Sun Protection Clothing Market Size

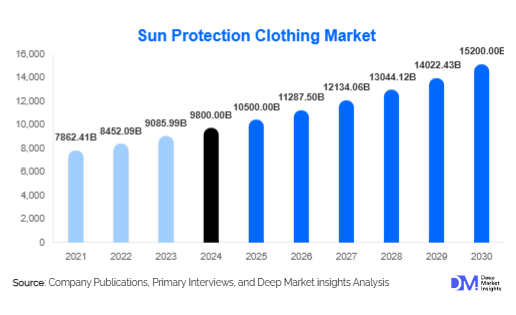

According to Deep Market Insights, the global sun protection clothing market size was valued at USD 9,800 million in 2024 and is projected to grow from USD 10,500 million in 2025 to reach USD 15,200 million by 2030, expanding at a CAGR of 7.5% during the forecast period (2025-2030). Growth in this market is primarily driven by increasing awareness about harmful UV radiation, the rising incidence of skin-related health conditions, and the growing popularity of outdoor recreational activities that necessitate effective sun safety apparel.

Key Market Insights

- Dermatologist-recommended UPF-rated apparel is gaining traction as awareness of skin cancer prevention rises.

- Technological innovations in fabrics, including nanoparticle-infused textiles and moisture-wicking synthetics, are reshaping performance wear.

- Women’s sun protective clothing dominates the global market, supported by higher adoption rates in outdoor leisure and wellness fashion.

- North America accounts for the largest market share, led by strong consumer demand in the U.S. and Canada, while Asia-Pacific is the fastest-growing region, driven by increasing middle-class spending and urban outdoor lifestyles.

- Sustainability trends, including bamboo, hemp, and organic cotton fabrics, are gaining momentum across premium brands.

- E-commerce channels are accelerating sales, particularly for niche brands and new market entrants.

What are the latest trends in the sun protection clothing market?

Fashion-Integrated UV Protection

Sun protection clothing is no longer limited to bulky, performance-first designs. Global brands are integrating UPF ratings into everyday fashion apparel such as dresses, skirts, polos, and even office wear. This trend is attracting a broader consumer base, particularly style-conscious urban women and millennials, who are seeking both functionality and aesthetics. Fashion-forward protective clothing lines are being introduced in mainstream retailers, making sun-safe apparel more accessible beyond niche sports and outdoor stores.

Sustainable and Eco-Friendly Fabrics

Consumer preferences are shifting toward sustainable fabrics such as bamboo, hemp, and organic cotton that are naturally breathable and biodegradable. Many brands are positioning eco-friendly sun protective clothing as part of broader wellness and conscious living movements. The combination of UV protection with environmental responsibility is proving to be a major differentiator, particularly in developed markets where green purchasing decisions strongly influence consumer loyalty.

Smart and Technical Textiles

R&D investment is driving the rise of technical fabrics with integrated nanotechnology that provide enhanced durability, moisture management, and high UPF ratings. Innovations such as self-cooling fabrics and lightweight UV-reflective coatings are creating new premium categories in the market. Sportswear brands are leading adoption, integrating smart textiles that balance athletic performance with long-term skin safety, especially for activities like surfing, hiking, and marathon running.

What are the key drivers in the sun protection clothing market?

Rising Skin Cancer Awareness

The global increase in skin cancer cases, coupled with dermatologists’ advocacy for preventive clothing, is significantly driving the adoption of UPF-rated apparel. Consumers are becoming proactive in minimizing risks associated with UV exposure, and governments and NGOs are amplifying campaigns around safe sun practices.

Growth in Outdoor Recreational Activities

From hiking and surfing to beach tourism and sports leagues, outdoor lifestyle trends are expanding demand for protective clothing. The global boom in wellness tourism and active lifestyles is reinforcing the need for reliable, high-performance sun protection solutions across genders and age groups.

E-commerce Penetration and Digital Marketing

Online platforms have become critical to the growth of this market, enabling brands to educate consumers on the benefits of UPF apparel. Influencer-led campaigns, product demonstrations, and easy comparisons across online stores are accelerating adoption, particularly among younger consumers.

What are the restraints for the global market?

Higher Costs Compared to Regular Apparel

Sun protection clothing is priced at a premium due to advanced fabrics and specialized treatments. This cost gap limits adoption in price-sensitive markets, where consumers may prefer cheaper alternatives such as sunscreens or umbrellas.

