Sports Hospitality Market Size

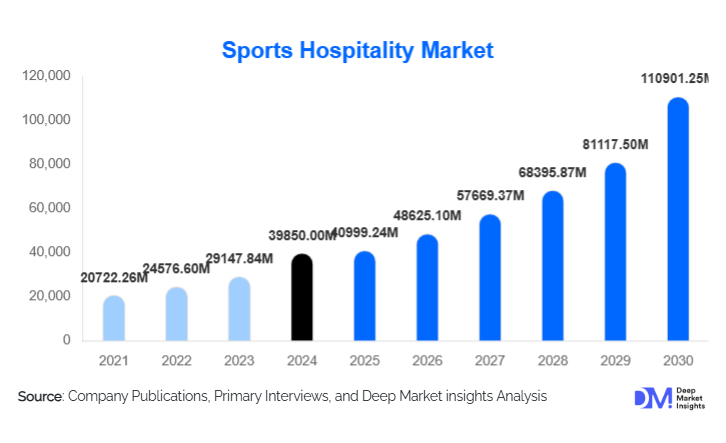

According to Deep Market Insights, the global sports hospitality market size was valued at USD 39,850.00 million in 2024 and is projected to grow from USD 47,262.1 million in 2025 to reach USD 110,901.25 million by 2030, expanding at a CAGR of 18.6% during the forecast period (2025–2030). This growth is driven by increasing demand for premium fan experiences, rising corporate investment in sports-based engagement, and a resurgence in global sports tourism following major international event recoveries post-pandemic.

Key Market Insights

- Corporate hospitality dominates global revenue, accounting for around 63% of the 2024 market share, as companies leverage sports events for networking and brand engagement.

- Football (soccer) remains the leading sport for hospitality services, capturing approximately 35% of global market value due to its global fan base and continuous international tournaments.

- Food & Beverage services contribute nearly one-third of overall revenues, with high-margin gourmet dining and luxury in-venue catering leading the segment.

- Asia-Pacific is the fastest-growing region, driven by rising disposable incomes, event infrastructure investments, and the hosting of mega-sporting events.

- Europe and North America collectively account for 75% of the total market share, with strong demand for premium suites, VIP boxes, and exclusive sponsorship-linked experiences.

- Digital integration and AR/VR-based fan engagement are emerging as pivotal differentiators for hospitality providers seeking to personalize the event experience.

Latest Market Trends

Technologically Enhanced Hospitality Experiences

Sports hospitality is undergoing a rapid digital transformation. AR and VR technologies are being integrated into pre-event previews, allowing fans to explore lounges and suites before booking. AI-driven concierge applications, mobile-based access control, and real-time guest service analytics are enhancing personalization and operational efficiency. These innovations cater to tech-savvy audiences seeking a seamless and data-enriched hospitality journey. Furthermore, hybrid event experiences combining in-venue attendance with virtual participation options are expanding access and profitability for operators.

Expansion into Emerging Event Destinations

Countries in the Middle East, Asia-Pacific, and Latin America are investing heavily in infrastructure to host international sporting events such as World Cups, Olympics, and racing series. This expansion is creating vast opportunities for hospitality providers to build premium offerings around these global showcases. Government-led initiatives like “Vision 2030” in Saudi Arabia and India’s expanding sports league ecosystem are reshaping regional market dynamics, positioning emerging economies as pivotal demand centers for global sports hospitality growth.

Sports Hospitality Market Drivers

Rising Demand for Premium Fan Experiences

Fans increasingly seek more than just event attendance; they desire immersive, exclusive, and comfort-driven experiences. This evolution in fan expectations fuels the growth of VIP boxes, premium seating, exclusive lounges, and celebrity meet-and-greets. Stadium operators are redesigning spaces to prioritize these high-value experiences, which now contribute significantly to event profitability. As disposable incomes and willingness to pay for luxury experiences rise, fan-based hospitality demand is expanding beyond traditional corporate buyers.

Corporate Investment in Brand Engagement

Sports hospitality is a powerful medium for corporate relationship building. Businesses utilize premium sports experiences to entertain clients, reward employees, and enhance brand visibility. This strategic use of hospitality for B2B networking has made the corporate segment the single largest market contributor. With marketing budgets increasingly allocating funds toward experiential platforms, hospitality providers are tailoring offerings, such as turnkey corporate suites and co-branded event packages, to suit enterprise needs.

Global Growth in Sports Tourism

The convergence of sports and travel is driving hospitality market expansion. Fans traveling across borders to attend major sporting events contribute significantly to premium hotel, catering, and entertainment revenues. Countries hosting large-scale tournaments have seen surges in hospitality spending, leading to new partnerships between travel agencies, airlines, and sports organizations. The continued globalization of major leagues and tournaments will sustain this cross-sector growth.

