Swimming Pool Covers Market Size

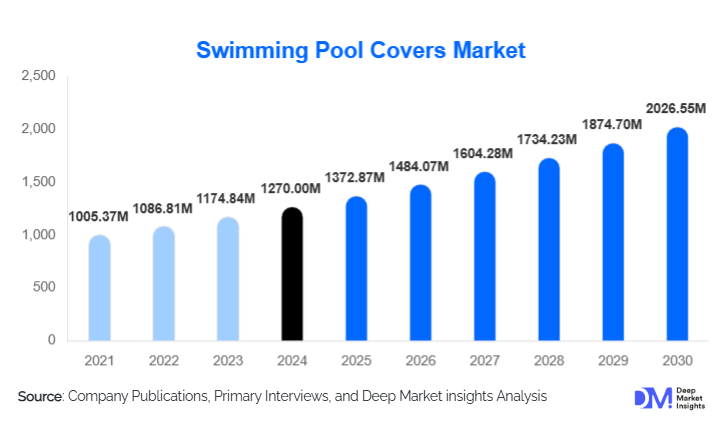

According to Deep Market Insights, the global swimming pool covers market size was valued at USD 1,270 million in 2024 and is projected to grow from USD 1,372.87 million in 2025 to reach USD 2,026.55 million by 2030, expanding at a CAGR of 8.1 during the forecast period (2025–2030). The market growth is driven by increasing adoption of energy-efficient and safety-compliant pool covers, rising residential and commercial pool construction, and growing environmental awareness, encouraging water conservation and reduced chemical usage.

Key Market Insights

- Thermal and safety pool covers dominate demand, driven by consumer focus on energy efficiency, pool safety, and reduced maintenance costs.

- Residential swimming pools represent the largest end-use segment, with homeowners investing in covers to enhance safety, aesthetics, and operational efficiency.

- North America is the leading regional market, supported by high pool penetration, stringent safety regulations, and increasing investment in private pools.

- Europe is the fastest-growing market, fueled by eco-conscious consumers, government incentives for energy-efficient solutions, and the adoption of automated pool cover systems.

- Asia-Pacific is emerging as a growth hotspot, led by rapid urbanization, rising disposable incomes, and increased demand for residential and commercial recreational facilities.

- Technological advancements, including automated, retractable, and solar-powered pool covers, are reshaping consumer expectations and driving premium product adoption.

What are the latest trends in the swimming pool covers market?

Adoption of Automated and Smart Pool Covers

Automation and smart pool cover technologies are gaining traction globally. Automated retractable covers allow users to cover and uncover pools with minimal effort, enhancing convenience and safety. Integration with smart home systems enables remote operation, scheduling, and monitoring of pool covers. These innovations reduce energy costs by retaining heat and minimizing water evaporation, aligning with the growing consumer preference for high-tech, low-maintenance solutions.

Environmentally Sustainable Pool Covers

Rising environmental awareness has encouraged the adoption of covers that minimize water loss and chemical usage. Solar pool covers, thermal blankets, and eco-friendly polymer-based materials help conserve energy and water. The trend is further reinforced by regulations in regions like Europe and North America, which incentivize energy-efficient pool management. Sustainability-focused designs are becoming key differentiators for premium manufacturers.

What are the key drivers in the swimming pool covers market?

Increasing Residential and Commercial Pool Installations

Growing urbanization, rising disposable incomes, and expanding hospitality sectors are fueling demand for residential and commercial pools. Homeowners and facility operators are increasingly investing in pool covers to reduce maintenance costs, improve safety, and extend pool life. The construction of luxury resorts, hotels, and sports complexes is further boosting the demand for high-quality swimming pool covers worldwide.

Stringent Safety Regulations

Government regulations and safety standards are driving the adoption of safety-compliant pool covers, especially in North America and Europe. Mandatory safety measures to prevent accidental drownings are prompting both residential and commercial pool owners to install covers, creating a sustained market opportunity for compliant products.

Energy Efficiency and Water Conservation Demand

Swimming pool covers reduce water evaporation and heat loss, lowering energy and chemical usage. Rising electricity costs and environmental concerns are encouraging pool owners to invest in thermal and solar covers. The increased awareness of sustainable practices across regions is positively impacting market growth, especially for premium and automated covers.

What are the restraints for the global market?

High Initial Costs

The adoption of automated, thermal, and retractable pool covers is often hindered by high upfront costs. Small residential pool owners may find premium solutions financially inaccessible, restricting market penetration among cost-sensitive customers.

