Sports Sunglasses Market Size

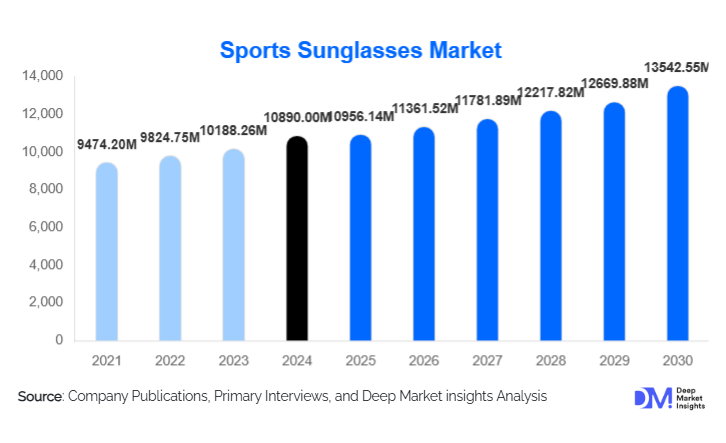

According to Deep Market Insights, the global sports sunglasses market size was valued at USD 10,890.00 million in 2024 and is projected to grow from USD 11,292.93 million in 2025 to reach USD 13,542.55 million by 2030, expanding at a CAGR of 3.7% during the forecast period (2025–2030). The market’s growth is primarily driven by rising outdoor and recreational sports participation, increasing awareness about UV and glare protection, and the integration of advanced lens technologies into fashionable designs appealing to both athletes and lifestyle consumers.

Key Market Insights

- Polarized lenses dominate the market, accounting for nearly 75% of total 2024 revenue due to their superior glare reduction and high popularity among outdoor and water sports users.

- Adults (men and women combined) represent about 78% of total sales, driven by high disposable income and active lifestyle adoption.

- North America leads the global market with around one-third of total revenue, supported by a strong sports culture and premium brand penetration.

- Asia-Pacific is the fastest-growing region, projected to record a CAGR of 7–8% led by rising fitness trends and expanding sports infrastructure in China and India.

- Offline retail remains dominant with more than 80% of sales, though online direct-to-consumer channels are rapidly expanding due to virtual try-on technology and e-commerce convenience.

- Technological advancements such as photochromic lenses, impact-resistant coatings, and eco-based materials are shaping new premium and sustainable product offerings.

Latest Market Trends

Smart and Connected Eyewear

Leading manufacturers are exploring the integration of smart features such as heads-up displays, fitness tracking sensors, and Bluetooth connectivity. This transition toward connected eyewear bridges performance equipment with wearable technology, targeting professional athletes and tech-savvy consumers alike. Companies are investing in R&D to balance lightweight designs with embedded electronics, aiming to enhance user performance feedback and on-field data visualization.

Eco-Friendly and Sustainable Designs

Growing consumer emphasis on sustainability is prompting brands to adopt bio-based frame materials, recycled plastics, and low-impact coatings. Several companies have launched collections made from ocean plastics and plant-derived polymers, aligning with broader ESG commitments. Eco-conscious designs not only appeal to environmentally aware consumers but also support regulatory compliance with emerging global sustainability standards.

Performance-Lifestyle Convergence

Sports sunglasses are no longer limited to athletes; they have evolved into versatile accessories for everyday outdoor use. Brands are combining performance functionality with contemporary aesthetics, driving crossover appeal among lifestyle and athleisure consumers. This fusion of style and sport utility is expanding addressable demand beyond niche sports users into the broader fashion eyewear segment.

Sports Sunglasses Market Drivers

Rising Outdoor and Fitness Participation

The global boom in recreational sports, adventure tourism, and fitness activities is a major growth driver. Increasing participation in cycling, running, and water sports has fueled steady demand for protective eyewear that offers UV filtration, glare control, and durability.

Technological Advancements in Lens and Frame Materials

Manufacturers are adopting innovations such as polarized coatings, photochromic lenses, and impact-resistant polycarbonate materials. These advancements enhance performance and comfort while improving product differentiation in the premium segment.

