Stress Relief Supplements Market Size

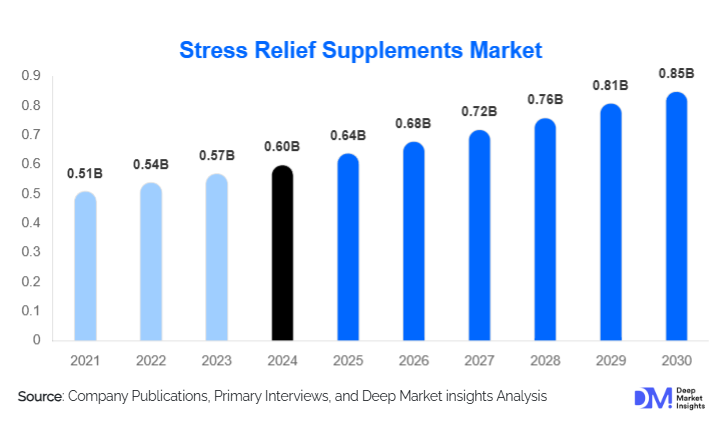

According to Deep Market Insights, the global Stress Relief Supplements market size was valued at USD 0.60 billion in 2024 and is projected to grow from USD 0.64 billion in 2025 to reach USD 0.85 billion by 2030, expanding at a CAGR of 6% during the forecast period (2025–2030). The market growth is primarily driven by rising global stress levels, increasing consumer preference for natural and herbal remedies, and the expansion of online retail channels offering convenient access to a wide range of stress relief supplements.

Key Market Insights

- Herbal adaptogens such as ashwagandha are leading ingredients globally, offering clinically supported stress-relief benefits and widespread consumer acceptance.

- Capsules and tablets remain the dominant dosage form, providing stability, precise dosing, and consumer familiarity, although gummies, oils, and powders are gaining popularity.

- North America dominates the market, led by the U.S., due to high disposable incomes, mental wellness awareness, and established retail and e-commerce infrastructure.

- Asia-Pacific is the fastest-growing region, driven by increasing stress awareness, adoption of traditional remedies, and rising middle-class populations in India and China.

- Online and D2C channels are reshaping distribution, enabling direct consumer engagement, subscription models, and personalized wellness offerings.

- Clean-label, organic, and non-GMO certifications are shaping product differentiation, reflecting consumer demand for transparency, quality, and sustainability in supplements.

Latest Market Trends in Stress Relief Supplements

Shift Toward Natural and Adaptogenic Ingredients

Consumers are increasingly seeking natural solutions over synthetic pharmaceuticals for stress relief. Ingredients such as ashwagandha, rhodiola, chamomile, lavender, melatonin, and L-theanine are gaining popularity for their proven calming, mood-enhancing, and sleep-promoting properties. Multi-ingredient blends combining herbal adaptogens and minerals are also emerging, allowing brands to offer holistic solutions targeting stress, anxiety, and sleep simultaneously. This trend is bolstered by growing clinical studies, consumer awareness campaigns, and the influence of wellness-focused digital media.

Technology-Enabled Personalized Wellness

Digital health platforms and mobile applications are increasingly integrated with stress relief supplements, offering personalized recommendations based on stress levels, sleep patterns, and lifestyle. Subscription-based models, wellness tracking apps, and personalized dosage suggestions are engaging consumers directly and fostering brand loyalty. Additionally, advanced extraction methods, improved bioavailability technologies, and innovative dosage forms like gummies, liquids, and oils enhance product effectiveness and convenience, appealing to younger, tech-savvy consumers seeking immersive wellness experiences.

Market Drivers

Rising Global Stress and Anxiety Levels

Modern lifestyles with longer work hours, urbanization, digital overload, and social pressures have increased global stress levels. Rising incidences of sleep disorders, burnout, and anxiety are prompting consumers to seek preventive, non-pharmaceutical interventions. Stress relief supplements offer an accessible and convenient solution, fueling market growth across working professionals, students, and health-conscious adults.

Preference for Natural and Herbal Supplements

There is a marked shift toward botanical, herbal, and mineral-based supplements as consumers prioritize clean-label, organic, and sustainable products. These supplements are perceived as safer, holistic, and supportive of overall well-being, which aligns with the preventive healthcare trend. Products with certifications such as vegan, organic, and non-GMO are particularly appealing to environmentally conscious and health-oriented consumers.

Expansion of Online Retail and Direct-to-Consumer Channels

E-commerce platforms have become key drivers by providing convenient access to a wide range of products, reviews, and subscription services. Digital marketing, social media influence, and influencer campaigns further increase awareness and adoption. Online channels allow brands to directly engage with consumers, offer personalized wellness solutions, and provide subscription-based delivery, enhancing customer loyalty and repeat purchases.

