Sports Nutrition Supplements Market Size

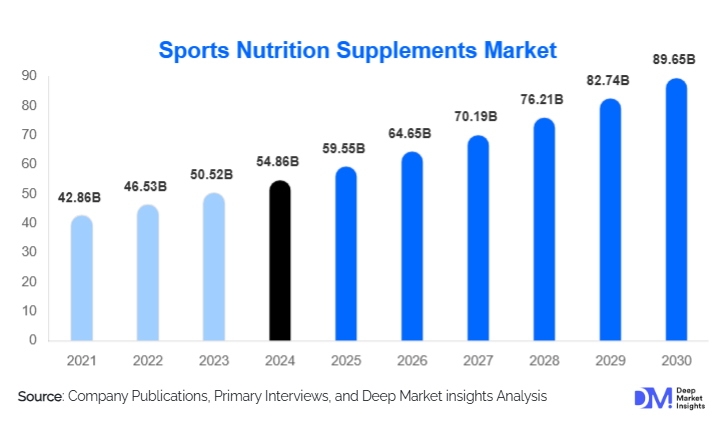

According to Deep Market Insights, the global sports nutrition supplements market size was valued at USD 54.86 billion in 2024 and is projected to grow from USD 59.55 billion in 2025 to reach USD 89.65 billion by 2030, expanding at a CAGR of 8.57% during the forecast period (2025–2030). The market growth is primarily driven by increasing consumer focus on health and fitness, rising participation in sports and recreational activities, and the growing popularity of protein-based supplements among both athletes and the general population.

Key Market Insights

- Rising demand for protein-centric nutrition is reshaping product innovation, with brands introducing ready-to-drink (RTD) protein beverages, plant-based powders, and amino acid formulations.

- Widespread adoption of e-commerce channels and direct-to-consumer models is accelerating global accessibility and product diversity.

- North America remains the dominant regional market, driven by strong gym culture, brand awareness, and well-established supplement regulations.

- Asia-Pacific is the fastest-growing region, supported by increasing youth fitness trends, expanding sports infrastructure, and rising disposable income levels in emerging economies such as India and China.

- Functional ingredient innovationincluding probiotics, adaptogens, and nootropics transforming traditional formulations into holistic performance solutions.

- Brand transparency and clean labeling are becoming critical purchasing factors as consumers prioritize natural, certified, and non-GMO supplement options.

Latest Market Trends

Plant-Based and Sustainable Supplements on the Rise

Consumer preference is shifting toward plant-based protein sources such as pea, hemp, and soy, aligning with broader trends in sustainable nutrition. Manufacturers are reformulating products to cater to vegan and flexitarian consumers while maintaining high protein content and bioavailability. Eco-friendly packaging, carbon-neutral production, and ethically sourced ingredients are also emerging as key differentiators in brand positioning. This trend is expected to gain further momentum as environmental awareness and dietary inclusivity continue to expand globally.

Digital Fitness Ecosystems Driving Product Integration

The convergence of sports nutrition with digital fitness platforms is reshaping market dynamics. Fitness apps, wearable devices, and AI-driven meal planners now recommend personalized supplement regimens based on user data. Brands are partnering with digital health startups to integrate supplement tracking, subscription services, and loyalty programs, creating a seamless fitness-nutrition ecosystem. This digitalization is enhancing customer engagement, retention, and long-term adherence to nutritional routines.

Sports Nutrition Supplements Market Drivers

Growing Health and Fitness Awareness

Global awareness of the importance of nutrition in achieving fitness goals is significantly boosting supplement demand. The increasing influence of social media fitness influencers, along with post-pandemic health consciousness, is driving adoption across both professional athletes and everyday consumers. As more individuals engage in gym workouts, home training, and endurance sports, demand for protein powders, recovery drinks, and energy boosters continues to rise.

Expansion of Functional and Personalized Nutrition

Consumers are shifting toward supplements tailored to specific needssuch as muscle recovery, hydration, endurance, or mental performance. This has led to growth in customized formulations, including gender-specific blends, age-oriented supplements, and microbiome-supporting ingredients. Advances in nutrigenomics and biomarker analysis are enabling personalized nutrition recommendations, paving the way for a new era of precision sports supplementation.

