Stand Mixer Market Size

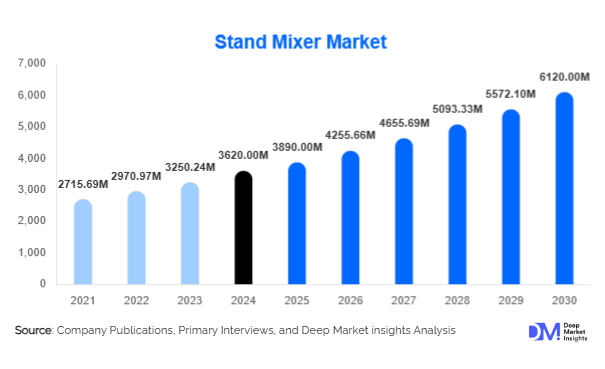

According to Deep Market Insights, the global stand mixer market size was valued at USD 3,620 million in 2024 and is projected to grow from USD 3,890 million in 2025 to reach USD 6,120 million by 2030, expanding at a CAGR of 9.4% during the forecast period (2025–2030). The market growth is driven by rising household baking trends, increasing adoption of premium kitchen appliances, and the growing demand from commercial foodservice establishments worldwide.

Key Market Insights

- Residential usage dominates the stand mixer market, accounting for more than 65% of 2024 demand, fueled by home baking, cooking shows, and social media food trends.

- Premium and smart stand mixers are gaining traction, offering digital controls, Wi-Fi connectivity, and multi-functional attachments.

- North America leads the market, with strong adoption in the U.S. and Canada, while Asia-Pacific is the fastest-growing region, driven by urbanization and rising disposable incomes in China and India.

- E-commerce is the fastest-growing distribution channel, supported by Amazon, Alibaba, and brand-owned D2C platforms.

- Commercial demand is expanding, particularly from bakeries, cafés, and quick-service restaurants, which are upgrading to heavy-duty models.

- Sustainability and energy efficiency are emerging as key differentiators, with consumers preferring durable, eco-conscious appliances.

What are the prevailing trends currently influencing the global stand mixer market?

Smart and Connected Appliances

The integration of IoT and digital controls in stand mixers is reshaping consumer expectations. Models with Bluetooth/Wi-Fi connectivity, recipe syncing, and app-based controls are emerging in premium product lines. These features cater to tech-savvy consumers who seek convenience, automation, and integration with smart kitchens. Enhanced user interfaces, safety sensors, and pre-programmed modes are expected to become mainstream in the next five years.

Growing Popularity of Multi-Functional Attachments

Manufacturers are increasingly offering attachments such as pasta makers, food processors, spiralizers, and meat grinders to transform stand mixers into multi-purpose appliances. This trend appeals to households with limited space and consumers seeking value-for-money appliances. The expansion of modular attachments is creating repeat purchase opportunities and building long-term customer loyalty for leading brands.

Shift Toward Premiumization

Consumer preference is shifting toward mid-range and premium mixers, driven by better durability, advanced features, and aesthetic appeal. Kitchen appliances are increasingly seen as lifestyle products, leading to demand for high-design, luxury mixers. Premium offerings are also supported by gift purchases, wedding registries, and culinary enthusiast communities.

What are the primary growth drivers impacting the stand mixer market?

Rising Home Baking and Cooking Trends

The surge in home cooking and baking, amplified by social media platforms and food influencers, has significantly boosted demand for stand mixers. Consumers are increasingly investing in mixers to replicate bakery-quality results at home. This trend has particularly grown post-pandemic and continues to fuel sustained market demand.

Expansion of the Foodservice Industry

The growth of cafés, artisanal bakeries, and commercial kitchens is driving demand for heavy-duty stand mixers. The foodservice industry values mixers for efficiency, consistency, and the ability to handle large batch operations. With the global bakery and confectionery industries expected to expand steadily, commercial adoption will remain a strong growth driver.

Increasing Disposable Incomes and Urbanization

Rising middle-class incomes and urban lifestyle changes are driving appliance upgrades in emerging economies. Stand mixers, once considered luxury appliances, are now becoming accessible to broader demographics. In markets such as India, China, and Southeast Asia, consumers are prioritizing convenience-driven kitchen tools.

What are the key challenges and restraints affecting the global stand mixer market?

High Initial Cost and Maintenance

Premium stand mixers, priced above USD 500, remain out of reach for budget-conscious consumers. Maintenance costs, including servicing and replacement of attachments, also act as a restraint. This limits penetration in price-sensitive markets and slows replacement cycles.

Competition from Alternative Appliances

Compact hand mixers, blenders, and food processors provide affordable alternatives, particularly in households with limited cooking needs. This competition reduces the adoption rates of stand mixers among casual users, particularly in emerging economies.

