Surface Disinfectant Wipes Market Size

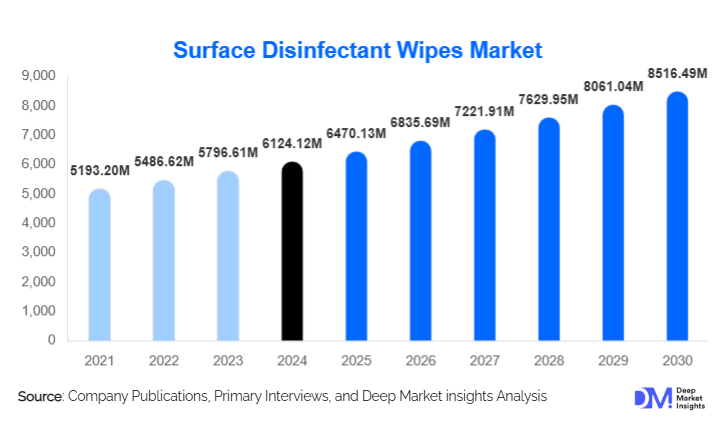

According to Deep Market Insights, the global surface disinfectant wipes market size was valued at USD 6,124.12 million in 2024 and is projected to grow from USD 6,470.13 million in 2025 to reach USD 8,516.49 million by 2030, expanding at a CAGR of 5.65% during the forecast period (2025–2030). The market’s growth is driven by rising hygiene awareness, stringent infection-control standards in healthcare and commercial sectors, and consumer preference for convenient, ready-to-use cleaning solutions.

Key Market Insights

- Surface disinfectant wipes are becoming a hygiene staple across healthcare, hospitality, and residential sectors, as they offer quick, effective surface disinfection without additional tools or dilution.

- Biodegradable and eco-friendly wipes are gaining momentum, as institutions and consumers shift toward sustainable cleaning products with plant-based substrates.

- Healthcare facilities remain the largest end-use segment, accounting for nearly 29% of the 2024 market, driven by strict infection-control protocols.

- North America dominates the global market, contributing roughly 30% of total revenue in 2024, followed by Europe and Asia-Pacific.

- Asia-Pacific is the fastest-growing region, led by expanding healthcare infrastructure and hygiene initiatives in China, India, and Southeast Asia.

- Technological advancements, including smart dispensing units and IoT-enabled usage monitoring in institutional settings, are improving efficiency and compliance.

What are the latest trends in the surface disinfectant wipes market?

Eco-Friendly and Biodegradable Wipes Rising

Growing environmental consciousness is pushing manufacturers toward biodegradable substrates such as bamboo, cellulose, and plant-based nonwovens. Companies are reducing plastic content in packaging, adopting water-based disinfectant formulations, and obtaining eco-certifications to align with sustainability mandates. Institutional procurement policies increasingly include environmental compliance clauses, giving eco-friendly wipes a competitive edge. This trend is expected to accelerate as governments impose stricter disposal and sustainability standards for single-use products.

Smart Packaging and Dispenser Integration

Innovations such as sensor-based dispensers, refillable canisters, and digitally monitored usage systems are transforming institutional cleaning. Hospitals, airports, and offices are deploying automated wipe dispensers that reduce waste and monitor consumption. Digital tracking tools integrated with hygiene protocols are emerging as part of “smart facility management.” These advancements enhance operational efficiency while reinforcing compliance with hygiene standards.

What are the key drivers in the surface disinfectant wipes market?

Increasing Infection-Control Awareness

The global focus on hygiene, intensified by recent pandemics, has cemented disinfectant wipes as essential cleaning tools. Hospitals, clinics, and households use wipes for rapid disinfection of high-touch surfaces, reducing the risk of pathogen transmission. Governments and healthcare authorities mandate surface disinfection practices, driving consistent institutional demand.

Convenience and Time Efficiency

Ready-to-use wipes eliminate the need for measuring, mixing, or rinsing. They are ideal for high-traffic environments where quick turnaround and visible cleanliness are priorities, such as hospitals, hotels, schools, and offices. This convenience factor has significantly boosted household adoption and on-the-go consumption.

Institutional Hygiene and Commercial Expansion

Expansion of food service, hospitality, and transportation sectors has led to increasing institutional cleaning standards. The food service and hospitality industries, in particular, require daily surface disinfection, stimulating bulk purchases. Manufacturers are responding by developing wipes optimized for food-contact surfaces and large-volume institutional packs.

