Tactical Footwear Market Size

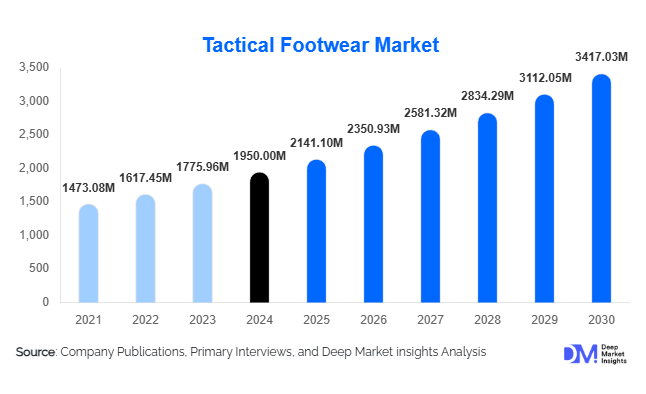

According to Deep Market Insights, the global tactical footwear market size was valued at USD 1950.00 million in 2024 and is projected to grow from USD 2141.10 million in 2025 to reach USD 3417.03 million by 2030, expanding at a CAGR of 9.8% during the forecast period (2025–2030). The market’s expansion is driven by the increasing demand from defense and law enforcement agencies, rising outdoor and adventure activities, and the adoption of innovative lightweight materials and eco-friendly manufacturing practices by leading footwear brands worldwide.

Key Market Insights

- Boots dominate the global tactical footwear market, accounting for nearly 69% of total revenue in 2024 due to their widespread use in defense and law enforcement procurement.

- North America leads the global market with about 38.7% share in 2024, driven by large institutional contracts and robust outdoor participation.

- Asia-Pacific is the fastest-growing region, supported by defense modernization in China and India, and expanding civilian adoption of tactical-style footwear.

- E-commerce and D2C channels are reshaping tactical footwear sales, providing global reach, customization, and improved brand engagement.

- Technological innovation and sustainability, including the use of recycled materials, breathable membranes, and lightweight composites, are defining new product launches.

- Growing cross-over into civilian lifestyle and outdoor markets is expanding tactical footwear’s total addressable market beyond institutional buyers.

What are the latest trends in the Tactical Footwear Market?

Rise of Lightweight and Hybrid Tactical Designs

Manufacturers are focusing on reducing footwear weight while maintaining durability and protection. Hybrid tactical shoes that blend features of running shoes and combat boots are gaining traction among law enforcement, first responders, and outdoor enthusiasts. These models offer improved mobility, comfort, and breathability without sacrificing support or traction. Modern designs integrate EVA midsoles, TPU shanks, and abrasion-resistant uppers to meet dual requirements of agility and protection. This trend reflects a broader shift toward multi-environment footwear suited for both field operations and everyday tactical wear.

Sustainable and Eco-Conscious Manufacturing

With growing environmental awareness, leading brands are incorporating recycled polyester, bio-based leather substitutes, and water-efficient production techniques. Tactical footwear, once perceived as resource-intensive, is being reimagined with eco-friendly components that meet military specifications while reducing carbon footprint. Certification programs and government procurement preferences for sustainable suppliers are reinforcing this transition. Companies investing in clean manufacturing and sustainable sourcing are expected to benefit from both regulatory incentives and brand differentiation.

What are the key drivers in the Tactical Footwear Market?

Rising Defense and Security Expenditures

Global defense budgets are expanding, with countries upgrading equipment and uniform standards. Tactical footwear is a critical component of soldier modernization programs. The United States, China, India, and EU nations have increased procurement budgets for protective gear. Institutional demand provides predictable, high-volume contracts for certified manufacturers, supporting long-term revenue stability.

Growing Outdoor and Civilian Tactical Adoption

Beyond military use, tactical footwear is entering the mainstream outdoor and adventure market. Hikers, hunters, and survivalists prefer tactical-grade boots for their durability and traction. The “tactical lifestyle” trend, where civilians adopt military-inspired apparel and gear, has fueled crossover sales. Tactical sneakers and low-cut trainers are particularly popular among urban consumers seeking a mix of performance and style.

Expansion of Digital Retail and Customization

E-commerce platforms are revolutionizing tactical footwear distribution. Online specialty stores, brand websites, and digital configurators allow users to customize fit, color, and sole type. This democratization of access helps smaller brands reach global buyers. Online retail already represents a significant and growing share of civilian tactical footwear sales, particularly in Asia-Pacific and Europe.

What are the restraints for the global market?

High Manufacturing and Retail Costs

Tactical footwear involves premium materials such as Kevlar, GORE-TEX membranes, and heavy-duty rubber, which drive up production costs. Retail prices remain high, limiting adoption in cost-sensitive markets. In regions with budget constraints, procurement cycles are delayed, slowing market penetration for new entrants.

