendly solutions. Studios and clinics are increasingly adopting high-tech accessories to improve client satisfaction, reduce procedure time, and comply with stringent hygiene regulations.

Tattoo Accessories Market Drivers

Increasing Tattoo Culture and Body Art Acceptance

The global rise in tattoo acceptance among younger demographics is a major driver. Tattoos are no longer limited to subcultures, and professional studios offering modern designs are flourishing. Social media platforms showcasing tattoos and influencer-led promotion are expanding consumer awareness, directly impacting demand for high-quality tattoo accessories, including needles, inks, and machines.

Growth in Cosmetic and Medical Tattoo Applications

Permanent makeup, scalp micropigmentation, and medical tattooing provide significant growth avenues. Dermatology clinics and cosmetic centers are increasingly adopting tattoo accessories for professional procedures, driving demand for precision tools, certified inks, and specialized aftercare products. This segment is expected to expand at a faster rate than traditional tattoo applications due to increasing consumer preference for aesthetic enhancements and medical corrections.

Expansion of E-Commerce and Online Distribution

Online retailing of tattoo accessories is rapidly growing, allowing studios and consumers to access global brands conveniently. E-commerce provides price transparency, product variety, and educational resources for DIY users. The rise of online marketplaces is also facilitating brand penetration in emerging regions, enabling smaller players to enter the market and compete effectively.

Market Restraints

Regulatory and Hygiene Challenges

Strict regulations around tattoo inks, needles, and sterilization equipment create compliance hurdles for manufacturers and studios. Non-compliance can lead to legal repercussions, limiting market entry for new players. Regulatory differences across regions also challenge global product standardization.

High Equipment and Material Costs

High-quality tattoo machines, inks, and sterilization equipment require substantial investment, restricting small studios and individual artists. The cost barrier slows the adoption of advanced products and may hinder market penetration in price-sensitive regions, especially in emerging economies.

Tattoo Accessories Market Opportunities

Emerging Regional Markets

Asia-Pacific, Latin America, and parts of the Middle East offer significant growth potential. Rising disposable incomes, urbanization, and increasing acceptance of tattoos are driving demand in India, China, and Brazil. Entry into these markets with localized products, training programs for artists, and affordable packages can capture substantial market share.

Advanced Technology Integration

Investment in smart tattoo machines, wireless pens, and vegan or hypoallergenic inks can differentiate brands. Studios and clinics adopting advanced equipment enhance safety and efficiency, offering a competitive edge. Innovations in sterilization, digital stencil printing, and precision needles also present premium pricing opportunities.

Regulatory Compliance and Certification

Offering certified and compliant tattoo accessories builds trust with studios and end-users. Governments promoting hygiene standards in tattooing create opportunities for manufacturers to position themselves as safe, reliable suppliers. Participation in national initiatives such as India’s “Make in India” or China’s “Made in China 2025” can further support market growth through subsidies and incentives.

Product Type Insights

Tattoo needles and cartridges dominate the market, accounting for approximately 28% of the 2024 global market. Demand is driven by frequent replacements, precision requirements, and compatibility with various tattoo machines. Tattoo inks are the second-largest segment, representing around 24% of the market, fueled by growing cosmetic tattoo applications and the need for vibrant, stable pigments. The trend toward vegan and hypoallergenic inks is also contributing to market expansion.

Application Insights

Traditional tattooing holds the largest share at 40% of the 2024 market due to the high number of professional studios and hobbyist artists worldwide. Cosmetic and medical tattoos are the fastest-growing applications, driven by demand for permanent makeup, scalp pigmentation, and scar camouflage solutions. Temporary tattoos, while niche, are popular in events and festivals, providing additional revenue streams.

Distribution Channel Insights

Offline channels such as specialty stores and beauty supply shops dominate initial sales; however, online channels are rapidly gaining share, particularly in North America and Europe. E-commerce facilitates access to high-quality accessories for studios and DIY users, while offering pricing transparency and product education. Digital marketing and influencer campaigns are increasingly shaping purchase decisions.

End-Use Insights

Tattoo studios and parlors account for the largest demand share, representing over 50% of the market, due to recurring purchases of needles, inks, and sterilization equipment. Dermatology and cosmetic clinics are growing rapidly, providing demand for specialized machines, inks, and aftercare products. Retail and e-commerce channels support DIY consumers, while event-based temporary tattoo applications offer niche opportunities. Export-driven demand is notable from North America and Europe to the Asia-Pacific and Latin America, creating additional growth avenues.

| By Product Type | By Application | By End-Use | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds approximately 35% of the 2024 tattoo accessories market, driven by the U.S. and Canada. Established tattoo culture, regulatory standards, and high disposable incomes support widespread adoption of professional-grade equipment. Cosmetic tattooing is a key growth driver, particularly in urban centers.

Europe

Europe accounts for around 28% of the 2024 market. Germany, the U.K., and France are leading consumers due to high studio density and growing awareness of hygiene standards. The region also sees a surge in cosmetic and medical tattoo applications, contributing to strong market growth.

Asia-Pacific

Asia-Pacific is the fastest-growing region, fueled by rising middle-class incomes, expanding tattoo culture, and increasing e-commerce penetration. Countries like India, China, Japan, and Australia are witnessing growth in professional studios and cosmetic tattoo services, positioning the region as a critical market for the future.

Latin America

Brazil, Argentina, and Mexico are emerging markets for tattoo accessories, with rising disposable incomes and expanding interest in professional tattooing. While still small in market size, the growth potential is significant for mid-range and cosmetic tattoo products.

Middle East & Africa

MEA accounts for a smaller portion of the market but is gaining traction in urban areas. UAE and Saudi Arabia lead adoption due to high-income consumers and luxury tattoo trends. Africa, as a whole, shows potential for growth through cosmetic and permanent tattoo applications in healthcare and aesthetic clinics.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Tattoo Accessories Market

- Cheyenne Professional Tattoo Equipment

- FK Irons

- Eikon Device

- Dragonhawk Tattoo Supply

- Hawink Tattoo Equipment

- Kwadron

- Stigma-Rotary

- Intenze Tattoo Ink

- World Famous Tattoo Ink

- Dynamic Tattoo Supply

- Vampire Tattoo Ink

- Silverback Ink

- Atom Tattoo Machines

- INKJECTA

- Critical Tattoo Supply

Recent Developments

- In March 2025, Cheyenne launched a next-generation wireless rotary machine, improving precision and reducing artist fatigue.

- In January 2025, FK Irons introduced a certified vegan ink line targeting cosmetic tattooing applications in Europe and North America.

- In December 2024, Dragonhawk expanded e-commerce operations in Asia-Pacific, facilitating direct-to-consumer access to needles, inks, and machines.