Staycation Market Size

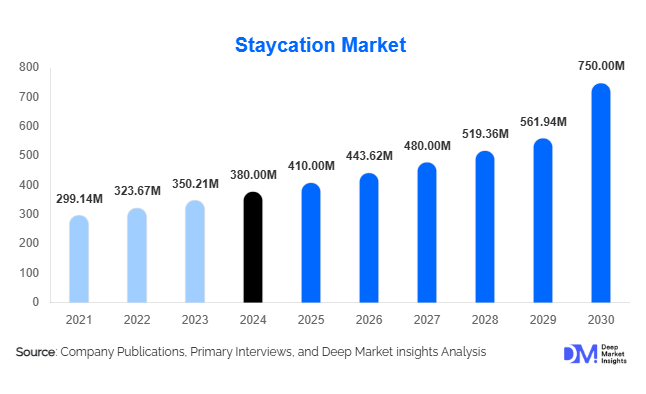

According to Deep Market Insights, the global staycation market size was valued at USD 380 million in 2024 and is projected to grow from USD 410 million in 2025 to reach USD 750 million by 2030, expanding at a CAGR of 8.2% during the forecast period (2025–2030). The staycation market growth is primarily driven by rising consumer demand for convenient short-break travel, increasing adoption of wellness and sustainable experiences, and the rapid expansion of digital booking platforms that make local travel more accessible and personalized.

Key Market Insights

- Hotels and resorts dominate the accommodation segment, accounting for nearly 45% of market share in 2024, due to strong brand trust, bundled amenities, and curated leisure experiences.

- Families are the largest traveler segment, representing 35–40% of demand, fueled by the preference for convenient, safe, and child-friendly short vacations.

- Asia-Pacific is the fastest-growing region, projected to expand at nearly 9–10% CAGR as rising disposable incomes and domestic tourism initiatives fuel growth in China, India, and Southeast Asia.

- Domestic staycations lead globally, with over 70% of market share, highlighting the preference for local and regional travel over long-haul international trips.

- Wellness-focused staycations are surging, with rising demand for spa retreats, mindfulness programs, and eco-lodges that align with health-conscious consumer trends.

- OTAs and online booking platforms capture over 50% of bookings, driven by convenience, transparent pricing, and AI-based personalization features.

Latest Market Trends

Wellness-Driven Staycations on the Rise

Staycation providers are increasingly integrating wellness features such as yoga, spa, meditation, and nature-based healing programs. As stress and urban fatigue drive demand for rejuvenation, these packages are positioned as holistic lifestyle escapes. Wellness-focused staycations also align with broader sustainability goals, with eco-lodges, farm stays, and carbon-neutral experiences gaining prominence. Governments are supporting this trend with domestic tourism incentives and wellness infrastructure development, creating a strong foundation for market expansion.

Technology-Enabled Staycation Experiences

Digital innovation is reshaping how travelers discover and book staycations. OTAs and mobile apps are embedding AI-powered personalization, dynamic pricing, and real-time availability. Virtual tours, contactless check-ins, and IoT-enabled amenities are being adopted by hotels and boutique lodges. Platforms offering curated local experiences such as culinary trails, cultural workshops, or adventure add-ons are enhancing consumer engagement. Social media and influencer-driven marketing are also amplifying awareness of hidden local gems, accelerating adoption among younger demographics.

Staycation Market Drivers

Changing Consumer Preferences for Local, Flexible Travel

Consumers are shifting toward nearby, time-efficient vacation options that require less logistical planning and reduce exposure to travel risks. Staycations provide affordable, flexible getaways that fit into a modern work-life balance, especially for urban residents. This trend has accelerated post-pandemic, as travelers prioritize safety, proximity, and convenience without compromising on relaxation or quality.

Rise of Remote and Hybrid Work Models

The adoption of remote work has created demand for “workcations” and flexible staycation packages. Professionals can now combine leisure and productivity in domestic destinations offering strong connectivity, workspace infrastructure, and lifestyle amenities. This shift has expanded the potential customer base for staycation providers beyond traditional weekend travelers.

Growing Awareness of Sustainability and Health

Environmental consciousness and wellness-oriented lifestyles are pushing travelers toward local, low-carbon travel options. Staycations significantly reduce travel-related emissions and provide opportunities for eco-friendly experiences. Health-focused lodging with sustainable amenities, organic dining, and safe recreational spaces has become a strong market differentiator.

Market Restraints

Perceived Lack of Novelty

One major barrier is the perception that staycations lack the excitement of international travel. Unless destinations offer unique attractions, curated activities, or differentiated lodging, repeat demand may stagnate. This necessitates continuous innovation in product offerings to maintain consumer interest.

Seasonality and Infrastructure Gaps

Staycation demand is often seasonal, peaking during holidays and weekends. Limited infrastructure, such as underdeveloped roads, poor digital services, or a lack of amenities, can restrict accessibility and diminish guest experiences in some regions. Addressing these gaps is critical to sustain long-term growth.

Staycation Market Opportunities

Wellness and Holistic Lifestyle Integration

The global wellness economy presents a significant opportunity to integrate wellness into staycations. Properties offering mental health retreats, spa therapies, and digital detox experiences can attract high-value travelers. Partnerships with healthcare providers and wellness brands can further expand this niche.

Technology and Personalization in Bookings

Enhanced digital platforms that offer AI-driven personalization, seamless payments, and curated recommendations are unlocking new demand. Tech-enabled features like VR previews and smart hospitality systems are differentiating experiences, appealing strongly to millennials and Gen Z audiences.