Market Restraints

Regulatory Challenges and Product Standardization

Stringent and inconsistent regulatory frameworks across regions pose challenges for market participants. Differing definitions of “supplements,” labeling requirements, and claims regulations complicate product launches and international expansion. The prevalence of counterfeit or substandard products also undermines consumer trust, making compliance and certification critical for established brands.

High Costs of Premium Formulations

Rising prices of high-quality raw materials, such as whey isolates and natural flavorings, increase overall production costs. This limits affordability in developing regions and can restrain market penetration. Premium formulations that incorporate advanced ingredients or patented blends often command higher price points, making them less accessible to mass-market consumers.

Market Opportunities

Emergence of Functional Beverages and Snacks

Beyond traditional powders and capsules, sports nutrition is rapidly expanding into convenient formats such as protein bars, energy gels, and fortified beverages. These ready-to-consume products cater to on-the-go lifestyles and attract non-athlete consumers seeking daily nutrition support. Innovation in flavor profiles, texture, and clean-label ingredients is broadening the consumer base while driving higher frequency of purchase.

Expansion into Female and Senior Consumer Segments

Sports nutrition is increasingly targeting new demographics such as women and older adults. Formulations focused on bone density, hormonal balance, and muscle retention are gaining traction. Marketing strategies emphasizing wellness, active aging, and holistic health are expected to unlock new growth opportunities, particularly in mature economies.

Product Type Insights

Protein supplements remain the dominant category, driven by demand for whey, casein, and plant-based protein powders. Amino acids and BCAA supplements are gaining popularity for muscle recovery and performance enhancement. Pre-workout and post-workout products are expanding rapidly, supported by innovation in caffeine alternatives and electrolyte blends. Energy bars, RTD shakes, and meal replacements are strengthening the convenience-driven segment, particularly among millennials and busy professionals seeking portable nutrition options.

Distribution Channel Insights

Online retail dominates the global sports nutrition supplements market, driven by ease of comparison, access to global brands, and direct delivery models. Specialty stores and fitness centers remain vital for experiential marketing and personalized recommendations. Pharmacies are emerging as trusted retail points, particularly for medically endorsed supplements. Subscription-based delivery models and influencer-driven affiliate sales are gaining traction, enhancing customer retention and brand loyalty.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America leads the global market, supported by a strong sports culture, widespread fitness participation, and robust brand presence. The U.S. accounts for the largest share, with consumers increasingly favoring plant-based and clean-label formulations. Strategic partnerships between fitness chains, e-commerce platforms, and supplement brands are enhancing accessibility and consumer engagement.

Europe

Europe represents a mature and highly regulated market emphasizing quality, safety, and sustainability. The U.K., Germany, and France are key contributors, driven by high gym memberships and growing vegan supplement demand. European consumers prioritize transparency and traceability, fueling growth in certified organic and non-GMO products.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by India, China, Japan, and Australia. Rising disposable incomes, urbanization, and exposure to global fitness trends are propelling supplement adoption. E-commerce growth and influencer-led marketing are key accelerators, particularly among younger demographics seeking muscle-building and weight-management solutions.

Latin America

Latin America’s market growth is supported by increasing sports participation and the expansion of international supplement brands. Brazil and Mexico dominate regional demand, with consumers gravitating toward affordable whey and BCAA-based products. Government initiatives promoting health and wellness are expected to sustain growth momentum.

Middle East & Africa

The region is witnessing steady growth due to expanding gym networks and rising youth health awareness. The UAE and Saudi Arabia are leading markets, with premium supplement demand linked to affluent lifestyles and sports events. South Africa shows growing domestic manufacturing and distribution capacity, supported by increasing urban fitness engagement.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Sports Nutrition Supplements Market

- Glanbia plc

- Abbott Laboratories

- PepsiCo, Inc. (Gatorade)

- The Coca-Cola Company (BodyArmor)

- Nestlé S.A.

- MusclePharm Corporation

- Clif Bar & Company

- Herbalife Nutrition Ltd.

- Post Holdings, Inc.

- Optimum Nutrition

Recent Developments

- In August 2025, Glanbia Nutritionals launched a new range of functional protein powders enriched with adaptogens and nootropics to target holistic wellness and cognitive performance.

- In June 2025, PepsiCo expanded its Gatorade GX platform to include personalized recovery supplements integrated with smart hydration tracking devices.

- In March 2025, Nestlé Health Science acquired a majority stake in Orgain, a leader in plant-based nutrition to strengthen its sustainable nutrition portfolio.