Tank Tops and Sleeveless Market Size

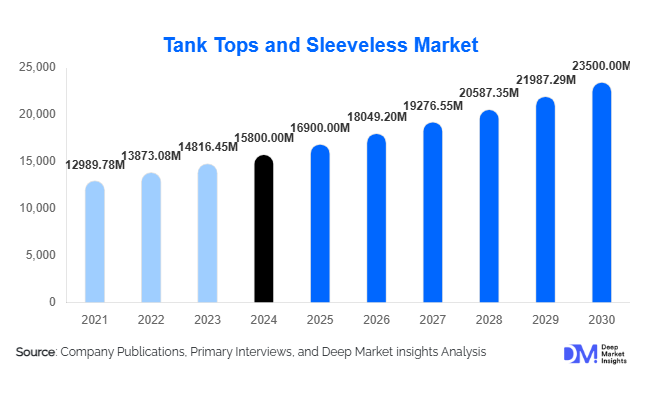

According to Deep Market Insights, the global tank tops and sleeveless market size was valued at USD 15,800 million in 2024 and is projected to grow from USD 16,900 million in 2025 to reach USD 23,500 million by 2030, expanding at a CAGR of 6.8% during the forecast period (2025–2030). The market growth is primarily driven by rising athleisure trends, increasing consumer preference for casual and performance-oriented apparel, and the growing penetration of e-commerce and branded retail channels globally.

Key Market Insights

- Performance and athleisure tank tops are gaining popularity, particularly among fitness enthusiasts and younger demographics seeking stylish yet functional apparel.

- Women’s segment dominates the market, reflecting fashion variety, seasonal trends, and social media influence that drives demand for branded and designer tank tops.

- North America leads the market, driven by high disposable income, fitness culture, and a strong affinity for branded and premium products.

- Asia-Pacific is the fastest-growing region, led by urbanization, rising middle-class income in India and China, and expanding online retail infrastructure.

- Sustainable and eco-friendly fabrics are emerging as a key consumer preference, providing opportunities for premium-priced tank tops made of organic cotton, bamboo, and recycled fibers.

- E-commerce platforms and direct-to-consumer channels are reshaping market dynamics by offering variety, convenience, and targeted marketing to younger consumers.

Latest Market Trends

Rise of Athleisure and Sports-Inspired Apparel

Tank tops and sleeveless apparel are increasingly being worn not just as casual clothing but as part of athleisure and sports wardrobes. Moisture-wicking, sweat-resistant, and stretchable fabrics are becoming standard, particularly in sports and performance categories. Consumers are now expecting designs that combine fashion with functionality, which has led to collaborations between sports brands and high-street fashion labels. Social media influence and celebrity endorsements are further amplifying demand for stylish sleeveless wear that can transition from workouts to casual outings.

Technology-Integrated and Sustainable Textiles

Innovation in fabrics is driving market growth. Smart textiles with anti-odor, UV protection, and moisture-wicking capabilities are appealing to fitness-conscious and outdoor enthusiasts. Simultaneously, sustainable and eco-friendly materials such as organic cotton, bamboo, and recycled polyester are becoming mainstream, catering to environmentally conscious consumers. Companies integrating both technology and sustainability gain a competitive edge by targeting premium segments and eco-aware millennials.

Tank Tops and Sleeveless Market Drivers

Rising Popularity of Athleisure and Fitness Apparel

The global shift toward fitness-oriented lifestyles is fueling demand for sports and performance tank tops. Consumers increasingly prefer apparel that supports workouts while offering style, comfort, and breathability. Fitness clubs, yoga studios, and outdoor sports activities are driving bulk purchases for institutional and retail consumption.

Increasing Disposable Income and Urbanization

Urban populations in emerging economies such as India, China, and Brazil are adopting Western fashion trends, including casual and athleisure wear. Rising disposable incomes allow consumers to purchase branded and premium tank tops, expanding market growth in these regions.

Growth of E-commerce Platforms

Online retail has lowered barriers for consumers to access a wide range of designs, fabrics, and brands. E-commerce also enables brands to reach niche segments, promote limited-edition collections, and leverage data-driven marketing to increase sales efficiency and customer loyalty.