Market Restraints

Regulatory Complexity and Quality Concerns

Varied regulatory frameworks across countries create challenges in product approval, labeling, and permissible health claims. Inconsistent enforcement and a lack of standardization can lead to safety concerns and reduce consumer trust. Manufacturers must invest in compliance and quality assurance to mitigate these risks.

Intense Competition and Price Sensitivity

The market is highly competitive, with numerous global, regional, and local players offering similar products. Commoditization, especially in popular ingredients like ashwagandha and chamomile, leads to pricing pressures. Price-sensitive consumers in developing regions further constrain profitability, compelling brands to differentiate through certification, formulation, and marketing.

Stress Relief Supplements Market Opportunities

Innovation in Personalized and Multi-Ingredient Formulations

There is growing consumer demand for personalized supplements tailored to individual stress, sleep, and wellness profiles. Multi-ingredient blends combining adaptogens, minerals, and sleep-promoting compounds provide holistic benefits, offering differentiation for existing and new players. Integration with wellness apps and digital tracking systems can enhance engagement and product efficacy.

Expansion into Emerging Markets

Asia-Pacific and Latin America present high growth potential due to rising disposable incomes, urban stress, and cultural acceptance of traditional botanical remedies. Localizing formulations, complying with regional regulations, and leveraging e-commerce can unlock substantial market opportunities for both new entrants and established players.

Emphasis on Sustainability and Certifications

Consumers increasingly prefer organic, non-GMO, and sustainably sourced supplements. Companies that proactively obtain certifications, ensure transparent sourcing, and communicate environmental responsibility are likely to gain competitive advantages. Sustainability-focused strategies can also help meet evolving regulatory standards and reinforce consumer trust.

Product Type Insights

Ashwagandha-based supplements dominate the market due to strong clinical support, consumer trust, and wide availability. Capsules and tablets are the most popular forms, offering stability and precise dosing, although gummies and oils are gaining traction among younger demographics. Clean-label, organic, and non-GMO products are witnessing faster growth as consumers prioritize transparency and sustainability.

Application Insights

Stress relief supplements are primarily used by adults, working professionals, students, and women experiencing lifestyle-related stress or hormonal fluctuations. Emerging applications include workplace wellness programs, preventive health regimes, digital wellness integration, and mental health support, expanding demand across traditional and non-traditional segments.

Distribution Channel Insights

Online and direct-to-consumer channels dominate the market, offering convenience, subscription services, and personalized engagement. Pharmacies, drugstores, and health food stores remain important, particularly for older consumers and premium products. E-commerce growth is particularly notable in Asia-Pacific and North America, driven by mobile adoption and social media marketing.

Consumer Insights

Working adults represent the largest end-user segment, accounting for nearly 45–50% of market demand. Students and younger consumers are adopting stress relief supplements rapidly, often favoring innovative formats like gummies and liquids. Elderly populations and women are also important segments, particularly for products targeting sleep, mood, and hormonal stress.

| By Ingredient | By Format | By Target |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds approximately 37% of the global market, driven by the U.S. and Canada. High disposable income, awareness of mental wellness, and established retail and e-commerce infrastructure support sustained demand. The U.S. market emphasizes clean-label, organic, and clinically validated products.

Europe

Europe accounts for roughly 27% of the global market, with Germany, the U.K., and France as key contributors. Consumers favor herbal, organic, and eco-certified products, and younger demographics are driving growth in digital and e-commerce channels. Sustainability and preventive health trends further fuel market expansion.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by India and China. Rising stress levels, growing middle-class affluence, and cultural acceptance of traditional remedies are key drivers. Online retail and e-commerce platforms enable the broad distribution of herbal and natural supplements.

Latin America

Brazil, Mexico, and Argentina are emerging markets for stress relief supplements. Outbound travel, increasing awareness, and urban wellness trends are gradually boosting adoption, though the region currently represents a smaller share (7–8%) of global demand.

Middle East & Africa

The Middle East and Africa account for about 6% of the market. High-income consumers in the GCC countries and urban centers are adopting premium supplements. Africa’s natural herbal resources present both domestic growth opportunities and export potential.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Stress Relief Supplements Market

- Himalaya Drug Company

- Cureveda

- Nature’s Plus

- Pharmalinea Ltd.

- Nutraceutical International Corporation

- NOW Foods

- Garden of Life

- Gaia Herbs

- Nature’s Way

- Solgar

- Olly

- GNC Holdings

- Herbalife Nutrition Ltd.

- Life Extension

- The Honest Company

Recent Developments

- In March 2025, Himalaya Drug Company launched an enhanced ashwagandha-based supplement line with improved bioavailability and clinical validation for stress and sleep support.

- In January 2025, Cureveda expanded its digital D2C platform, offering personalized stress management programs integrated with supplement subscriptions in India and Southeast Asia.

- In February 2025, Gaia Herbs introduced a clean-label, multi-ingredient adaptogen blend targeting working professionals and students, emphasizing sustainability and organic sourcing.