What are the restraints for the global market?

Raw Material Cost Volatility

Price fluctuations in nonwoven substrates, packaging resins, and disinfectant actives (such as alcohols and quaternary ammonium compounds) impact manufacturing costs. These cost pressures limit profitability and hinder new entrants who lack economies of scale. In addition, environmental regulations restricting certain chemicals add to compliance costs.

Market Saturation in Mature Regions

In North America and Europe, high penetration levels and stringent efficacy testing slow product introductions. Manufacturers face longer approval timelines and rising competition among established brands, moderating overall market growth in mature regions.

What are the key opportunities in the surface disinfectant wipes industry?

Sustainable Product Innovation

Transitioning to biodegradable substrates and low-toxicity formulations presents strong differentiation potential. Brands emphasizing plant-based wipes, recyclable packaging, and verified eco-certifications can capture premium market segments and meet government sustainability mandates.

Emerging Market Expansion

Asia-Pacific, Latin America, and the Middle East are witnessing rapid healthcare and hospitality development, creating substantial new demand for disinfectant wipes. Establishing regional production hubs and distribution networks will help companies tap into these fast-growing markets while minimizing import dependency.

Digital and Smart Hygiene Solutions

Institutional cleaning programs increasingly rely on technology. Smart dispensers, IoT-based consumption tracking, and integration with facility management software present opportunities for product differentiation and long-term service contracts with large organizations.

Product Type Insights

Synthetic substrate wipes dominate the global surface disinfectant wipes market, accounting for approximately 80% of total revenue in 2024. These wipes are preferred across healthcare, commercial, and residential settings for their superior durability, high absorbency, compatibility with alcohol and quaternary ammonium-based disinfectants, and cost-effectiveness in bulk applications. Their widespread acceptance is also linked to enhanced shelf life and better performance on non-porous surfaces such as plastics, stainless steel, and glass, making them a practical choice for hospitals and corporate facilities.

However, biodegradable wipes are rapidly emerging as the fastest-growing product type, driven by tightening environmental regulations and rising consumer preference for eco-friendly hygiene solutions. Governments in North America and Europe are pushing for compostable and plastic-free alternatives, stimulating product innovation using natural fibers such as bamboo and cellulose. Meanwhile, pack sizes of 51–75 wipes lead the global market with a ~31% share in 2024, offering an optimal balance of cost efficiency and convenience for high-frequency users in both professional and household settings.

Application Insights

High-touch surface cleaning remains the leading application segment, accounting for the majority of consumption in 2024. These wipes are used extensively on frequently handled surfaces such as handrails, door handles, countertops, and medical equipment. The COVID-19 pandemic heightened awareness about cross-contamination, reinforcing long-term demand from hospitals, corporate offices, public transit, and retail environments.

Equipment cleaning represents a fast-growing sub-segment, propelled by increased digitization in workplaces and healthcare facilities. The use of sensitive electronics in clinical environments, like monitors and diagnostic devices, has driven demand for alcohol-free and non-corrosive disinfectant wipes. Additionally, food-contact surface disinfection is expanding due to stringent global food safety regulations and the growing emphasis on preventing foodborne illnesses in restaurants, food manufacturing, and catering sectors.

Distribution Channel Insights

Supermarkets and hypermarkets continue to dominate the retail distribution landscape, providing strong visibility and convenience for household and small business consumers. These outlets offer a wide range of brands and packaging options, catering to impulse and bulk purchases alike.

Online platforms are the fastest-growing channel, bolstered by the e-commerce boom and consumers’ preference for subscription-based delivery models. The rise of direct-to-consumer (D2C) sales and online brand stores has also enabled faster product customization and marketing agility. In institutional segments, B2B direct sales and long-term supply contracts, especially with hospitals, hospitality chains, and cleaning service providers, remain key revenue drivers, ensuring consistent demand and predictable cash flows for manufacturers.

End-Use Insights

Healthcare facilities lead the global end-use segment, contributing approximately 29% of the market share in 2024. The sector’s dominance stems from strict infection control mandates, particularly in hospitals, clinics, and laboratories, where surface sterilization is mission-critical. The adoption of EPA- and EN-certified disinfectant wipes in this sector is expected to intensify as healthcare-acquired infection (HAI) prevention programs gain traction worldwide.