Maintenance and Durability Concerns

Pool covers require regular maintenance to prevent wear, degradation from UV exposure, and mold formation. Low-quality covers may have shorter lifespans, which discourages adoption in regions where durability and long-term performance are critical.

What are the key opportunities in the swimming pool covers market?

Expansion in Asia-Pacific and Emerging Economies

Rapid urbanization, rising disposable incomes, and the growth of residential and commercial pools in countries like China, India, and Southeast Asia present significant opportunities. Manufacturers can tap into the demand for automated, safety-compliant, and eco-friendly covers, offering mid- to premium-tier solutions to cater to growing middle-class populations.

Integration of Smart Technologies

The rise of IoT and smart home adoption creates opportunities for pool covers integrated with sensors, mobile apps, and automation systems. Such products allow remote operation, real-time monitoring, and energy management, meeting consumer demand for convenience and efficiency while promoting premium pricing and differentiation.

Government Incentives for Energy Efficiency

Energy conservation policies and incentives for eco-friendly products in Europe and North America encourage the adoption of thermal and solar pool covers. Pool owners seeking to reduce utility bills and comply with environmental standards are expected to contribute significantly to market growth.

Product Type Insights

Thermal covers dominate the market, accounting for approximately 40% of the 2024 market, due to their energy-saving and water retention benefits. Safety covers hold a 28% share, driven by strict regulatory compliance and homeowner safety concerns. Retractable and automatic covers are growing rapidly, capturing 15% of the market, as convenience and smart home integration appeal to premium customers. Vinyl and polymer-based covers make up the remainder, primarily catering to cost-conscious buyers.

Application Insights

Residential pools remain the largest application, contributing about 55% of market demand in 2024, driven by rising private pool installations and enhanced safety requirements. Commercial pools in hotels, resorts, and recreational facilities account for 30%, while public and sports pools cover the remaining 15%. Photovoltaic/solar applications are emerging, combining energy efficiency with traditional pool protection.

Distribution Channel Insights

Online sales through manufacturer websites and e-commerce platforms account for a growing share, especially for premium and automated pool covers. Specialty retailers and pool equipment distributors continue to dominate mid- and low-range product distribution. Direct sales to construction projects, hotels, and commercial establishments form a significant segment, while partnerships with architects and pool contractors are increasingly leveraged for high-end installations.

| By Product Type | By Material Type | By Pool Type | By Functionality | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds the largest share of 35% in 2024, driven by high residential pool penetration, stringent safety regulations, and growing demand for energy-efficient solutions. The U.S. leads the regional market due to widespread adoption of automated and thermal covers, while Canada shows moderate growth with a focus on winterized solutions.

Europe

Europe accounts for approximately 30% of the global market in 2024. Germany, France, and the U.K. are key contributors, driven by government incentives for energy-efficient products, strong construction of private pools, and eco-conscious consumer preferences. Europe is also the fastest-growing region with a CAGR of 10% from 2025–2030.

Asia-Pacific

Asia-Pacific is emerging as a high-growth market, led by China, India, and Japan. Rapid urbanization, increasing disposable income, and the growth of hotels and resorts are driving demand. The market here is expected to grow at a CAGR of 11% during the forecast period.

Latin America

Brazil, Mexico, and Argentina contribute to the region’s growing market, primarily driven by residential pool adoption and resort developments. Market penetration is still moderate compared to North America and Europe.

Middle East & Africa

The Middle East, led by the UAE, Saudi Arabia, and Qatar, shows rising demand for luxury pools and automated covers. Africa’s adoption is limited but growing, driven by luxury hotels and resorts in South Africa and Kenya.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Swimming Pool Covers Market

- Maytronics Ltd.

- GLI Pool Products

- Cover-Pools

- Loop-Loc Pool Products

- Blue Haven Pools & Spas

- Aladdin Pools

- Interline Pool Products

- Riyadh Pools

- Reef Industries

- Duckback Inc.

- POOLCOVERS.COM

- H2O Pool Covers

- Auto Cover Company

- Solarlux

- Polin Waterparks

Recent Developments

- In March 2025, Maytronics Ltd. launched an automated solar pool cover system with integrated smart monitoring in North America.

- In January 2025, GLI Pool Products expanded its European operations to Germany and France, focusing on energy-efficient thermal covers.

- In December 2024, Cover-Pools introduced eco-friendly polymer covers in Asia-Pacific, targeting residential and commercial segments in India and China.