Expansion of E-Commerce and D2C Channels

Online platforms have democratized access to global eyewear brands. Virtual fitting tools, augmented reality previews, and direct-to-consumer models have increased sales penetration in previously underrepresented regions, contributing to double-digit online segment growth.

Market Restraints

High Cost of Premium Products

Sports sunglasses featuring advanced technology and branded craftsmanship command premium prices, often restricting adoption in developing economies. Price-sensitive consumers continue to opt for cheaper, low-quality alternatives that lack certified UV protection.

Counterfeit and Low-Quality Imitations

The global market faces persistent challenges from counterfeit imports and unregulated low-cost substitutes. These not only erode brand value but also expose users to substandard protection levels, undermining trust and overall market growth.

Sports Sunglasses Market Opportunities

Emerging Market Expansion

Developing regions such as India, Southeast Asia, and Latin America are witnessing surges in outdoor recreation and sports infrastructure investment. Tailored product portfolios with localized pricing and climate-specific lens designs offer strong growth potential for new entrants.

Integration of Smart Technologies

Augmented reality displays, heart-rate sensors, and GPS modules embedded within eyewear present lucrative innovation pathways. Brands integrating such features can capture the premium and performance-driven consumer base, especially within professional sports communities.

Lifestyle and Athleisure Crossover

Positioning sports sunglasses as fashion-forward accessories creates new consumption occasions beyond athletic use. Collaborations with fashion designers and influencers are enabling brands to tap mainstream fashion and travel markets.

Product Type Insights

Polarized lenses dominate the global sports sunglasses market, accounting for approximately 75% of total market share in 2024 and generating an estimated USD 3.7 billion in revenue. The dominance of this segment is primarily driven by their superior ability to reduce glare and eye fatigue under intense sunlight, making them indispensable for high-performance sports such as cycling, fishing, sailing, and skiing. Driver: clear utility for glare reduction in water and road sports, along with strong consumer preference for polarized optics in the premium performance segment. The segment’s leadership is further supported by advancements in anti-reflective coatings and polarization films that enhance contrast without compromising visibility.

Photochromic lenses are a fast-emerging sub-segment, propelled by convenience across variable light conditions—ideal for multi-sport users such as cyclists and hikers. Driver: convenience for athletes moving across shaded and sunny terrains without switching eyewear. Similarly, mirrored and coated lenses are gaining traction for their dual appeal of aesthetics and functionality, offering glare and heat reduction in winter sports and high-altitude activities. The prescription (Rx) sports eyewear category is expanding steadily, driven by aging athlete demographics and growing demand for personalized performance eyewear through optical channels. Driver: rising demand from athletes and recreational users requiring corrective yet high-performance eyewear. Meanwhile, non-polarized basic lenses maintain relevance in the entry-level and fashion crossover segments due to affordability and wide accessibility.

Material Insights

Polycarbonate lenses and frames continue to be the most widely used materials in sports sunglasses due to their lightweight, impact-resistant, and cost-effective characteristics. Driver: Compliance with global safety and impact resistance standards is essential for cycling, skiing, and motorsports. However, TR-90 and nylon frames are rapidly gaining favor among endurance athletes for their exceptional flexibility, durability, and comfort during prolonged wear. Driver: demand for lightweight wraparound designs and ergonomic comfort. The metal/alloy frames segment caters to a smaller yet profitable niche that values durability and lifestyle aesthetics, while hybrid composite materials are emerging as a key innovation trend, blending strength and style to attract crossover consumers between sports and fashion segments.

End-User Insights

Adults represent approximately 78% of global market demand in 2024, primarily driven by strong sales in men’s performance eyewear. Driver: high disposable income and brand loyalty in organized sports such as cycling, running, and golf. The women’s segment is growing at an accelerated rate as brands emphasize unisex, fashion-forward, and size-adaptive designs tailored to female athletes. Professional athletes continue to anchor the premium segment due to sponsorship deals, performance contracts, and custom gear requirements. Driver: demand for precision optics and brand-endorsed custom-fit designs. The amateur athlete category is expanding rapidly across emerging markets, supported by increasing participation in recreational and community-level sports. The children and youth segment is also gaining momentum, as rising awareness of UV protection and participation in school sports drives parental spending on protective eyewear.