Market Restraints

High Cost of Premium Hospitality Packages

Sports hospitality remains a luxury proposition, often priced beyond the reach of mass audiences. High costs associated with venue suites, gourmet catering, and travel restrict accessibility to corporations and high-net-worth individuals. The elevated pricing model limits volume-based scalability, posing a challenge for operators seeking to diversify their consumer base.

Event and Operational Vulnerability

The sector is highly dependent on live event continuity. Unforeseen disruptions, such as global pandemics, political instability, or event cancellations, can directly impact revenues. Additionally, logistical complexities of multi-country event coordination, fluctuating travel costs, and security regulations create operational uncertainties that hinder consistent profitability.

Sports Hospitality Market Opportunities

Emerging Market Expansion

Rapid infrastructure development in the Asia-Pacific and the Middle East presents substantial growth potential. Governments and private developers are investing in modern stadiums and sports complexes designed with integrated VIP suites and hospitality zones. This regional expansion enables both international brands and local startups to enter high-growth markets early, capitalizing on event tourism and domestic demand for premium experiences.

Technological Integration and Smart Hospitality

Technology-driven hospitality management, powered by AI and IoT, offers a significant opportunity for differentiation. Providers adopting smart-ticketing, virtual previews, digital concierge apps, and dynamic pricing are improving user experience and maximizing revenue per attendee. These advancements reduce operational inefficiencies and enable predictive service models that enhance satisfaction and retention.

Sustainability and ESG-Focused Hospitality

There is a growing consumer and regulatory focus on sustainability in event management. Sports hospitality operators are incorporating eco-friendly materials, local sourcing, and energy-efficient infrastructure into lounges and catering services. Offering carbon-neutral or low-impact hospitality packages aligns with ESG goals and attracts environmentally conscious clientele, unlocking a niche premium market segment.

Service Type Insights

Food & Beverage (F&B) services continue to lead the global sports hospitality market, accounting for approximately 31% of total market share in 2024. This dominance is driven by the premium placed on curated culinary experiences within high-end sports events. F&B offerings have evolved beyond traditional catering, integrating gourmet menus, mixology experiences, and luxury brand tie-ups to enhance overall guest satisfaction. Operators are increasingly collaborating with celebrity chefs and global beverage brands to elevate the perceived value of hospitality packages. The segment benefits from strong margins and repeat spending, positioning it as a vital revenue generator within the hospitality ecosystem. Additionally, rising guest expectations for comfort and personalization have accelerated investment in in-venue premium amenities such as private lounges, high-end bars, and in-seat service technologies, each designed to boost per capita spend and enhance the event experience.

Sports Type Insights

Football (Soccer) dominates the global sports hospitality landscape, contributing approximately 35% of total market revenue in 2024. The sport’s unparalleled global following, strong broadcast ecosystem, and dense tournament calendar, from UEFA Champions League to FIFA World Cup, have fostered a robust corporate sponsorship culture. The segment’s leadership is further propelled by the high ROI associated with corporate hospitality and premium seating within football arenas. Emerging markets in Asia and the Middle East are expanding football’s commercial footprint, introducing high-value hospitality packages that mirror European standards. Cricket follows as a lucrative subsegment, particularly in South Asia, Australia, and the UK, where marquee events command strong premium pricing and consistent sellouts. Motorsports and tennis, known for their affluent attendee base, are also witnessing growth driven by the appetite for exclusive, “Instagrammable” experiences and behind-the-scenes access.

Attendee Insights

Corporate buyers remain the cornerstone of the global sports hospitality market, representing about 63% of total market share in 2024. This segment’s dominance is attributed to the strategic use of sports hospitality for relationship management, marketing activation, and brand building. Companies increasingly view premium event experiences as a tool to strengthen client engagement, reward employees, and host high-level networking sessions. Budgets for client entertainment and corporate events have grown steadily, particularly in developed economies such as the U.S., UK, and Germany. The individual and high-net-worth consumer segment, while smaller in volume, is expanding rapidly due to the global rise of the experience economy, where exclusivity, personalization, and access are key value drivers. The willingness of affluent fans to pay for bespoke and VIP-level experiences underscores this trend.

Distribution Channel Insights

Events-at-Venue distribution channels lead the global market, capturing about 42% of the total market share in 2024. This dominance is primarily fueled by the modernization of stadiums and arenas, which now integrate hospitality zones directly into the architectural design. These premium spaces, luxury boxes, VIP lounges, and club-level suites allow teams and venue operators to control pricing, customer data, and experience quality. Direct sales channels also enable dynamic pricing models and personalized guest engagement. Meanwhile, travel agents and online travel agencies (OTAs) are gaining traction, catering to international fans seeking bundled travel and accommodation packages. Corporate sales remain crucial, supported by long-term contracts and account management strategies that ensure recurring revenue streams for hospitality providers.

