Strip Parquet Floors Market Size

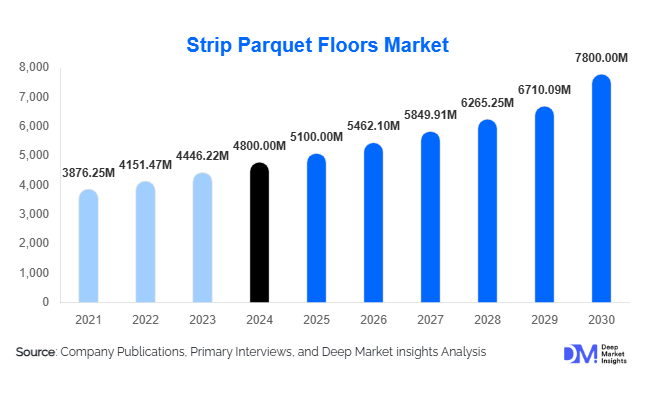

According to Deep Market Insights, the global strip parquet floors market size was valued at USD 4,800 million in 2024, and is projected to grow from USD 5,100 million in 2025 to reach USD 7,800 million by 2030, expanding at a CAGR of 7.1% during the forecast period (2025–2030). The growth in the strip parquet floors market is primarily driven by increasing demand for premium, decorative wood flooring in residential and commercial sectors, rising renovation and remodeling activity in mature markets, and expanding urbanization, coupled with aesthetic preferences in emerging economies.

Key Market Insights

- Engineered strip parquet is dominating demand, due to its superior stability, lower warping risk, and ease of installation compared with solid wood strips.

- Oak is the leading wood species in strip parquet usage globally, thanks to its wide availability, durability, and designer appeal.

- Residential end-use leads the consumption of strip parquet floors, particularly in home renovation and premium new-home segments.

- Asia-Pacific commands the largest regional share in 2024, fostered by rapid real estate growth, rising middle-income populations, and a strong desire for premium finishes.

- Europe remains an innovation and design hub, with high demand for sustainable, certified wood products and designer parquet patterns.

- Technological and finishing innovations as low-VOC coatings, digitally milled patterns, and click/float systemsare reshaping how strip parquet is specified and installed globally.

Latest Market Trends

Sustainability and Wood Certification Momentum

Across many developed markets, architects, designers, and regulatory bodies are placing growing importance on sustainable sourcing. FSC, PEFC, and similar certifications are increasingly becoming prerequisites for procurement, especially in commercial and institutional projects. This is pushing strip parquet manufacturers to adopt stricter forestry practices, third-party audits, and clear chain-of-custody systems. Some producers are also marketing carbon footprint labels or offering take-back/refinishing services to differentiate. As a result, “green” strip parquet is gaining share, and premium prices can often be fetched for certified lines.

Designer Patterns & Customization Trends

While straight-strip parquet remains the baseline, demand for decorative patternsespecially herringbone, chevron, basketweave, and mixed-width installations, is rising, particularly in high-end residential and luxury commercial projects. Buyers now expect more customization in width, length, finish, and texture (distressed, wire-brushed, matte). Manufacturers are increasingly offering quick-turn custom runs, and digital visualization tools (AR/VR) are aiding specification. This pattern-driven innovation is broadening the appeal of strip parquet beyond traditional markets.

Strip Parquet Floors Market Drivers

Growth in Renovation & Retrofit Activity

In mature real estate markets, a large share of construction-related flooring demand is coming from renovation and retrofit projects, rather than new builds. Homeowners upgrading interiors, commercial tenants redoing office floors, and hospitality refurbishments are choosing wood flooring upgrades to increase aesthetic value and property appeal, thereby fueling demand for strip parquet floors.

Rising Consumer Preference for Premium Interiors

As disposable incomes increase globally, especially in urbanizing regions, more consumers are seeking elevated interior finishes. Wood flooring is seen as a hallmark of premium quality, and strip parquet, with its texture, patterning, and durability, becomes a go-to choice for those wanting the look of hardwood with design flexibility.

Technological & Product Innovation

Advances in engineered wood technology, glue-less click systems, better moisture-resistance, low-VOC finishing, and pre-fabricated pattern modules have lowered installation complexity and performance risk. These improvements make strip parquet more cost-effective and reliable in varied climates and substrates, expanding its addressable market.

Market Restraints

Raw Material Price Volatility & Supply Risk

The cost of high-quality hardwood, especially premium or exotic species, is subject to fluctuations driven by forest regulation, logging quotas, trade tariffs, and transport costs. Any supply chain disruption directly squeezes margins or forces price increases, which can discourage buyers in price-sensitive segments.

Competition from Alternative Flooring Materials

High-performance alternatives such as luxury vinyl tile (LVT), engineered laminates, SPC, and high-end ceramics offer lower cost, water resistance, and ease of maintenance. In many markets, such products are favored for areas (kitchens, wet zones) or for cost containment, reducing the addressable volume for strip parquet.

Strip Parquet Floors Market Opportunities

Modular & Hybrid Flooring Systems

Collaborative systems combining strip parquet modules with other materials (stone, tile, glass) or modular “floorscapes” that allow quick reconfiguration present a new frontier. For example, parquet “inserts” within tile fields, or sliding wood panels over utility access points, cater to architects seeking flexibility in interior design. Suppliers offering modular, plug-and-play strip parquet kits can tap this niche.

