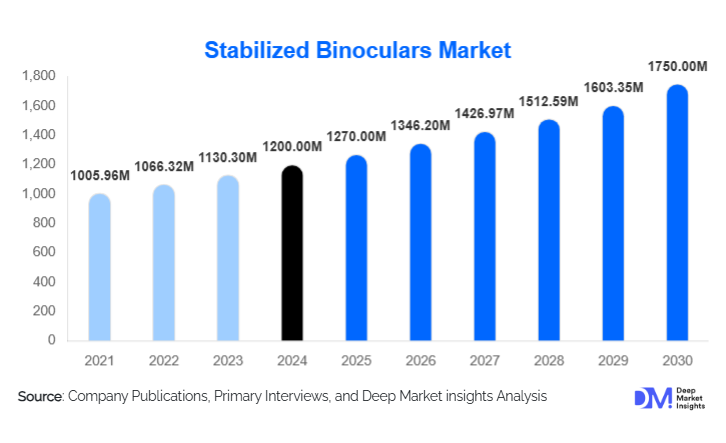

Stabilized Binoculars Market Size

According to Deep Market Insights, the global stabilized binoculars market size was valued at approximately USD 1,200 million in 2024 and is projected to grow from about USD 1,270 million in 2025 to reach around USD 1,750 million by 2030, expanding at a CAGR of 6.0% during the forecast period (2025–2030). This growth is primarily driven by rising defense and maritime surveillance spending, greater adoption in outdoor and recreational optics, and advances in stabilization and digital integration technologies.

Key Market Insights

- Optical and prism-based stabilization continues to lead in high-performance segments due to its clarity and low latency, especially in defense and marine applications.

- Mid-magnification stabilized binoculars dominate usage globally, as they strike an optimum balance between magnification, portability, and reduced shake.

- Military & defense end-use commands a strong share thanks to high per-unit pricing, large procurement orders, and stringent performance demands.

- Premium tier products (> USD 1,000) contribute a disproportionate share of revenue due to advanced features, ruggedness, and targeting professional users.

- North America remains a leading revenue region, supported by high defense budgets, strong marine and recreational optics demand.

- Asia-Pacific is the fastest-growing region, fueled by rising middle classes, expanding defense modernization, and growing outdoor recreation culture.

Latest Market Trends

Hybrid & Digital Stabilization Features Gaining Traction

Manufacturers are increasingly integrating hybrid stabilization approaches (optical + electronic) and smart features like digital overlays, GPS tagging, live video streaming, and augmented-reality displays. These hybrid systems offer more flexibility, adaptability, and lower weight compared to purely mechanical stabilized systems. This trend particularly appeals to mid-premium segments and helps differentiate products in a relatively crowded landscape.

Miniaturization and Weight Reduction

Advances in materials (lightweight alloys, carbon fiber, precision motors) and more efficient sensor systems are enabling stabilization modules with reduced size, weight, and power consumption. As a result, previously bulky stabilized binoculars are becoming portable enough for hiking, boating, and field use. This miniaturization is opening new consumer segments (travel, adventure optics) that were previously less accessible due to weight constraints.

Stabilized Binoculars Market Drivers

Heightened Defense & Maritime Surveillance Budgets

Globally, governments are prioritizing modernization of border security, maritime domain awareness, and naval surveillance systems. Stabilized binoculars are a critical component of surveillance kits aboard patrol vessels, coastal watch towers, unmanned platforms, and aircraft. Their ability to maintain stable images under motion and vibration makes them indispensable in modern defense and security deployments.

Growth of Outdoor Recreation & Wildlife Tourism

Rising interest in wildlife observation, birdwatching, marine tourism, and remote adventure travel is fueling demand for user-friendly optical instruments that stabilize visuals under shaky conditions. Recreational consumers increasingly demand higher performance, portability, and durability, shifting preferences toward stabilized binoculars even in non-professional use.

Advances in Sensor, Motor & Optical Technologies

Technical innovations as more precise gyroscope systems, low-noise motors, better stabilization algorithms, superior optical coatings, and ultra-low dispersion glass, continue to push the performance envelope. These enable more stable, clearer images even at higher magnification with fewer artifacts, making stabilized binoculars more attractive across application areas.

Market Restraints

Cost, Weight & Power Limitations

Stabilization systems add cost, mass, and energy consumption. High-end stabilized binoculars often carry significant premiums, making them less accessible to price-sensitive buyers. Additionally, heavier designs reduce usability in handheld or field contexts, while battery constraints limit continuous use in remote environments.

Reliability, Complexity & Maintenance Risks

More moving parts, sensors, electronics, and precision components increase the risk of failure under harsh conditions (vibration, shock, moisture, dust). Repair, servicing, spare parts availability, and durability are major concerns, particularly in rugged deployment or remote regions. Some potential buyers may avoid stabilized models if reliability is uncertain or the costs of maintenance are high.

Stabilized Binoculars Market Opportunities

Defense & Security Modernization in Emerging Markets

Many developing and mid-income nations are actively upgrading their surveillance and coastal defense capabilities. These markets expect optical systems tailored for local climates (heat, humidity, corrosion) and may favor sourcing from local or regional partners. Entrants that can deliver rugged, cost-effective stabilized binoculars with local service support have good potential to capture share in these emerging defense procurement cycles.