Which strategic opportunities exist for stakeholders in the stand mixer market?

Technological Integration and Smart Kitchens

Integration of AI, IoT, and automation presents a major opportunity. Smart mixers capable of automated speed adjustments, recipe guidance, and integration with smart home ecosystems are expected to capture premium market share. Brands investing in digital ecosystems will gain a long-term competitive advantage.

Untapped Potential in Emerging Economies

Asia-Pacific, Latin America, and Africa represent underpenetrated markets with growing disposable incomes. Rising demand for western-style baking, cooking shows, and kitchen upgrades is expected to accelerate adoption. Localized product innovations, including compact and affordable models, can significantly expand demand in these regions.

Sustainability and Circular Economy

Growing consumer awareness around sustainability creates opportunities for eco-friendly designs, energy-efficient motors, and recyclable materials. Extended product lifecycles, repairable components, and modular designs are likely to become strong purchase drivers in the next decade.

Product Type Insights

Tilt-head stand mixers dominate the market, accounting for around 52% of global revenue in 2024. Their compact design, ease of use, and affordability make them the preferred choice for households. Bowl-lift mixers, although more powerful, cater to commercial and heavy-duty applications, while high-end multi-functional mixers are gaining momentum in premium consumer segments.

Bowl Capacity Insights

3–5 liter stand mixers lead with 48% share of the global market in 2024, striking the right balance between household utility and affordability. Larger capacity mixers above 8 liters are predominantly used in commercial kitchens and industrial-scale bakeries, reflecting steady but niche demand.

Application Insights

Household usage remains the largest application, contributing to nearly 67% of market demand in 2024. The rise in home-based baking businesses, social media-driven cooking trends, and gifting culture has strengthened residential adoption. Meanwhile, commercial use is expanding rapidly, supported by the professionalization of artisanal bakeries and cafés worldwide.

Distribution Channel Insights

Online retail is the fastest-growing channel, representing 38% of sales in 2024 and projected to exceed 50% by 2030. E-commerce platforms offer broader product visibility, competitive pricing, and customer reviews, influencing purchasing decisions. Offline retail, however, remains critical for premium brands, where in-store demonstrations drive higher conversion rates.

Price Range Insights

Mid-range mixers (USD 200–500) account for 44% share of the market in 2024, reflecting strong demand from middle-class consumers seeking value-for-money appliances. Premium and luxury categories are growing faster, driven by lifestyle positioning and increasing gifting demand.

| By Product Type | By Bowl Capacity | By Application | By Distribution Channel | By Price Range | By Technology/Features |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

North America

North America leads the global market with a 32% share in 2024, driven by high household appliance penetration, a thriving bakery sector, and strong brand presence. The U.S. remains the largest single market, supported by premium product adoption and the rising popularity of home baking shows.

Europe

Europe holds a 28% market share, with demand concentrated in Germany, the U.K., France, and Italy. Culinary traditions, widespread bakery culture, and consumer preference for premium appliances fuel growth. Sustainability-focused designs are particularly well-received in this region.

Asia-Pacific

APAC is the fastest-growing region with a CAGR exceeding 11% during 2025–2030. China and India are emerging as key markets due to rising disposable incomes, adoption of western-style baking, and growing e-commerce penetration. Japan and South Korea represent mature, high-tech appliance markets.

Latin America

Latin America shows steady adoption, particularly in Brazil and Mexico. Rising café culture and growing middle-class income are expected to support future demand. However, higher product prices remain a restraint.

Middle East & Africa

MEA remains a smaller but growing market. GCC countries such as the UAE and Saudi Arabia are adopting premium mixers as part of luxury kitchen upgrades. South Africa leads regional demand due to its developed foodservice industry.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Stand Mixer Market

- Whirlpool Corporation (KitchenAid)

- Kenwood Limited

- Breville Group

- Philips Domestic Appliances

- Hamilton Beach Brands

- Electrolux AB

- Smeg S.p.A

- Cuisinart (Conair Corporation)

- Panasonic Corporation

- Shenzhen Midea Group

- Bosch Home Appliances

- Morphy Richards

- Ankarsrum Kitchen

- Bear Electric Appliance

- De’Longhi Appliances

Recent Developments

- In June 2025, KitchenAid launched a new smart-enabled stand mixer with app integration, expanding its premium appliance portfolio in North America and Europe.

- In April 2025, Kenwood introduced a sustainable product line using recycled plastics and energy-efficient motors, targeting eco-conscious European consumers.

- In February 2025, Breville announced the launch of a multi-functional stand mixer series in APAC, featuring modular attachments for pasta, juicing, and grinding.