Growth in Emerging Premium Markets

Countries in Southeast Asia, the Middle East (GCC), and Latin America are experiencing rising wealth and luxury construction. Many high-net-worth residential, boutique hotels, and upscale offices are now specifying premium interiors, creating opportunities for strip parquet suppliers who can localize manufacture or partner to reduce logistics costs. Tapping these regional growth corridors is a key expansion route.

Retrofitting & Value-Added Service Offerings

Many older buildings in Europe, North America, and East Asia are candidates for interior refurbishment rather than full rebuilds. Parquet suppliers can offer value-added services like on-site sanding/refinishing, reclamation of existing wood, parquet overlay systems, and lifecycle maintenance packages of which strengthen customer lock-in and revenue per project.

Product Type Insights

Engineered strip parquet leads the segment, combining stability with cost efficiency, making it the preferred choice in many global projects. Solid strip parquet still retains prestige for ultra-premium installations where thick wear layers and multiple refinishing cycles are desired. Customized pre-finished strips and pattern modules (herringbone, chevron) are gaining traction, enabling designers to push boundaries without complex site execution.

Application Insights

Residential flooring dominates usage, especially in living rooms, bedrooms, and dining zones, where aesthetic upgrade matters most. Commercial applicationsespecially in offices, boutiques, hotels, and upscale retailare growing faster in relative terms, as developers use high-end finishes to distinguish assets. Institutional applications (heritage buildings, galleries, performance halls) remain niche but important for specialized specifications. In many cases, parquet is used in combination with acoustics or underfloor heating, expanding its usage context beyond purely decorative roles.

Distribution Channel Insights

Specialty flooring showrooms and designer/dealer networks remain key for strip parquet, especially in premium segments. However, e-commerce and digital B2B marketplaces are gaining ground for standardized strip parquet lines. Some manufacturers are experimenting with direct-to-architect sales and specification platforms. Partnerships with interior design firms, modular home kit suppliers, and flooring installation franchises are also growing as indirect channels. Value chain consolidation is visible, with manufacturers acquiring or partnering with finishing and installation service providers.

Consumer / Buyer Segment Insights

Specifiers and architects account for a large share of high-end strip parquet purchases, especially in commercial or institutional projects. Homeowners in the luxury/residential renovation segment are an increasing direct buyer group. Developers and real estate firms drive volume in new residential projects, often specifying engineered strip parquet in premium units. Boutique hoteliers and hospitality chains are also rising as repeat buyers for upscale flooring solutions. Lastly, flooring contractors and installers are influential as they guide product choice and installation methods.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific commands the largest share, estimated at nearly 36% of the global market in 2024. Rapid urbanization, robust real estate growth in China, India, Southeast Asia, and rising middle-class demand for premium interiors drive growth. China and India are the powerhouses: China for scale and export, India for domestic demand and growing renovation cycles. Southeast Asia (Vietnam, Thailand, Malaysia) shows high growth rates. Local manufacturing bases are being built to serve both domestic and export markets.

Europe

Europe holds a significant share ( 25-28% in 2024), led by Germany, France, the UK, Italy, and the Nordic countries. Demand is supported by renovation of heritage buildings, strong specification practices (architect-driven interiors), and green building regulations. Northern and Eastern Europe are showing faster growth in percentage terms, while Western Europe remains large in absolute value.

North America

North America captures around 20–22% of the market in 2024, led by the U.S. and Canada. Strong renovation markets, luxury housing segments, and preference for engineered wood in variable climates bolster demand. In the U.S., populous states in Sun Belt growth corridors (Florida, Texas, California) are key growth zones. Canada’s preference for wood flooring also supports stable adoption.

Latin America

Latin America’s share is more modest ( 6–7%). Brazil leads, with growing urban housing and interest in premium real estate finishes. Mexico and Colombia follow. Challenges include logistics, import duties, and variable purchasing power, but growth in high-end residential and boutique hospitality projects is a tailwind.

Middle East & Africa (MEA)

MEA represents around 5% of the global market in 2024. GCC countries (UAE, Saudi Arabia, Qatar) lead demand due to luxury real estate and hospitality investment. There is heavy import reliance. South Africa and Turkey are local hubs. Africa’s growth is more uneven, but pockets of demand in high-income urban areas (Nigeria, Kenya) and regional projects (embassies, cultural centers) offer prospects. GCC countries exhibit some of the fastest CAGR rates in the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Strip Parquet Floors Market

- Anderson

- Cadorin Group

- Castro Wood Floors

- Columbia Flooring Originals

- FIEMME 3000

- IndusParquet

- Lopez Pigueiras

- PG Model

- Salis Srl

- Serenzo

- Surco

- Teka Parquet

- UnikoLegno

- Bona AB (in the wood finishing/parquet segment)

- Kährs (in engineered parquet/wood flooring adjacent segment)

Recent Developments

- In early 2025, several European parquet manufacturers announced expansions in their finishing lines to include ultra-matt and textured matte finishes to meet shifting consumer preferences for non-glossy wood surfaces.

- In mid-2025, a prominent engineered wood flooring company in Asia launched a “click-strip parquet” module for fast installation over concrete slabs, targeting high-rise residential projects.

- In late 2024 / early 2025, a cluster of parquet firms merged with wood drying and kiln technology providers to better control the supply chain and reduce moisture-related defects in tropical climates.