Market Restraints

Price Sensitivity in Developing Regions

While premium tank tops are growing in popularity, many consumers in price-sensitive markets still prefer low-cost, unbranded options. This limits the growth of higher-margin products in emerging economies.

Raw Material Price Volatility

Fluctuations in cotton, polyester, and elastane prices can impact manufacturing costs and retail pricing. Supply chain disruptions and trade restrictions can further constrain profitability and limit growth potential.

Tank Tops and Sleeveless Market Opportunities

Expansion in Emerging Markets

Countries in the Asia-Pacific, including India, Vietnam, and Thailand, offer substantial growth opportunities due to rising incomes, urbanization, and increased e-commerce adoption. Local manufacturing and strategic partnerships can help brands tap into this growing demand.

Integration of Smart and Sustainable Fabrics

Technologically advanced fabrics with moisture-wicking, anti-odor, and UV protection features are in high demand. Combining these with sustainable materials provides a unique positioning for premium segments and differentiates brands in a competitive landscape.

Brand Collaborations and Influencer Marketing

Collaborations with fashion designers, fitness brands, and social media influencers are creating viral trends and exclusive collections. This strategy helps brands engage younger demographics and boost online sales through limited-edition tank tops and promotional campaigns.

Product Type Insights

Sports and sweat-wicking tank tops dominate the market, accounting for 28% of global market share in 2024. Their popularity stems from growing fitness trends and demand for performance apparel. Fashion and designer tank tops are also gaining traction in premium segments, while basic cotton tank tops retain a steady demand due to affordability and comfort.

Material Insights

Cotton remains the most preferred material, representing 35% of the market in 2024. Consumers favor natural fabrics for their comfort and breathability. Polyester blends and elastane-based fabrics are prominent in performance and sportswear categories, catering to moisture-wicking and stretchability requirements.

End-Use Insights

The women’s segment leads with 45% market share in 2024, driven by variety, seasonal fashion trends, and athleisure adoption. Men’s and kids’ segments are growing, particularly in sportswear categories. Export-driven demand is significant from the U.S., Germany, and Japan, with emerging applications in work-from-home casual wear and eco-friendly apparel.

Distribution Channel Insights

Online retail is the fastest-growing channel, holding 32% of market share in 2024. Convenience, variety, and targeted promotions drive growth. Offline retail remains important, especially in department stores and branded stores, while multi-brand stores and specialty outlets cater to local consumer preferences.

| By Product Type | By Material Type | By End-Use | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for 30% of the global market, led by the U.S. due to high disposable income, fitness culture, and preference for premium and branded tank tops. Canada shows moderate but steady demand. Consumers prioritize athleisure, branded, and designer products.

Europe

Europe holds 25% market share, with Germany, the U.K., and France as major contributors. Consumers prefer sustainable, fashionable, and performance-driven tank tops. The market is driven by eco-conscious choices and high online retail adoption.

Asia-Pacific

APAC is the fastest-growing region. China and India are driving demand through urbanization, rising middle-class incomes, and online retail penetration. Japan and South Korea represent mature markets focused on performance and lifestyle apparel.

Middle East & Africa

MEA contributes 10% of the market, led by the UAE and Saudi Arabia. Demand is fueled by high disposable incomes, fashion awareness, and growing fitness trends.

Latin America

LATAM represents 7% of the market, with Brazil and Mexico leading demand. Youth fashion trends and increasing participation in fitness activities support market growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Tank Tops and Sleeveless Market

- Nike

- Adidas

- Puma

- Under Armour

- Lululemon

- H&M

- Zara

- Uniqlo

- VF Corporation

- Hanesbrands

- Gildan

- American Eagle Outfitters

- Gap Inc.

- Columbia Sportswear

- Decathlon

Recent Developments

- In Q1 2025, Nike launched a new line of sustainable tank tops using recycled polyester and organic cotton, targeting environmentally conscious consumers.

- In Q2 2025, Adidas expanded its athleisure sleeveless collection in North America, integrating moisture-wicking fabrics and influencer-led marketing campaigns.

- In Q3 2025, Lululemon introduced smart performance tank tops with anti-odor and UV-protection features, strengthening its premium sports apparel portfolio.