Emerging Regional Demand

Domestic tourism is rapidly rising in emerging markets such as India, Southeast Asia, and China. Government-led travel incentives, improved infrastructure, and rising middle-class affluence are fueling this growth. Providers who localize offerings and adapt to cultural preferences will capture these high-growth opportunities.

Product Type Insights

Hotels & Resorts dominate, accounting for around 45% of 2024 revenues. Their leadership stems from established infrastructure, trusted brands, and the ability to offer bundled experiences that combine accommodation with leisure amenities, dining, spa services, and loyalty programs that enhance perceived value. Vacation rentals and boutique eco-lodges are experiencing rapid growth due to rising demand for unique, sustainable, and family-friendly experiences. Serviced apartments are increasingly popular among remote workers and long-stay travelers seeking hybrid work-leisure solutions, offering predictable amenities such as kitchenettes, laundry services, and dedicated workspaces.

Traveler Type Insights

Family travelers represent 35–40% of the market in 2024, making them the largest demographic. Couples and young professionals are expanding rapidly, drawn to boutique, adventure, and experience-focused offerings. Solo travelers and digital nomads, while a smaller share, are growing, supported by flexible remote work arrangements and a preference for experiential travel. This trend has particularly fueled demand for workation packages that integrate reliable connectivity with flexible booking options.

Application Insights

Leisure and relaxation dominate applications, contributing nearly 60% of global staycation demand. Sub-segments such as wellness retreats, cultural immersions, culinary experiences, and adventure-based packages are high-growth areas, driven by consumers seeking curated and low-friction experiences. Corporate retreats and workcations represent emerging applications, leveraging flexible accommodations and extended-stay properties to accommodate professional needs alongside leisure.

Distribution Channel Insights

OTAs and online booking platforms control over 50% of the market, supported by convenience, competitive pricing, and broad inventory. Direct bookings through hotel websites are growing, fueled by loyalty programs and exclusive offers that strengthen customer retention. Offline channels, including local travel agencies, remain relevant in emerging markets, but digitalization is the dominant growth driver globally.

| By Product Type | By Application | By Traveler Type | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds the largest share of the global staycation market at approximately 31% of revenues in 2024. Growth is driven by high disposable incomes, well-developed hospitality infrastructure, and a strong domestic leisure culture. Consumers increasingly prefer short drives and larger short-term rental homes that accommodate work-friendly environments, supporting both family vacations and bleisure travel. Urban populations are frequently seeking weekend escapes to nearby resorts, countryside destinations, and lakeside retreats, further boosting demand.

Europe

Europe represents around 22% of the global market. Growth is underpinned by a strong domestic tourism culture, convenient short-haul rail networks, and robust government support for regional tourism initiatives. Popular markets include the U.K., Germany, France, and Spain. Travelers increasingly seek daycations and short overnight escapes, with wellness-oriented countryside retreats, boutique lodging, and curated cultural experiences seeing strong uptake. The high accessibility of destinations via train or car enhances the adoption of short-stay experiences.

Asia-Pacific

Asia-Pacific is the fastest-growing region, accounting for roughly 28% of revenues and projecting a CAGR of 9–10%. Growth is fueled by a rising middle class, post-pandemic recovery in intra-country travel, and strong demand for experiential family staycations. Leading markets include China, India, Japan, and Australia. Travelers are drawn to extended-stay accommodations, vacation rentals with home-like amenities, and family-focused experiential packages that combine leisure with cultural or outdoor experiences.

Latin America

Latin America is an emerging market with steady growth, primarily driven by Brazil and Mexico. The region benefits from strong leisure demand, cost-effective local travel, and interest in coastal and eco destinations. Travelers favor outdoor and nature-focused staycations, including glamping and wellness escapes. Urban populations are increasingly exploring local destinations due to affordability and convenience, while improving infrastructure and safety perceptions continue to support broader market adoption.

Middle East & Africa

This region contributes 8–10% of global revenues, led by high-end domestic travel in GCC countries such as the UAE and Saudi Arabia. Luxury resorts, city escapes, and government-supported domestic tourism initiatives are primary growth drivers. In Africa, the market is smaller but expanding, driven by eco-tourism projects, wellness resorts, and nature-focused staycations. Consumers in this region are increasingly seeking premium experiences and curated local packages that combine leisure, wellness, and cultural immersion.

Oceania (Australia & New Zealand)

Oceania’s staycation market is shaped by geographic isolation from major international destinations, making domestic and nearshore escapes particularly appealing. Road trips, glamping, coastal retreats, and short overnight stays are popular. Travelers are motivated by the desire for nature, wellness, and experiential travel, while convenient accessibility enhances frequent weekend and micro-break bookings.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Staycation Market

- Marriott International

- Hilton Worldwide

- Accor S.A.

- InterContinental Hotels Group (IHG)

- Hyatt Hotels Corporation

- Four Seasons Hotels and Resorts

- Airbnb, Inc.

- Vrbo (Expedia Group)

- Booking Holdings

- Wyndham Hotels & Resorts

- Minor Hotels

- OYO Hotels & Homes

- Mandarin Oriental Hotel Group

- Shangri-La Hotels and Resorts

- Taj Hotels (Indian Hotels Company Ltd.)

Recent Developments

- In July 2025, Marriott International announced the expansion of its wellness-focused “Stay Local” program, integrating spa and mindfulness packages across select city hotels in the U.S. and Europe.

- In June 2025, Airbnb launched a new curated category for “Wellness Staycations,” featuring farm stays, eco-lodges, and meditation retreats in Asia-Pacific and Europe.

- In May 2025, Accor unveiled investment plans for boutique and eco-friendly resorts in India, aimed at capturing the country’s rapidly growing domestic tourism demand.