Fragmented Standards and Procurement Complexity

Different nations and agencies impose varied footwear specifications, certifications, and compliance norms. This lack of harmonization increases product-development costs and delays contracts. Managing multi-standard inventories also adds supply-chain complexity for global players, constraining scale advantages.

What are the key opportunities in the Tactical Footwear Industry?

Government and Institutional Procurement Growth

Rising national defense and homeland security investments worldwide offer long-term contracts for tactical footwear suppliers. With modernization initiatives such as “Make in India,” “Made in USA,” and “China 2025,” governments are encouraging local production, opening new avenues for joint ventures and regional manufacturing bases.

Civilian and Outdoor Expansion

Outdoor recreation, survival training, and tactical sports are increasingly popular globally. Brands are capitalizing on this by offering hybrid tactical/outdoor collections that blend performance with fashion. These lines attract consumers who value durability and utility, extending market reach beyond professionals to general consumers.

Technological & Sustainable Innovation

Incorporating smart insoles, anti-fatigue midsoles, RFID tracking, and biodegradable materials offers opportunities for differentiation. Footwear designed for improved ergonomics, heat regulation, and durability can command premium pricing. Sustainability also provides a marketing edge in government tenders that prioritize eco-compliant suppliers.

Product Type Insights

Tactical boots continue to dominate the global tactical footwear market, contributing nearly 69% of total revenue in 2024. Their superior protection, ankle stability, and load-bearing capability make them indispensable for defense and law-enforcement procurement. Demand is primarily driven by institutional contracts and soldier modernization programs emphasizing comfort, traction, and all-terrain adaptability. Within this segment, desert and jungle boots remain the most procured categories globally, particularly for harsh climate operations. Meanwhile, tactical shoes, lightweight, low-cut models designed for urban policing, plainclothes operations, and civilian tactical use, are gaining momentum, driven by end-users prioritizing agility and stealth. Hybrid and utility footwear, blending athletic comfort with tactical-grade protection, is also expanding rapidly, supported by demand from first responders who require both flexibility and protection during operations.

Specialist tactical footwear, including rescue and anti-static mission-specific designs, remains a niche but lucrative segment, supported by stringent regulatory requirements and defense contracts that specify performance standards for unique operational environments.

Material Insights

Full-grain leather continues to be the preferred material for premium tactical boots due to its perceived durability, protective performance, and compliance with traditional procurement specifications. Its dominance is reinforced by military tenders emphasizing abrasion resistance and long-term field reliability. However, synthetic materials such as ballistic nylon and advanced microfiber composites are rapidly gaining traction due to their lightweight properties, breathability, and lower production costs, appealing especially to mid-range and civilian buyers.

Composite and hybrid constructions that combine leather durability with synthetic flexibility are increasingly adopted by premium brands seeking to balance protection and comfort. Meanwhile, specialty membranes like GORE-TEX and eVent are in high demand among professional users and high-end consumers operating in extreme climates, where waterproofing, temperature regulation, and breathability are mission-critical.

Distribution Channel Insights

Offline retail continues to lead the tactical footwear market, accounting for over 50% of total 2024 revenue. Institutional supply chains, defense contractors, uniform outfitters, and specialty stores remain central to fulfilling large-scale procurement contracts. Procurement through B2G (business-to-government) channels is driven by long-term defense budgets, certification requirements, and strategic vendor relationships.

However, online and D2C (direct-to-consumer) channels are growing exponentially as brands enhance global reach and personalization. The expansion of digital retail platforms enables brands to connect directly with tactical enthusiasts, outdoor consumers, and smaller private security firms. User reviews, social media marketing, and influencer-driven campaigns are accelerating the adoption of niche innovations, while general retail and sporting goods outlets benefit from the increasing crossover between tactical and outdoor lifestyle footwear.

End-Use Insights

Military & Defense remains the largest end-user category, accounting for a significant share of global tactical footwear revenue. Demand is driven by ongoing modernization programs, emphasis on soldier comfort, and focus on lighter, more ergonomic footwear designed for long-term deployments. Law enforcement represents the second-largest and fastest-evolving segment, with demand centered on rapid-response capabilities, comfort during extended shifts, and advanced traction or ballistic resistance for urban operations. Tactical shoes and side-entry boots are increasingly popular among police units requiring mobility and discretion.