Distribution Channel Insights

Offline retail continues to dominate with approximately 84% of total global sales in 2024. Specialty sports retailers and optical stores remain central to this dominance due to the consumer preference for physical try-ons, personalized fitting, and expert advice. Driver: in-store fitting experiences, partnerships with sports teams, and professional recommendations for high-performance eyewear. However, the online and direct-to-consumer (DTC) channels are expanding swiftly—accounting for nearly 16% of sales—as virtual try-on tools, AI-assisted customization, and digital marketing campaigns accelerate e-commerce adoption. Driver: lower customer acquisition costs and enhanced personalization capabilities through data-driven digital engagement. The growth of subscription-based sports eyewear models and influencer-led campaigns is further accelerating the shift toward digital sales channels, especially among younger consumers.

| By Product Type / Lens Technology | By Frame Material / Construction | By Application / Sport Use | By End User | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains the largest regional market, commanding a 33.7% share in 2024, valued at approximately USD 1.65 billion. The United States leads regional demand, supported by high consumer spending on premium outdoor gear, a well-established sports culture, and significant penetration of organized recreational activities such as cycling, running, and golf. Regional Driver: robust consumer expenditure on premium/outdoor equipment and strong presence of organized sports infrastructure. A dense network of specialty retailers, optical chains, and large-scale e-commerce platforms further reinforces the region’s dominance. Increasing technological innovation from brands headquartered in the U.S.—such as Oakley and Nike Vision—continues to elevate product performance and design sophistication. The Canadian market also contributes meaningfully, benefiting from its vibrant outdoor recreation culture and emphasis on protective eyewear during high-UV and snow reflection conditions.

Europe

Europe accounts for roughly 28–30% of the global sports sunglasses market revenue, driven by high participation in outdoor recreational activities, including cycling, skiing, and mountain trekking. Countries such as Germany, the U.K., France, and Italy represent the largest consumption bases. Regional Driver: strong outdoor recreation culture, deep-rooted premium brand acceptance, and regulatory alignment on optical safety standards promoting performance eyewear. European consumers are highly receptive to sustainable and eco-friendly materials, stimulating innovation in bio-based frame production and recyclable lens technologies. Furthermore, the presence of established luxury brands in Italy and France sustains premium pricing and design leadership in the region.

Asia-Pacific

The Asia-Pacific region is the fastest-growing market, forecast to expand at a CAGR of 7–8% between 2025 and 2030. Countries such as China, India, Japan, and Australia are driving this acceleration through rising disposable incomes, rapid urbanization, and growing adoption of outdoor and fitness lifestyles. Regional Driver: expanding e-commerce ecosystems, increasing participation in recreational sports, and the proliferation of affordable local brands offering polarized and photochromic lenses. Government initiatives such as “Make in India” and China’s “Made in China 2025” are boosting local manufacturing capacity, improving affordability, and reducing import dependency. The region also presents immense opportunities for global brands to capture mid-tier segments through collaborations with regional sports leagues and digital retail channels.

Latin America

Latin America represents a smaller yet steadily growing market segment, with notable demand emerging from Brazil, Argentina, and Mexico. Regional Driver: rising interest in recreational sports such as cycling and running, coupled with expanding retail presence from global sports brands. Although price sensitivity remains a constraint, there is growing acceptance of value-performance products, particularly polarized lenses designed for tropical sunlight and outdoor tourism. Increasing brand collaborations with local sports influencers and regional distributors are helping expand visibility and consumer trust in this market.

Middle East & Africa (MEA)

The MEA region naturally benefits from high UV exposure levels, making UV-protective eyewear an essential accessory for daily outdoor activities and sports. Regional Driver: intense sunlight conditions, growing outdoor tourism, and expansion of the premium segment across GCC countries such as the UAE, Saudi Arabia, and Qatar. The UAE and Saudi Arabia have emerged as lucrative markets for luxury sports eyewear, driven by affluent consumers, international brand availability, and government-led initiatives promoting outdoor wellness. Meanwhile, South Africa serves as both a consumption hub and a regional manufacturing base for sports eyewear distribution across Sub-Saharan Africa. The combination of climatic conditions and rising leisure infrastructure investments positions MEA as a key growth frontier over the next decade.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|