Household and commercial applications follow closely, supported by increased hygiene awareness and convenience-driven consumption. The transportation sector, covering airlines, metros, and shared mobility services, is the fastest-growing end-use category, benefiting from post-pandemic travel recovery and stricter cleanliness protocols. Emerging applications in educational institutions, gyms, and co-working spaces are further broadening the customer base and diversifying product demand.

| By Product Type | By Application | By Distribution Channel | By End Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounted for nearly 30% of the global surface disinfectant wipes market in 2024, maintaining its position as the largest regional market. The United States dominates regional demand, underpinned by advanced healthcare infrastructure, strong regulatory compliance (EPA and FDA standards), and an entrenched hygiene culture. Key drivers include sustained hospital procurement, robust retail distribution networks, and the growing popularity of eco-certified cleaning products. Government initiatives promoting infection prevention in public spaces, coupled with an active professional cleaning services sector, continue to propel consumption. Canada contributes additional growth through rising healthcare modernization and strong retail penetration of sustainable wipe brands.

Europe

Europe remains a mature but innovation-driven market, supported by consistent institutional demand from hospitals, laboratories, and public facilities. Germany, the U.K., France, and Italy collectively represent the bulk of regional consumption. The enforcement of the EU Biocidal Products Regulation (BPR) ensures efficacy and safety compliance, sustaining trust among end-users. Market growth is further reinforced by the rapid adoption of biodegradable and recyclable packaging in line with the European Green Deal. Increasing demand for sustainable hygiene solutions from hospitality, corporate, and educational sectors continues to drive expansion, while consumer preference for fragrance-free and dermatologically safe formulations enhances product differentiation.

Asia-Pacific

Asia-Pacific (APAC) is the fastest-growing regional market, accounting for roughly 25–30% of global revenue in 2024. China, India, Japan, and South Korea are key demand centers, driven by healthcare infrastructure expansion, government-backed sanitation campaigns, and the proliferation of organized retail. Rising disposable incomes and urban lifestyles have made disinfectant wipes an everyday household essential. The region is also witnessing substantial local manufacturing investments, particularly in China and India, which are strengthening supply chain resilience and reducing import dependency. Additionally, rapid growth in medical tourism, educational institutions, and the hospitality industry is fueling the demand for professional-grade disinfectant wipes.

Latin America

Latin America represents a developing yet increasingly significant market, with Brazil and Mexico leading regional adoption. Growth is driven by the expansion of healthcare infrastructure, the hospitality industry’s post-pandemic recovery, and a growing middle-class population prioritizing hygiene. Rising institutional procurement, particularly in public hospitals and hotels, has stimulated imports from North America and Asia. While local production remains limited, foreign direct investments and partnerships are expected to enhance domestic manufacturing capabilities over the coming years. Government-led hygiene awareness programs and urbanization trends are further contributing to steady market development.

Middle East & Africa

The Middle East and Africa (MEA) region is experiencing steady growth, propelled by large-scale healthcare modernization and infrastructure investments. The Gulf Cooperation Council (GCC) countries, including Saudi Arabia, the UAE, and Qatar, are leading consumers, supported by strong infection-control regulations in hospitals and hospitality facilities. In Africa, nations such as South Africa, Kenya, and Egypt are driving growth through expanding hospital networks and government-funded public health programs. Rising foreign investment in medical and commercial real estate sectors and increasing hygiene awareness among urban populations are accelerating adoption. Ongoing efforts toward healthcare digitization and smart facility management are expected to further strengthen demand in this region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Surface Disinfectant Wipes Market

- The Clorox Company

- Kimberly-Clark Corporation

- Ecolab Inc.

- Reckitt Benckiser Group PLC

- 3M Company

- S.C. Johnson & Son Inc.

- GOJO Industries Inc.

- PDI Healthcare

- Metrex Research LLC

- Diversey Holdings Ltd.

- STERIS plc

- Paul Hartmann AG

- Evonik Industries AG

- Betco Corporation

- Whiteley Corporation

Recent Developments

- In June 2025, Ecolab Inc. launched a new line of biodegradable disinfectant wipes designed for hospital and food-service use, utilizing plant-based substrates to reduce environmental impact.

- In May 2025, The Clorox Company announced the expansion of its disinfectant wipes production facility in the U.S. to meet rising institutional and consumer demand.

- In April 2025, Reckitt Benckiser introduced smart dispenser technology for commercial cleaning applications, enabling usage tracking and inventory optimization.