Price Tier Insights

The ultra-premium segment continues to set the benchmark for profitability, driven by bespoke services such as concierge support, exclusive access, and private networking experiences. These offerings cater to high-net-worth individuals and multinational corporations seeking exclusivity and prestige. The premium segment attracts mass affluent consumers looking for high-quality yet accessible experiences, while the standard tier appeals to cost-sensitive customers enticed by upgrade opportunities and add-on experiences. Across all tiers, digital engagement tools, such as mobile apps for bookings, in-seat services, and loyalty rewards, enhance convenience and foster customer retention.

| By Service Type | By Sport Type | By End User | By Distribution Channel | By Price Tier |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounted for approximately 35% of the global sports hospitality market value in 2024 (~USD 4.2 billion). The region’s growth is underpinned by an advanced sports infrastructure, strong corporate spending on entertainment, and the expansion of major leagues such as the NFL, NBA, and MLB. A key growth driver is the ongoing modernization of stadiums and arenas, transforming them into multi-purpose, year-round destinations with premium suites, private clubs, and experiential F&B zones. Stadium owners are investing in digital engagement and augmented reality experiences to elevate fan satisfaction and maximize ROI from hospitality assets. Cities such as New York, Los Angeles, and Toronto are leading hubs for high-value corporate packages, with consistent event calendars ensuring stable revenue streams. The regional market will continue expanding as experiential investments deepen and corporate buyers seek innovative engagement formats.

Europe

Europe leads the global sports hospitality landscape with nearly 40% share (~USD 4.8 billion in 2024). The region’s leadership is anchored in its deeply embedded corporate hospitality culture and dense sports event calendar, ranging from UEFA tournaments and tennis grand slams to Formula 1 and Premier League matches. Markets such as the UK, Germany, France, and Spain drive demand, benefiting from established networks of VIP seating, sponsorship packages, and exclusive club memberships. A key regional driver is the integration of corporate entertainment into sports ecosystems, allowing brands to leverage premium hospitality as a measurable marketing channel. High occupancy rates in corporate boxes and VIP suites, coupled with a strong tradition of relationship-based sales, ensure Europe’s continued dominance through 2030.

Asia-Pacific (APAC)

The Asia-Pacific region currently represents around 20% of global revenue (~USD 2.4 billion in 2024) and is poised to record the fastest CAGR of over 20% through 2030. This growth is propelled by the rapid rise of sports tourism, increasing disposable incomes, and the hosting of high-profile tournaments across India, China, Japan, and Australia. Nations are heavily investing in new stadiums, sports infrastructure, and regional leagues, such as the Indian Premier League (IPL) and Chinese Super League, which are driving strong demand for hospitality packages. A major driver for APAC is the rising affluence of middle-class consumers and corporate participation in hospitality offerings. Enhanced connectivity, improved travel infrastructure, and the appeal of integrated entertainment-tourism experiences are further expanding the market’s footprint.

Middle East & Africa (MEA)

The MEA region holds an estimated 8% of global market share (~USD 970 million in 2024), with growth fueled by mega-event hosting and robust government investment in sports tourism and infrastructure. The Gulf Cooperation Council (GCC) nations, particularly the UAE, Saudi Arabia, and Qatar, have made strategic strides by building world-class sports destinations that seamlessly integrate hospitality ecosystems. Hosting global events such as the FIFA World Cup 2022 and Formula 1 races has significantly elevated regional visibility and demand for ultra-premium experiences. The region’s driver lies in its purpose-built hospitality frameworks, designed to cater to high-net-worth individuals and corporate sponsors seeking exclusivity, luxury, and brand exposure. South Africa also contributes meaningfully through cricket and rugby hospitality, supported by local tourism growth.

Latin America

Latin America accounts for about 7% of the global sports hospitality market (~USD 850 million in 2024). Although constrained by macroeconomic challenges, the region’s fan intensity and passion-driven demand provide a strong base for periodic revenue spikes around marquee events. Brazil and Argentina remain key markets, leveraging their football-centric culture and global tournament hosting. A regional growth driver is the increasing corporate activation around marquee events, where brands invest in VIP seating and sponsorship packages to connect with audiences. While per-capita spending remains lower than in North America or Europe, opportunities persist in aligning hospitality offerings with the event cycle of Copa América, World Cup qualifiers, and regional club championships.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Sports Hospitality Market

- Sodexo Group

- Delaware North

- ATPI Ltd.

- IMG Worldwide

- Legends International

- Creative Artists Agency (Sports Division)

- DTB Sports Hospitality and Event Management

- Keith Prowse

- On Location Experiences

- Wasserman

- Sportfive

- RK Sports Hospitality

- Honey & Co. Ltd.

- CSM Sports & Entertainment

- Hospitality Finder

Recent Developments

- In May 2025, Legends International expanded its hospitality portfolio by acquiring premium event contracts across major European football clubs, strengthening its position in luxury stadium experiences.

- In March 2025, Sodexo Live! introduced AI-enabled hospitality management systems to personalize fan experiences and optimize service delivery across U.S. venues.

- In January 2025, Delaware North partnered with a leading tech firm to implement contactless access and virtual concierge features across its sports hospitality properties.