Synthetic Diamonds Market Size

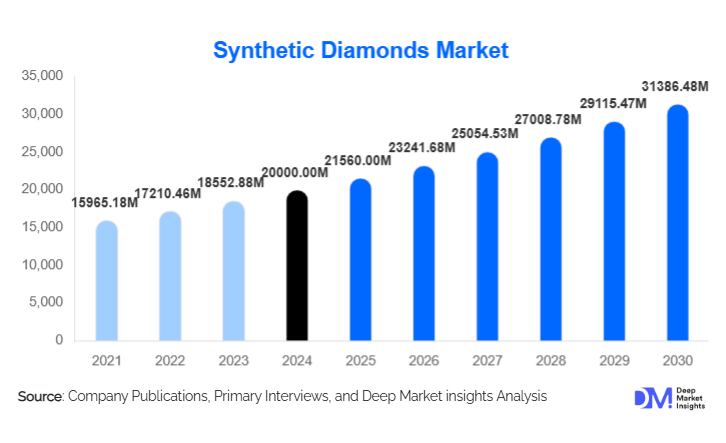

According to Deep Market Insights, the global synthetic diamonds market size was valued at USD 20,000 million in 2024 and is projected to grow from USD 21,560 million in 2025 to reach USD 31,386.48 million by 2030, expanding at a CAGR of 7.8% during the forecast period (2025–2030). The growth of the synthetic diamonds market is primarily driven by increasing consumer preference for ethical and sustainable gemstones, expanding industrial applications in electronics and semiconductors, and advancements in production technologies such as chemical vapor deposition (CVD) and high-pressure high-temperature (HPHT) methods.

Key Market Insights

- Gem-quality synthetic diamonds are gaining strong traction in the jewelry sector, due to affordability, ethical sourcing, and customization options that appeal to millennials and Gen Z consumers.

- Industrial applications of synthetic diamonds are expanding rapidly, including uses in cutting, grinding, drilling, and thermal management in electronics and semiconductor devices.

- Asia-Pacific dominates global demand, led by China and India, driven by industrial growth, rising jewelry consumption, and increasing technological adoption.

- North America remains a key market, with the U.S. and Canada contributing significant demand for gem-quality diamonds and industrial applications.

- Technological advancements, including automation, AI-driven quality control, and CVD process improvements, are enhancing production efficiency and diamond quality.

- Export-driven demand, particularly from Europe and North America to APAC and MEA, is increasing, supporting global market growth.

What are the latest trends in the synthetic diamonds market?

Rise of Lab-Grown Gemstones

Consumers are increasingly favoring lab-grown diamonds over mined diamonds for jewelry due to sustainability, ethical sourcing, and affordability. Jewelers are leveraging marketing campaigns to emphasize the environmental and social benefits of synthetic diamonds. Customizable shapes, colors, and sizes offered by CVD-produced diamonds are attracting younger, fashion-conscious buyers, leading to a broader adoption of lab-grown jewelry globally. Social media and influencer marketing are playing a key role in educating customers and promoting ethical consumerism trends.

Industrial and Technological Applications Driving Growth

Synthetic diamonds are increasingly used in high-precision industrial applications, including cutting, grinding, drilling, and polishing tools, as well as in electronics for heat sinks and semiconductor devices. CVD and HPHT diamonds offer superior thermal conductivity and mechanical strength, meeting the demands of emerging high-power electronics, automotive, aerospace, and mining industries. Industrial adoption is expected to continue rising due to increased automation and growing semiconductor production worldwide.

What are the key drivers in the synthetic diamonds market?

Ethical and Sustainable Consumer Preferences

Consumers, particularly millennials and Gen Z, are choosing synthetic diamonds as eco-friendly alternatives to mined diamonds. The ethical sourcing and lower environmental impact resonate strongly in developed regions like North America and Europe, driving demand in the gem-quality segment of the market.

Cost-Effectiveness Compared to Natural Diamonds

Synthetic diamonds cost approximately 20–40% less than natural diamonds, making them accessible to a broader audience. The price advantage is significant for jewelry applications and large-volume industrial use, fueling market growth across multiple segments.

Expanding Industrial Applications

The superior hardness, electrical insulation, and thermal conductivity of synthetic diamonds make them ideal for cutting tools, heat sinks, and electronic devices. Rising industrialization, semiconductor expansion, and high-tech manufacturing are key growth catalysts for the synthetic diamonds market.

What are the restraints for the global market?