Consumer & Adventure Optics Market Expansion

The rise of expedition tourism, wildlife photography, boating, and adventure sports has created a latent demand for portable stabilized optics. Companies that can offer lighter, lower-cost stabilized binoculars (or hybrid systems) targeted to outdoor enthusiasts can unlock new volume markets. Subscription, rental, or lens-upgrade models may also help reduce adoption barriers.

Smart & Connected Optics Integration

Embedding connectivity (Bluetooth, WiFi), AR overlays, AI image stabilization, GPS, and live video streaming opens new value pools. For example, marine operators or wildlife researchers might stream stabilized imagery to remote screens, log coordinates, or overlay data. Such smart capabilities justify premium pricing and increase appeal to tech-savvy sectors.

Product Type Insights

Within the stabilized binoculars market, optical / prism-based stabilization systems dominate the premium and defense-grade segments due to their low latency and image fidelity. Hybrid optical + electronic systems are gaining momentum in mid-premium tiers, bridging performance and flexibility. Entry and budget models typically offer lighter electronic stabilization or sensor smoothing. Over time, the market is likely to shift gradually toward hybrid and smart types as component costs decline and consumer expectations evolve.

Application Insights

The military & defense application remains a core revenue contributor due to high output per unit and large procurement scale. Marine / boating is another strong application, especially for stabilized binoculars used on decks where wave motion is a factor. Wildlife / outdoor recreation is the fastest-rising consumer application, with growing uptake among nature enthusiasts, birdwatchers, and adventure travelers. Search & rescue/surveillance (civil/NGO) is an emergent application niche, particularly in disaster zones or remote missions. Astronomy/stargazing remains niche but attractive for high-end users seeking stabilized viewing for deep sky observation.

Distribution Channel Insights

Specialized optical dealers and defense contracting channels remain significant for high-end and institutional sales. However, online and direct-to-consumer (D2C) channels are gaining momentum in consumer and mid-premium segments, enabling manufacturers to reach global audiences with lower overhead. Equipment rental firms (for tours, marine operations) also represent a channel for sampling and gradual adoption. For defense and marine procurement, direct contracting and OEM partnerships still dominate.

User/Base Segment Insights

The institutional / government/defense user segment holds a strong influence due to volume contracts and higher margin potential. The commercial / marine/surveillance firms segment is important for applications such as offshore platforms, security firms, and marine operators. The consumer / outdoor enthusiast segment is growing fast, particularly for mid-premium and lightweight stabilized binoculars marketed to nature lovers and tourists. The scientific / research segment, though smaller, can demand customized high-end optics for environmental monitoring, surveying, or remote sensing tasks.

Age / Experience Insights

Within consumer segments, ages 30–55 often lead purchases due to stable income and interest in recreational optics. Younger users (20–30) are drawn to tech-integrated, lighter, portable models. Older users (55+) may gravitate toward proven, high-reliability premium models with warranty and support, especially for travel or birdwatching. Experience level matters: advanced users (photographers, biologists) demand higher optical performance and feature sets, while casual users prioritize ease of use and value.

| By Product Type | By Application | By Distribution Channel | By User Type |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America remains one of the largest markets, accounting for roughly 35–38 % of global stabilized binocular revenue in 2024. The United States drives the bulk with strong defense budgets, widespread recreational optics adoption, and a mature marine/boating sector. Canada contributes through surveillance, wildlife, and expedition applications. The region’s buyers often demand high specifications, premium brands, and after-sales support.

Europe

Europe holds around 25–30 % of the global market in 2024, with countries such as Germany, the UK, France, and the Nordic region being key consumers. European demand is driven by maritime nations, a strong outdoor recreation culture, and high regulatory/quality standards. Growth is steady, with premium optics and sustainable design valued highly.

Asia-Pacific

Asia-Pacific is the fastest-growing region in percentage terms. In 2024, it may represent 20–25 % of global revenue. Key markets include China, India, Japan, South Korea, and Australia. Drivers include increasing defense/coast guard procurement, rising disposable income fueling outdoor recreation, and expanding marine tourism. China and India are especially notable for their high future growth potential.

Middle East & Africa

In 2024, this region accounts for 8–10 %. Leading countries include the UAE, Saudi Arabia, South Africa, and others investing in coastal surveillance, resource sector optics, and marine operations. Growth rates are relatively high, supported by assertive government procurement, infrastructure investments, and strategic security priorities.

Latin America

Latin America contributes about 5–8 % in 2024. Brazil, Argentina, and Mexico are major users driven by wildlife tourism, coastal operations, and gradually increasing defense optics budgets. Price sensitivity and currency volatility are challenges, but growth is supported by ecological tourism and coastal development.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Stabilized Binoculars Market

- Canon

- Fujifilm / Fujinon

- Nikon

- Zeiss

- Bushnell

- Swarovski Optik

- Sig Sauer

- Kite Optics

- Steiner / Steiner-Optics

- Meopta

- Newcon / Fraser Optics

- Leica

- Vortex Optics

- Kowa

- Kenko / Tokina

Recent Developments

- Continuous product miniaturization is evident, with firms pushing lighter stabilization modules and compact optics to broaden handheld consumer applications.

- Strategic partnerships and defense contracts have increased, as optics firms tie up with defense/surveillance integrators to embed stabilized binoculars in larger sensor systems (e.g., border monitoring, naval patrol vessels).