Private security agencies contribute notably to market growth, particularly in regions facing urban security challenges. Their procurement cycles are frequent due to high wear rates, with a preference for cost-effective yet durable boots. The civilian and tactical enthusiast segment is expanding quickly, fueled by lifestyle trends, outdoor recreation, and brand marketing that promotes tactical aesthetics as a blend of performance and everyday utility. Influencer-led marketing and tactical sports have amplified this trend globally.

| By Product Type | By End User / Application | By Material / Construction | By Price Tier | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains the dominant regional market, commanding approximately 38.7% share in 2024. The U.S. leads the region’s growth, underpinned by large-scale law enforcement and defense procurements, as well as the presence of key domestic manufacturers supplying government contracts. High disposable income and a thriving tactical lifestyle culture also drive demand for premium civilian tactical footwear. Increasing adoption among private security firms and outdoor enthusiasts, combined with robust public safety budgets, ensures continued market leadership. The expansion of direct-to-consumer (D2C) channels and strong brand engagement further reinforces regional dominance. Large law enforcement and private security procurement programs, coupled with strong consumer spending power and advanced retail networks, sustain North America’s leadership in both institutional and civilian tactical footwear demand.

Europe

Europe represents approximately 25–30% of global tactical footwear revenue, with leading markets including the U.K., Germany, France, and Italy. Regional growth is propelled by NATO standardization initiatives and an emphasis on multi-terrain, interoperable footwear designs suitable for both urban and rural operations. European buyers place high importance on product certifications, sustainability, and durability, driving the adoption of eco-friendly materials and recyclable soles. Civilian adoption is also increasing, supported by a growing preference for utility-style footwear among consumers engaged in outdoor and adventure activities. NATO-aligned procurement standards, rigorous quality certifications, and a focus on multi-environment tactical designs underpin Europe’s sustained market momentum.

Asia-Pacific

The Asia-Pacific region is the fastest-growing market, forecast to post a double-digit CAGR through 2030. China leads production and consumption due to its large manufacturing base, while India, Japan, and South Korea are accelerating procurement under defense modernization initiatives. Civilian adoption of tactical footwear is also surging, supported by a rapidly expanding middle class, e-commerce accessibility, and the popularity of outdoor sports. Price-sensitive markets such as Vietnam, Indonesia, and the Philippines are driving demand for mid-range, value-oriented tactical boots and shoes. Expanding defense modernization programs, rising outdoor participation, and the growing middle class’s appetite for affordable tactical footwear are key factors fueling the Asia-Pacific’s robust growth trajectory.

Latin America

Latin America, led by Brazil, Argentina, and Colombia, holds an estimated 5–8% of the global market share. Growth is primarily driven by private security and police force procurement amid rising urban security concerns. Local governments are increasingly prioritizing tactical gear upgrades, while private contractors and industrial sectors seek durable and cost-effective solutions. Local distribution through specialty stores and dealers enhances accessibility in the region’s price-sensitive markets. Heightened urban security challenges and increasing demand from private security and police forces are propelling the adoption of rugged, affordable tactical footwear across Latin America.

Middle East & Africa

The Middle East & Africa (MEA) region accounts for roughly 5–7% of total 2024 revenue, with robust government and military procurement supporting steady growth. GCC countries, including Saudi Arabia and the UAE, lead in tactical boot imports for military and paramilitary operations conducted in harsh desert climates. Demand is also rising for heat-resistant, breathable footwear with specialized soles adapted to sand and high-temperature conditions. In Africa, South Africa, Nigeria, and Kenya are witnessing increasing adoption in both military and outdoor segments, supported by local manufacturing incentives and safety footwear regulations. Rising defense and border-security spending in hot-climate nations and growing interest in desert-optimized tactical footwear with climate-adaptive materials are key accelerators of MEA market growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Tactical Footwear Market

- Under Armor Inc.

- 5.11 Inc.

- adidas AG

- Wolverine Worldwide Inc.

- Belleville Boot Company

- Danner (LaCrosse Footwear)

- Magnum Boots International

- Salomon Group

- Haix Group

- Rocky Brands Inc.

- LOWA Sportschuhe GmbH

- Maelstrom Footwear

- Nike Inc. (Tactical Division)

- Altama Footwear Co.

- Bates Footwear

Recent Developments

- In July 2025, Under Armor introduced a new tactical boot line featuring recycled nylon uppers and advanced anti-fatigue soles, targeting military and law enforcement buyers.

- In May 2025, 5.11 Inc. launched a hybrid tactical sneaker for outdoor enthusiasts, blending athletic comfort with reinforced toe protection.

- In April 2025, Wolverine Worldwide announced a partnership with the U.S. Department of Defense to supply lightweight, eco-certified combat boots under the Made-in-USA initiative.

- In March 2025, Salomon Group unveiled an Asia-exclusive tactical footwear range, combining performance design with climate-adaptive materials suited for tropical operations.