High Production Costs for Gem-Quality Diamonds

Producing flawless, large-sized synthetic diamonds remains capital-intensive, particularly for CVD-based gem-quality diamonds. High initial investment requirements and operational costs limit the entry of smaller manufacturers into the premium jewelry segment.

Consumer Skepticism About Quality

Some consumers perceive synthetic diamonds as inferior to natural diamonds, slowing adoption in certain regions. Market players must educate customers about quality equivalence and certification to overcome perception barriers.

What are the key opportunities in the synthetic diamonds industry?

Growth in Emerging Markets

Emerging economies, especially in the Asia-Pacific and Latin America, are witnessing a surge in middle-class populations with disposable income. Rising jewelry consumption and industrial demand in countries like India and China present a multi-billion-dollar growth opportunity for manufacturers and retailers of synthetic diamonds.

Integration into Electronics and Semiconductor Industries

Synthetic diamonds’ excellent thermal management properties make them suitable for high-power electronic devices, LEDs, and semiconductor applications. Adoption in these industries is expanding rapidly, providing new revenue streams for producers and technology innovators.

Technological Advancements and Sustainable Manufacturing

Innovations in CVD and HPHT technologies are enabling the production of high-quality, customizable diamonds with fewer defects. Governments in China and India offer subsidies for lab-grown diamond production, encouraging eco-friendly manufacturing. Technological integration allows companies to produce colored or premium gemstones, creating additional revenue potential in luxury markets.

Product Type Insights

Gem-quality synthetic diamonds dominate the market, accounting for 55% of total revenue in 2024. Consumer preference for ethically sourced and affordable jewelry drives this trend. Industrial-grade diamonds are growing steadily, particularly in cutting, drilling, and polishing tools, accounting for a significant portion of industrial demand. CVD technology is leading production, providing high precision and better quality compared to HPHT, representing 48% market share.

Application Insights

Jewelry remains the largest application segment, holding 52% of the market share. Industrial applications, including cutting, drilling, and polishing tools, are growing rapidly due to rising manufacturing activities and electronics demand. Electronics and semiconductor applications are the fastest-growing segment, leveraging synthetic diamonds for heat dissipation and high-performance devices.

End-Use Industry Insights

The jewelry & fashion sector accounts for approximately 50% of market share, with strong growth in engagement rings, necklaces, and luxury watches. Industrial demand contributes nearly 35% of overall growth, supported by electronics, automotive, and aerospace applications. Emerging end uses include high-power semiconductors and medical instruments, expanding the overall market base and export-driven demand globally.

| By Product Type | By Manufacturing Technology | By Application | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds a 28% share of the global synthetic diamonds market, led by the U.S. Industrial and jewelry applications dominate demand, with a focus on gem-quality diamonds for ethical and sustainable jewelry consumption.

Europe

Europe accounts for 18% market share, led by Germany, the U.K., France, and Italy. Ethical consumption, luxury jewelry trends, and electronics applications support market expansion. The region is also the fastest-growing outbound market for premium synthetic diamonds.

Asia-Pacific

APAC dominates with 38% market share, driven by China and India. Industrial applications, expanding electronics manufacturing, and rising jewelry demand contribute to growth. India exhibits the highest CAGR of 11–12%, reflecting strong jewelry consumption and emerging industrial applications.

Middle East & Africa

MEA represents 7% of the market, primarily due to the UAE and Saudi Arabia’s luxury jewelry demand. Regional industrial adoption is growing steadily.

Latin America

LATAM holds 3–4% market share, with Brazil leading. Demand is primarily from mid-tier jewelry consumption and emerging industrial usage.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Synthetic Diamonds Market

- De Beers Group

- Element Six

- Scio Diamond Technology

- WD Lab Grown Diamonds

- ALTR Created Diamonds

- Pure Grown Diamonds

- New Diamond Technology

- Lucent Diamonds

- Diamond Foundry

- Tairus

- Charles & Colvard

- Henan Huanghe Whirlwind

- Henan Zhengzhou New Diamond

- Zhongnan Diamond

- Applied Diamond

Recent Developments

- In May 2025, Element Six expanded its CVD diamond production capacity in China to meet rising industrial and jewelry demand.

- In April 2025, Scio Diamond Technology launched a new line of customizable lab-grown diamonds for luxury jewelry markets in North America and Europe.

- In February 2025, WD Lab Grown Diamonds introduced advanced HPHT reactors to increase industrial-grade diamond production for electronics and cutting tools.