Lack of Awareness in Emerging Markets

Despite rising health concerns, awareness about UPF ratings and certified sun-protective apparel remains low in several regions, particularly in Latin America, Africa, and parts of Asia. Consumer education campaigns are still at a nascent stage, creating a barrier to widespread adoption.

What are the key opportunities in the sun protection clothing industry?

Integration with Smart Wearables

The next frontier in sun protection clothing lies in the integration of sensors and smart textiles. UV exposure tracking devices embedded within clothing could allow consumers to monitor their sun exposure in real-time. Collaborations between tech firms and apparel manufacturers present a strong opportunity for premium and performance-focused brands.

Regional Demand Growth in APAC

Asia-Pacific’s rising middle-class populations are embracing outdoor sports, travel, and leisure activities, creating opportunities for brands to tap into a massive consumer base. Countries such as China, India, and Australia are projected to witness exponential demand growth, particularly in women’s and children’s apparel segments.

Sustainability as a Differentiator

Brands that integrate sustainable fabrics with strong UV protection are likely to capture consumer loyalty in developed markets such as Europe and North America. Eco-certified collections, combined with transparent supply chain disclosures, provide strong branding advantages.

Product Type Insights

Tops & Shirts dominate the global market, accounting for nearly 32% of the market share in 2024. These products are versatile, suitable for both casual wear and outdoor sports, and are the most widely adopted across genders. Swimwear holds the second-largest share, driven by growing adoption in coastal regions and wellness tourism. Hats & caps are also gaining traction as complementary protective gear.

Fabric Type Insights

Synthetic fabrics such as polyester and nylon lead the market with approximately 40% share in 2024, owing to their superior durability, quick-drying properties, and ability to integrate advanced UV treatments. Cotton-based fabrics follow closely, with strong adoption in casual and lifestyle wear categories. Bamboo and hemp fabrics are expanding in premium segments, appealing to eco-conscious consumers.

End User Insights

Women’s sun protective clothing dominates, contributing nearly 48% of global revenue in 2024. This segment benefits from higher spending on wellness fashion and lifestyle apparel. The children’s segment is the fastest growing, supported by parental focus on preventive healthcare and outdoor activity safety.

Distribution Channel Insights

Online retail accounts for nearly 45% of sales in 2024, making it the largest and fastest-growing distribution channel. E-commerce platforms and D2C websites are accelerating global reach, while offline specialty stores remain critical in urban hubs where consumers prefer in-person product evaluation.

| By Product Type | By Fabric Type | By End User | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America represents the largest market, accounting for 38% of global revenue in 2024. The U.S. dominates due to strong awareness campaigns, high adoption of active lifestyles, and the presence of established brands. Canada follows with a rising interest in eco-conscious clothing lines.

Europe

Europe is a mature but steadily growing market, with Germany, the U.K., and France driving demand. Sustainability-focused initiatives and outdoor leisure activities support long-term growth. Europe’s market accounts for around 27% share in 2024.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by China, India, Japan, and Australia. Rising disposable incomes, expanding tourism, and increasing outdoor recreation are driving market penetration. APAC’s CAGR is projected to exceed 9% from 2025 to 2030.

Latin America

Latin America is gradually adopting sun protection clothing, particularly in Brazil and Mexico, where beach tourism is robust. Awareness campaigns are still limited, but niche premium brands are entering the region.

Middle East & Africa

MEA shows high potential, particularly in the UAE and South Africa. Harsh climates and rising luxury consumption are creating strong demand for both premium lifestyle and outdoor-focused sun protection apparel.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Sun Protection Clothing Market

- Coolibar

- Columbia Sportswear

- Patagonia

- REI Co-op

- Speedo International

- Under Armour

- Adidas

- Uniqlo

- Decathlon

- Lands’ End

- Quiksilver

- O’Neill

- Tommy Bahama

- Nike

- Billabong

Recent Developments

- In May 2025, Columbia Sportswear launched a new line of lightweight, high-UPF hiking shirts designed with moisture-wicking technology for extreme outdoor activities.

- In April 2025, Coolibar introduced a sustainable bamboo-based apparel collection combining eco-friendly fibers with dermatologically tested UV protection.

- In February 2025, Patagonia announced the expansion of its recycled fabric portfolio for UPF-rated swimwear, reinforcing its commitment to sustainability and sun safety.